First Quantum Minerals Reports Second Quarter 2024 Results

(In United States dollars, except where noted

otherwise)

TORONTO, July 23, 2024 (GLOBE NEWSWIRE) -- First

Quantum Minerals Ltd. (“First Quantum” or the "Company”) (TSX: FM)

today reports results for the three months ended June 30, 2024 (“Q2

2024” or the "second quarter") of a net loss attributable to

shareholders of the Company of $46 million ($0.06 loss per share)

and an adjusted loss1 of $13 million ($0.02 adjusted

loss per share2).

“We had another solid quarter in Zambia and with

the work achieved to date, both Kansanshi and Sentinel are set up

well for the remainder of the year. At Enterprise, the continued

successful commissioning and ramp up has enabled the declaration of

commercial production on June 1, 2024 while the S3 Expansion is

progressing well and on track for completion in mid-2025. We also

initiated a copper hedge program as we continue efforts to maintain

the strength of the balance sheet,” commented Tristan Pascall,

Chief Executive Officer of First Quantum. “Finally, it was pleasing

to reach a Shareholder Rights Agreement with Jiangxi Copper, which

formalizes a clear basis for the relationship between us. The

relationship with Jiangxi Copper, who have been a long standing

customer, has solidified since their purchase of First Quantum

shares in 2019. We look forward to Jiangxi Copper's continued

strong support on the strategic direction of the Company.”

Q2 2024 SUMMARY

There were a number of developments during the

second quarter that are also detailed in this news release.

- A Shareholder Rights Agreement with Jiangxi Copper Company

Limited (“Jiangxi Copper”);

- Additional power supply restrictions by the Zambian Electricity

Supply Corporation Limited ("ZESCO");

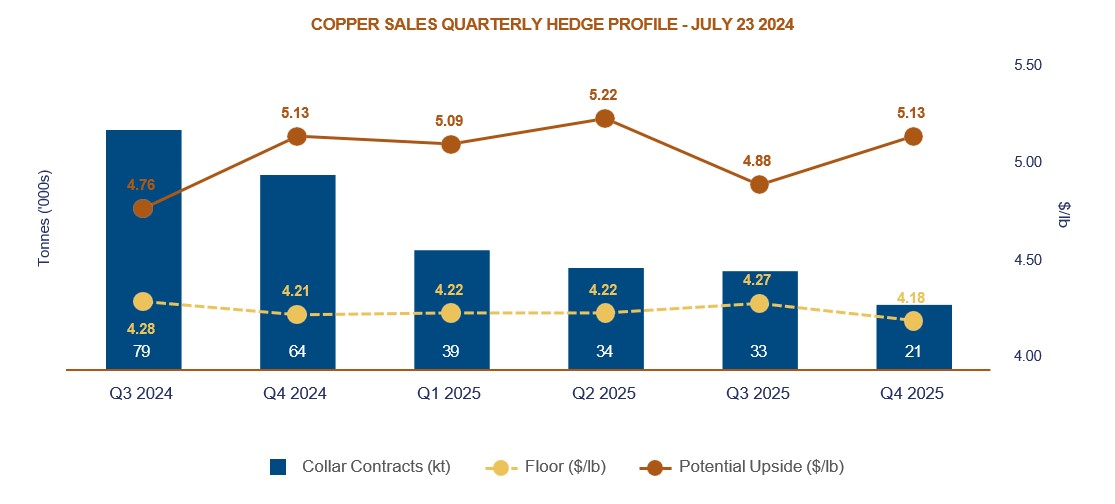

- Implementation of a copper hedging program;

- Updated NI 43-101 Technical Report for Kansanshi

In Q2 2024, First Quantum reported gross profit

of $333 million, EBITDA1 of $336 million, a net loss

attributable to shareholders of $0.06 per share, and an adjusted

loss per share2 of $0.02. Relative to the first quarter

of 2024 (“Q1 2024”), second quarter financial results improved due

to higher copper and gold prices.

Total copper production for the second quarter

was 102,709 tonnes, a 2% increase from Q1 2024 as a result of

higher production at Kansanshi. Copper sales volumes totaled 94,628

tonnes, lagging production due to the timing of shipments and

vessel delays. Copper C1 cash cost3 was $1.73 per lb in

the second quarter, benefiting from strong by-product gold credits.

Enterprise declared commercial production as of June 1, 2024.

2024 guidance remains unchanged for copper and

gold production, while nickel production has narrowed to reflect

year-to-date production at Ravensthorpe. Copper unit cost guidance

remains unchanged.

____________________________

1 EBITDA and adjusted earnings (loss) are non-GAAP

financial measures. These measures do not have a standardized

meaning prescribed by IFRS and might not be comparable to similar

financial measures disclosed by other issuers. See “Regulatory

Disclosures”.

2 Adjusted earnings (loss) per share is a non-GAAP ratio

which does not have a standardized meaning prescribed by IFRS and

might not be comparable to similar financial measures disclosed by

other issuers. See “Regulatory Disclosures”.

3 C1 cash cost (C1) is a non-GAAP ratio, which does not

have a standardized meaning prescribed by IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. See “Regulatory Disclosures”

SHAREHOLDERS RIGHTS AGREEMENT

On July 23, 2024, the Company entered into a

shareholder rights agreement (the “Shareholder Rights Agreement” or

“SRA”) with Jiangxi Copper. The Shareholder Rights Agreement will

formalize and provide structure to the relationship that exists

between the two organizations. Further, the Shareholder Rights

Agreement is also expected to support reasonable sharing of best

practices between the parties across the copper value chain,

including in smelting and refining, in which Jiangxi Copper is a

world leader. The four key provisions of the SRA are:

- Nomination rights:

Jiangxi Copper will have the right to nominate one person for

consideration by the Nominating and Governance Committee of the

board of the Company, which will make a recommendation to the board

regarding the appointment or election of the nominee;

- Standstill:

Jiangxi Copper has agreed to customary standstill restrictions

which, subject to certain exceptions, prohibit Jiangxi Copper from

taking certain actions, including, without the consent of the

Company, acquiring shares of the Company during the term of the SRA

and for a period of six months following the termination of the

SRA;

- Restrictions on

dispositions: Jiangxi Copper has agreed to certain

restrictions on the disposition of its shares of the Company which

include, subject to certain exceptions (i) the right of the Company

to designate one or more purchasers of such shares in the event

that Jiangxi Copper proposes to sell a block of 5% or more of the

shares of the Company, and (ii) not selling such shares to any

person that owns, or would own, following completion of such sale,

more than 9.9% of the issued and outstanding shares of the Company

(allowing for certain ordinary secondary market transactions

executed through the TSX or other stock exchanges on which the

common shares are listed); and,

- Shareholder

support: Jiangxi Copper has agreed that it will not

withhold its vote in respect of the director nominees proposed by

management of the Company or the reappointment of auditors, nor

will it vote against any other matters recommended by the Company’s

board of directors (other than matters relating to an acquisition

of all the shares of the Company by a third party, a sale of a

controlling interest in any material asset of the Company or an

issuance of shares that would result in a person owning more than

10% of the issued and outstanding shares of the Company).

The SRA will terminate upon the earlier of July

23, 2027 and the date on which Jiangxi Copper’s ownership

percentage of the Company’s shares falls below 10%. Jiangxi Copper

and the Company may terminate the SRA at any time by mutual written

agreement.

