RNS Number:7862B

Eurocity Properties PLC

30 September 2002

ANNOUNCEMENT

Eurocity Properties PLC ("Eurocity" or "the Company")

Eurocity announces its results for the year ended 31 March 2002.

Chairman's Statement

Results

I am very sorry to have to report a loss before tax for the year ended 31 March

2002 of #1,005,000, last year #432,000. This loss includes an exceptional loss

of #419,000, last year nil, which related to costs incurred in an abortive

transaction. The net asset value has fallen to 38.8p per share from 57.7p per

share.

Review

During the year the group sold all but one of the properties held as trading

stock. It also sold three investment properties and acquired five investment

properties increasing the value of the investment portfolio to #10,730,815.

As has been previously stated the company strategy was to look for transactions

that would significantly increase the group's size. This was not successful, it

did not have the support of shareholders, and has resulted in significant costs

being incurred.

Since the year end Baron Bloom and Desmond Bloom have resigned. They were

replaced by Andrew Perloff and Peter Rowson, of Panther Securities PLC, our

largest shareholder. Danny Glasner resigned as a non-executive director, and I

am grateful to him for his support during a most difficult period.

The new directors have rationalised the creditor situation and Panther

Securities PLC have provided financial support to the company. They have also

provided managerial and administrative support free of charge for which I am

most grateful. These actions have enabled the financial situation to be

stabilised. The group is currently trading at a small profit.

Future

It is my belief that the company is too small to prosper as a quoted company and

that a corporate solution should be sought for its future.

Nicholas Jeffrey LLB

Chairman

Chief Executive's Statement

"Never in the field of small property companies has so much been expended by so

few for such little benefit to so many shareholders."

Shareholders will be aware that Peter Rowson and myself were appointed directors

at an EGM requisitioned by Panther Securities PLC of which I am Chairman and

Chief Executive and Peter Rowson is Finance Director. Panther Securities PLC

holds approximately 29% of Eurocity's share capital which makes it the largest

shareholder.

The EGM held on 2 May 2002 was requisitioned because I was dissatisfied with the

excessive costs of managing a small property company such as Eurocity. I am

sorry to say my concerns were fully justified.

The loss for the year ending 31 March 2002 amounts to #1,005,000 of which

#419,000 is directly related to the costs appertaining to the abortive proposal

to acquire Hong Kong companies indirectly owning large development properties in

Central China. This acquisition was effectively blocked by Panther's opposition

to it. Even allowing for this costly fiasco, there are further losses of

#600,000, a large part of which are the massive management expenses of Desmond

and Baron Bloom.

During the year, nine properties were sold. The group disposed of six of its

seven trading properties for a profit on book valuation of #99,000. The group

also sold three commercial properties in Norwich, Aberystwyth and Kirkintilloch

which produced rental income in excess of the mortgage interest. These three

properties were sold for a loss on book valuation of #160,000.

Shortly after Peter Rowson and myself were appointed to the Board, we were

informed that Eurocity (Crawley) Ltd had been seized by the former owner of that

company for failure to pay the deferred consideration of #300,000. We therefore

arranged for Panther Securities PLC to make a secured loan to Eurocity to enable

it to repay its debts and reclaim its assets, such loan being on the same terms

as those agreed by the Vendor, Netcentric PLC, and thus allowing friendly hands

to stand in the stead of Netcentric PLC at no additional cost to Eurocity.

Since taking management control we have looked at every overhead and, where

possible, cut them out so much so that it is anticipated that the next half

yearly figures should show a small profit.

However, whilst we are currently profitable, all properties are mortgaged with

repayment loans and with the mountain of old debt there is a negative cash flow

which we are seeking to address. Whilst we have managed to negotiate reductions

and deferred payments, the debts still have to be paid.

We hope we will be helped in this regard by recovering from the Blooms a

substantial sum which was spent on what the Board considers to be personal

expenses. This sum is in addition to the #55,000 which has just been recovered

from Baron Bloom.

