RNS Number:9257A

First Artist Corporation PLC

16 July 2004

First Artist Corporation plc

Interim report

Six months ended 30 April 2004

Company Registration No: 2725009

First Artist Corporation Plc ("FAC")

Interim Report for the Six months ended 30 April 2004

Chairman's Statement

In our last report for the period to 31 October 2003, issued in March, we stated

that we were encouraged by the improvements in the UK market although the

continental European market-place remained unpredictable.

On the back of a profitable January this year, our confidence in the UK market

was not misplaced; and we now forecast an upturn in this summer's trading window

with an improved contribution from the European markets. As per our original

strategy, we continue to maintain a presence in emerging football markets such

as the US and the Far East with minimal drain on the group's central resources.

Following the Strategic Review conducted in the 4th quarter of 2003, efficient

management of cash and costs remain the company's priority with direct

expenditure wholly focussed on developing the core business.

To that end, the First Artist Snooker Academy was closed in May. The anticipated

growth and support from snooker authorities has not materialised as forecast and

the Board has therefore transferred the operation of the business to its

management. First Artist will retain a minority interest in the new business and

a continuing involvement in snooker player management.

Like for like continuing sales have increased 37% to #1.19 million compared to

the corresponding period last year, with annualised overheads falling 37%. After

exceptional charges this has resulted in a like for like operating loss for the

period of #0.34 million compared to a loss of #1.75 million in the corresponding

period last year. Group loss for the period was #0.39 million after deducting

#0.15 million loss incurred by the Snooker Academy (Period to 30 April 2003:

Loss #2.17 million).

Group and financial review

Sales

The primary revenue for the group continues to be derived from the transferring

of professional football players between clubs. The Group generated sales of

#1.23 million in the period. Sales of #1.19 million were generated from

continuing activities, up 37% from #0.87 million last year. There were 21 deals

in the period versus 17 deals in the corresponding period last year.

Operating profit before exceptional costs

The operating loss before exceptional costs of #0.03 million, was #0.46 million

(Period to 30 April 2003:loss of #1.67 million), including #0.15 million loss

from the Snooker Academy and is stated after deducting fees payable to

third-parties of #0.28 million (corresponding period to 30 April 2003: #0.31

million), and operating expenses of #1.42 million (corresponding period to 30

April 2003: #2.23 million). The operating expenses include a release of bad debt

provisions of #0.03 million due to improved debtor collection.

Liquidity and capital resources

At 30 April 2004 the net borrowing of the Group was #0.73 million (including

#0.48 million of bank debt), up from a net borrowing balance of #0.40 million as

at 31 October 2003. #0.04 million was paid in reducing finance lease balances

and there was #0.44 million operating cash outflow, derived from the group

operating losses before amortisation and depreciation of #0.45 million and an

increase in non-cash working capital of #0.01 million. Net current assets

include #0.22 million of receivables net of provisions and trade creditors.

Outlook and current operations

In recent months, trading conditions in the UK and European football market have

stabilised somewhat and, as evidenced during the first few weeks of the summer

trading window, the Board remains confident as regards its prospective 2004

turnover. That said, there remains a natural level of uncertainty in the

marketplace and visibility of earnings continues to be unpredictable.

Following the completion of the Strategic Review, as announced in October 2003,

the Board remains confident in the long-term viability of the football sector as

the significant revenue engine for the group and has agreed that the best route

forward to maximise shareholder value is to;

*concentrate on its core football activities; continue to take steps to

improve FAC's cash position and balance sheet;

* identify suitable opportunities for expansion into 'non-footballing'

areas through acquisition, or other arrangements.

* develop a broader scope of services for the Group's client and contact

base.

On 1 July 2004, 5,997,014 ordinary shares held by V.S.R.Fioranelli were bought

back by the Company and cancelled. The issued share capital of the Company now

consists of 47,906,523 ordinary shares of 0.25p each.

On behalf of the Board, I would like to thank our previous Chairman, Brain

Baldock for the support, guidance and experience he brought to FAC in his time

with the Group and wish him well in his retirement. The Board also welcomes

Richard Hughes to FAC as Group Financial Director.

