TIDMBIRD

RNS Number : 5759L

Blackbird PLC

09 September 2019

9 September 2019

Blackbird plc

("Blackbird" or the "Company")

Interim results

Blackbird plc (AIM: BIRD), the developer and seller of the

market-leading cloud video platform Blackbird, announces its

interim results for the six months ended 30 June 2019.

Ian McDonough, CEO of Blackbird, commented:

"The overriding theme for Blackbird in 2019 is momentum. The

first half of 2019 has been an incredibly busy period for Blackbird

and has seen our renewed strategy on sports and news gain traction,

with the Company booking record revenues for the period and

doubling our deferred revenue and contracted order book since 31

December 2018.

"Blackbird is a market leading product and all evidence points

to the industry's large-scale transformation, of moving to the

cloud for its video editing needs, as now being well and truly

underway. Our revised strategy is now 'bedded in' and the sales

traction demonstrated in new sectors with a different breed of

customer demonstrates that we are strongly positioned to capitalise

on this significant industry shift.

"When authorised to do so, and within the regulatory parameters

of our AIM listing, I have continued to increase my holding in the

Company for which I see such great potential."

Operational highlights (POST PERIOD)

-- Blackbird selected to exhibit alongside Google Cloud at IBC

in Amsterdam later this month for the full duration of this major

trade show. Blackbird is the only co-exhibitor focused on cloud

video editing.

o Google Cloud's public policy is that they are strategically

focused on accelerating their penetration of the enterprise base,

which is aligned with Blackbird's own strategy

-- Significant six-figure, multi-year deal signed with A+E

Networks starting post-period end

o Landmark deal on a recurring basis - validating our new

strategy

-- Extension of TownNews deal, adding a further 15 US TV

stations bring the total to 40

o Demonstrating Blackbird's ability to quickly 'land and expand'

within large organisations

Operational highlights

-- Doubling of deferred revenue and contracted order book compared to 31 December 2018

-- Expansion and three-year extension of deal with IMG Media, a

leading global producer and distributor of sports media

-- Extension of contracts with leading media rights companies

Deltatre, MSG Networks and Gfinity

-- Blackbird selected by global fitness technology leader

Peloton to edit its daily virtual spin classes

-- Two-year contract signed with Australia's National Rugby

League, for live video clipping and publishing, following a highly

competitive tender process

-- Achieved Microsoft Azure Co-Sell Partner status

-- Implementation of Blackbird Productions Partnership Program

("BP3") to post-production houses

-- Improved Blackbird platform with JavaScript web-based

editing/clipping and enhanced social media publishing

-- Company name change to Blackbird plc

-- Board strengthened with appointment of Andrew Bentley as

Chairman, Dawn Airey as Non-Executive Director and Stephen White as

Chief Operating and Financial Officer

Financial highlights

-- Record revenues of GBP479k for the 6 months to 30 June 2019,

up 27% year-on-year (6 months to 30 June 2018: GBP377k)

-- Contracted orders and deferred revenue increased by 113% to

GBP1,208k from GBP566k at 31 December 2018

-- Operating costs of GBP1,416k (6 months to 30 June 2018: GBP1,289k)

-- EBITDA loss of GBP1,017k (6 months to 30 June 2018: GBP965k)

-- Net loss before tax GBP1,189k (6 months to 30 June 2018: GBP1,274k)

Enquiries:

Blackbird Plc Tel: +44 (0)20 8879

7245

Ian McDonough, Chief Executive Officer

Stephen White, Chief Operating and Financial

Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Broker) 5656

Nick Naylor

Nicholas Chambers

About Blackbird plc

Blackbird operates in the fast-growing SaaS and cloud video

market. It has created the world's most advanced suite of

cloud-native computing applications for video, all underpinned by

its lightning-fast codec. Blackbird's patented technology allows

for frame accurate navigation, playback, viewing and editing in the

cloud. Blackbird underpins multiple applications, which are used by

rights holders, broadcasters, sports and news video specialists,

esports, live events and content owners, post-production houses,

other mass market digital video channels and corporations.

