TIDMFCRM

RNS Number : 6090J

Fulcrum Utility Services Ltd

14 December 2022

14 December 2022

FULCRUM UTILITY SERVICES LIMITED

("Fulcrum" or "the Group")

Unaudited interim results for the six months ended 30 September

2022

Fulcrum Utility Services Limited, a leading independent provider

of essential utility services including multi-utility connections

and renewable energy infrastructure, provides its interim results

for the six-month period ended 30 September 2022.

The first half of FY23 has been challenging for the Group, as it

has continued to experience the impact of the significant, ongoing

demands presented by a turbulent energy market and wider difficult

economic conditions.

The Group's legacy operational issues have also been deeper and

more longstanding than anticipated. This, together with challenges

with historical projects and the unprecedented cost increases

impacting much of the Group's supply chain, has continued to erode

sales margins and weighed heavily on the Group's performance.

The Group's progress in the period was also further hampered by

a cyber security incident, which impaired managerial and system

information, and the ability to fully invoice customers, for up to

three weeks.

Financial headlines:

-- Revenues for the six months to 30 September 2022 decreased by 16% on the previous year to GBP23.9 million (H122:

GBP28.6 million)

-- Adjusted EBITDA(1) of GBP(3.3) million (H122: Adjusted EBITDA(1) of GBP1 million)

-- Net cash(2) position as at 30 September 2022 of GBP4.8 million (30 September 2021: net debt(2) of GBP3.3 millio

n)

(1) Adjusted EBITDA is operating (loss) / profit excluding the

impact of exceptional items, other net gains, depreciation,

amortisation and equity-settled share-based payment charges.

(2) Net cash / debt is defined as cash and cash equivalents less

loans and borrowings, excluding lease liabilities.

Strategic and operational headlines:

-- New Executive team implemented critical improvement actions to protect and improve margins and to refocus the

Group on its core utility infrastructure and asset ownership growth strategy

-- Despite challenging market conditions, the Group is pleased to have won a series of major utility contract awards

in the period including:

--

-- a GBP4.1m contract to design and deliver the high voltage electrical infrastructure that will power a new

158-acre solar farm and battery storage facility;

-- a GBP2m multi-utility infrastructure project to power a leisure resort in the south of England for a

leading brand of family resorts;

-- a GBP2m contract to deliver High Voltage electrical infrastructure that will power a new Battery Energy

Storage System in the north of England; and

-- a GBP1.2 million project to support the energisation High Voltage infrastructure for a new 50MW solar

farm.

-- Importantly, these contracts have been tendered on in line with the Group's improved margin strategy and have

been secured under enhanced contractual terms which better protect the Group and its margins in the current

economic conditions

-- Inclusive of the contract wins, the order book at 30 September 2022 was GBP50.2 million, an increase of 3% (31

March 2022: GBP48.7 million)

Domestic Asset Sale update

-- In the period, the Group successfully completed tranche five of the domestic gas assets transfer to ESP for a

total consideration of GBP2.2 million on 31 May 2022. GBP2.1 million of this was received in cash on 1 June

22 with a further GBP0.1 million in cash received in respect of the previous tranches of assets transferred.

Post Period end

-- The Group is pleased to confirm that it has continued to win a strong succession of new contract wins and

continues to build a healthy pipeline of new opportunities;

-- Tranche six of the domestic gas assets transfer to ESP was also successfully completed for a total consideration

of GBP1.6 million. GBP1.5 million of this was received in cash on 1 December 2022;

-- The Company entered into an arrangement with Bayford & Co Ltd ("Bayford") and funds managed by the Harwood

Capital Management Limited Group ("Harwood") in respect of the provision of funding of up to GBP6 million (the

"Facility") by way of a convertible loan; and

-- Review initiated to consider all the various strategic options available to the Group in order to maximise value

for all shareholders

-- The Group confirms that Antony Collins, Interim CEO, will leave the business on 31 December 2022 following the

completion of his 12-month assignment. The Board would like to thank Antony for his contribution to Fulcrum

during his tenure

-- Lindsay Austin, Managing Director of The Bayford Group, will take over day-to-day responsibility from Antony

Collins as Interim CEO. A handover process is currently underway.

Current trading and Outlook

The Executive team's continuing priority is to protect and

improve margins in the current turbulent market conditions. New

critical measures, including controls and procedures to ensure

optimal performance and to improve and protect the Group's margins,

have been implemented and, whilst the benefits of these actions are

yet to be fully realised and will take longer than expected to

positively impact the Group's results, the Board is pleased that

the series of multi-utility contracts won in the period have been

under these revised contractual terms.

In conjunction with these management improvements, and supported

by the new Facility, the Group has initiated a review of the

various strategic options available to it to maximise value for all

shareholders and to ensure it continues to have adequate working

capital.

Medium to long-term market fundamentals remain strong and the

Group's experience and capabilities mean it remains well positioned

to benefit from the UK's transition to a low carbon economy and a

net-zero future.

Jennifer Babington, Chair, said:

"The Board and I are disappointed in these results but remain

confident that the business is taking the necessary actions to turn

the Group's performance around. This is a challenging task, taking

longer than anticipated, as improvements are being implemented

alongside turbulent and difficult economic conditions. Despite

these challenges, the medium to long-term growth opportunities for

the Group remain clear and are underpinned by strong market drivers

and government stimulus. We are also very pleased to be supported

by our major shareholders as we move the business forward. The

recent Facility will support the Group's strategy review, which

will underpin its turnaround. I also believe the new Facility is

another positive demonstration of the future potential that our

major shareholders see in Fulcrum."

This announcement contains inside information.

Enquiries:

Fulcrum Utility Services Limited +44 (0)114 280

Jonathan Jager, Chief Financial Officer 4150

Cenkos Securities plc (Nominated adviser and broker)

Camilla Hume / Callum Davidson (Nomad) / Michael +44 (0)20 7397

Johnson (Sales) 8900

Notes to Editors:

Fulcrum is a multi-utility infrastructure and services provider.