ZAMBIA POWER UPDATE

On June 11, 2024, ZESCO informed the mining

sector that power curtailment for all mining customers will

increase from the 20% previously communicated to 40% effective July

1, 2024. In response, First Quantum has strategically decided to

source additional power beyond the formal requirements set by ZESCO

to ensure stable operations and support the grid during this

challenging situation. Effective July 1, 2024, the Company is

sourcing 193 MW, or 52% of its maximum power requirement, from

regional sources. Consequently, the impact on C1 copper cash

costs1 is expected to be $0.06 per lb, up from the $0.03

per lb communicated in the first quarter of 2024. The Company

anticipates it will be able to sufficiently substitute curtailed

power with imports from the region for the duration of the

emergency and thereby avoid operational interruptions.

The energy generation deficit is anticipated to

ease with Zambia’s next rainy season, which, according to

traditional weather patterns, begins in mid-November and lasts

until April. Typically, there is a 3 to 4 month delay before the

rains impact Zambia's hydro-power generation, such that by early

2025, Zambia's hydro generation capabilities should begin to

recover.

In the medium term, the Company is in advanced

discussions with three Independent Power Producers to provide

partial offtake commitments for advanced projects scheduled to come

online in the first and second quarter of 2025. The commercial

operation date of these advanced projects align well with the

commissioning and ramp-up of the S3 Expansion project at

Kansanshi.

Longer term, the Company is advancing offtake

arrangements with independent renewable power producers. This

includes a large scale solar/wind generation project with

commissioning targeted for 2026/2027, and hydro projects in

Zambia's Northwest and Northern Provinces. Additionally, the

Company is following developments related to infrastructure

investments to build transmission lines with Angola and Tanzania,

countries with current and forecast excess power.

____________________________

1 C1 cash cost (C1) is a non-GAAP ratio, which does not

have a standardized meaning prescribed by IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. See “Regulatory Disclosures”

COBRE PANAMÁ UPDATE

On July 1, 2024, the new president of Panama,

José Raúl Mulino, was inaugurated into office. In his inauguration

speech, President Mulino announced that the Government of Panama

("GOP") will conduct, with international experts, a strict

environmental audit of the Cobre Panamá mine. The Company

reiterates that transparency and compliance with environmental

standards have always been fundamental for the development of its

operations and welcomes the audit process to broaden the

understanding of conditions at the mine and the challenges to

environmental management brought about by the abrupt mine

suspension.

Steps towards two arbitration proceedings have

been taken by the Company, one under the Canada-Panama Free Trade

Agreement (“FTA”), and another under the International Chamber of

Commerce (“ICC”) pursuant to the arbitration clause of the

Refreshed Concession Contract.

- ICC Arbitration:

On November 29, 2023, Minera Panamá S.A. ("MPSA") initiated

arbitration before the ICC's International Court of Arbitration

pursuant to the ICC’s Rules of Arbitration and Clause 46 of the

Refreshed Concession Contract, to protect its rights under

Panamanian law and the Refreshed Concession Contract that the GOP

agreed to in October 2023. The arbitration clause of the contract

provides for arbitration in Miami, Florida. A final hearing for

this matter is scheduled for September 2025.

- FTA Arbitration:

On November 14, 2023, First Quantum submitted a notice of intent to

the GOP initiating the consultation period required under the FTA.

First Quantum submitted an updated notice of intent on February 7,

2024. First Quantum is entitled to seek any and all relief

appropriate in arbitration, including, but not limited to, damages

and reparation for Panama’s breaches of the Canada-Panama FTA.

These breaches include, among other things, the GOP’s failure to

permit MPSA to lawfully operate the Cobre Panamá mine prior to the

Supreme Court’s November 2023 decision and the GOP’s pronouncements

and actions concerning closure plans and Preservation and Safe

Management ("P&SM") at Cobre Panamá. The Company has the right

to file its arbitration claim under FTA within three years of

Panama’s breaches of the FTA.

The Company reiterates that arbitration is not

the preferred outcome for the situation in Panama, and it remains

committed to dialogue with the new government of Panama and to

being part of a solution for the country and its people.

KANSANSHI S3 EXPANSION

During the second quarter of 2024, construction

of the S3 Expansion project at Kansanshi continued to focus on

major mechanical equipment assembly and installation, namely the

mills and primary crusher, in parallel with assembly and

installation of structural steel, pipe work and electrical work.

Long lead equipment is being received on site and the last delivery

of flotation cells was completed early in the third quarter of

2024. System configuration of the plant control system has

commenced with a focus on early commissioning of medium voltage

power reticulation and plant services in the milling area. The

majority of the capital spend on the S3 Expansion is expected to

occur in 2024, with first production expected in mid-2025.

KANSANSHI NI 43-101 TECHNICAL REPORT

On July 23, 2024, the Company filed an updated

NI 43-101 Technical Report for Kansanshi. The Kansanshi Technical

Report discloses an updated Mineral Resource estimate which

accounts for mining and processing depletions since the filing of a

previous report in September 2020. The updated Measured and

Indicated Mineral Resource estimate, as at the end of December

2023, now stands at 1,160.9 Mt at an average copper grade of

0.61%TCu (excluding stockpiles). Commensurate with the increase in

the Mineral Resource inventory, and also accounting for depletion,

the end of December 2023 reported Proven and Probable Mineral

Reserve has now risen to 935.2 Mt with an average grade of

0.56%TCu, and with an additional 169.5 Mt stockpiled at an average

grade of 0.40%TCu. The increase in Mineral Reserve extends the

operating life of Kansanshi by 5 years to 2049.

Q2 2024 OPERATIONAL HIGHLIGHTS

Total copper production for the second quarter

was 102,709 tonnes, a 2% increase from Q1 2024. Copper sales

volumes totaled 94,628 tonnes, approximately 8,081 tonnes lower

than production due to the timing of shipments and vessel delays at

Walvis Bay, Namibia and Dar-es-Salaam, Tanzania related to weather,

port congestion and schedule disruptions. Copper C1 cash

cost1 was $0.29 per lb lower quarter-over-quarter at

$1.73 per lb, benefiting from strong gold by-product credits.

- Kansanshi’s copper production of

41,507 tonnes in Q2 2024 was 10,034 tonnes higher than the previous

quarter as a result of higher feed grades on the sulphide and mixed

circuits. Grades improved due to higher-grade material from the

Main 15 and Main 17 cutbacks, predominately from mining at higher

elevation. Copper C1 cash cost1 of $1.51 per lb was

$0.83 lower quarter-over-quarter due to higher by- product credits

as a result of improved gold production and stronger gold prices.

Production guidance for 2024 is maintained at 130,000 to 150,000

tonnes of copper and 65,000 to 75,000 ounces of gold. Copper grades

are expected to modestly improve over the course of the year as

mining progresses at higher elevation areas with higher-grade

material from the Main 15 and Main 17 cutbacks. A swap of the mixed

and sulphide mills is planned for the third quarter of 2024 in

order to maximize mixed grade through the mills during this

period.

