Gemfields Resources Plc

Final results for the year ended 30 June 2007

21 December 2007

Gemfields Resources Plc ("Gemfields" or "the Company", Ticker "GEM") is pleased

to report its final results for the year ended 30 June 2007.

Highlights

* The commencement of trial mining at the Mbuva-Chibolele Emerald Mine.

* The construction of Phase I of the washing plant at Mbuva-Chibolele.

* The first two auctions for the sale of emeralds.

* The completion of the acquisition of Sarina Global Limited and its Mitondo

East exploration licence in the Ndola Rural Emerald Restricted Area,

Zambia.

* The signing of an option agreement to acquire the Jagoda Pink Tourmaline

Mine.

* A cash placing of 8,000,000 ordinary shares for �3,200,000.

* The post-year end acquisition of a 75% interest in the Kagem Emerald Mine

in Zambia.

* The post-year end acquisition of an option to acquire a portfolio of in

excess of 25 licences and licence applications for gemstone exploration in

Madagascar.

* The post-year end acquisition of an option to acquire a worldwide and

exclusive 15 year licence to use the Faberg� brand name in respect of

gemstones (excluding diamonds).

* In consideration for these post-year end acquisitions Gemfields will issue

137,910,340 new ordinary shares in the Company to Rox Limited, a

Pallinghurst Resources portfolio company.

The Chairman's Statement and the primary financial statements are set out

below. The full financial statements have been sent to shareholders and they

can also be viewed on the company's website at www.gemfields.co.uk.

Enquiries:

Gemfields

Richard James, CFO richard.james@gemfields.co.uk

+44 (0)20 7016 9416

Conduit PR

Leesa Peters/Ed Portman +44 (0)20 7429 6600

+44 (0)781 215 9885

Canaccord Adams Limited

Robin Birchall +44 (0)20 7050 6500

Chairman's statement

__________________________________________________________________________________________

Dear Shareholder,

Welcome to the consolidated financial statements for Gemfields Resources PLC

("the Company"). A great deal has been achieved in the year ended 30 June 2007.

Operations

* Mbuva-Chibolele Mine

Trial mining at Gemfields' 100% owned Mbuva-Chibolele Mine commenced ahead of

schedule. The construction of Phase I of the washing plant, which involved the

erection of a primary crushing and screening circuit, was also completed.

Two emerald sales have already been held. A total of 607,912 carats of emeralds

were sold in November 2006 with proceeds of US$768,246. Then, in February 2007,

a total of 385,085 carats of emeralds were sold with proceeds of US$1,028,121.

A trend for better quality emeralds has emerged as we continue to mine. As the

mine deepens we anticipate that the quality of the emeralds will keep improving

as we move away from the near surface, lower grade mineralisation.

* Kariba Amethyst Mine ("Kariba")

Production continued at the 50% owned Kariba Amethyst Mine with sales of

US$2,133,088 for the year. The completion of a privatisation agreement to

purchase a further 26% of Kariba from the Zambian government has taken much

longer than had been anticipated but the Company expects it to be signed in the

near future. A feasibility study is underway at the property and management

believes that production can be increased significantly.

Securing of Further Gemstone Projects in Zambia

The following further gemstone projects were secured during the year:

* Sarina Global Limited ("Sarina")

Gemfields completed the acquisition of 100% of the share capital of Sarina for

US$1,432,500 consideration, which was payable in the form of 1,500,000 shares

in the Company issued at �0.50 per share. With this acquisition, the Mitondo

East Exploration licence was added to Gemfields' other six exploration licences

in the Ndola Restricted Emerald Area.

* Large Scale Amethyst Prospecting Licence

A large scale amethyst prospecting licence PLLS-300 was approved by the

Ministry of Mines in favour of Gemfields covering an area of 80 sq kms. This

licence is adjacent to the area covered under the gemstone licence held by

Kariba Minerals Limited, in which Gemfields holds a 50% equity stake. Kariba's

amethyst mineralisation is hosted in one of the several parallel shear zones in

the area. Gemfields has acquired this prospecting licence to explore the

potential of additional mineralisation in the other shear zones.