The Group operates nationally with its head office in Sheffield,

UK. It designs, builds, owns and maintains utility infrastructure

and offers smart meter exchange programmes.

https://investors.fulcrum.co.uk

Financial performance

Group revenue for the first six months of the financial year was

GBP23.9 million, GBP4.7 million, 16% behind the first half of last

year (H1 2022: GBP28.6 million). This decline was seen across a

number of our Infrastructure: Design and Build activities, as we

exited a number of loss making Smart Metering Services contracts,

as well as seeing fewer large gas contracting projects than in the

previous year.

Gross margin, excluding the impact of exceptional items, was 11%

in the first half of the financial year, down 10.9% compared to the

first half of FY22, as a consequence of unprecedented increases in

material and labour costs, as well as unfavourable contractual

terms impeding the Group's ability to recover adverse cost impacts.

These issues have since been addressed with revised and more

rigorous controls being introduced with the Group anticipating the

benefits will begin to be seen in the future trading periods.

The Group is reporting an adjusted EBITDA(1) of GBP(3.3)

million, versus a GBP1 million adjusted EBITDA(1) in the first half

of last year (H1 2022) and a loss before tax of GBP20.3 million (H1

2022: loss before tax of GBP1.3 million).

As a result of the increasing cost of capital and challenging

trading conditions, the Group has felt it necessary to recognise a

significant impairment of GBP12.1 million on its intangible assets,

with a further GBP2.3 million being provided for additional loss

making contracts identified within the Infrastructure: Design and

Build operations. Consequently, the Group is reporting an Operating

Loss of GBP20.2 million for the first six months of the financial

year (GBP19.1 million adverse to the same period in FY22).

Pleasingly the order book has improved since 31 March 2022 and

we are seeing encouraging signs of new contract wins with better

target margins. At 30 September 2022 the order book was GBP50.2

million, an increase of 3% from GBP48.7 million, at 31 March

2022.

Over the six months to 30 September 2022, net asset value

reduced to GBP25.5 million (FY 2022: GBP45.9 million) primarily as

a result of the GBP12.1 million impairment of intangible assets,

which represents a full write down of the intangibles previously

carried for the Dunamis and Fulcrum businesses, and a significant

impairment to the goodwill in the Maintech business. The Group is

therefore reporting a GBP20.7 million loss after tax (H1 2022: loss

of GBP1.1 million) and a reduction in net assets per share to 6.4p

per share from 11.5p per share at 31 March 2022.

At 30 September 2022, the Group had cash and cash equivalents of

GBP4.8 million, a decrease of GBP6.4 million from 31 March 2022 (FY

2022: cash and cash equivalents of GBP11.2 million).

Delivering contracts safely, efficiently, and profitably

Maintaining the highest standards of health and safety remains

our highest priority. A safety-first strategy is in place to ensure

zero harm and, although this is well embedded into our culture and

operations, we are never complacent and are committed to continuous

improvement in health and safety performance.

In the period, the Executive team has implemented critical

improvements to protect and improve margins in the current

difficult economic conditions. New contracts won, have been

tendered on in line with the Group's revised margin strategy and

secured under enhanced contractual terms which better protect the

Group and its margins in the current economic conditions. This

includes, for example, additional mechanisms to protect and recover

margin considering the wider and unprecedent market issues of

supply chain pressure and cost inflation in materials and

labour.

Consolidated Interim Statement of Comprehensive Income

For the six months ended 30 September 2022 (unaudited)

Unaudited Unaudited

Six months ended 30 Six months ended 30 Audited

September 2022 September 2021 Year ended

31 March

2022

Note GBP'000 GBP'000 GBP'000

------------------------------ ----- ----------------------------- ----------------------------- -------------

Revenue 2 23,939 28,552 61,846

------------------------------ ----- ----------------------------- ----------------------------- -------------

Cost of sales - underlying (21,316) (22,306) (50,149)

Cost of sales - exceptional

items 4 (2,091) - (5,422)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Total cost of sales (23,407) (22,306) (55,571)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Gross profit 532 6,246 6,275

Administrative expenses -

underlying (7,477) (7,063) (15,094)

Administrative expenses -

exceptional items 4 (12,694) (184) (5,202)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Total administrative expenses (20,171) (7,247) (20,296)

Other net (losses)/gains 5 (513) (34) 330

------------------------------ ----- ----------------------------- ----------------------------- -------------

Operating loss (20,152) (1,035) (13,691)

Net finance expense (159) (256) (496)

Loss before tax (20,311) (1,291) (14,187)

Taxation 7 (382) 187 765

------------------------------ ----- ----------------------------- ----------------------------- -------------

Loss for the financial

period/year (20,693) (1,104) (13,422)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Other comprehensive income

Items that will never be

reclassified to profit or

loss:

Revaluation of utility assets - - 4,252

Surplus arising on utility

assets internally adopted in

the period/year 29 119 57

Reversal of prior increase of - (83) -

utility assets

Additional costs allocated to

previously revalued assets (3) (37) -

Impairment of previously

revalued utility assets - - (477)

Deferred tax on items that

will never be reclassified

to profit or loss 246 (380) (1,083)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Total comprehensive expense

for the period/year (20,421) (1,485) (10,673)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Loss per share attributable to the owners of the business

-------------

Basic 6 (5.2)p (0.5)p (5.2)p

Diluted 6 (5.2)p (0.5)p (5.1)p

------------------------------ ----- ----------------------------- ----------------------------- -------------

Adjusted EBITDA

Adjusted EBITDA is the basis that the Board uses to measure and

monitor the Group's financial performance as it is a more accurate

reflection of the commercial reality of the Group's business.

Further details of the Alternative Performance Measures are

included in note 3.