- Sentinel reported copper production

of 53,595 tonnes in Q2 2024, approximately 8,630 tonnes lower than

the previous quarter. The decline in production was due to lower

grades in the second quarter, which was expected given the

exceptionally strong grades in Q1 2024. The ongoing Stage 3

(Western Cut-back) development progressed well during the second

quarter with the in-pit crusher successfully commissioned ahead of

schedule and below budget and enabled access to softer ore. Copper

C1 cash cost1 of $1.94 per lb is higher than the

preceding quarter, reflecting lower production volumes. Copper

production guidance for 2024 is maintained at 220,000 to 250,000

tonnes. Mining performance and throughput is expected to continue

to improve over the remainder of the year with the ongoing

development of Stage 3, which will enable improved mining

productivities and increased availability of softer material on

shorter haul cycles.

- Enterprise produced 6,147 tonnes of

nickel during the second quarter, an increase from 4,031 tonnes in

Q1 2024. The first half of the year has yielded consistently

positive results, meeting expectations and supporting the

recommendation to declare commercial production as of June 1, 2024.

Mining volumes are steadily improving and ramping up in accordance

with the mobilization strategy and enhanced contractor fleet asset

management. The plant performance has been strong, with increased

fresh feed leading to higher recovery rates and a focus on

optimising recovery for each ore type. An increase in mining

volumes is anticipated through the dry season with a focus on the

South Wall cutback and sinking the pit sump in preparation for the

wet season. Ore variability controls will be prioritized as mixed

oxides with lower feed grade will be primarily processed in

September and October of 2024, but nickel production consistency is

expected to be maintained through higher throughput at full plant

capacity and stable milling rates. Production guidance for 2024 has

been narrowed to 17,000 to 20,000 contained tonnes of nickel

(previously 10,000 to 20,000 tonnes).

- Cobre Panamá currently remains in a

phase of P&SM with production halted and production guidance

suspended. During the second quarter, the process plant

preservation and maintenance cycle was changed from 14 to 28 days,

with equipment being run and monitored. This new maintenance cycle

allows for the completion of outstanding work and corrective

maintenance activities required to maintain the integrity of the

assets. Furthermore, all the major ultra-class mobile equipment is

in a maintenance cycle that adheres to the original equipment

manufacturer's long-term storage recommendations and includes

periodic inspections as well as scheduled startups. This equipment

will be required as part of the P&SM plan that is awaiting

approval by the Ministry of Commerce and Industries. The costs for

the P&SM program in the second quarter were approximately $17

million per month. For the remainder of the year, P&SM expenses

are expected to be $15 to $20 million per month, depending on the

level of environmental stability and asset integrity programs.

Approximately 121 thousand dry metric tonnes of copper concentrate

remains onsite. The sale of this concentrate will result in a net

cash inflow of approximately $265 million at current market prices.

Relevant ministries and government agencies (a cross-government

committee) conducted an inspection at site. In the report of this

committee, it was recommended that the copper concentrate be

exported and the power plant be re-started.

- At Ravensthorpe, nickel production

for the second quarter totaled 1,253 contained tonnes of nickel,

compared to 3,740 tonnes in Q1 2024. Ravensthorpe was placed into

care and maintenance from May 2024. Preparation and cleaning of

plant and equipment for care and maintenance that commenced in May

2024 will be finalized in the first few weeks of the third quarter

of 2024. Activity will be focused on execution of preventative

maintenance plans that have been developed with equipment being run

and monitored to help maintain it in good working condition. In

addition, the Company continues to support its personnel and local

regional communities through the change in circumstances at

Ravensthorpe. Care and maintenance costs for Ravensthorpe are

expected to be approximately $5 million per month for the third

quarter and reduce to approximately $2 million per month from the

fourth quarter onwards. Production guidance has been lowered to

5,000 contained tonnes of nickel (previously 12,000 to 17,000

tonnes) to reflect the closure.

____________________________

1 C1 cash cost (C1) is a non-GAAP ratio, which does not

have a standardized meaning prescribed by IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. See “Regulatory Disclosures”

FINANCIAL HIGHLIGHTS

Financial results continue to be impacted by Cobre Panamá being

in a phase of P&SM, however, the second quarter benefitted from

strong copper and gold prices.

- Gross profit for the second quarter of $333 million was $177

million higher than Q1 2024, while EBITDA1 of

$336 million for the same period was $156 million higher.

- Cash flows from operating activities of $397 million ($0.48 per

share2) for the quarter were $12 million lower than Q1

2024.

- Net debt3 increased by $160 million

during the quarter, attributable mainly to planned higher capital

expenditures at Kansanshi, bringing the net debt3 level

to $5,437 million, with total debt at $6,313 million, as at June

30, 2024.

HEDGING PROGRAM

During the second quarter, the Company entered

into derivative contracts, in the form of unmargined zero cost

copper collars, as protection from downside price movements,

financed by selling price upside beyond certain levels on a matched

portion of production. More than half of planned production remains

exposed to spot copper prices through the period until

end-2025.

At July 23, 2024, the Company had zero cost

copper collar contracts for 269,650 tonnes at weighted average

prices of $4.24 per lb to $5.00 per lb outstanding with maturities

to December 2025.

____________________________

1 EBITDA is a non-GAAP financial measure which does not

have a standardized meaning prescribed by IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. See “Regulatory Disclosures”.

2 Cash flows from operating activities per share is a

non-GAAP ratio, which does not have a standardized meaning

prescribed by IFRS and might not be comparable to similar financial

measures disclosed by other issuers. See “Regulatory

Disclosures”.

3 Net debt is a supplementary financial measure which

does not have a standardized meaning prescribed by IFRS and might

not be comparable to similar financial measures disclosed by other

issuers. See “Regulatory Disclosures”.

