TIDMFRG

RNS Number : 1361N

Firering Strategic Minerals PLC

21 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA,

CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR NEW ZEALAND OR IN OR

INTO ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

BREACH OF ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE A PROSPECTUS OR OFFERING MEMORANDUM OR AN OFFER

FOR SALE OR SUBSCRIPTION IN RESPECT OF ANY SECURITIES IN THE

COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR CONTAIN ANY

INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR ADVICE TO ANY

PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY

SECURITIES OF FIRERING STRATEGIC MINERALS PLC IN ANY JURISDICTION

WHERE TO DO SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATION (EU) NO . 596/2014 AS IT FORMS PART OF

UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018, AS AMENDED . UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN .

21 September 2023

Firering Strategic Minerals Plc

("Firering", the "Company" or the "Group") (AIM:FRG)

Result of Placing and TVR

Firering, an exploration and development company focusing on

strategic minerals, announces that, further to its announcement of

6.33 p.m. (London time) yesterday, it has successfully completed

and closed the Placing (the "Placing").

Result of the Placing

A placing agreement was entered into by the Company and Optiva

Securities Limited ("Optiva") on 20 September 2023. The

oversubscribed Placing has raised, in aggregate, gross proceeds of

GBP756,000 through the placing of 11,630,769 new Ordinary Shares to

certain investors at a price of 6.5 pence per share. The Placing

Price represents a discount of approximately 4.13 per cent. to the

Closing Price of 6.78 pence per Ordinary Share on 19 September

2023, being the latest practicable business day prior to the

publication of yesterday's announcement.

Intended Subscriptions

Certain directors of the Company, together with their related

parties, have confirmed their intention to subscribe for

approximately 1,076,922 Ordinary Shares at the Placing Price by

funding an additional approximate GBP70,000 (the " Intended

Subscription"). As the Company is currently in a close period under

MAR until the publication of its interim results for the period

from 1 January 2023 to 30 June 2023 ("Interim Results"), the

Directors are not permitted to enter into a subscription agreement

until after publication of the Interim Results (and subject to each

not being in possession of any other unpublished price sensitive

information at such time). It is expected that the Interim Results

will be published before the end of September 2023, and the

Directors and their related parties intend to participate in the

Intended Subscription once able to do so. Such subscriptions will

fall to be treated as related party transactions under Rule 13 of

the AIM Rules for Companies.

The following Directors intend to participate in the Intended

Subscription in the following amounts:

Name Position Holding of % of Existing Number of

Existing Ordinary Ordinary Ordinary

Shares Share Capital shares to

be subscribed

for

Non-Executive

Youval Rasin Chairman 12,610,000 14.15% 384,615

--------------------------- ------------------- --------------- ---------------

Senior Independent

Non-Executive

Neil Herbert Director 1,455,371 1.63% 384,615

--------------------------- ------------------- --------------- ---------------

Yehoshua Shai Chief Financial

Kol Officer 6,990,000 7.85% 153,846

--------------------------- ------------------- --------------- ---------------

Vassilios Independent Non-Executive

Carellas Director Nil Nil 153,846

--------------------------- ------------------- --------------- ---------------

A further announcement will be made as and when the Intended

Subscription is completed.

Issue of Warrants

The Company has issued 581,538 warrants to subscribe for

ordinary shares to Optiva, subject to Admission, as part of their

fee arrangements. The warrants have an exercise price of 6.5 pence

per share and an exercise period ending 3 years from the date of

Admission .

Admission and Total Voting Rights

Application will be made to the London Stock Exchange for

admission of the 11,630,769 Placing Shares to trading on AIM. It is

expected that admission will become effective and dealings in the

Placing Shares will commence on AIM at 8.00 a.m. on 27 September

2023 (or such later date as may be agreed between the Company and

the Bookrunner, but no later than 6 October 2023).

The Placing Shares will be issued fully paid and will rank pari

passu in all respects with the Company's existing Ordinary

Shares.

Following Admission, the total number of Ordinary Shares in the

capital of the Company in issue will be 100,729,041 with voting

rights. This figure may be used by shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Company's issued share capital pursuant to the Company's

Articles.

Capitalised terms used but not otherwise defined in this

announcement shall have the meanings ascribed to such terms in the

Company's announcement made at 6.33 p.m. on 20 September 2023,

unless the context requires otherwise.

For further information on the Company, please visit www.fireringplc.com or contact:

Firering Strategic Minerals

Yuval Cohen

Vassilios Carellas

Tel: +44 20 7236 1177

SPARK Advisory Partners Limited

Nominated Adviser

Neil Baldwin / James Keeshan / Adam Dawes

Tel: +44 20 3368 3550

Optiva Securities Limited

Broker

Christian Dennis / Daniel Ingram

Tel: +44 20 3137 1903

St Brides Partners Limited

Financial PR

Ana Ribeiro / Susie Geliher / Isabelle Morris

T: +44 20 7236 1177

E: firering @stbridespartners.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFFLLAFIIFIV

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

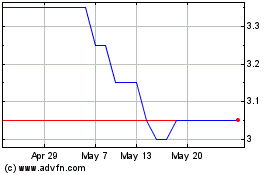

Firering Strategic Miner... (LSE:FRG)

Historical Stock Chart

From Apr 2024 to May 2024

Firering Strategic Miner... (LSE:FRG)

Historical Stock Chart

From May 2023 to May 2024