Since it is cloud-native, Blackbird removes the need for costly,

high end workstations and can be used from almost anywhere on

almost any device. It also allows full visibility on multi-location

digital content, improves time to market for live content such as

video clips and highlights for social media distribution, and

ultimately results in much more effective monetisation.

Blackbird(R) is a registered trademark of Blackbird plc.

Websites

www.blackbird.video

Social media

www.linkedin.com/company/blackbird-cloud

www.twitter.com/blackbirdcloud

www.facebook.com/blackbirdplc

Chief Executive Officer's Statement

The overriding theme for Blackbird in 2019 is momentum. The

first half of 2019 has been an incredibly busy period for Blackbird

and has seen our renewed strategy on sports and news gain traction,

with the Company booking record revenues for the period and

doubling our deferred revenue and contracted order book since 31

December 2018.

We have generated considerable sales momentum, signing a number

of key new deals and renewing important contracts. The Company took

the logical step of rebranding itself Blackbird plc during the

period as we consolidate our commercial efforts behind the

Blackbird platform.

The signing of a multi-year deal with A+E Networks, which

started post the period end, is a strategically important

enterprise-scale contract that sees Blackbird unlocking significant

value from thousands of hours of archived footage and empowering

the A+E teams across multiple sites to create relevant and timely

content for their viewers' enjoyment. This is a landmark deal for

Blackbird and we are hard at work with the A+E team bringing their

video workflows into the cloud.

In news, the addition of a further 15 TV Stations to our

TownNews relationship was the third extension in the last year and

has led to Blackbird now being used in 40 US TV stations.

Commercially our partnership is a great example of a successful OEM

strategy where Blackbird and TownNews land and then expand.

We also made good progress in our target market of sports

broadcasting, signing contract extensions with Deltatre, MSG and

Gfinity along with a high-profile deal that sees Blackbird used by

global exercise brand Peloton. Blackbird expanded its footprint

further afield signing contracts with Australia's NRL and Rapid

Rugby.

Our initiatives included the launch of our Blackbird Productions

Partnership Program ("BP3"), signing up 14 post-production houses

in the period. This partnership incentivises post-production houses

to resell Blackbird directly to production companies, freeing up

internal sales resource and reducing internal support and

administration.

The product and development team have continued to evolve the

Blackbird platform. This included making the JavaScript editor,

which enables Blackbird to be accessed via a web-browser, being

made available to all customers and enhancing our social media

publishing options. Continuing to enhance our platform opens up the

addressable market for Blackbird to further potential

customers.

It is very significant that Google has identified Blackbird as a

key partner for the upcoming IBC show in Amsterdam; we will be on

their booth meeting their prospects and customers.

These are exciting times for the Company and I look forward to

working with the team to build on the recent growth momentum and to

delivering more good news to the market.

Chairman's Statement

I am pleased to report on the solid progress that Blackbird has

made over the period in my first set of results as Chairman. In the

six-month period to 30 June 2019, we continued sales growth

momentum and booked record revenues through licensing our Blackbird

cloud video solutions as part of the core media infrastructure for

companies and generating SaaS-based repeatable revenues. The

success of our strategy to move to longer term infrastructure deals

is demonstrated by the growth in share of revenue from such deals

in the period to 84% of invoiced sales compared to 52% in the

corresponding period in 2018.

Our Commercial successes in the first half of the year included

signing up A+E Networks where the use of Blackbird is designed to

deliver major productivity enhancements across the business and

significantly accelerate the visibility, immediacy and management

of A+E Network's video archive for the repurposing of content;

growing and extending the IMG deal for a further three years as

well as deals with MSG Networks, Deltatre and Gfinity; signing a

deal with Peloton, the global fitness technology leader, to provide

editing infrastructure for its on-demand virtual classes; and

signing a two year deal with Australia's National Rugby League for

live clipping, editing and publishing of match highlights. Post

Period we have extended our TownNews deal to 40 US stations by

adding a further 15 TV stations.

Our technology and product development team continue to focus on

supporting our commercial opportunities. As well as enhancing the

core platform the team has made strong progress developing the

Blackbird Player and demonstrated live 1080p video input at NAB in

Las Vegas in April.