CONSOLIDATED FINANCIAL

HIGHLIGHTS

|

|

QUARTERLY |

|

Q2 2024 |

Q1 2024 |

Q2 2023 |

|

Sales revenues |

|

1,231 |

|

|

1,036 |

|

|

1,651 |

|

|

Gross profit |

|

333 |

|

|

156 |

|

|

265 |

|

|

Net earnings (loss) attributable to shareholders of the

Company |

|

(46 |

) |

|

(159 |

) |

|

93 |

|

|

Basic earnings (loss) per share |

|

($0.06 |

) |

|

($0.21 |

) |

$0.13 |

|

|

Diluted earnings (loss) per share |

|

($0.06 |

) |

|

($0.21 |

) |

$0.13 |

|

|

Cash flows from operating activities3 |

|

397 |

|

|

411 |

|

|

719 |

|

|

Net debt1 |

|

5,437 |

|

|

5,277 |

|

|

5,650 |

|

|

EBITDA1,2 |

|

336 |

|

|

180 |

|

|

568 |

|

|

Adjusted earnings (loss)1 |

|

(13 |

) |

|

(154 |

) |

|

85 |

|

|

Adjusted earnings (loss) per share3 |

|

($0.02 |

) |

|

($0.20 |

) |

$0.12 |

|

|

Cash cost of copper production excluding Cobre Panamá (C1) (per

lb)3,4 |

$1.73 |

|

$2.01 |

|

$2.23 |

|

Total cost of copper production excluding Cobre

Panamá (C3) (per lb)3,4 |

$2.83 |

|

$2.97 |

|

$3.23 |

|

Copper all-in sustaining cost excluding Cobre

Panamá (AISC) (per lb)3,4 |

$2.71 |

|

$2.77 |

|

$3.08 |

|

|

Cash cost of copper production (C1) (per lb)3,4 |

$1.73 |

|

$2.02 |

|

$1.98 |

|

|

Total cost of copper production (C3) (per lb)3,4 |

$2.87 |

|

$3.04 |

|

$2.92 |

|

|

Copper all-in sustaining cost (AISC) (per lb)3,4 |

$2.82 |

|

$2.85 |

|

$2.64 |

|

|

Realized copper price (per lb)3 |

$4.39 |

|

$3.78 |

|

$3.75 |

|

|

Net earnings (loss) attributable to shareholders of the

Company |

|

(46 |

) |

|

(159 |

) |

|

93 |

|

|

Adjustments attributable to shareholders of the Company: |

|

|

|

Adjustment for expected phasing of Zambian

value-added tax (“VAT”) |

|

(27 |

) |

|

(10 |

) |

|

(31 |

) |

|

Loss on redemption of debt |

|

– |

|

|

10 |

|

|

– |

|

|

Total adjustments to EBITDA1 excluding

depreciation2 |

|

71 |

|

|

3 |

|

|

15 |

|

|

Tax adjustments |

|

6 |

|

|

3 |

|

|

8 |

|

|

Minority interest adjustments |

|

(17 |

) |

|

(1 |

) |

|

– |

|

|

Adjusted earnings (loss)1 |

|

(13 |

) |

|

(154 |

) |

|

85 |

|

1 EBITDA and adjusted earnings (loss)

are non-GAAP financial measures, and net debt is a supplementary

financial measure. These measures do not have a standardized

meaning under IFRS and might not be comparable to similar financial

measures disclosed by other issuers. Adjusted earnings (loss) have

been adjusted to exclude items from the corresponding IFRS measure,

net earnings (loss) attributable to shareholders of the Company,

which are not considered by management to be reflective of

underlying performance. The Company has disclosed these measures to

assist with the understanding of results and to provide further

financial information about the results to investors and may not be

comparable to similar financial measures disclosed by other

issuers. The use of adjusted earnings (loss) and EBITDA represents

the Company’s adjusted earnings (loss) metrics. See “Regulatory

Disclosures”.

2 Adjustments to EBITDA in 2024 relate principally to an

impairment expense of $71 million, a foreign exchange revaluations

gain of $14m and a restructuring expense of $12 million (2023 -

royalties and revisions in estimates of restoration provision).

3 Adjusted earnings (loss) per share, realized metal

prices, copper all-in sustaining cost (copper AISC), copper C1 cash

cost (copper C1), cash flows from operating activities per share

and total cost of copper (copper C3) are non-GAAP ratios, which do

not have a standardized meaning prescribed by IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. See “Regulatory Disclosures”.

4 Excludes the sale of copper anode produced from

third-party concentrate purchased at Kansanshi. Sales of copper

anode attributable to third-party concentrate purchases were 12,100

tonnes for the three months ended June 30, 2024, (8,821 tonnes for

the three months ended June 30, 2023).

CONSOLIDATED OPERATING HIGHLIGHTS

|

|

QUARTERLY |

|

Q2 2024 |

Q1 2024 |

Q2 2023 |

|

Copper production (tonnes)1 |

|

102,709 |

|

100,605 |

|

187,175 |

|

Cobre Panamá |

|

– |

|

– |

|

90,086 |

|

Kansanshi |

|

41,507 |

|

31,473 |

|

34,657 |

|

Sentinel |

|

53,595 |

|

62,225 |

|

54,045 |

|

Other Sites |

|

7,607 |

|

6,907 |

|

8,387 |

|

Copper sales (tonnes)2 |

|

94,628 |

|

101,776 |

|

177,362 |

|

Cobre Panamá |

|

– |

|

– |

|

86,964 |

|

Kansanshi2 |

|

36,332 |

|

31,683 |

|

30,732 |

|

Sentinel |

|

51,113 |

|

62,899 |

|

51,135 |

|

Other Sites |

|

7,183 |

|

7,194 |

|

8,531 |

|

Gold production (ounces) |

|

32,266 |

|

26,984 |

|

52,561 |

|

Cobre Panamá |

|

– |

|

– |

|

28,994 |

|

Kansanshi |

|

23,575 |

|

20,082 |

|

16,346 |

|

Guelb Moghrein |

|

8,144 |

|

6,285 |

|

6,686 |

|

Other sites |

|

547 |

|

617 |

|

535 |

|

Gold sales (ounces)3 |

|

37,140 |

|

29,778 |

|

48,640 |

|

Cobre Panamá |

|

– |

|

– |

|

26,881 |

|

Kansanshi |

|

28,860 |

|

20,523 |

|

15,825 |

|

Guelb Moghrein |

|

7,572 |

|

9,015 |

|

5,233 |

|

Other sites |

|

708 |

|

240 |

|

701 |

|

Nickel production (contained tonnes)4 |

|

7,400 |

|

7,771 |

|

5,976 |

|

Nickel sales (contained tonnes)5 |

|

7,645 |

|

8,211 |

|

5,906 |

|

Cash cost of copper production (C1) (per lb)2,6 |

$1.73 |

$2.02 |

$1.98 |

|

C1 (per lb) excluding Cobre Panamá 2,6 |

$1.73 |

$2.01 |

$2.23 |

|

Total cost of copper production (C3) (per lb)2,6 |

$2.87 |

$3.04 |

$2.92 |

|

Copper all-in sustaining cost (AISC) (per lb)2,6 |

$2.82 |

$2.85 |

$2.64 |

|

AISC (per lb) excluding Cobre Panamá 2,6 |

$2.71 |

$2.77 |

$3.08 |

1 Production is presented on a contained basis, and

is presented prior to processing through the Kansanshi smelter.

2 Sales exclude the sale of copper anode produced from

third-party concentrate purchased at Kansanshi. Sales of copper

anode attributable to third-party concentrate purchases were 12,100

tonnes for the three months ended June 30, 2024, respectively,

(8,821 tonnes for the three months ended June 30, 2023).

3 Excludes refinery-backed gold credits purchased and

delivered under the precious metal streaming arrangement (see

“Precious Metal Stream Arrangement”).

4 Nickel production includes 6,147 tonnes tonnes of

pre-commercial production from Enterprise for the three months

ended June 30, 2024, which is not included in earnings (loss) or

C1, C3 and AISC calculations. (two hundred twenty tonnes for the

three months ended June 30, 2023).

5 Nickel sales (contained tonnes) includes 5,044 tonnes

tonnes of pre-commercial sales from Enterprise for the three months

ended June 30, 2024, (nil tonnes for the three months ended March

31, 2023.)

6 Copper all-in sustaining cost (copper AISC), copper C1

cash cost (copper C1), and total cost of copper (copper C3) are

non-GAAP ratios, which do not have a standardized meaning

prescribed by IFRS and might not be comparable to similar financial

measures disclosed by other issuers. See “Regulatory

Disclosures”.

