RNS Number:7681W

First Artist Corporation PLC

22 March 2004

22 March 2004

Immediate Release

First Artist Corporation Plc

("First Artist" or "the Company")

Final Resultsfor the sixteen months ended 31 October 2003

First Artist Corporation is a leading European management and representation

company looking after the commercial interests of footballers and other high

profile personalities in the football and television market.

Summary

Results for the sixteen months ended 31 October 2003

* The financial and regulatory constraints which continue within the

football sector have had a major impact on sales during the reporting

period.

* Sales of #4.2 million for the period after reported sales at 30 June 2003

of #2.5 million (2002: #6.7 million).

* Operating loss before goodwill amortisation and restructuring costs of

#2.6 million after reporting a loss of #2.7 million for the year ended 30

June 2003 (profit of #2.0 million to June 2002).

* Operating cash outflow of #0.6 million in the period. Debt reduced from

#1.1 million at 30 June 2002 to #0.4 million.

* Provisions for bad and doubtful debts of #0.8 million (June 2003 #0.3

million) have been booked during the period as a result primarily of the

extended delay in the receipt of monies owed by European clubs.

* #0.5 million of non-recurring exceptional costs incurred arising fromthe

restructuring of the group and transaction abort fees.

* Goodwill arising from the acquisition of FIMO Sport Promotion AG written

off.

Current trading

* Evidence of improvement in the UK following the completion of the media

deal between the Premier League and BSkyB.

* Around #0.6 million of new business was written in the winter trading

window (January), from 12 deals, of which 8 were written in the UK.

* The arrangements for media rights have not yetfinalised in the

Continental markets so the situation remains unpredictable.

Business diversification

* First Artist announced that talks which would have resulted in a

reversal of the Outside Group into First Artist (as announced on 17 July 2003)

ended in the Autumn. Costs of #0.1 million were incurred.

* Business development during the period:

* Media division continues to maintain a solid sales and profits profile

* Snooker management and academy launched

* US representational office established with minimal investment

Headline numbers Sixteen months ended Year ended 30 Year ended 30

31

June 2003 June 2002

October 2003

(Audited)

(Unaudited) (Audited)

#m #m #m

Sales 4.2 2.5 6.7

Operating (loss)/profit* (2.6) (2.7) 2.0

(Loss)/profit before tax* (2.7) (2.7) 2.0

(Loss)/earnings per share (pence)* (4.21)p (3.87)p 3.45p

Fully diluted (loss)/earnings per share (4.21)p (3.87)p 3.39p

(pence)*

* Stated before goodwill amortisation and impairment of #11.8 million (June

2003: #11.5m; June 2002 #1.4m) and restructuring of #0.5 million (June 2003:

#0.3m; June 2002 #nil)

For further information please contact:

First Artist Corporation plc 020 8900 1818

Jon Smith, Chief Executive

Jonathan Lees, Finance Director

WMC Communications 020 7591 3999

Scott Learmouth / Jo Livingston

Chairman's Statement

For the sixteen months ended 31 October 2003

In my last report for the interim twelve months to 30 June 2003, I reported that

the continental European marketplace had continued to decline significantly.

This was due to premier clubs dramatically reducing their expenditure to shore

up their financial defences after the introduction of FIFA imposed trading

windows and in light of the TV rights uncertainties across Europe. However, I

also reported that we were encouraged by the impact that the BSkyB television

rights deal had on the UKmarket in the period immediately following this

reporting period. This resulted in a busy summer period for the London office,

although European deal activity remained stagnant.

During this current reporting period we initiated a major rationalisation

programme which resulted in the closure of some offices and the termination of a

number of employment contracts. Head-count of the Group was reduced by around

40%. The Group started to benefit from the resulting savings of #1.6 million on

an annualised basis, from March 2003. The cost of this restructuring was around

#0.4 million. The remainder of the non recurring exceptional costs were

incurred in relation to the aborted transaction with Outside Group in the summer

of 2003.

We have remained alert to the priority of cash management throughout the whole

period. We achieved a successful summer trading window and took the opportunity

to sort out a number of balance sheet issues.

As previously reported in our last results statement, the Board has reviewed its

valuation of acquired goodwill. In the light of current market conditions and

the trading restrictions being imposed by the football authorities and in

accordance with Financial Reporting Standards Nos. 10 and 11, the Board has

carried out a review of the balance sheet values of goodwill arising from

football acquisitions. As at 31 October 2003, additional provisions totalling

#9.7 million have been made to reduce the carrying value of goodwill to zero.