* Jagoda Pink Tourmaline Mine ("Jagoda")

An option agreement for the acquisition of Gemstone Mining Licence number GL

205 was also signed. The licence area covers approximately 3.75 sq kms

including the Jagoda mine which has recorded production of over 40 tonnes of

pink tourmaline between the mid 1990s and 2005. Gemfields paid US$50,000 for an

option to acquire the licence for a price of US$1.95m. This option expired at

the end of September 2007 but a further US$50,000 has since been paid to extend

the option period to the end of March 2008.

Cash Placing

The Company raised a further �3,200,000 during the year with a placing of

8,000,000 ordinary shares at �0.40 per share.

These funds have been earmarked for the development of Kariba and Jagoda.

Post- Year End Acquisition

The Company is pleased to announce that subsequent to the year end it has

conditionally agreed to acquire from Rox Limited ("Rox", a Pallinghurst

Resources portfolio company) a 75% interest in the Kagem emerald mine in

Zambia.

Rox has also granted to Gemfields an option to acquire a portfolio of in excess

of 25 licences and licence applications for gemstone exploration in Madagascar

held through its subsidiary Oriental Mining.

In addition, Faberg� Limited, another Pallinghurst Resources portfolio company

has agreed to grant Gemfields an option to acquire a worldwide and exclusive 15

year licence to use the Faberg� brand name in respect of gemstones (excluding

diamonds).

Under the proposed transaction, Gemfields is to acquire Greentop International

Inc. ("Greentop") (a BVI company) and Krinera Group SA ("Krinera") (a

Panamanian company), the holding companies through which Rox's interest in the

Kagem mine is held (via intermediate holding companies). In consideration for

the acquisition of Greentop and Krinera, Gemfields will issue to Rox

137,910,340 new ordinary shares in the Company (constituting 55% of Gemfields'

share capital after implementation of the transaction on a fully diluted

basis).

As the proposed transaction is classified as a reverse takeover under the AIM

Rules, the transaction is conditional, amongst other things, on Gemfields

obtaining the approval of its shareholders. Gemfields' shares have been

suspended from trading since the announcement of the acquisition pending the

preparation and publication of a Circular and notice of extraordinary general

meeting ("EGM") setting out the details of the proposed transaction and seeking

shareholder approval. Competent persons reports are being prepared and it is

expected that the Circular and notice of EGM will be sent to shareholders in

the first quarter of 2008.

Outlook

The future is looking very positive for the Company.

* The anticipated quality of the Kagem resource is expected to transform the

performance of Gemfields.

* Further exploration of Gemfields' properties has produced encouraging

results.

* Negotiations are continuing for further acquisitions of various coloured

gemstone properties.

Graham Mascall

20 December 2007

Consolidated profit and loss account for the year ended 30 June 2007

Year ended Year ended

30 June 30 June

2007 2006

(restated)

US$ US$

Turnover

Group and share of joint venture 2,862,911 1,171,332

Less: share of joint venture (1,066,544) (1,171,332)

turnover

________ ________

1,796,367 - -

________ ________

Cost of sales (5,865,121) - -

Administration expenses (3,604,417) (3,068,170)

________ ________

Group operating loss (7,673,171) (3,068,170)

Share of operating loss in:

Joint venture (181,356) (228,131)

________ ________

Loss on ordinary activities

before

interest, taxation and disposal (7,854,527) (3,296,301)

of fixed assets

Profit on disposal of fixed 186,044 - -

assets - group

Profit on disposal of fixed 4,548

assets - joint venture

________ ________

Loss on ordinary activities

before

interest and taxation (7,663,935) (3,296,301)

Interest receivable - group 524,218 371,310

Interest receivable - share of 411 - -

joint venture

Interest payable - group 5 - - (8,025)

Interest payable - share of joint (18,980) (37,684)

venture

________ ________

Loss on ordinary activities (7,158,286) (2,970,700)

before taxation

Taxation on loss on ordinary (116,160) 48,106

activities

________ ________

Loss for the year (7,274,446) (2,922,594)

Loss per share

Basic and diluted US$(0.07) US$(0.04)

________ ________

All amounts relate to continuing

activity.

