TIDMGETB

RNS Number : 3412L

GetBusy PLC

05 September 2023

5 September 2023

GetBusy plc

2023 Half-year Results

Significant value creation continues

GetBusy plc ("GetBusy", the "Company" or the "Group") (AIM:

GETB), a leading provider of productivity software for professional

and financial services, announces its unaudited results for the six

months ended 30 June 2023 (the "Period", "H1" or "H1 2023").

H1 2023 H1 2022 Change

GBP'000 GBP'000 Reported currency Constant currency(***)

------------------

Group ARR 20,121 18,068 11% 14%

------------------ -----------------------

Group recurring revenue 10,102 8,519 19% 16%

-------- -------- ------------------ -----------------------

Group total revenue 10,521 9,070 16% 13%

-------- -------- ------------------ -----------------------

Group adjusted EBITDA* 164 24 583%

-------- -------- -------------------------------------------

Group adjusted loss before tax** (603) (724) 17%

-------- -------- -------------------------------------------

Group loss before tax (782) (879) 11%

-------- -------- -------------------------------------------

Cash 1,659 2,131 (22)%

-------- -------- -------------------------------------------

Financial highlights

-- Recurring revenue growth of 16% at constant currency to GBP10.1m (H1 2022: GBP8.5m)

-- Recurring revenue comprises 96% of total revenues (H1 2022: 94%)

-- ARR growth of 14% at constant currency to GBP20.1m (H1 2022:

GBP18.1m) and up 7% at constant currency since the start of the

year

-- Gross margin remains strong at 89.9% (H1 2022: 90.4%) with greater volume of cloud revenue

-- Adjusted EBITDA of GBP164k (H1 2022: GBP24k)

-- Cash of GBP1.7m (H1 2022: GBP2.1m) remains strong,

underpinned by undrawn committed GBP2.0m facility with total of

GBP3.7m available growth capital

Operational highlights

-- Strong net revenue retention of 100.5% per month (H1 2022:

100.6%), reflecting successful fair-price monetisation efforts and

lower gross churn

-- Group ARPU up 14% at constant currency to GBP275 (H1 2022: GBP245)

-- 0.7% reduction in paying users to 73,126 (H1 2022: 73,667),

reflecting strategy to focus on higher value customers

-- Launched major new integration for SmartVault with Thomson

Reuters' UltraTax application, opening promising new accounting

markets within US

-- Workiro now signed 20 partners in the ERP ecosystem

Outlook

-- Our core markets remain robust, driven by structural changes

in the way people work and a strengthening mandate for security and

productivity optimisation

-- The Group's underlying trading continues to be in line with

market expectations(****) , remaining modestly profitable at the

Adjusted EBITDA(*) level during H2 2023 as it continues to invest

in long-term growth, with strong cash inflows from H2-weighted

customer renewals

Daniel Rabie, CEO of GetBusy, comments:

"We have made significant progress during H1 2023 in setting up

the Group to capitalise on the expanding market opportunity ahead

of us, while delivering 16% constant currency growth in recurring

subscription revenue.

"We are investing for near-term growth through customer

acquisition and ensuring our long-term prospects are underpinned by

innovative products serving large markets with the compelling and

resilient growth drivers of productivity, cyber-security, mobility

and privacy.

"We look forward to bedding-in our investments over the course

of H2 with the expectation that they will deliver enhanced growth

into 2024 and beyond."

*Adjusted EBITDA is Adjusted Loss before Tax with capitalised

development costs added back. A full list of our alternative

performance measures, together with a glossary of certain terms,

can be found in note 2.

** Adjusted Loss before Tax is Loss before tax, depreciation and

amortisation on owned assets, long-term incentive costs, net

capitalised development costs, finance costs that are not related

to leases, and non-underlying items.

*** Changes at constant currency are calculated by retranslating

the comparative period at the current period's prevailing rate of

exchange.

**** Expectations for the year-ending 31 December 2023 are

considered to comprise Revenue of GBP21.1m and Adjusted EBITDA of

GBP0.7m.