I was delighted to welcome Stephen White and Dawn Airey to the

Board during the period. Stephen joins us from Comcast's NBC

Universal in the newly created Chief Operating and Financial

Officer role, whilst Dawn is assisting us in executing our strategy

of growing Blackbird globally through her wealth of international

experience and huge network of contacts. I would also like to thank

David Main, who stepped down as Chairman in May, for his valuable

contribution in the role over the past three years. David continues

to serve on the Board and we continue to benefit from his vast

experience.

Financial

Revenue increased by 27% to GBP479k for the six-month period

ending 30 June 2019 compared to the corresponding period last year.

Deferred revenue and Contracted Order book were GBP1,208k at 30

June 2019, an increase of 86% compared to 30 June 2018 and of 113%

compared to 31 December 2018. Invoiced sales increased 3% to

GBP503k for the six-month period ending 30 June 2019 versus GBP489k

in the corresponding period last year. As we shift our business

model away from short-term project work to longer-term, larger

contracts, this metric has and will continue to become less

important as it is no longer a good indicator of sales activity

within the period.

In North America, revenue for the period increased by 152% year

on year to GBP159k, whilst revenue for the period from the sports

sector increased by 64% year on year to GBP198k reflecting our

strategic focus on the sector.

Operating costs for the period were GBP1,416k versus GBP1,289k

in the corresponding period last year, net of capitalised

development costs of GBP197k (2018: GBP111k). The increase in costs

has been driven through the strengthening of the team which has

been previously communicated. The EBITDA loss for the period was

GBP1,017k versus GBP965k in the corresponding period last year,

whereas the loss for the period was GBP1,189k versus GBP1,274k due

to a lower amortisation charge compared to the prior period.

Cash used in operations in the period was GBP1,044k versus

GBP902k in the same period last year.

Outlook

We started the second half of the year in a strong position with

contracted orders and deferred revenue at the highest level in the

Company's history at GBP1,208k versus GBP566k at 31 December 2018.

This includes the new multi-year deals with A+E Networks, which

started post the period end, and the extensions with TownNews and

IMG, and creates a solid platform for future revenue growth. We

have made a strong start to the second half of the year maintaining

the momentum from the first half.

We continue to progress with our strategy to position Blackbird

as a key infrastructure component in the technology stack of major

media businesses. To this end we have multiple ongoing discussions

with large companies around the globe. As Cloud adoption becomes

more prevalent in larger companies, with our strong Blackbird

platform offering, and with the right commercial team in place, we

are well positioned to exploit this.

UNAUDITED AND CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME FOR THE SIX MONTHSED 30

JUNE 2019

Unaudited

Half year Unaudited Audited

to Half year Year to

30 June to 31

2019 30 June December

2018 2018

GBP GBP GBP

CONTINUING OPERATIONS

Revenue 479,474 377,438 870,310

Cost of Sales (80,989) (53,800) (125,079)

========================================= ============= ============ ============

GROSS PROFIT 398,485 323,638 745,231

625 - -

Other income

Operating costs (1,415,931) (1,289,026) (2,738,515)

========================================= ============= ============ ============

EARNINGS BEFORE INTEREST, TAXATION,

DEPRECIATION AND AMORTISATION (1,016,821) (965,388) (1,993,284)

Depreciation (37,337) (21,318) (44,432)

Amortisation (122,149) (264,580) (544,889)

Employee share option costs (24,910) (23,832) (32,445)

(184,396) (309,730) (621,766)

OPERATING LOSS (1,201,217) (1,275,118) (2,615,050)

Finance income 16,300 970 15,898

Finance expense on lease liability (3,870) - -

======================================== ============= ============ ============

LOSS BEFORE INCOME TAX (1,188,787) (1,274,148) (2,599,152)

Income Tax - - 24,534

========================================= ============= ============ ============

LOSS FOR THE PERIOD (1,188,787) (1,274,148) (2,574,618)

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD (1,188,787) (1,274,148) (2,574,618)

========================================= ============= ============ ============

Earnings per share expressed

in pence per share:

Basic - continuing and total

operations (0.40p) (0.68p) (1.07p)

========================================= ============= ============ ============

UNAUDITED AND CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

30 JUNE 2019

Unaudited Unaudited Audited

at 30 June at 30 June at 31 December

2019 2018 2018

GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible assets 822,682 884,060 748,062