REALIZED METAL PRICES1

|

|

QUARTERLY |

|

Q2 2024 |

Q1 2024 |

Q2 2023 |

|

Average LME copper cash price (per lb) |

$4.42 |

|

$3.83 |

|

$3.84 |

|

|

Realized copper price1 (per lb) |

$4.39 |

|

$3.78 |

|

$3.75 |

|

|

Treatment/refining charges (“TC/RC”) (per lb) |

|

($0.06 |

) |

|

($0.10 |

) |

|

($0.15 |

) |

|

Freight charges (per lb) |

|

($0.05 |

) |

|

($0.07 |

) |

|

($0.03 |

) |

|

Net realized copper price1 (per lb) |

$4.28 |

|

$3.61 |

|

$3.57 |

|

|

Average LBMA cash price (per oz) |

$2,338 |

|

$2,070 |

|

$1,976 |

|

|

Net realized gold price1,2 (per oz) |

$2,207 |

|

$1,930 |

|

$1,797 |

|

|

Average LME nickel cash price (per lb) |

$8.35 |

|

$7.52 |

|

$10.12 |

|

|

Net realized nickel price1 (per lb) |

$7.86 |

|

$7.40 |

|

$9.50 |

|

1 Realized metal prices are a non-GAAP ratio, do not

have standardized meanings under IFRS and might not be comparable

to similar financial measures disclosed by other issuers. See

“Regulatory Disclosures” for further information.

2 Excludes gold revenues recognized under the precious

metal stream arrangement.

2024 GUIDANCE

Guidance is based on a number of assumptions and

estimates as of June 30, 2024, including among other things,

assumptions about metal prices and anticipated costs and

expenditures. Guidance involves estimates of known and unknown

risks, uncertainties and other factors, which may cause the actual

results to be materially different.

Production guidance remains unchanged for copper

and gold. Guidance for nickel production has narrowed to between

22,000 and 25,000 tonnes, to reflect year-to-date production at

Ravensthorpe. In addition, Enterprise nickel production guidance

has narrowed to 17,000 and 20,000 tonnes as a result of strong

year-to-date production.

Copper unit cost guidance remains unchanged.

Previous nickel unit cash cost guidance for 2024 was for

Ravensthorpe only and has therefore been withdrawn. Enterprise is

excluded from unit cost guidance for 2024 as operations ramp up

this year.

PRODUCTION GUIDANCE

|

000’s |

2024 |

|

Copper (tonnes) |

370 – 420 |

|

Gold (ounces) |

95 – 115 |

|

Nickel (contained tonnes) |

22 – 25 |

PRODUCTION GUIDANCE BY OPERATION1

|

Copper production guidance (000’s tonnes) |

2024 |

|

Kansanshi |

130 – 150 |

|

Trident - Sentinel |

220 – 250 |

|

Other sites |

20 |

|

Gold production guidance (000’s ounces) |

|

|

Kansanshi |

65 – 75 |

|

Guelb Moghrein |

28 – 38 |

|

Other sites |

2 |

|

Nickel production guidance (000’s contained

tonnes) |

|

|

Ravensthorpe |

5 |

|

Trident - Enterprise |

17 – 20 |

1 Production is stated on a 100%

basis as the Company consolidates all operations.

1 Realized metal price, C1 cash cost (C1), and All-in

sustaining cost (AISC) are non-GAAP ratio which does not have a

standardized meaning prescribed by IFRS and might not be comparable

to similar financial measures disclosed by other issuers. See

“Regulatory Disclosures”

CASH COST1 AND ALL-IN SUSTAINING

COST1

|

Total Copper |

2024 |

|

C1 (per lb)1 |

$1.80 – $2.05 |

|

AISC (per lb)1 |

$2.70 – $3.00 |

1 C1 cash cost (C1), and all-in sustaining cost

(AISC) are non-GAAP ratios, and do not have a standardized meaning

prescribed by IFRS and might not be comparable to similar financial

measures disclosed by other issuers. See “Regulatory

Disclosures”.

PURCHASE AND DEPOSITS ON PROPERTY, PLANT & EQUIPMENT

|

|

2024 |

|

Capitalized stripping1 |

180 – 230 |

|

Sustaining capital1 |

260 – 290 |

|

Project capital1 |

810 – 880 |

|

Total capital expenditure |

1,250 – 1,400 |

1 Capitalized stripping, sustaining capital and

project capital are non-GAAP financial measures which do not have a

standardized meaning prescribed by IFRS and might not be comparable

to similar financial measures disclosed by other issuers. See

“Regulatory Disclosures”.

ENVIRONMENT, SOCIAL AND GOVERNANCE (“ESG”)

Pioneering sustainable mining:

At Kansanshi, the Company’s collaboration with Hitachi Construction

Machinery Co Ltd. (“Hitachi”) and ABB Ltd. to trial a fully

battery-powered dump truck commenced in July 2024. This project

will test the truck's performance and battery management system,

aiming to reduce battery weight and improve load capacity and

efficiency using Hitachi's dynamic charging technology and the

Company’s advanced trolley systems. This trial reflects First

Quantum's commitment to sustainable mining and innovative

technologies that reduce environmental impact and enhance

productivity.

Supporting Zambia’s food security

efforts: First Quantum is supporting Zambia's food

security efforts in response to the severe droughts by contributing

$500,000 towards the transportation costs for imported grain from

Dar-es-Salaam, Tanzania. This initiative underscores the Company’s

commitment to community resilience and aims to enhance food

security during this critical period.

ESG Reporting: The Company

published its primary sustainability report, the 2023 ESG Report,

the 2023 Climate Change Report, the 2023 Tax Transparency and

Contributions to Governments Report as well as the 2023 Modern

Slavery Report in May 2024. The latest sustainability reports can

be found in the ESG Analyst Centre on the Company’s website:

https://www.first-quantum.com. These include the TCFD-aligned

Climate Change Reports, ESG Reports, Tax Transparency and

Contributions to Government Reports, as well as Company’s

sustainability policies.

COMPLETE FINANCIAL STATEMENTS AND MANAGEMENT’S

DISCUSSION AND ANALYSIS

The complete Consolidated Financial Statements

and Management’s Discussion and Analysis for the three and six

months ended June 30, 2024 are available at www.first-quantum.com

and at www.sedarplus.com and should be read in conjunction with

this news release.

CONFERENCE CALL DETAILS

The Company will host a conference call and

webcast to discuss the results on Wednesday, July 24, 2024 at 9:00

am (EST).

Conference call and webcast details: Toll-free

North America: 1-844-763-8274 Toll-free International:

+1-647-484-8814 Webcast: Direct link or on our website

A replay of the webcast will be available on the First Quantum

website.

For further information, visit our website at

www.first-quantum.com or contact:

Bonita To, Director, Investor Relations (416) 361-6400

Toll-free: 1 (888) 688-6577

E-Mail: info@fqml.com

REGULATORY DISCLOSURES

Non-GAAP and Other Financial

Measures

EBITDA, ADJUSTED EARNINGS (LOSS) AND ADJUSTED EARNINGS (LOSS)

PER SHARE

EBITDA, adjusted earnings (loss) and adjusted

earnings (loss) per share exclude certain impacts which the Company

believes are not reflective of the Company’s underlying performance

for the reporting period. These include impairment and related

charges, foreign exchange revaluation gains and losses, gains and

losses on disposal of assets and liabilities, one-time costs

related to acquisitions, dispositions, restructuring and other

transactions, revisions in estimates of restoration provisions at

closed sites, debt extinguishment and modification gains and

losses, the tax effect on unrealized movements in the fair value of

derivatives designated as hedged instruments, and adjustments for

expected phasing of Zambian VAT.