Chairman

Alex Johnston

16th July 2004

Contact: Jon Smith or Richard Hughes at First Artist on 020 8900 1818

Consolidated Profit and Loss Account

For the six months ended 30 April 2004

Notes Six months Six months Period from

ended ended 1 July 2002 to

30 April 2004 30 April 2003 October 2003

(Unaudited) (Unaudited) (Unaudited)

#000's #000's #000's

Sales Continuing 1,185 866 4,191

Discontinued 48 - 38

---------- ---------- -----------

1,233 866 4,229

Cost of sales (279) (309) (1,147)

---------- ---------- -----------

Gross profit 954 557 3,082

Administrative

expenses (1,416) (2,229) (5,622)

Exceptional

administrative

expenses (28) (77) (480)

---------- ---------- -----------

Operating loss before goodwill

---------- ---------- -----------

Continuing (337) (1,749) (2,955)

Discontinued (153) - (65)

---------- ---------- -----------

(490) (1,749) (3,020)

Administrative

expenses -

goodwill

impairment and

amortisation - (768) (11,820)

---------- ---------- -----------

Group

operating loss (490) (2,517) (14,840)

Share of

operating loss

of associates - (29) (97)

---------- ---------- -----------

Total

operating loss (490) (2,546) (14,937)

Loss on

disposal of

investment - - (26)

---------- ---------- -----------

(490) (2,546) (14,963)

Investment

income - 9 11

Interest

payable (17) (25) (54)

---------- ---------- -----------

Loss on

ordinary

activities

before

taxation (507) (2,562) (15,006)

Taxation 2 120 395 414

---------- ---------- -----------

Loss on

ordinary

activities

after taxation (387) (2,167) (14,592)

Dividends - - -

---------- ---------- -----------

Retained loss

for the period (387) (2,167) (14,592)

========== ========== ===========

LOSS PER SHARE 3 (0.72) p (4.02) p (27.08) p

Basic loss per share

Fully diluted

loss per share 3 (0.72) p (4.02) p (27.08) p

Basic loss per

share 3 (0.67) p (2.45) p (4.21) p

(before goodwill and exceptional)

Diluted loss per share

(before goodwill and exceptional) 3 (0.67) p (2.45) p (4.21) p

Consolidated Balance Sheet

As at 30 April 2004

Notes As at As at As at

30 April 2004 30 April 2003 31 October 2003

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

FIXED ASSETS

Intangible assets - 10,536 -

Tangible assets 775 850 811

Investments - 26 -

---------- ---------- -----------

775 11,412 811

---------- ---------- -----------

CURRENT ASSETS

Debtors 3,287 4,812 3,504

Cash at bank and in hand 143 - 156

---------- ---------- -----------

3,430 4,812 3,660

CREDITORS: Amounts

falling due within one

year (2,960) (3,577) (2,908)

---------- ---------- -----------

NET CURRENT ASSETS 470 1,235 752

---------- ---------- -----------

TOTAL ASSETS LESS

CURRENT 1,245 12,647 1,563

LIABILITIES

CREDITORS: Amounts

falling due after more

than one year (28) (176) (87)

---------- ---------- -----------

NET ASSETS 1,217 12,471 1,476

========== ========== ===========

CAPITAL AND RESERVES

Called up share capital 5 135 135 135

Share premium account 5 6,217 6,217 6,217

Merger reserve 5 - 8,283 -

Profit and loss account 5 (5,135) (2,164) (4,876)

---------- ---------- -----------

1,217 12,471 1,476

========== ========== ===========

Consolidated Cash Flow Statement

For the Six Months ended 30 April 2004

Notes Six months Six months Period from

ended ended 1 July 2002 to

30 April 2004 30 April 2003 31 October 2003

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

Cash outflow from

operating

activities 4 (441) (177) (623)

Returns on

investments and

servicing of

finance (17) (16) (43)

Taxation 136 - (97)

Capital

expenditure and

financial

investment (3) 43 43

Acquisitions and

disposals - (141) (141)

---------- ---------- -----------

Cash outflow

before financing (325) (291) (861)

---------- ---------- -----------

FINANCING:

Payments of

deferred cash

consideration - (503) (545)

Capital element

of

finance lease (35) (23) (55)

rental payments ---------- ---------- -----------

(35) (526) (600)

---------- ---------- -----------

Decrease in cash

in the period (360) (817) (1,461)

Cash used to

decrease debt

financing 35 526 600

New finance - - (104)

leases

Deferred

consideration on

acquisition of

subsidiaries - 639 1,627

---------- ---------- -----------

(325) 348 662

Net debt at the

beginning of the

period (403) (1,517) (1,065)

---------- ---------- -----------

Net debt at the

end of the period (728) (1,169) (403)

========== ========== ===========

Statement of Total Recognised Gains and Losses

For the Six months ended 30 April 2004

Six Months Ended Six Months Ended Period from 1July 2002 to

30 April 2004 30 April 2003 31 October 2003

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

Loss for the

financial period (387) (2,167) (14,592)

Currency translation

differences on

net foreign currency

investments 128 217 59

---------- ---------- -----------

Total recognised

gains and losses (259) (1,950) (14,533)

========== ========== ===========

Notes to the Interim Accounts:

For the six months ended 30 April 2004

1. Basis of preparation

The financial information contained within this interim report does not

constitute statutory accounts within the meaning of Section 240 of the Companies

Act 1985. The interim financial information has been prepared on the basis of

the accounting policies set out in the Group's statutory accounts for the period

ended 31 October 2003.

The figures for the six months ended 30 April 2004 and 30 April 2003 are

unaudited. The figures for the period from 1 July 2002 to 31 October 2003 have

been extracted from the statutory accounts which have been filed with the

Registrar of Companies and did not contain a statement required under Section

237 (2) or (3) of the Companies Act 1985. In their report on the accounts the

auditors drew readers attention to the disclosures made by the Directors

regarding the Company's ability to continue as a going concern but their opinion

was not qualified in that respect.

In view of the continuing losses during the period to 30 April 2004, the

Directors have prepared and considered detailed trading and cash flow forecasts

for the next twelve months. Costs continue to be closely monitored and

controlled following a major restructuring programme carried out in the previous

period and the company remains in regular contact with its bankers and other

major creditors. Ongoing negotiations with overdue debtors to agree acceptable

payment terms also remain a priority.

The Directors cannot predict the future trading and funding requirements of the

Group with certainty, but believe that the above actions together with the

continued support of the Company's bankers will provide sufficient finance to

enable the Group to meet its liabilities as they fall due. The Directors

therefore believe that it is appropriate for the financial statements for the

period to 30 April 2004 to be prepared on a going concern basis.

2. Tax credit

The tax credit is based on the estimated effective rate for the period as a

whole.

Six months Six Months Period from 1 July

Ended Ended 2002 to

30 April 2004 30 April 2003 31 October 2003

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

UK corporation

tax credit/(charge) - 121 66

Adjustments in

respect of

prior periods 9 - (8)

Foreign taxes (29) 201 294

---------- ---------- -----------

Current tax

credit/(charge)

for the

period (20) 322 352

---------- ---------- -----------

Deferred

Taxation: 140 73 62

Origination and reversal of

timing differences ---------- ---------- -----------

Tax credit/(charge)

on ordinary activities 120 395 414

========== ========== ===========

3. Loss per share

The calculations of loss per share are based on the following profits and

numbers of shares:

The adjusted loss per share is based on loss after tax before goodwill

impairment, amortisation and exceptional items.

Six months Six Months Period from

Ended Ended 1 July to

30 April 2004 30 April 2003 31 October

(Unaudited) (Unaudited) 2003(Audited)

Number Number Number

Weighted average number of 0.25 pence

ordinary shares in issue during the

period

For basic earnings per

share 53,903,537 53,903,537 53,893,666

Exercise of share options - - -

---------- ---------- -----------

For diluted earnings per

share 53,903,537 53,903,537 53,893,666

Loss for the financial period #'000s #'000s #'000s

Loss for adjusted earnings

per share (359) (1,322) (2,292)

Adjustment for goodwill

impairment and

amortisation - (768) (11,820)