Property, plant and equipment 439,609 46,479 32,816

================================ ============= ============= ================

1,262,291 930,539 780,878

=============================== ============= ============= ================

CURRENT ASSETS

Trade and other receivables 298,911 323,350 301,742

Tax receivable - - 24,534

Cash and cash equivalents 3,793,427 6,196,701 5,032,087

-------------------------------- ------------- ------------- ----------------

4,092,338 6,520,051 5,358,363

=============================== ============= ============= ================

TOTAL ASSETS 5,354,629 7,450,590 6,139,241

================================ ============= ============= ================

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 2,363,890 2,363,890 2,363,890

Share premium 21,456,572 21,456,572 21,456,572

Capital contribution reserve 125,000 125,000 125,000

Retained earnings (19,539,103) (17,083,371) (18,375,226)

TOTAL EQUITY 4,406,359 6,862,091 5,570,236

================================ ============= ============= ================

LIABILITIES

NON-CURRENT LIABILITIES

Lease liability 338,731 - -

------------------------------- ------------- ------------- ----------------

338,731 - -

CURRENT LIABILITIES

Lease liability 78,828 - -

Trade and other payables 530,711 588,499 569,005

-------------------------------- ------------- ------------- ----------------

TOTAL CURRENT LIABILITIES 609,539 588,499 569,005

-------------------------------- ------------- ------------- ----------------

TOTAL LIABILITIES 948,270 588,499 569,005

TOTAL EQUITY AND LIABILITIES 5,354,629 7,450,590 6,139,241

================================ ============= ============= ================

UNAUDITED AND CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

FOR THE SIX MONTHSED 30 JUNE 2019

Capital

Called up contribution Retained

share capital Share premium reserve earnings Total equity

GBP GBP GBP GBP GBP

Balance at 1

January 2018 1,443,890 16,935,301 125,000 (15,833,053) 2,671,138

Net issue of

Share Capital 920,000 4,521,271 - - 5,441,271

Share based payment - - - 23,832 23,832

Total comprehensive

income - - - (1,274,150) (1,274,150)

---------------------- --------------- -------------- -------------- ------------- -------------

Balance at 30

June 2018 2,363,890 21,456,572 125,000 (17,083,371) 6,862,091

---------------------- --------------- -------------- -------------- ------------- -------------

Changes in equity

Share based payment - - - 8,613 8,613

Total comprehensive

income - - - (1,300,468) (1,300,468)

====================== =============== ============== ============== ============= =============

Balance at 31

December 2018 2,363,890 21,456,572 125,000 (18,375,226) 5,570,236

====================== =============== ============== ============== ============= =============

Changes in equity

Share based payment - - - 24,910 24,910

Total comprehensive

income - - - (1,188,787) (1,188,787)

====================== =============== ============== ============== ============= =============

Balance at 30

June 2019 2,363,890 21,456,572 125,000 (19,539,103) 4,406,359

====================== =============== ============== ============== ============= =============

UNAUDITED AND CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 30 JUNE 2019

Unaudited Unaudited Audited

Half year Half year Year to

to to 31

30 June 30 June December

2019 2018 2018

GBP GBP GBP

EARNINGS BEFORE INTEREST, TAXATION,

DEPRECIATION AND AMORTISATION (1,016,820) (965,388) (1,993,284)

Decrease/(increase) in trade

and other receivables 2,831 (102,255) (75,785)

(Decrease)/increase in trade

and other payables (30,766) 166,002 149,435

---------------------------------------------- ---------------- --------------- ----------------

CASH USED IN OPERATIONS (1,044,755) (901,641) (1,919,634)

Tax received 24,534 25,268 25,268

---------------------------------------------- ---------------- --------------- ----------------

NET CASH FROM OPERATING ACTIVITIES (1,020,221) (876,373) (1,894,366)

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of intangible fixed

assets (196,769) (110,545) (254,856)

Purchase of tangible fixed

assets (12,142) (8,047) (17,498)

Interest received 11,259 970 11,036

---------------------------------------------- ---------------- --------------- ----------------

NET CASH FROM INVESTING ACTIVITIES (197,652) (117,622) (261,318)