Although the Board believes that the marketplace will recover, it feels that

general uncertainty and the less predictable earnings visibility demands this

prudent approach.

During the period the Board changed its accounting treatment of fixed asset

investments to comply with Section 131 of the Companies Act. The only effect of

this change on the Group financial statements is to reduce the share premium

account by #8.3 million and to create a merger reserve of a similar amount.

Thismerger reserve has subsequently been released to the profit and loss

account following the impairment of the related goodwill.

During the forthcoming financial year, the Board will be seeking approval from

its shareholders and confirmation by the High Court to restructure its balance

sheet to remove the deficit on the profit and loss account by the cancellation

of the share premium account.

Outlook and current operations:

Deal activity in January has increased three fold yearon year which is

encouraging. The Group has written around #0.6 million of business, from 12

deals in the month of which 8 were written in the UK. However, ahead of any new

media rights deals being completed in Europe, the market outside the UK remains

highly unpredictable.

Whilst the Board remains optimistic about the level of business available to be

written during the 2004 summer transfer window, the uncertainty in the market

makes it impossible to forecast earnings.

Our business diversification strategy leveraging core skills into non-football

related sectors continues to be a priority. Although our efforts to grow this

element of the business organically are progressing well, we are disappointed

that we were unable toconclude or agree terms with the Outside Group on a basis

that would be satisfactory to the shareholders of First Artist.

We announced on 2 October 2003 that, in view of the unpredictable nature of the

soccer market, a full, independent strategic review would be conducted to assess

a way forward for First Artist. The focus of the review was agreed to be an

increase in shareholder value. This was carried out by myself and Alex Johnston,

the two independent directors of First Artist. Baker Tilly were appointed to

manage the review.

We are discussing our options with the executive directors and with our

advisers. We conclude that whatever other strategic options are identified, the

absolute short-term priority is to strengthen the core business by reducing

overheads without damaging our revenue earning capacity, and to improve our cash

position and balance sheet by continuing to negotiate acceptable payment terms

with our overdue debtors.

Whilst the directors cannotpredict the future trading and funding requirements

of the Group with certainty, they consider that these actions, if successfully

concluded, combined with the continued support of the Company's bankers, will

provide sufficient finance to enable theGroup to meet its liabilities as they

fall due.

I am indebted to Alex Johnston for the substantial time he devoted to the

review.

I would like to pay tribute to the efforts of all management and staff who have

worked with great commitment in such a volatile and difficult environment.

Chairman

Brian Baldock

22 March 2004

Chief Executive's Review

As we announced last year, we have changed the year end to 31 October in order

to incorporate the entire summer trading window in one accounting period. This

has been an incredibly difficult period for everybody involved in the industry.

The combination of the trading restrictions imposed by FIFA (which have

effectively limited us to only four months of deal activity in each calendar

year) and the general economic downturn in the football sector has impacted our

football agency business.

There remains continued financial uncertainty in continental Europe,

particularly in Italy. However, as anticipated, through the strength of our

relationships with clubs and through the quality of our client list, deal

activity in the summer trading window (June - August) increased year on year in

the UK market, helped by the signing of a new television rights deal between the

Premier League and BSkyB.

During the summer trading window the Group wrote over #2.0 million of business,

from over 30 deals, of which over 75% was written in the UK. In the recent

January trading window the improving trend has continued with sales increasing

three-fold year on year to around #0.6 million.

As a result of the busy summer in the UK, sales in the Group increased from #2.5

million at 30 June 2003 to #4.2 million at 31 October 2003 (#6.7 million for the

year ended 30 June 2002). The number of deals increased from 32 at 30 June 2003

to 66 at 31 October 2003, compared to 83 in the year ended 30 June 2002. The

operating loss before restructuring and goodwill amortisation and impairment for

the yearended 30 June 2003 of #2.7 million fell to #2.6 million by 31 October

2003. This loss was exacerbated by #0.2 million of foreign exchange losses,

mostly unrealised, and #0.8 million of additional debtor provisions booked

during the period, up from a charge of #0.3 million as at 30 June 2003. These

debtor provisions primarily emanate from our European client base, which has

continued to extend payment terms.

Football is the biggest entertainment platform in the world and we believe that

in the short-term the agreement of new rights deals coupled with a more prudent,

financially responsible industry culture should result in the sector returning

to prosperity.