Adjustment for exceptional

costs (28) (77) (480)

---------- ---------- -----------

Loss for earnings per

share (387) (2,167) (14,592)

========== ========== ===========

4. Reconciliation of operating loss to net operating cash flow

Six months Six Months Period from

ended ended 1 July to

30 April 2004 30 April 2003 31 October 2003

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

Operating loss (490) (2,546) (14,937)

Depreciation 39 64 166

Impairment and

amortisation of goodwill - 768 11,820

Loss on disposal of fixed

assets 1 19 41

Share of operating loss

of - 29 97

associates

Decrease in debtors 230 1,295 2,232

(Decrease) in creditors (349) (23) (101)

Exchange 128 217 59

----------- ---------- -----------

Net cash outflow from

operating activities (441) (177) (623)

=========== ========== ===========

5. Analysis of changes in net debt

At 1 November Cash Non-Cash At 30 April

2003 flow changes 2004

#'000s #'000s #'000s #'000s

Cash at bank

and in hand 156 (13) - 143

Bank

overdrafts (137) (347) - (484)

---------- -------- -------- ---------

19 (360) - (341)

---------- -------- -------- ---------

Finance (115) 35 - (80)

Leases

Debt due within

one year (265) - (42) (307)

Debt due after

more than one (42) - 42 -

year ---------- -------- -------- ---------

(422) 35 - (387)

---------- -------- -------- ---------

Total (403) (325) - (728)

========== ======== ======== =========

6. Reconciliation of movement in shareholders' funds

Six Months ended Six Months ended Period from

30 April 2004 30 April 2003 1 July to

(Unaudited) (Unaudited) 31 October 2003

#000's #000's (Audited)

#000's

Loss for the financial

period (387) (2,167) (14,592)

Foreign exchange

adjustment 128 217 59

Cancellation of Deferred

Share Consideration on

acquisition of

unincorporated business - (50) (50)

----------- ---------- -----------

Decrease in

shareholders' (259) (2,000) (14,583)

funds

Opening shareholders'

funds 1,476 14,471 16,059

----------- ---------- -----------

Closing shareholders'

funds 1,217 12,471 1,476

=========== ========== ===========

Shareholders' funds are entirely attributable to equity interests.

7. Interim Report

Copies of this interim report are being sent to all shareholders and are

available to the public at the Company's registered office, First Artist House,

87 Wembley Hill Road, Wembley, Middlesex HA9 8BU.

INDEPENDENT REVIEW REPORT TO FIRST ARTIST CORPORATION PLC

Introduction

We have been instructed by the company to review the financial information set

out on pages 3 to 9 and we have read the other information contained in the

interim report and considered whether it contains any apparent mistatements or

material inconsistencies with the financial information.

This report, including the conclusion, has been prepared for and only for the

company for the purpose of their interim report and for no other purpose or to

any other person to whom this report is shown or into whose hands it may come

save where expressly agreed by our prior consent in writing.

Directors' Responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by the directors. It is best

practice that the accounting policies and presentation applied to the interim

figures should be consistent with those applied in preparing the preceding

annual accounts except where any changes, and the reasons for them, are

disclosed.

Review Work Performed

We conducted our review in accordance with guidance contained in Bulletin 1999/4

issued by the Auditing Practices Board as if that Bulletin applied. A review

consists principally of making enquiries of management and applying analytical

procedures to the financial information and underlying financial data and based

thereon, assessing whether the accounting policies and presentation have been

consistently applied unless otherwise disclosed. A review excludes audit

procedures such as tests of controls and verification of assets, liabilities and

transactions. It is substantially less in scope than an audit performed in

accordance with Auditing Standards and therefore provides a lower level of

assurance than an audit. Accordingly we do not express an audit opinion on the

financial information.

Review Conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30 April 2004.

BAKER TILLY

Chartered Accountants

2 Bloomsbury Street

London WC1B 3ST

16th July 2004

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QKAKBDBKDCOD

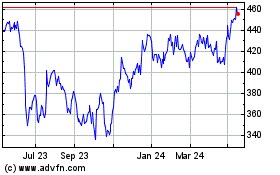

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024