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 September ended 30 September 31 March

2022 2021 2022

-------------------- --------------------

GBP'000 GBP'000 GBP'000

Operating loss (20,152) (1,035) (13,691)

Equity-settled share-based payment

charge 27 216 639

Other net losses/(gains) 513 34 (330)

Exceptional items within operating

loss 14,785 184 10,624

Depreciation and amortisation 1,528 1,598 3,257

------------------------------------ -------------------- -------------------- ------------

Adjusted EBITDA (3,299) 997 499

(Loss)/surplus arising on sale

of domestic utility assets and

enhanced payments (513) (34) 330

------------------------------------ -------------------- -------------------- ------------

Adjusted EBITDA including sale

of domestic utility assets (3,812) 963 829

------------------------------------ -------------------- -------------------- ------------

Consolidated Interim Statement of Changes in Equity

For the six months ended 30 September 2022 (unaudited)

Share capital Share premium Revaluation Merger reserve Retained Total equity

reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------------- -------------- ---------------- --------------- ---------------- -------------

Balance at 1

April 2022

(audited) 399 20,777 9,969 11,347 3,383 45,875

Loss for the

period - - - - (20,693) (20,693)

Surplus arising

on utility

assets

internally

adopted in the

period - - 29 - - 29

Disposal of

previously

revalued

assets - - (873) - 873 -

Depreciation on

previously

revalued

assets - - (137) - 137 -

Additional

costs

allocated to

previously

revalued

assets - - (3) - - (3)

Deferred tax in

respect of

items that

will never be

reclassified

to profit and

loss - - 246 - - 246

Transactions

with equity

shareholders:

Equity settled

share-based

payments - - - - 27 27

Balance at 30

September 2022

(unaudited) 399 20,777 9,231 11,347 (16,273) 25,481

For the six

months ended 30

September 2021

Restated

balance at 1

April 2021

(audited) 222 389 9,552 11,347 13,871 35,381

Loss for the

period - - - - (1,104) (1,104)

Surplus arising

on utility

assets

internally

adopted in the

period - - 119 - - 119

Disposal of

previously

revalued

assets - - (1,179) - 1,179 -

Depreciation on

previously

revalued

assets - - (129) - 129 -

Reversal of

prior increase

of utility

assets - - (83) - - (83)

Additional

costs

allocated to

previously

revalued

assets - - (37) - - (37)

Deferred tax in

respect of

items that

will never be

reclassified

to profit and

loss - - (380) - - (380)

Transactions

with equity

shareholders:

Equity settled

share-based

payments - - - - 216 216

---------------- -------------- -------------- ---------------- --------------- ---------------- -------------

Balance at 30

September 2021

(unaudited) 222 389 7,863 11,347 14,291 34,112

---------------- -------------- -------------- ---------------- --------------- ---------------- -------------

Consolidated Interim Balance Sheet

At 30 September 2022

Unaudited Unaudited Audited

30 September 2022 30 September 2021 31 March 2022

Note GBP'000 GBP'000 GBP'000

-------------------------------- ------ ------------------- ------------------- ---------------

Non-current assets

Property, plant and equipment 9 36,088 35,071 37,151

Intangible assets 10 3,245 18,240 15,597

Right-of-use assets 2,082 2,732 2,323

Deferred tax assets 2,331 3,645 3,495

-------------------------------- ------ ------------------- ------------------- ---------------

43,746 59,688 58,566

-------------------------------- ------ ------------------- ------------------- ---------------

Current assets

Contract assets 21,175 21,241 20,177

Inventories 421 462 433

Trade and other receivables 11 10,005 7,927 9,620

Cash and cash equivalents 14 4,774 1,035 11,176

-------------------------------- ------ ------------------- ------------------- ---------------

36,375 30,665 41,406

-------------------------------- ------ ------------------- ------------------- ---------------

Total assets 80,121 90,353 99,972

-------------------------------- ------ ------------------- ------------------- ---------------

Current liabilities

Trade and other payables 12 (14,922) (12,570) (15,825)

Contract liabilities (27,107) (30,636) (25,272)

Current lease liability (808) (913) (802)

Current provisions 15 (3,161) (34) (3,035)

-------------------------------- ------ ------------------- ------------------- ---------------

(45,998) (44,153) (44,934)

-------------------------------- ------ ------------------- ------------------- ---------------

Non-current liabilities

Non-current lease liability (1,643) (2,152) (1,873)

Borrowings 13 - (4,296) -

Non-current provisions 15 (2,031) - (1,296)

Deferred tax liabilities (4,968) (5,640) (5,994)

-------------------------------- ------ ------------------- ------------------- ---------------

(8,642) (12,088) (9,163)

-------------------------------- ------ ------------------- ------------------- ---------------

Total liabilities (54,640) (56,241) (54,097)

-------------------------------- ------ ------------------- ------------------- ---------------

Net assets 25,481 34,112 45,875

-------------------------------- ------ ------------------- ------------------- ---------------

Equity

Share capital 399 222 399

Share premium 20,777 389 20,777

Revaluation reserve 9,231 7,863 9,969

Merger reserve 11,347 11,347 11,347

Retained earnings (16,273) 14,291 3,383

-------------------------------- -------------------------- ------------------- ---------------

Total equity 25,481 34,112 45,875

-------------------------------- -------------------------- ------------------- ---------------

Consolidated Interim Cash Flow Statement

For the six months ended 30 September 2022

Unaudited Unaudited Audited

Six months ended 30 Six months ended 30 Year ended 31 March 2022

September 2022 September 2021

GBP'000 GBP'000 GBP'000

---------------------------- ----------------------------- -------------------------- --------------------------

Cash flows from operating

activities

Loss for the period/year

after tax (20,693) (1,104) (13,422)

Tax charge/(credit) 382 (187) (765)

--------------------------- --- ------------------------- -------------------------- --------------------------

Loss before tax for the

period/year (20,311) (1,291) (14,187)

Adjustments for:

Depreciation 892 874 1,832

Amortisation of intangible

assets 636 724 1,425

Exceptional items - fixed

asset impairment - - 1,920

Exceptional items -

intangible asset

impairment 12,059 - 2,309

Net finance expense 159 256 496

Equity settled share-based

payment charges 27 216 639

Loss on disposal of

utility assets 560 119 75

Gain on IFRS 16 lease

modification - - (16)

Additional consideration

receivable from previous

utility asset sales - - (259)

Increase in c ontract

assets (998) (5,197) (4,537)

Increase in trade and

other receivables (589) (1,903) (3,154)

Decrease/(increase) in

inventories 12 (24) 5

(Decrease)/increase in

trade and other payables (1,077) (94) 3,370

Increase/(decrease) in

contract liabilities 1,835 3,538 (1,826)

Decrease/(increase) in

provisions 861 (20) 4,277

Cash outflow from

operating activities (5,934) (2,802) (7,631)

Tax received 22 - 12

Net cash outflow from

operating activities (5,912) (2,802) (7,619)

--------------------------- --- ------------------------- -------------------------- --------------------------

Cash flows from investing

activities

Acquisition of external

utility assets (1,558) (1,166) (2,468)

#Utility assets internally

adopted (344) (1,097) (2,475)

Acquisition of property,

plant and equipment (68) (216) (242)

Acquisition of intangible

assets (343) (57) (424)

Proceeds on disposal of

utility assets 2,082 3,725 6,487

Receipt of deferred

consideration on disposal

of utility assets - 642 642

Costs paid in relation to

disposal of utility assets (4) (28) (141)

Additional consideration

received from previous

utility asset sales 210 - 49

Net cash (outflow)/inflow

from investing activities (25) 1,803 1,428

--------------------------- --- ------------------------- -------------------------- --------------------------

Cash flows from financing

activities

Proceeds from issue of ordinary

shares - - 21,263

Share issue transaction costs - - (698)

Borrowings received - 2,000 5,250

Borrowings repaid - (3,250) (10,950)

Prepaid arrangement fees - (3) (11)

Interest paid and banking

charges (non-IFRS 16) (42) (137) (297)

IFRS 16 - principal payments (377) (453) (1,022)

IFRS 16 - interest payments (46) (57) (121)

IFRS 16 - proceeds received on

disposal of leased vehicle - - 19

Net cash (outflow)/inflow from

financing activities (465) (1,900) 13,433

-------------------------------- ------------------------- -------------------------- --------------------------

Net (decrease)/increase in cash

and cash equivalents (6,402) (2,899) 7,242

Cash and cash equivalents at

beginning of period/year 11,176 3,934 3,934

-------------------------------- ------------------------- -------------------------- --------------------------

Cash and cash equivalents at

end of period/year 4,774 1,035 11,176

-------------------------------- ------------------------- -------------------------- --------------------------

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

1. Basis of preparation of the condensed consolidated interim financial information

General information

Fulcrum Utility Services Limited (the "Company") is a limited

company incorporated in the Cayman Islands and domiciled in the UK.

The ordinary shares are traded on AIM on the London Stock Exchange.

The address of its registered office is PO Box 309, Ugland House,

Grand Cayman, KY1-1104, Cayman Islands.

The condensed consolidated interim financial information for the

six months ended 30 September 2022 comprise the Company and its

subsidiaries (together referred to as the "Group").

The condensed consolidated interim financial information,

including the financial information for the year ended 31 March

2022 set out in this interim financial information, does not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. The information for the year ended 31 March

2022 is derived from the non-statutory accounts for that financial

year. The non-statutory accounts for the year ended 31 March 2022

were approved on 1 August 2022. The Auditor's report on those

accounts was unqualified.

These condensed consolidated interim financial statements have

not been audited or reviewed. They were approved by the Board on 13

December 2022.

Basis of preparation

The condensed consolidated interim financial information for the

six month period ended 30 September 2022 has been prepared in

accordance with IAS 34, 'Interim Financial Reporting' as adopted by

the United Kingdom. The condensed consolidated interim financial

information should be read in conjunction with the Annual Report

and Accounts for the year ended 31 March 2022, which have been

prepared in accordance with International Financial Reporting

Standards (IFRSs) as adopted by the United Kingdom.

Going-concern basis

The condensed consolidated interim financial information is

prepared on the basis that the Group is a going concern but with

material uncertainties currently in evidence. In assessing going

concern and determining whether there are material uncertainties,

the Directors consider the Group`s business activities, together

with factors that are likely to affect its future development and

position.

A review of the Group`s cash flows, solvency, liquidity position

and borrowing facilities has taken place. At 30 September 2022 the

Group had net assets of GBP25.5 million (31 March 2022: GBP45.9

million) including net cash of GBP4.8 million (31 March 2022:

GBP11.2 million). In the six months to 30 September 2022 the

Group's net cash outflow from operations before tax was GBP6.0

million (31 March 2022: GBP7.6 million).

Following the period in question, the Company entered into an

arrangement with Bayford & Co Ltd ("Bayford") and funds managed

by the Harwood Capital Management Limited Group ("Harwood") in

respect of the provision of funding of up to GBP6 million (the

"Facility") by way of a convertible loan. This Facility is expected

to support the Group to initiate a review of the various strategic

options available to it to maximise value for all shareholders and

to ensure the Group continues to have adequate working capital,

however it is anticipated that additional funding will be required

to support its future trading in FY24.

Accounting policies

The same accounting policies are followed in this condensed

consolidated interim financial information as were applied in the

Group`s latest audited financial statements to 31 March 2022.

2. Segmental analysis

The Board has been identified as the Chief Operating Decision

Maker (CODM) as defined under IFRS 8: Operating Segments. The

directors consider there to be two operating segments,

Infrastructure: Design and Build, and Utility assets: Own and

Operate. Fulcrum's Infrastructure: Design and Build segment

provides utility infrastructure and connections services. Utility

assets: Own and Operate comprises both the ownership of gas,

electrical and meter assets and the safe and efficient conveyance

of gas and electricity through its transportation networks. Gas

transportation services are provided under the iGT licence granted

from Ofgem in June 2007 and electricity services are provided under

the iDNO licence granted from Ofgem in November 2017.