However, we continue to seek ways to use our core strengths to reduceour

dependence on football. The strategic review has considered all such options.

We have invested around #0.1 million in snooker management and in a snooker

academy based in Northampton. The roster of managed players total nine and

includePeter Ebdon and Ding Junhui, who recently performed well at the Wembley

Masters. The academy has seen around twenty young players through its doors

since September, mostly from the Middle East and Asia.

Group and Financial Review

Sales

The Group generated sales of #4.2 million in the sixteen months ended 31 October

2003 compared to #2.5 million for the twelve months ended 30 June 2003, which

was down 63% from #6.7 million last year. There were 66 deals in the period up

from 32 at June 30 2003 which compares to 83 deals in the previous year.

Operating profit before goodwill amortisation and exceptionals

The operating loss of #2.7 million reported in our last statement for the twelve

months ended 30 June 2003 (2002:profit of #2.0 million) has reduced to a loss of

#2.6 million before goodwill amortisation and impairment and one-off exceptional

costs for the sixteen months ended 31 October 2003. This is stated after

deducting fees payable to third-parties of #1.15 million, up from #0.9 million

at 30 June 2003, and administrative expenses of #5.7 million, up from #4.2

million at 30 June 2003. Administrative expenses include foreign exchange losses

of #0.2 million incurred as a result of the strengthening Swiss franc versus the

primary trading currencies, and bad and doubtful debt provisions of #0.8

million, up from #0.3 million as at 30 June 2003, resulting primarily from the

extended delay in the receipt of monies owed by Italian clubs.

Operating loss after goodwill amortisation and exceptionals

The operating loss of #14.9 million is stated after #0.5 million of exceptional

charges arising from the Group's restructuring and its aborted transaction with

Outside Group and #11.8 million of goodwill amortisation and impairment. The

restructuring costs include the costs of office closure, one-off employee

settlements and associated legal costs. The charge for goodwill amortisation and

impairment includes a one-off impairment charge of #9.7 million primarily in

respect of the acquisition of FIMO Sport Promotion AG.

Liquidity and capital resources

At 31 October 2003 the net cash balance of the Group was #19,000 down from a

cash balance of #1.5 million as at 30 June 2002. #0.6 million was paid as

deferred consideration, #0.1 million in tax and #0.2 million was spent on

investments, capex and finance costs. There was also a #0.6 million operating

cash outflow, incorporating #0.5 million of one-off restructuring costs, derived

from the Group operating losses before amortisation and depreciation of #3.0

million. Non-cash net current assets have declined from #2.2 million to #0.7

million. Net current assets include #1.3 million of trade receivables net of

provisions,trade creditors, trade accruals and deferred consideration. Debt at

31 October 2003 was down from #1.1 million at 30 June 2002 to #0.4 million,

comprising #0.3 million of deferred consideration and #0.1 million of finance

leases.

Consolidated Profit and Loss Account

For the sixteen months ended 31 October 2003

Notes Sixteen Year ended 30 Year ended

months June 2003 30

ended 31 June 2002

October 2003 (Unaudited)

(Audited) #000's (Audited)

#000's #000's

Sales 4,229 2,463 6,700

Cost of sales (1,147) (900) (1,246)

Gross profit 3,082 1,563 5,454

Administrative (5,622) (4,136) (3,445)

expenses

Exceptional (480)(300) -

charge

Operating

(loss)/profit (3,020) (2,873) (2,009)

before goodwill

Goodwill (11,820) (11,525) (1,376)

impairment and

amortisation

Group operating

(loss)/profit (14,840) (14,398) 633

Share of

operating loss of (97) (97) (45)

associates

Total operating

(loss)/profit (14,937) (14,495) 588

Loss on disposal (26) (26) -

of investment

(14,963) (14,521) 588

Investment income 11 9 82

(14,952) (14,512) 670

Interest payable (54) (29) (28)

(Loss)/profit on

ordinary

activities before (15,006) (14,541) 642

taxation

Taxation 3 414 603 (321)