|

|

QUARTERLY |

|

Q2 2024 |

Q1 2024 |

Q2 2023 |

|

Operating profit |

117 |

|

20 |

|

252 |

|

|

Depreciation |

148 |

|

157 |

|

301 |

|

|

Other adjustments: |

|

|

|

|

Foreign exchange loss (gain) |

6 |

|

(20 |

) |

(15 |

) |

|

Impairment expense1 |

61 |

|

10 |

|

– |

|

|

Royalty payable2 |

– |

|

– |

|

18 |

|

|

Restructuring expense |

6 |

|

6 |

|

– |

|

|

Other expense (income) |

(2 |

) |

8 |

|

3 |

|

|

Revisions in estimates of restoration provisions at closed

sites |

– |

|

(1 |

) |

9 |

|

|

Total adjustments excluding depreciation |

71 |

|

3 |

|

15 |

|

|

EBITDA |

336 |

|

180 |

|

568 |

|

1 The three months ended June 30, 2023, include an

impairment charge of $60 million following the decision to scale

back operations at Ravensthorpe in Q1 and subsequently placing the

mine on care and maintenance in May

2 The three months ended June 30, 2023, include royalty

attributable due to ZCCM-IH of $18 million relating to the year

ended December 31, 2022.

|

|

QUARTERLY |

|

Q2 2024 |

Q1 2024 |

Q2 2023 |

|

Net earnings (loss) attributable to shareholders of the

Company |

|

(46 |

) |

|

(159 |

) |

|

93 |

|

|

Adjustments attributable to shareholders of the Company: |

|

|

|

|

Adjustment for expected phasing of Zambian VAT |

|

(27 |

) |

|

(10 |

) |

|

(31 |

) |

|

Loss on redemption of debt |

|

– |

|

|

10 |

|

|

– |

|

|

Total adjustments to EBITDA excluding depreciation |

|

71 |

|

|

3 |

|

|

15 |

|

|

Tax adjustments |

|

6 |

|

|

3 |

|

|

8 |

|

|

Minority interest adjustments |

|

(17 |

) |

|

(1 |

) |

|

– |

|

|

Adjusted earnings (loss) |

|

(13 |

) |

|

(154 |

) |

|

85 |

|

|

Basic earnings (loss) per share as reported |

|

($0.06 |

) |

|

($0.21 |

) |

|

$0.13 |

|

|

Diluted earnings (loss) per share |

|

($0.06 |

) |

|

($0.21 |

) |

|

$0.13 |

|

|

Adjusted earnings (loss) per share |

|

($0.02 |

) |

|

($0.20 |

) |

|

$0.12 |

|

REALIZED METAL PRICES

Realized metal prices are used by the Company to

enable management to better evaluate sales revenues in each

reporting period. Realized metal prices are calculated as gross

metal sales revenues divided by the volume of metal sold in lbs.

Net realized metal price is inclusive of the treatment and refining

charges (TC/RC) and freight charges per lb.

OPERATING CASHFLOW PER SHARE

In calculating the operating cash flow per

share, the operating cash flow calculated for IFRS purposes is

divided by the basic weighted average common shares outstanding for

the respective period.

NET DEBT

Net debt is comprised of bank overdrafts and

total debt less unrestricted cash and cash equivalents.

CASH COST, ALL-IN SUSTAINING COST, TOTAL

COST

The consolidated cash cost (C1), all-in

sustaining cost (AISC) and total cost (C3) presented by the Company

are measures that are prepared on a basis consistent with the

industry standard definitions by the World Gold Council and Brook

Hunt cost guidelines but are not measures recognized under IFRS. In

calculating the C1 cash cost, AISC and C3, total cost for each

segment, the costs are measured on the same basis as the segmented

financial information that is contained in the financial

statements.

C1 cash cost includes all mining and processing

costs less any profits from by-products such as gold, silver, zinc,

pyrite, cobalt, sulphuric acid, or iron magnetite and is used by

management to evaluate operating performance. TC/RC and freight

deductions on metal sales, which are typically recognized as a

component of sales revenues, are added to C1 cash cost to arrive at

an approximate cost of finished metal.

AISC is defined as cash cost (C1) plus general

and administrative expenses, sustaining capital expenditure,

deferred stripping, royalties and lease payments and is used by

management to evaluate performance inclusive of sustaining

expenditure required to maintain current production levels.

C3 total cost is defined as AISC less sustaining

capital expenditure, deferred stripping and general and

administrative expenses net of insurance, plus depreciation and

exploration. This metric is used by management to evaluate the

operating performance inclusive of costs not classified as

sustaining in nature such as exploration and depreciation.