The information provided to the Board includes management

accounts comprising operating result before exceptional items for

each segment and other financial and non-financial information used

to manage the business on a consolidated basis.

Six months to 30 September 2022 Six months to 30 September 2021

(unaudited) (unaudited)

Infrastructure: Utility assets: Infrastructure: Utility assets:

Design and Build Own and Operate Total Group Design and Build Own and Operate Total Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----------------- ---------------- ----------- ----------------- ---------------- -----------

Reportable segment

revenue 21,942 1,997 23,939 26,665 1,887 28,552

Adjusted EBITDA* (4,152) 853 (3,299) 213 784 997

Other net

gains/(losses) 47 (560) (513) 85 (119) (34)

Share based

payment charge (27) - (27) (216) - (216)

Depreciation and

amortisation (1,105) (423) (1,528) (1,326) (272) (1,598)

------------------ ----------------- ---------------- ----------- ----------------- ---------------- -----------

Reportable segment

operating

(loss)/profit

before

exceptional items (5,237) (130) (5,367) (1,244) 393 (851)

Cost of sales -

exceptional items (2,091) - (2,091) - - -

Administrative

expenses

-exceptional

items (12,694) - (12,694) (184) - (184)

------------------ ----------------- ---------------- ----------- ----------------- ---------------- -----------

Reporting segment

operating

(loss)/profit (20,022) (130) (20,152) (1,428) 393 (1,035)

Net finance

expense (22) (137) (159) (45) (211) (256)

------------------ ----------------- ---------------- ----------- ----------------- ---------------- -----------

(Loss)/profit

before tax (20,044) (267) (20,311) (1,473) 182 (1,291)

------------------ ----------------- ---------------- ----------- ----------------- ---------------- -----------

Year ended 31 March 2022 (audited)

Infrastructure: Utility assets:

Design and Build Own and Operate Total Group

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------- ------------------ ----------------- -------------

Reportable segment revenue 57,631 4,215 61,846

Adjusted EBITDA* (1,557) 2,056 499

Other net gains 146 184 330

Share based payment charge (639) - (639)

Depreciation and amortisation (2,606) (651) (3,257)

---------------------------------------------------------------- ------------------ ----------------- -------------

Reportable segment operating (loss)/profit before exceptional

items (4,656) 1,589 (3,067)

Cost of sales - exceptional items (3,502) (1,920) (5,422)

Administrative expenses - exceptional items (5,202) - (5,202)

---------------------------------------------------------------- ------------------ ----------------- -------------

Reporting segment operating loss (13,360) (331) (13,691)

Net finance expense (107) (389) (496)

---------------------------------------------------------------- ------------------ ----------------- -------------

Loss before tax (13,467) (720) (14,187)

---------------------------------------------------------------- ------------------ ----------------- -------------

*Adjusted EBITDA is operating (loss) / profit excluding the

impact of exceptional items, other net losses/gains, depreciation,

amortisation and equity-settled share-based payment charges. Full

reconciliation of Alternative Performance Measures (APMs) is

provided in note 3 .

The Group derives all of its revenue from the UK and all of the

Group's customers are based in the UK. The Group`s revenue is

derived from contracts with customers.

3. Alternative Performance Measures ("APMs")

The Group uses APMs, as listed below, to present users of the

accounts with a clear view of what the Group considers to be the

results of its underlying, sustainable business operations, thereby

enabling consistent period-on-period comparisons and making it

easier for users of the accounts to identify trends. APMs are not

defined by IFRS and therefore may not be directly comparable with

other companies` APMs. APMs should be considered in addition to,

and are not intended to be a substitute for, or superior to, IFRS

measurements.

Alternative Performance

Measure Definition

----------------------------- --------------------------------------------------

Adjusted EBITDA Operating profit/loss excluding exceptional

items, other net losses/gains, amortisation

and depreciation and equity-settled share-based

payments

Adjusted loss before taxation Loss before taxation excluding amortisation

of acquired intangibles and exceptional

items included within cost of sales and

administrative expenses

Net assets per share Net assets divided by the number of shares

in issue at the financial reporting date

------------------------------- ------------------------------------------------

A reconciliation of APMs to statutory measures is disclosed in

the tables below:

(a) Reconciliation of operating loss to "adjusted EBITDA"

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

2022

GBP'000 GBP'000 GBP'000

----------------------------------- ------------------------------ ------------------------------ ------------

Operating loss (20,152) (1,035) (13,691)

Adjusted for:

Exceptional items within operating

loss (note 4) 14,785 184 10,624

Other net losses/(gains) (note

5) 513 34 (330)

Amortisation and depreciation 1,528 1,598 3,257

Equity-settled share-based

payments 27 216 639

----------------------------------- ------------------------------ ------------------------------ ------------

Adjusted EBITDA (3,299) 997 499

----------------------------------- ------------------------------ ------------------------------ ------------

(b) Reconciliation of loss before tax to "adjusted loss before

taxation"

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 September ended 30 September 31 March

2022 2021 2022

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------- ------------------- ------------

Loss before tax (20,311) (1,291) (14,187)

Adjusted for:

Exceptional items included

in cost of sales 2,091 - 5,422

Exceptional items included

in administrative expenses 12,694 184 5,202

Amortisation of acquired intangibles 624 624 1,248

------------------------------------- ------------------- ------------------- ------------

Adjusted loss before taxation (4,902) (483) (2,315)

------------------------------------- ------------------- ------------------- ------------

(c) Net assets per share

Unaudited Unaudited Audited

30 September 30 September 31 March

2022 2021 2022

------------------------------------ -------------- -------------- ----------

Net assets at end of period/year

(GBP`000) 25,481 34,112 45,875

Issued shares at end of period/year

(000`s) 399,313 222,118 399,313

Net assets per share (p) 6.4p 15.4p 11.5p

------------------------------------ -------------- -------------- ----------

4. Exceptional items

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

2022

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------------------- ------------------------------- -------------