Consolidated statement of total recognised gains and losses and reconciliation

of movements in shareholders' funds for the year ended 30 June 2007

2007 2006

(restated)

US$ US$

Statement of total recognised gains and

losses

Loss for the financial year

- Group (7,150,275) (2,704,885)

- Joint venture (124,171) (217,709)

________ ________

Total gains and losses for the year

before currency

adjustments for translation differences

on consolidation

in respect of exchange translation (7,274,446) (2,922,594)

differences

Exchange translation differences (7,204) 52,802

________ ________

Total recognised gains and losses for (7,281,650) (2,869,792)

the financial year

________ ________

Prior year adjustments

- Personnel costs (385,930) - -

________ ________

Total losses recognised since last (7,667,580) (2,869,792)

financial statements

________ ________

Consolidated balance sheet at 30 June 2007

2007 2007 2006 2006

(restated) (restated)

US$ US$ US$ US$

Fixed assets

Intangible assets 12,461,205 10,834,190

Tangible assets 9,712,608 10,357,816

Investment in joint

venture

- share of gross assets 1,006,107 696,823

- share of gross (1,013,384) (572,724)

liabilities

________ ________

(7,277) 124,099

________ ________

22,166,536 21,316,105

Current assets

Debtors 1,051,072 734,084

Stocks 2,190,472 12,270

Cash at bank and in hand 9,835,940 12,873,317

________ ________

13,077,484 13,619,671

Creditors: amounts falling

due

within one year (2,343,728) (2,700,111)

________ ________

Net current assets 10,733,756 10,919,560

________ ________

Creditors: amounts falling

due

after one year

Deferred taxation (176,826) -

________ ________

Total assets less current 32,723,466 32,235,665

liabilities

________ ________

Capital and reserves

Called up share capital 1,871,166 1,685,128

Share premium account 33,775,898 28,011,141

Merger reserve 10,500,346 9,096,496

Option reserve 858,469 443,663

Profit and loss reserve (14,282,413) (7,000,763)

________ ________

Shareholders' funds - 32,723,466 32,235,665

equity

________ ________

Company balance sheet at 30 June 2007

2007 2007 2006 2006

(restated) (restated)

US$ US$ US$ US$

Fixed assets

Tangible assets 4,199 4,390

Investments 11,370,276 9,937,776

________ ________

11,374,475 9,942,166

Current assets

Debtors 29,055,567 19,675,183

Stocks 33,018 -

Cash at bank and in hand 9,531,928 11,843,680

________ ________

38,620,513 31,518,863

Creditors: amounts

falling due

within one year (7,761,497) (6,325,657)

________ ________

Net current assets 30,859,016 25,193,206

________ ________

Total assets less current 42,233,491 35,135,372

liabilities

________ ________

Capital and reserves

Called up share capital 1,871,166 1,685,128

Share premium account 33,775,898 28,011,141

Merger reserve 10,500,346 9,096,496

Option reserve 858,469 443,663

Profit and loss reserve (4,772,388) (4,101,056)

________ ________

Shareholders' funds - 42,233,491 35,135,372

equity

________ ________

Consolidated cash flow statement for the year ended 30 June 2007

Year ended Year ended

30 June 30 June

2007 2006

US$ US$ US$ US$

Cash outflow from operating (8,600,194) (2,785,824)

activities

Capital expenditure and

financial

investment

Payments to acquire (50,000) (2,448,853)

intangible fixed assets

Payments to acquire tangible (978,808) (2,434,076)

fixed assets

Proceeds from disposals of 289,777 -

fixed assets

Exploration and development (144,515) (2,743,805)

expenditure

________ ________

(883,546) (7,626,734)

________ ________

Cash outflow before use

of liquid resources and (9,483,740) (10,412,558)

financing

Financing

Issue of shares (net of issue 5,922,145 18,902,788

costs)

Return on investments and

servicing of finance

Interest received 524,218 371,310

Interest paid - (8,025)

________ ________

524,218 363,285

________ ________

(Decrease)/Increase in cash (3,037,377) 8,853,515

________ ________

1

END

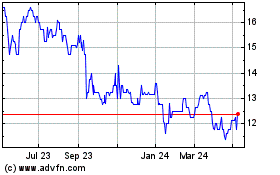

Gemfields (LSE:GEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

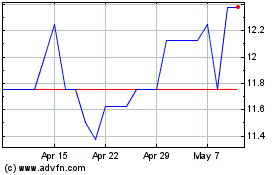

Gemfields (LSE:GEM)

Historical Stock Chart

From Jan 2024 to Jan 2025