|

For the three months ended June 30, 2024 |

Cobre Panamá |

Kansanshi |

Sentinel |

Guelb Moghrein |

Las Cruces |

Çayeli |

Pyhäsalmi |

Copper |

|

Ravensthorpe |

|

Enterprise |

Nickel |

|

Corporate

& other |

|

Total |

|

Cost of sales1 |

(9 |

) |

(420 |

) |

(300 |

) |

(48 |

) |

1 |

|

(15 |

) |

(4 |

) |

(795 |

) |

(46 |

) |

(42 |

) |

(88 |

) |

(15 |

) |

(898 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

Depreciation |

9 |

|

60 |

|

70 |

|

4 |

|

– |

|

1 |

|

2 |

|

146 |

|

– |

|

4 |

|

4 |

|

(2 |

) |

148 |

|

|

By-product credits |

(1 |

) |

65 |

|

– |

|

31 |

|

– |

|

5 |

|

3 |

|

103 |

|

1 |

|

– |

|

1 |

|

– |

|

104 |

|

|

Royalties |

– |

|

46 |

|

36 |

|

2 |

|

– |

|

2 |

|

– |

|

86 |

|

1 |

|

2 |

|

3 |

|

– |

|

89 |

|

|

Treatment and refining charges |

– |

|

(5 |

) |

(8 |

) |

(1 |

) |

– |

|

(1 |

) |

– |

|

(15 |

) |

(1 |

) |

– |

|

(1 |

) |

– |

|

(16 |

) |

|

Freight costs |

– |

|

– |

|

(5 |

) |

– |

|

– |

|

(2 |

) |

– |

|

(7 |

) |

– |

|

– |

|

– |

|

– |

|

(7 |

) |

|

Finished goods |

– |

|

(5 |

) |

(15 |

) |

– |

|

– |

|

1 |

|

(1 |

) |

(20 |

) |

9 |

|

23 |

|

32 |

|

– |

|

12 |

|

|

Other4 |

1 |

|

120 |

|

2 |

|

(1 |

) |

– |

|

1 |

|

– |

|

123 |

|

2 |

|

(1 |

) |

1 |

|

17 |

|

141 |

|

|

Cash cost (C1)2,4 |

– |

|

(139 |

) |

(220 |

) |

(13 |

) |

1 |

|

(8 |

) |

– |

|

(379 |

) |

(34 |

) |

(14 |

) |

(48 |

) |

– |

|

(427 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

Depreciation (excluding depreciation in finished goods) |

(10 |

) |

(62 |

) |

(74 |

) |

(4 |

) |

1 |

|

(2 |

) |

(2 |

) |

(153 |

) |

(1 |

) |

(2 |

) |

(3 |

) |

2 |

|

(154 |

) |

|

Royalties |

– |

|

(46 |

) |

(36 |

) |

(2 |

) |

– |

|

(2 |

) |

– |

|

(86 |

) |

(1 |

) |

(2 |

) |

(3 |

) |

– |

|

(89 |

) |

|

Other |

– |

|

(3 |

) |

(3 |

) |

– |

|

– |

|

(1 |

) |

– |

|

(7 |

) |

– |

|

– |

|

– |

|

– |

|

(7 |

) |

|

Total cost (C3)2,4 |

(10 |

) |

(250 |

) |

(333 |

) |

(19 |

) |

2 |

|

(13 |

) |

(2 |

) |

(625 |

) |

(36 |

) |

(18 |

) |

(54 |

) |

2 |

|

(677 |

) |

|

Cash cost (C1)2,4 |

– |

|

(139 |

) |

(220 |

) |

(13 |

) |

1 |

|

(8 |

) |

– |

|

(379 |

) |

(34 |

) |

(14 |

) |

(48 |

) |

– |

|

(427 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

– |

|

|

– |

|

|

General and administrative expenses |

(18 |

) |

(7 |

) |

(11 |

) |

(1 |

) |

– |

|

(2 |

) |

– |

|

(39 |

) |

(2 |

) |

(1 |

) |

(3 |

) |

– |

|

(42 |

) |

|

Sustaining capital expenditure and deferred

stripping3 |

(4 |

) |

(42 |

) |

(57 |

) |

(1 |

) |

– |

|

(2 |

) |

– |

|

(106 |

) |

(7 |

) |

(6 |

) |

(13 |

) |

– |

|

(119 |

) |

|

Royalties |

– |

|

(46 |

) |

(36 |

) |

(2 |

) |

– |

|

(2 |

) |

– |

|

(86 |

) |

(1 |

) |

(2 |

) |

(3 |

) |

– |

|

(89 |

) |

|

Lease payments |

(1 |

) |

– |

|

(1 |

) |

– |

|

(1 |

) |

– |

|

– |

|

(3 |

) |

(1 |

) |

– |

|

(1 |

) |

– |

|

(4 |

) |

|

AISC2,4 |

(23 |

) |

(234 |

) |

(325 |

) |

(17 |

) |

– |

|

(14 |

) |

– |

|

(613 |

) |

(45 |

) |

(23 |

) |

(68 |

) |

– |

|

(681 |

) |

|

AISC (per lb)2,4 |

– |

|

$2.64 |

|

$2.87 |

|

$1.44 |

|

– |

|

$2.46 |

|

– |

|

$2.82 |

|

$18.91 |

|

$5.02 |

|

$9.99 |

|

– |

|

|

Cash cost – (C1)

(per lb)2,4 |

– |

|

$1.51 |

|

$1.94 |

|

$1.06 |

|

– |

|

$1.60 |

|

– |

|

$1.73 |

|

$15.25 |

|

$2.96 |

|

$7.35 |

|

– |

|

|

|

Total cost – (C3) (per lb)2,4 |

– |

|

$2.82 |

|

$2.95 |

|

$1.61 |

|

– |

|

$2.13 |

|

– |

|

$2.87 |

|

$15.97 |

|

$3.81 |

|

$8.16 |

|

– |

|

|

1 Total cost of sales per the Consolidated Statement

of Earnings (loss) in the Company’s unaudited condensed interim

consolidated financial statements.

2 C1 cash cost (C1), total costs (C3) and all-in

sustaining costs (AISC) are non-GAAP ratios which do not have a

standardized meaning prescribed by IFRS and might not be comparable

to similar financial measures disclosed by other issuers. See

“Regulatory Disclosures”.

3 Sustaining capital expenditure and deferred stripping

are non-GAAP financial measures which do not have a standardized

meaning prescribed by IFRS and might not be comparable to similar

financial measures disclosed by other issuers. See “Regulatory

Disclosures”.

4 Excludes purchases of copper concentrate from third

parties treated through the Kansanshi Smelter.

|

For the three months ended June 30, 2023 |

Cobre Panamá |

Kansanshi |

Sentinel |

Guelb Moghrein |

Las Cruces |

Çayeli |

Pyhäsalmi |

Copper |

Corporate & other |

Ravensthorpe |

Total |

|

Cost of sales1 |

(469 |

) |

(374 |

) |

(334 |

) |

(41 |

) |

(23 |

) |

(19 |

) |

(5 |

) |

(1,265 |

) |

(1 |

) |

(120 |

) |

(1,386 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

149 |

|

56 |

|

74 |

|

2 |

|

– |

|

4 |

|

1 |

|

286 |

|

– |

|

15 |

|

301 |

|

|

By-product credits |

32 |

|

30 |

|

– |

|

26 |

|

– |

|

3 |

|

5 |

|

96 |

|

– |

|

3 |

|

99 |

|

|

Royalties |

13 |

|

55 |

|

26 |

|

1 |

|

1 |

|

2 |

|

– |

|

98 |

|

– |

|

5 |

|

103 |

|

|

Treatment and refining charges |

(45 |

) |

(5 |

) |

(11 |

) |

(2 |

) |

– |

|

(3 |

) |

– |

|

(66 |

) |

– |

|

– |

|

(66 |

) |

|

Freight costs |

– |

|

– |

|

(6 |

) |

– |

|

– |

|

(2 |

) |

– |

|

(8 |

) |

– |

|

– |

|

(8 |

) |

|

Finished goods |

(5 |

) |

(8 |

) |

13 |

|

(5 |

) |

(1 |

) |

3 |

|

(1 |

) |

(4 |

) |

– |

|

5 |

|

1 |

|

|

Other4 |

2 |

|

69 |

|

5 |

|

(1 |

) |

3 |

|

1 |

|

– |

|

79 |

|

1 |

|

3 |

|

83 |

|

|

Cash cost (C1)2,4 |

(323 |

) |

(177 |

) |

(233 |

) |

(20 |

) |

(20 |

) |

(11 |

) |

– |

|

(784 |

) |

– |

|

(89 |

) |

(873 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation (excluding depreciation in finished goods) |