Exceptional items included in cost

of sales 2,091 - 5,422

Exceptional items included in

administrative expenses 12,694 184 5,202

------------------------------------- ------------------------------- ------------------------------- -------------

14,785 184 10,624

------------------------------------- ------------------------------- ------------------------------- -------------

(a) Exceptional items included in cost of sales

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

2022

GBP'000 GBP'000 GBP'000

------------------------ ------------------------------- ------------------------------- -------------

Fixed asset impairment - - 1,920

Onerous contracts 2,091 - 3,502

------------------------ ------------------------------- ------------------------------- -------------

2,091 - 5,422

------------------------ ------------------------------- ------------------------------- -------------

(b) Exceptional items included in administrative expenses

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

2022

GBP'000 GBP'000 GBP'000

--------------------------------- ------------------------------- ------------------------------- -------------

Restructuring costs 291 74 575

One-off legal and advisor costs 174 110 242

Intangible asset impairment 12,059 - 2,309

Onerous contracts 170 - 2,076

--------------------------------- ------------------------------- ------------------------------- -------------

12,694 184 5,202

--------------------------------- ------------------------------- ------------------------------- -------------

In the six month period to 30 September 2022, the Group

recognised an impairment of GBP11.9 million for goodwill and brands

and customer relationships. See note 10 for further detail.

5. Other net (losses)/gains

Included within other net (losses)/gains are the following

amounts:

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

2022

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------------------- ------------------------------- -------------

Loss on disposal of assets (560) (119) (75)

Additional consideration receivable

from utility asset sales in

previous years - - 259

Enhanced payments received 47 85 146

(513) (34) 330

------------------------------------- ------------------------------- ------------------------------- -------------

Additional consideration receivable from utility asset sales in

previous years is amounts due to the Group for utility assets sold

in previous years that were non-metered when sold and became

metered in the year ended 31 March 2022.

Enhanced payments are amounts receivable by the Group when the

number of domestic connections introduced by the Group to a

third-party reaches certain pre-agreed thresholds.

The loss on disposal of assets represents the loss arising on

sale of certain of the Group's utility assets to a third-party. The

Group has entered into an agreement with the third party to sell

part of its utility assets portfolio in structured tranches. The

loss outlined below is the result of assets transferred in the

current and previous financial period/year.

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

2022

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------------------- ------------------------------- -------------

Consideration - proceeds received 2,082 3,725 6,487

Consideration - proceeds receivable 10 - -

Consideration - retention receivable 64 115 201

------------------------------------- ------------------------------- ------------------------------- -------------

Total consideration 2,156 3,840 6,688

Net book value of assets sold

(including the effect of previous

revaluations) (2,631) (3,931) (6,580)

Legal and other costs relating to

the transactions (81) (28) (173)

Discounting of retention

consideration due in more than one

year (4) - (10)

Loss on disposal of assets (560) (119) (75)

------------------------------------- ------------------------------- ------------------------------- -------------

Some of the disposed utility assets had previously been revalued

in accordance with the Group policy. Upon disposal, this gave rise

to a transfer between the revaluation reserve and retained earnings

of GBP873,000 (year ended 31 March 2022: GBP1,445,000).

6. Earnings per share (EPS)

The calculation of the adjusted basic and diluted earnings per

share is based upon the following loss attributable to ordinary

shareholders and the weighted average number of ordinary shares

outstanding:

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

2022

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------------------- ------------------------------- -------------

Loss for the period/year used for

the calculation of basic EPS (20,693) (1,104) (13,422)

Exceptional items included in cost

of sales 2,091 - 5,422

Exceptional items included in

administrative expenses 12,694 184 5,202

Remove tax relief on exceptional

items (2,809) (35) (2,019)

Amortisation of brands and customer

relationships 624 624 1,248

------------------------------------- ------------------------------- ------------------------------- -------------

Loss for the period/year used for

the calculation of adjusted EPS (8,093) (331) (3,569)

------------------------------------- ------------------------------- ------------------------------- -------------

Number of shares:

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 September ended 30 31 March

2022 September 2022

2021

'000 '000 '000

-------------------------------- --------------------- ------------- -------------

Weighted average number

of ordinary shares for

the purpose of basic EPS 399,313 222,118 260,169

Effect of potentially dilutive

ordinary shares 1,437 4,219 1,739

-------------------------------- --------------------- ------------- -------------

Weighted average number

of ordinary shares for

the purpose of diluted

EPS 400,750 226,337 261,908

-------------------------------- --------------------- ------------- -------------

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

EPS 2022

------------------ -------------------------------- -------------------------------- -------------

Basic (5.2)p (0.5)p (5.2)p

Diluted basic (5.2)p (0.5)p (5.1)p

Adjusted basic (2.0)p (0.1)p (1.4)p

Adjusted diluted (2.0)p (0.1)p (1.4)p

------------------ -------------------------------- -------------------------------- -------------

7. Taxation

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2022 2021 31 March

2022

GBP'000 GBP'000 GBP'000

--------------------------- ------------------------------- ------------------------------- ------------

Current tax - - 380

Deferred tax (382) 187 385

--------------------------- ------------------------------- ------------------------------- ------------

Total tax (charge)/credit (382) 187 765

--------------------------- ------------------------------- ------------------------------- ------------

At Budget 2020, the government announced that the corporation

tax main rate (for all profits except ring-fence profits) for the

years starting 1 April 2021 and 2022 would be 19%. At Spring Budget

2021, the government announced that the corporation tax main rate

would rise to 25% for companies with profits over GBP250,000

together with the introduction of a small profits rate of 19% with

effect from 1 April 2023. The increase in the tax rate to 25% is

considered to be substantively enacted, and accordingly the

deferred tax balances expected to unwind after 1 April 2023 have

been calculated using the 25% tax rate.