CASH FLOWS FROM FINANCING ACTIVITIES

Share issue (net of expenses) - 5,441,269 5,441,271

Payment of lease liabilities (18,350) - -

Repayment of finance lease (2,437) (2,922) (5,849)

---------------------------------------------- ---------------- --------------- ----------------

NET CASH FROM FINANCING ACTIVITIES (20,787) 5,438,347 5,435,422

(Decrease)/ increase in cash

and cash equivalents (1,238,660) 4,444,352 3,279,738

---------------------------------------------- ---------------- --------------- ----------------

CASH AND CASH EQUIVALENTS AT

BEGINNING OF PERIOD 5,032,087 1,752,349 1,752,349

CASH AND CASH EQUIVALENTS AT

END OF PERIOD 3,793,427 6,196,701 5,032,087

---------------------------------------------- ---------------- --------------- ----------------

NOTES TO THE UNAUDITED AND CONDENSED CONSOLIDATED INTERIM

ACCOUNTS

FOR THE SIX MONTHS ENDED 30 JUNE 2019

1. Basis of preparation and accounting policies

These interim statements have been prepared on a basis

consistent with International Financial Reporting Standards (IFRS).

They do not contain all of the information required for full

financial statements and should be read in conjunction with the

consolidated financial statements of the Company as at and for the

year ended 31 December 2018. These interim financial statements do

not constitute statutory accounts within the meaning of the

Companies Act.

The interim financial information has not been audited. The

interim financial information was approved by the Board of

Directors on 9 September 2019. The information for the year ended

31 December 2018 is extracted from the statutory financial

statements for that year which have been reported on by the Group's

auditors and delivered to the Registrar of Companies. The audit

report was unqualified and did not contain a statement under s498

(2) or 498(3) of the Companies Act 2006.

The accounting policies applied by the Company in these interim

financial statements are the same as those applied by the Company

in its financial statements for the year ended 31 December 2018.

However, the interim financial statements are prepared in

accordance with IFRS 16, the new accounting standard for leases,

which came into effect from 1 January 2019. Additional disclosure

required by IFRS 16 has been included in the primary financial

statements and note 2.

2. Leases

Short-term leases and leases of low value

The Company leases its head office building. The lease in place

at 31 December 2018 expired during the period. The Company elected

not to recognise a right-of-use asset or lease liability for this

lease due to the short-term nature of the lease. The Company

recognised lease payments associated with this lease as an

operating expense on a straight-line basis over the remaining lease

term.

At the 31 December 2018 the Company also had a finance lease in

place for computer software which was of low value. This lease

expired during the period. The Company elected not to recognise a

right-of-use asset or lease liability due to the short-term nature

and low value of the lease. The full amount of the lease

outstanding at 31 December 2018 was expensed during the period.

Office Building

During the period the Company entered into a new non-cancellable

lease for a period of five years with an option to break after

three years. The Company has determined that it is likely to take

up the final two years of the lease. The Company has recognised a

right-of-use asset and a lease liability at the lease commencement

date. The right-of-use asset is measured at cost, which comprises

the initial amount of the lease liability adjusted for any lease

payments made at or before the commencement date.

The right-of-use asset is subsequently depreciated using the

straight-line method over the five year lease term.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date

discounted at an estimate of the Company's incremental borrowing

rate.

The Company recognised an initial right-of-use asset of

GBP431,988 and a depreciation charge of GBP15,859 relating to this

asset in the period resulting in a right-of-use asset of GBP416,129

at 30 June 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAXNKEEFNEFF

(END) Dow Jones Newswires

September 09, 2019 02:00 ET (06:00 GMT)

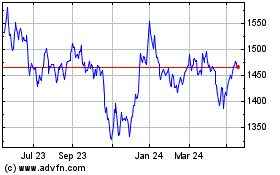

Ft Fbt (LSE:FBT)

Historical Stock Chart

From Feb 2025 to Mar 2025

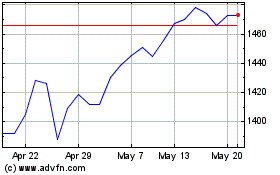

Ft Fbt (LSE:FBT)

Historical Stock Chart

From Mar 2024 to Mar 2025