The Company will need extra funds if it is to grow and you may be assured that

your Directors are currently examining available options.

AS Perloff

Managing Director

GROUP PROFIT AND LOSS ACCOUNT

For the year ended 31 March 2002

2002 2001

# #

TURNOVER 2,891,324 531,878

Cost of trading properties sold (1,664,864) -

Direct property expenses (83,986) (39,696)

Administrative expenses:

- Exceptional (418,518) -

- Other (818,918) (591,801)

OPERATING LOSS (94,962) (99,619)

Amounts written off investments - (5,188)

(Loss)/profit on sale of investment properties (160,177) 31,924

Interest receivable 5,983 15,735

Interest payable (756,336) (374,913)

LOSS ON ORDINARY ACTIVITIES BEFORE TAXATION (1,005,492) (432,061)

Taxation - -

LOSS ON ORDINARY ACTIVITIES AFTER TAXATION (1,005,492) (432,061)

LOSS PER SHARE

Basic 18.1p 10.9p

Fully diluted 18.1p 10.9p

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

for the year ended 31 March 2002

2002 2001

# #

Loss for the financial year (1,005,492) (432,061)

Unrealised (deficit)/surplus on revaluation of investment

properties (46,237) 385,508

Total recognised gains and losses relating to the year (1,051,729) (46,553)

NOTE OF HISTORICAL COST PROFITS AND LOSSES

for the year ended 31 March 2002

2002 2001

# #

Loss on ordinary activities before taxation (1,005,492) (432,061)

Realisation of property revaluation gains/(losses) of previous years 337,520 (66,376)

Historical cost loss on ordinary activities before taxation (667,972) (498,437)

Historical cost loss for the year retained after taxation (667,972) (498,437)

RECONCILIATION OF MOVEMENTS IN EQUITY SHAREHOLDERS' FUNDS

2002 2001

# #

Loss for the financial period (1,005,492) (432,061)

Other recognised gains and losses relating to the year (46,237) 385,508

New share capital subscribed 300,000 855,000

Share issue expenses - (15,000)

Net (reduction in)/addition to equity shareholders' funds (751,729) 793,447

Opening equity shareholders' funds 3,013,573 2,220,126

Closing equity shareholders' funds 2,261,844 3,013,573

GROUP BALANCE SHEET

31 March 2002

2002 2001

# #

FIXED ASSETS

Tangible assets 10,732,144 9,194,962

CURRENT ASSETS

Stock 229,988 1,842,418

Debtors 320,179 36,560

Investments - 119,442

Cash at bank and in hand 309,651 115,992

859,818 2,114,412

CREDITORS: Amounts falling due within one year (1,853,446) (2,101,746)

NET CURRENT (LIABILITIES)/ASSETS (993,628) 12,666

TOTAL ASSETS LESS CURRENT LIABILITIES 9,738,516 9,207,628

CREDITORS: Amounts falling due after more than one year (7,476,672) (6,194,055)

NET ASSETS 2,261,844 3,013,573

CAPITAL AND RESERVES

Called up share capital 2,912,670 2,612,670

Share premium account 663,581 663,581

Other reserve 53,711 53,711

Revaluation reserve 565,306 949,063

Profit and loss account (1,933,424) (1,265,452)

EQUITY SHAREHOLDERS' FUNDS 2,261,844 3,013,573

NET ASSET VALUE PER SHARE 38.8p 57.7p

GROUP CASH FLOW STATEMENT

For the year ended 31 March 2002

2002 2001

# (restated)

#

Cash flow from operating activities 2,013,472 (58,993)

Returns on investments and servicing of finance (725,929) (359,178)

Taxation - -

Capital expenditure and financial investment (1,297,840) 44,390

Acquisitions (27,110) (1,760,420)

CASH OUTFLOW BEFORE FINANCING (37,407) (2,134,201)

Financing 1,476,261 1,552,816

INCREASE/(DECREASE) IN CASH IN THE PERIOD 1,438,854 (581,385)