(Loss)/profit on

ordinary

activities after (14,592) (13,938) 321

taxation

Dividends - - -

Retained

(loss)/profit for (14,592) (13,938) 321

the period

Adjusted

(loss)/earnings 4 (4.21) pence (3.87) pence 3.45 pence

per share

Adjusted fully

diluted 4 (4.21) pence (3.87) pence 3.39 pence

(loss)/earnings

per share

Basic

(loss)/earnings 4 (27.08) (25.86) pence 0.65 pence

per share pence

Diluted

(loss)/earnings 4 (27.08) (25.86) pence 0.64 pence

per share pence

Consolidated Balance Sheet

As at 31 October 2003

Notes As at As at As at

31 October 30 June 2003 30 June 2002

2003 (Unaudited) (Audited)

(Audited) #000's #000's

#000's (as restated)

FIXED ASSETS

Intangible - 366 12,062

assets

Tangible assets 811 807 957

Investments - - 75

811 1,173 13,094

CURRENT ASSETS

Debtors 3,504 4,009 6,832

Cash at bank and 156 166 1,480

in hand

3,660 4,175 8,312

CREDITORS:

Amounts falling (2,908) (3,049) (4,668)

due within one

year

NET CURRENT 752 1,126 3,644

ASSETS

TOTAL ASSETS

LESS CURRENT 1,563 2,299 16,738

LIABILITIES

CREDITORS:

Amounts falling

due in greater (87) (158) (672)

than one year

Provision for

liabilities and - - (7)

charges

NET ASSETS 1,476 2,141 16,059

CAPITAL AND

RESERVES

Called up share 135 135 134

capital

Shares to be - - 150

issued

Share premium 6,217 6,217 6,118

account

Merger reserve - - 8,283

Profit and loss (4,876) (4,211) 1,374

account

6 1,476 2,141 16,059

Consolidated Cash Flow Statement

For the sixteen months ended 31 October 2003

Notes Sixteen Year ended Year ended

months ended 30 June 2003 30 June 2002

31 October

2003 (Unaudited) (Audited)

(Audited) #000's #000's

#000's

Cash (outflow)/inflow

from operating 5 (623) (961) 131

activities

Returns on

investments and (43) (20) 54

servicing of finance

Taxation (97) - (934)

Capital expenditure 43 57 (671)

Investments (141) (121) (3,074)

Cash (outflow)/inflow

before financing (861) (1,045) (4,494)

FINANCING:-

Issue of shares (net

of costs) - - 4,176

Payments of deferred

cash consideration (545) (580) (1,628)

Repayment of

directors loans - - 1,043

Capital element of

finance lease rental (55) (48) (8)

payments

(600) (628) 3,583

(Decrease)/increase

in cash in the period (1,461) (1,673) (911)

Cash used to decrease

debt financing 600 552 1,636

New finance leases (104) (67) (74)

Deferred 1,627 1,249 (4,107)

consideration

Movement in net 662 61 (3,456)

(debt)/funds

Net (debt)/funds at

the beginning of the (1,065) (1,065) 2,391

period

Net (debt)/funds at

the end of the period (403) (1,004) (1,065)

Statementof Total Recognised Gains and Losses

For the sixteen months ended 31 October 2003

Sixteen months Year ended Year ended

ended 30 June 2003 30 June 2002

31 October 2003

(Audited) (Unaudited) (Audited)

#000's #000's #000's

(Loss)/profit for the

financial period (14,592) (13,938) 321

Exchange adjustments

59 70 120

Total recognised gains

and losses (14,533) (13,868) 441

Notes to the Interim Accounts:

For the sixteen months ended 31 October 2003

1. Basis of preparation

The financial information contained in this report does not constitute statutory

accounts within the meaning of Section 240 of the Companies Act 1985. During

the period the Board changed its accounting treatment of fixed asset investments

to comply with Section 131 of the Companies Act. The only effect of this change

on the group financial statements is to reduce the share premium account by #8.3

million and to create a merger reserve of a similar amount. This merger reserve

has subsequently been released to the profit and loss account following the

impairment of the related goodwill. Prior year figures have been restated

accordingly.

In all other respects the financial information has been prepared on the basis

of the accounting policies set out in the statutory accounts of the group for

the year ended 30 June 2002.

Subject to the restatement referred to above, the figures for the year ended 30

June 2002 have been extracted from the statutory accounts filed with the

Registrar of Companies which contained an unqualified audit report and no

adverse statement under Section 237 (2) or (3) of the Companies Act 1985.

The figures for the year ended 30 June 2003 are unaudited.

The auditors report on the Group's statutory accounts for the sixteen month

period ended 31 October 2003 draws readers' attentionto the directors'

statements in the accounts regarding going concern issues. These issues are set

out in note 2 below.