The Group has GBP7.9 million (31 March 2022: GBP12.5 million) of

tax losses for which deferred tax assets of GBP2.0 million (31

March 2022: GBP3.1 million) have been recognised. The deferred tax

asset is expected to be recovered over five years. The Group also

has unrecognised tax losses of GBP22.1 million (31 March 2022:

GBP9.7 million) for which no deferred tax asset has been recognised

as there is insufficient certainty over whether those losses will

reverse.

8. Capital commitments

At 30 September 2022 the Group had entered into contracts to

purchase property, plant and equipment in the form of utility

assets for the amount of GBP5.5 million. The capital commitments at

31 March 2022 were GBP5.5 million and at 30 September 2021 were

GBP8.9 million .

9. Property, plant and equipment

Fixtures and fittings Computer equipment

Utility assets GBP'000 GBP'000 Total

GBP'000 GBP'000

Cost

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 1 April 2021 (audited) 71,380 1,069 1,344 73,793

Externally acquired assets 1,161 - 216 1,377

Internally adopted assets 578 - - 578

Surplus arising on internally adopted assets 119 - - 119

Disposals (3,951) - - (3,951)

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 30 September 2021 (unaudited) 69,287 1,069 1,560 71,916

---------------------------------------------- ---------------- --------------------- ------------------ ---------

Externally acquired assets 1,516 22 4 1,542

Internally adopted assets 1,846 - - 1,846

Additional costs allocated to internally

adopted assets on which a surplus previously

arose (62) - - (62)

Revaluation 4,252 - - 4,252

Disposals (2,712) - - (2,712)

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 31 March 2022 (audited) 74,127 1,091 1,564 76,782

---------------------------------------------- ---------------- --------------------- ------------------ ---------

Externally acquired assets 1,630 44 24 1,698

Internally adopted assets 340 - - 340

Surplus arising on internally adopted assets 29 - - 29

Disposals (2,636) - - (2,636)

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 30 September 2022 (unaudited) 73,490 1,135 1,588 76,213

---------------------------------------------- ---------------- --------------------- ------------------ ---------

Accumulated depreciation

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 1 April 2021 (audited) (34,353) (856) (1,270) (36,479)

Depreciation charge for the period (254) (30) (102) (386)

Disposals 20 - - 20

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 30 September 2021 (unaudited) (34,587) (886) (1,372) (36,845)

---------------------------------------------- ---------------- --------------------- ------------------ ---------

Depreciation charge for the period (359) (50) (43) (452)

Impairment from external revaluation (2,397) - - (2,397)

Disposals 63 - - 63

At 31 March 2022 (audited) (37,280) (936) (1,415) (39,631)

---------------------------------------------- ---------------- --------------------- ------------------ ---------

Depreciation charge for the period (410) (19) (70) (499)

Disposals 5 - - 5

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 30 September 2022 (unaudited) (37,685) (955) (1,485) (40,125)

---------------------------------------------- ---------------- --------------------- ------------------ ---------

Net book value

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 30 September 2022 (unaudited) 35,805 180 103 36,088

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 31 March 2022 (audited) 36,847 155 149 37,151

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 30 September 2021 (unaudited) 34,700 183 188 35,071

---------------------------------------------- ---------------- --------------------- ------------------ ---------

At 31 March 2021 (audited) 37,027 213 74 37,314

---------------------------------------------- ---------------- --------------------- ------------------ ---------

Additions of internally adopted assets within utility assets in

the six months ended 30 September 2022 are stated at the full cost

of construction of GBP0.7 million (year ended 31 March 2022: GBP3.7

million) less the deficit arising on internally adopted assets of

GBP0.4 million (year ended 31 March 2022: GBP1.3 million).

10. Intangible assets

Goodwill Brands & customer relationships Software Total

GBP'000

GBP'000 GBP'000 GBP'000

At 1 April 2021 (audited) 9,757 8,115 1,035 18,907

Additions - - 57 57

Amortisation for the period - (624) (100) (724)

--------------------------------- -------- ------------------------------- -------- --------

At 30 September 2021 (unaudited) 9,757 7,491 992 18,240

--------------------------------- -------- ------------------------------- -------- --------

Additions - - 367 367

Amortisation for the period - (624) (77) (701)

Impairment for the period (2,149) - (160) (2,309)

--------------------------------- -------- ------------------------------- -------- --------

At 31 March 2022 (audited) 7,608 6,867 1,122 15,597

--------------------------------- -------- ------------------------------- -------- --------

Additions - - 343 343

Amortisation for the period - (624) (12) (636)

Impairment for the period (7,608) (4,255) (196) (12,059)

--------------------------------- -------- ------------------------------- -------- --------

At 30 September 2022 (unaudited) - 1,988 1,257 3,245

--------------------------------- -------- ------------------------------- -------- --------

Given a number of internal and external factors, management

believes that indications for possible impairment exist for

goodwill and brands and customer relationships. Accordingly, an

impairment test has been carried out in relation to both goodwill

and brands and customer relationships. Where an impairment is

indicated, goodwill would be impaired first, followed by brands and

customer relationships on a pro-rata basis.

Goodwill and brands and customer relationships are tested for

impairment by comparing the carrying amount of each CGU with the

recoverable amount. The recoverable amount is the higher of fair

value less costs to sell and the value in use.

Goodwill brought forward at the start of the period relates to

the acquisition of Fulcrum Group Holdings Limited on 8 July 2010

and the acquisition of The Dunamis Group Limited on 5 February

2018. The carrying amount of the goodwill is allocated across

cash-generating units (CGUs). The goodwill held by the Group

relates to either the Fulcrum Infrastructure Services CGU or

Dunamis, which has two CGUs. The brands and customer relationships

also relate to the same CGUs.

In the impairment tests, the recoverable amounts are determined

based on value in use calculations which require assumptions. The

fair value measurement was categorised as a Level 3 fair value

based on the inputs in the valuation technique used.