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

2002 2001

# #

Increase/(decrease) in cash in the year 1,438,854 (581,385)

Cash inflow from increase in debt (1,476,261) (4,247,121)

Change in net debt resulting from cash flows (37,407) (4,828,506)

Amortisation of finance costs (24,424) -

MOVEMENT IN NET DEBT IN PERIOD (61,831) (4,828,506)

NET DEBT AT 1 APRIL 2001 (7,551,592) (2,723,086)

NET DEBT AT 31 MARCH 2002 (7,613,423) (7,551,592)

2002 2001

# (restated)

#

Reconciliation of operating loss to net cash flow from operating activities

Operating loss (94,962) (99,619)

Depreciation 796 4,549

Decrease in stocks 1,612,430 -

Increase in debtors (283,619) (720)

Increase in creditors 778,827 36,797

Net cash flow from operating activities 2,013,472 (58,993)

NOTES

1 The financial information set out above does not constitute statutory

accounts within the meaning of section 240 of the Companies Act 1985. The

figures for the year ended 31 March 2002 have been extracted from the audited

annual accounts which received an unqualified auditors' report that did not

contain a statement under section 237 (2) or (3) Companies Act 1985. The

audited statutory accounts will be delivered to the Registrar of Companies in

due course.

The figures for the year ended 31 March 2001 have been extracted from the

audited statutory accounts for that year which have been filed with the

Registrar of Companies and received an unqualified auditors' report which did

not contain a statement under section 237 (2) or (3) Companies Act 1985. Some

of the comparative figures in the cashflow statement and related notes have been

restated to correct an error in the 2001 accounts in connection with the

acquisition of a subsidiary. The effect on the cashflow statement is to reduce

the net cashflow from operating activities and the cash outflow from

acquisitions by #300,000.

2 The Board cannot recommend the payment of a dividend.

3 The accounting policies adopted are consistent with those in previous

years, except with regard to deferred taxation. This change in policy to adopt

FRS 19 "Deferred Taxation" is to comply with accounting best practice. There is

no effect on the current year or prior year figures.

4 The calculation of loss per ordinary share is based upon

the loss after taxation of #1,005,492 and on 5,553,011 being the weighted number

of ordinary shares in issue during the period (2001: loss #432,061 and 3,971,492

being the number of ordinary shares). The warrants have an exercise price above

the fair value of the company's shares and hence are non dilutive.

5 In August 2001, the company issued 600,000 50p ordinary

shares at par as part consideration for the purchase of investment properties by

CJV Properties Limited, a wholly owned subsidiary. In both these cases, the

fair value of the shares was based on independent valuations of the acquired

properties and a report was produced in accordance with section 108 of the

Companies Act 1985.

6 This preliminary announcement was approved by the board on

30 September 2002. Copies of this announcement are available at the office of

the company's nominated adviser, Nabarro Wells & Co Limited (Saddlers House,

Gutter Lane, Cheapside, London EC2V 6BR). The Report and Accounts will be

posted to shareholders today, and copies are available at Panther House 38 Mount

Pleasant,London, WC1X 0AP The Annual General Meeting will be held at the

offices of SJ Berwin & Co, 222 Grays Inn Road, London WC1X 8HB at 12 pm on 27

November 2002.

Enquiries to:

Andrew Perloff, Managing Director Tel: 020 7278 8011

Robert Lo/Keith Smith Tel: 020 7710 7400

Nabarro Wells & Co. Limited - Nominated Adviser

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BKOKBABKDBCB

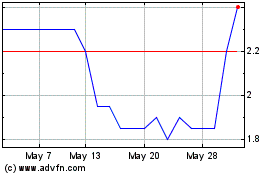

Energypathways (LSE:EPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

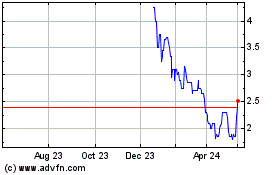

Energypathways (LSE:EPP)

Historical Stock Chart

From Jul 2023 to Jul 2024