2. Going concern

In view of the losses and the consequent deterioration of the financial position

of the Group, the directors have embarked on restructuring the business. During

the period under review the directors initiated a major rationalisation

programme, which resulted in the closure of certain offices and the termination

of a number of employment contracts.They continue to closely monitor and

control the situation and through diversification to seek new ways in which to

reduce reliance on traditional deal based revenue and to review opportunities in

sports other than football.

The directors have considered in detail the trading and cash flow forecasts for

the next twelve months. Whilst the directors cannot predict the future trading

and funding requirements of the group with certainty, they consider that the

above actions, combined with further acceptable negotiation of payment terms

with overdue debtors, if successfully concluded, and the continued support of

the Company's bankers, will provide sufficient finance to enable the Group to

meet its liabilities as they fall due. Thereforeit is appropriate for the

financial statements to be prepared on a going concern basis. The financial

statements do not include any adjustment that might result from the directors'

forecasts not being met.

3. Tax credit

The tax credit is based on the estimated effective rate for the period as a

whole.

Sixteen months ended Year ended Year ended

31 October 2003

30 June 2003 30 June 2002

(Audited)

#000's

(Unaudited) (Audited)

#000's #000's

UK corporation tax credit/(charge) 66 459 (130)

Adjustments in respect of prior periods (8) (43) (8)

Foreign taxes 294 (187) (187)

352 (325) (325)

Origination and reversal of timing differences 62 4 4

Tax on ordinary activities 414 (321) (321)

4.Earnings per share

The calculations of earnings per share are based on the following profits and

numbers of shares:

The adjusted earnings per share is based on profit after tax before the goodwill

amortisation charge.

Sixteen months Year ended Year ended

ended

30 June 30 June

31 October

2003 2002

2003

(Audited)

(Unaudited) (Audited)

Number

Number Number

Weighted average number of 0.25 pence ordinary

shares in issue during the period

For basic earnings per share 53,893,666 53,890,339 49,241,709

Exercise of share options - - 860,254

For diluted earnings per share 53,893,666 53,890,33950,101,963

(Loss)/profit for the financial period #000's #000's #000's

(Loss)/profit for adjusted earnings per share (2,266) (2,087) 1,697

Adjustment for goodwill amortisation (11,820) (11,525) (1,376)

Adjustment for restructuring (480) (300) -

Adjustment for loss on disposal of investment (26) (26) -

(Loss)/profit for earnings per share (14,592) (13,938) 321

5. Reconciliation of operating profit to net operating cash flow

Sixteen months Year ended Year ended

ended 31 October

2003 30 June 30 June

(Audited) 2003 2002

#000's (Unaudited) (Audited)

#000's #000's

Operating (loss)/profit (14,937) (14,495) 588

Depreciation 166 123 89

Amortisation of goodwill 11,820 11,525 1,376

Loss/(profit) on disposal of fixed assets 41 38 3

Decrease/(increase) in debtors 2,232 2,225 (3,010)

(Decrease)/increase in creditors (101) (544) 920

Share of operating loss of associates 97 97 45

Exchange 59 70 120

Net cash (outflow)/inflow from operating activities (623) (961) 131

6. Reconciliation of movement in shareholders' funds

Sixteen months Year ended Year ended

ended 31 October

30 June 30 June

2003

2003 2002

(Audited)

(Unaudited) (Audited)

#000's

#000's #000's

(Loss)/profit for the financial period (14,592) (13,938) 321

Foreign exchange adjustment 59 70 120

(14,533) (13,868) 441

New share capital subscribed net of costs - - 12,651

Cancellation of shares to be issued (50) (50) -

(Decrease)/increase in shareholders' funds (14,583) (13,918) 13,092

Opening shareholders' funds 16,059 16,059 2,967

Closing shareholders' funds 1,476 2,141 16,059

Shareholders' funds are entirely attributable to equity interests.

7. Annual Report

Copies of the Annual Report and Financial Statements will be circulated to

shareholders shortly and may be obtained after the posting date from the Company

Secretary, First Artist Corporation plc, First Artist House, 87 Wembley Hill

Road, Wembley, Middlesex, HA9 8BU.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JTMMTMMMTBJI

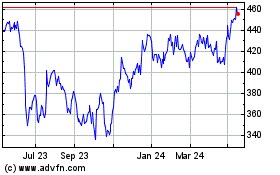

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024