(148 |

) |

(55 |

) |

(70 |

) |

(3 |

) |

– |

|

(4 |

) |

(1 |

) |

(281 |

) |

(1 |

) |

(14 |

) |

(296 |

) |

|

Royalties |

(13 |

) |

(37 |

) |

(26 |

) |

(1 |

) |

(1 |

) |

(2 |

) |

– |

|

(80 |

) |

– |

|

(5 |

) |

(85 |

) |

|

Other |

(6 |

) |

(2 |

) |

(3 |

) |

1 |

|

– |

|

– |

|

– |

|

(10 |

) |

– |

|

(1 |

) |

(11 |

) |

|

Total cost (C3)2,4 |

(490 |

) |

(271 |

) |

(332 |

) |

(23 |

) |

(21 |

) |

(17 |

) |

(1 |

) |

(1,155 |

) |

(1 |

) |

(109 |

) |

(1,265 |

) |

|

Cash cost (C1)2,4 |

(323 |

) |

(177 |

) |

(233 |

) |

(20 |

) |

(20 |

) |

(11 |

) |

– |

|

(784 |

) |

– |

|

(89 |

) |

(873 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

(12 |

) |

(7 |

) |

(10 |

) |

(1 |

) |

– |

|

– |

|

– |

|

(30 |

) |

– |

|

(3 |

) |

(33 |

) |

|

Sustaining capital expenditure and deferred

stripping3 |

(61 |

) |

(45 |

) |

(40 |

) |

(1 |

) |

– |

|

(1 |

) |

– |

|

(148 |

) |

– |

|

(7 |

) |

(155 |

) |

|

Royalties |

(13 |

) |

(37 |

) |

(26 |

) |

(1 |

) |

(1 |

) |

(2 |

) |

– |

|

(80 |

) |

– |

|

(5 |

) |

(85 |

) |

|

Lease payments |

(1 |

) |

– |

|

– |

|

– |

|

(1 |

) |

– |

|

– |

|

(2 |

) |

– |

|

(1 |

) |

(3 |

) |

|

AISC2,4 |

(410 |

) |

(266 |

) |

(309 |

) |

(23 |

) |

(22 |

) |

(14 |

) |

– |

|

(1,044 |

) |

– |

|

(105 |

) |

(1,149 |

) |

|

AISC (per lb)2,4 |

$2.16 |

|

$3.60 |

|

$2.71 |

|

$2.92 |

|

$5.49 |

|

$2.16 |

|

– |

|

$2.64 |

|

– |

|

$11.17 |

|

|

|

Cash cost – (C1) (per lb)2,4 |

$1.71 |

|

$2.36 |

|

$2.04 |

|

$2.30 |

|

$5.13 |

|

$1.72 |

|

– |

|

$1.98 |

|

– |

|

$9.58 |

|

|

|

Total cost – (C3) (per lb)2,4 |

$2.59 |

|

$3.68 |

|

$2.91 |

|

$2.83 |

|

$5.23 |

|

$2.59 |

|

– |

|

$2.92 |

|

– |

|

$11.76 |

|

|

1 Total cost of sales per the Consolidated Statement

of Earnings (loss) in the Company’s unaudited condensed interim

consolidated financial statements.

2 C1 cash cost (C1), total costs (C3) and all-in

sustaining costs (AISC) are non-GAAP ratios which do not have a

standardized meaning prescribed by IFRS and might not be comparable

to similar financial measures disclosed by other issuers. See

“Regulatory Disclosures”.

3 Sustaining capital expenditure and deferred stripping

are non-GAAP financial measures which do not have a standardized

meaning prescribed by IFRS and might not be comparable to similar

financial measures disclosed by other issuers. See “Regulatory

Disclosures”.

4 Excludes purchases of copper concentrate from third

parties treated through the Kansanshi Smelter.

5 Royalties in C3 and AISC costs exclude the 2022 impact

of $18 million attributable to the 3.1% sale of a gross royalty

interest in KMP to ZCCM-IH

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

Certain statements and information herein,

including all statements that are not historical facts, contain

forward- looking statements and forward-looking information within

the meaning of applicable securities laws. The forward- looking

statements include estimates, forecasts and statements as to the

Company’s expectations regarding production, sales volumes and full

year copper C1 cash costs and AISC; the effect and duration of the

SRA; the status of Cobre Panamá and the P&SM program and the

closure of Cobre Panamá, including the timing and operating

expenses thereof and the time and results of the pending

environmental audit at Cobre Panamá; development and operation of

the Company’s projects; the battery-powered dump truck trial at

Kansanshi; efforts to support food security in Zambia; the expected

carbon intensity of mining at Enterprise; the effect, timing,

capital expenditures and production of the S3 Expansion; the

increase in throughput capacity of the Kansanshi smelter; the

Company’s expectations regarding throughput capacity and mining

performance at Sentinel; anticipated mining volumes and throughput

at Enterprise; construction and commissioning of the CIL plant at

Guelb Moghrein; care and maintenance costs at Ravensthorpe and the

status of environmental approvals for Shoemaker Levy stage 1 and 3,

Tamarine Quarry and SML Stage 2; the timing of approvals and

permits required for Taca Taca, including the ESIA and water use

permits, and the ongoing engineering study; the amount and timing

of the Company’s expenditures at La Granja, project development and

the Company’s plans for community engagement and completion of an

engineering study for La Granja; the curtailment of power supply in

Zambia and the Company’s ability to secure sufficient power to

substitute curtailments and avoid interruptions to operations; the

Company’s future potential offtake arrangements with independent

power producers; the timing of approval of the renewal application

at Haquira and the Company’s goals regarding its drilling program;

the estimates regarding the interest expense on the Company’s debt,

cash flow on interest paid, capitalized interest and depreciation

expense; the expected effective tax rate for the Company for 2024;

the effect of foreign exchange on the Company’s cost of sales and

cash costs; the Company’s hedging programs; the effect of

seasonality on the Company’s results; capital expenditure and mine

production costs; the outcome of mine permitting and other required

permitting; the timing and outcome of legal and arbitration

proceedings which involve the Company; estimates of the future

price of certain precious and base metals; estimated mineral

reserves and mineral resources; mineral grade estimates; the

Company’s project pipeline, development and growth plans and

exploration and development program, future expenses and

exploration and development capital requirements; plans, targets

and commitments regarding climate change-related physical and

transition risks and opportunities (including intended actions to

address such risks and opportunities); and greenhouse gas emissions

and energy efficiency. Often, but not always, forward- looking

statements or information can be identified by the use of words

such as “aims”, “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate” or “believes” or

variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “would”, “might” or

“will” be taken, occur or be achieved.

With respect to forward-looking statements and

information contained herein, the Company has made numerous

assumptions including among other things, assumptions about the

geopolitical, economic, permitting and legal climate in which the

Company operates; continuing production at all operating

facilities; the price of certain precious and base metals including

copper, gold, nickel, silver, cobalt, pyrite and zinc; exchange

rates; anticipated costs and expenditure; the Company’s ability to

secure sufficient power to avoid interruption resulting from power

curtailment at its Zambian operations; mineral reserve and mineral

resource estimates; the timing and sufficiency of deliveries

required for the Company’s development and expansion plans; the

success of Company’s actions and plans to reduce greenhouse gas

emissions and carbon intensity of its operations; and the ability

to achieve the Company’s goals. Forward-looking statements and

information by their nature are based on assumptions and involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements, or industry

results, to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements or information. These factors include,

but are not limited to, future production volumes and costs, the

temporary or permanent closure of uneconomic operations, costs for

inputs such as oil, power and sulphur, political stability in

Panama, Zambia, Peru, Mauritania, Finland, Turkey, Argentina and

Australia, adverse weather conditions in Panama, Zambia, Finland,

Turkey, Mauritania, and Australia, potential social and

environmental challenges (including the impact of climate change),

power supply, mechanical failures, water supply, procurement and

delivery of parts and supplies to the operations and events

generally impacting global economic, political and social stability

and legislative and regulatory reform.

For mineral resource and mineral reserve figures

appearing or referred to herein, varying cut-off grades have been

used depending on the mine, method of extraction and type of ore

contained in the orebody.

See the Company’s Annual Information Form for

additional information on risks, uncertainties and other factors

relating to the forward-looking statements and information.

Although the Company has attempted to identify factors that would

cause actual actions, events or results to differ materially from

those disclosed in the forward-looking statements or information,

there may be other factors that cause actual results, performances,

achievements or events not as anticipated, estimated or intended.

Also, many of these factors are beyond First Quantum’s control.

Accordingly, readers should not place undue reliance on

forward-looking statements or information. The Company undertakes

no obligation to reissue or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. All forward-looking

statements made and information contained herein are qualified by

this cautionary statement.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/59f6f915-561d-4486-93bc-476a2767f416

First Quantum Minerals (LSE:FQM)

Historical Stock Chart

From Dec 2024 to Jan 2025

First Quantum Minerals (LSE:FQM)

Historical Stock Chart

From Jan 2024 to Jan 2025