The recoverable amounts of the CGUs have been determined from

value in use calculations which have been predicated on discounted

cash flow projections from financial plans approved by the Board.

The values assigned to the key assumptions represent management's

assessment of future trends in the relevant industries and have

been based on historical data from both external and internal

sources, together with the Group's views on the future achievable

growth and the impact of committed cash flows. Cash flows beyond

this are extrapolated using the estimated long-term growth rates as

summarised in the following paragraph.

The pre-tax cash flows that these projections produced were

discounted at pre-tax discount rates based on the Group's beta

adjusted cost of capital reflecting management's assessment of

specific risks related to each cash-generating unit. Pre-tax

discount rates of between 11.3% and 13.1% (31 March 2022: between

8.1% and 9.8%) have been used in the impairment calculations which

the directors believe fairly reflect the risks inherent in each of

the CGUs. The terminal cash flows are extrapolated in perpetuity

using a growth rate of 2.0% (31 March 2022: 2.0%). This is not

considered to be higher than the long-term industry growth

rate.

Following the review, the carrying value of the intangible

assets exceeded the associated value in use for all of the CGUs.

Consequently, an impairment of GBP2.2 million was made to the

carrying value of goodwill in the Fulcrum CGU, and impairments of

GBP5.4 million and GBP4.3 million were made to the carrying values

of goodwill and brands and customer relationships, respectively, in

the Dunamis CGUs.

A segment-level summary of the acquired intangible assets

allocation is presented below:

Fulcrum Dunamis Total

GBP'000 GBP'000 GBP'000

---------------------------------- -------- -------- --------

Goodwill - - -

Brands and customer relationships - 1,988 1,988

---------------------------------- -------- -------- --------

11. Trade and other receivables

Unaudited Unaudited Audited

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

----------------------------------- ------------------- ------------------- ---------------

Trade receivables 7,362 4,392 7,326

Other receivables and prepayments 2,643 3,535 2,294

----------------------------------- ------------------- ------------------- ---------------

10,005 7,927 9,620

----------------------------------- ------------------- ------------------- ---------------

12. Trade and other payables

Unaudited Unaudited Audited

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

---------------- ------------------- ------------------- ---------------

Trade payables 6,553 6,830 7,472

Other payables 8,369 5,740 8,353

---------------- ------------------- ------------------- ---------------

14,922 12,570 15,825

---------------- ------------------- ------------------- ---------------

13. Interest-bearing loans and borrowings

Changes in liabilities arising from financing activities are

shown below:

Unaudited Unaudited Audited

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

------------------------------------------- ------------------ ------------------ --------------

At the beginning of the period (94) 5,483 5,483

Repaid - (3,250) (10,950)

New borrowings - 2,000 5,250

Capitalised borrowing fees - (3) (11)

Amortisation of capitalised borrowing fees 71 66 134

------------------------------------------- ------------------ ------------------ --------------

At the end of the period (23) 4,296 (94)

------------------------------------------- ------------------ ------------------ --------------

As no borrowings are outstanding as at 30 September 2022, the

capitalised borrowing fees have been included within trade and

other receivables.

14. Reconciliation to net cash/(debt)

Unaudited Unaudited Audited

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

-------------------------- ------------------ ------------------ --------------

Cash and cash equivalents 4,774 1,035 11,176

Borrowings - (4,296) -

-------------------------- ------------------ ------------------ --------------

Net cash/(debt) 4,774 (3,261) 11,176

-------------------------- ------------------ ------------------ --------------

Net cash/(debt) is defined as cash and cash equivalents less

loans and borrowings, excluding lease liabilities.

15. Provisions

Provision

for costs

to settle Provision

ongoing for onerous Other

legal claims contracts provisions Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ------------- ------------ ------------ ---------

At 31 March 2021(audited) 54 - - 54

Provision created during the period (20) - - (20)

------------------------------------- ------------- ------------ ------------ ---------

At 30 September 2021 (unaudited) 34 - - 34

Provision released during the period (34) - - (34)

Provision created during the period - 5,578 121 5,699

Provision utilised during the period - (1,368) - (1,368)

At 31 March 2022 (audited) - 4,210 121 4,331

Provision created during the period - 2,261 - 2,261

Provision utilised during the period - (1,279) (121) (1,400)

------------------------------------- ------------- ------------ ------------ ---------

At 30 September 2022 (unaudited) - 5,192 - 5,192

------------------------------------- ------------- ------------ ------------ ---------

The provision for onerous contracts relates to future losses

expected to be incurred on contracts deemed to be onerous. The

amount and timing of the outflows related to these provisions are

uncertain, but a reliable estimate has been made.

Of the GBP5.2 million provision for onerous contracts, GBP2.0

million is expected to be settled in more than 12 months. All other

provisions are expected to be settled within 12 months.

16. Related parties

The Group has related party relationships with its subsidiaries,

directors and key management personnel. Details of the

remuneration, share options and pension entitlement of the

directors are included in the Remuneration Report on page 25 of the

Annual Report and Accounts 2022, which are available on the Fulcrum

Utility Services Limited website at

https://investors.fulcrum.co.uk.

Principal risks

The Board have assessed the Principal Risks as disclosed in the

2022 Annual Report and Accounts and have determined that there has

been no change in the risks faced or the risk rating of the risks

detailed.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KXLFFLLLXFBB

(END) Dow Jones Newswires

December 14, 2022 02:00 ET (07:00 GMT)

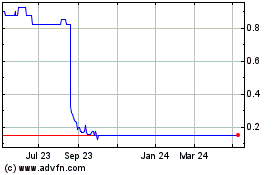

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Jan 2025 to Feb 2025

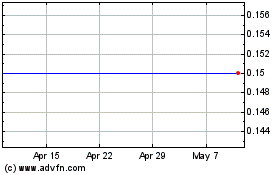

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Feb 2024 to Feb 2025