A copy of the presentation to investors will be available on the

Company's website, at www.getbusyplc.com shortly.

GetBusy plc

investors@getbusy.com

finnCap (Nominated Adviser and Broker)

Matt Goode / Charlie Beeson / Milesh Hindocha

(Corporate Finance) +44 (0)20 7220

Charlotte Sutcliffe / Harriet Ward (ECM) 0500

Alma PR (Financial PR) +44 (0)20 7886

Hilary Buchanan / Andy Bryant / Hannah Campbell 2500

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION (EU) NO 596/2014 AS IT FORMS PART OF UK

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018

("MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN. THE

PERSON RESPONSIBLE FOR MAKING THIS ANNOUNCEMENT ON BEHALF OF THE

COMPANY IS PAUL HAWORTH.

About GetBusy

GetBusy's specialist productivity software solutions enable

growing businesses to work securely and efficiently with their

customers, suppliers and teams anytime, anywhere. Our solutions can

be delivered flexibly across cloud, mobile, hosted and on-premise

platforms, whilst integrating seamlessly with a wide variety of

other class-leading core business systems.

With over 70,000 paying users and over 3 million collaborators

across multiple market sectors and jurisdictions, GetBusy is an

established and fast-growing SaaS business delivering sustained

double-digit growth in high-quality recurring subscription revenue

over the long term.

Further information on the Group is available at

www.getbusyplc.com

Significant value creation

Our focus in 2023 is to structure the business to capitalise on

the substantial market opportunity for productivity software tools

in the accounting and ERP markets. In H1, alongside delivering a

16% constant currency increase in high quality recurring

subscription revenue, we have made encouraging progress in

enlarging the markets available to us, scaling our customer

acquisition engines, increasing average selling price and improving

churn.

In the US, a market that harbours an outstanding opportunity in

the accounting sector, we have re-engineered our entire sales and

marketing operational methodology, improving our ability to scale

customer acquisition significantly over the next few years. With a

new structure and process now in place, supported by major

improvements in data insight capabilities, we have started to make

substantial investments in headcount to drive new business, and we

expect the sales team alone to more than double in size over

2023.

Leading technology suppliers to US accountants have selected

SmartVault as their preferred document management application for

resale partnerships, for example Right Networks, the leading cloud

service provider that offers the only intelligent cloud

purpose-built for accounting firms and professionals. SmartVault is

now available for purchase by Right Networks' entire base of 8,500

accounting firms (about 20% more than SmartVault's entire customer

count) and we are working with Right Networks to optimise adoption

through the peak Q4 selling season. As well as its strength among

users of Intuit's Lacerte and ProSeries tax applications - with

which SmartVault has the leading document workflow integration -

Right Networks is growing among users of Thomson Reuters' UltraTax

product, for which SmartVault launched an integration in early July

that potentially doubles its medium-term market opportunity.

UltraTax's user base is comparable in size to Intuit's Lacerte

product but typically across larger firms, with higher average

selling price for SmartVault and lower churn rates. We expect to

pursue additional integration partnerships during H2 to further

broaden our accessible market and cement SmartVault's position as

the dominant specialist document workflow software for US

accountants.

SmartVault's form-filling and quoting capabilities, which were

acquired at the end of 2021, are now available to customers as

elective add-ons. Together with our e-signature integration, these

add-ons allow us to build more progressive pricing and packaging

structures to increase ARPU among our most engaged customers, and

we expect to launch those packages to customers in early 2024.

Our US business obtained the key ISO27001 information security

certification during H1 and is now pursuing the complementary

SOC2-1 accreditation. These benchmarks are often required for

larger enterprise customers in which there is a greater IT

sophistication, as we have seen with our ISO27001 certification in

the UK, so we expect this effort to enable SmartVault to become

more successful among larger clients, such as those on the UltraTax

platform. Additionally, these enhanced security credentials are

essential for the asset finance providers served by our

CertifiedVault product; we expect to allocate a very modest level

of capital for customer acquisition in the asset finance market

over the balance of 2023 while we complete the certification

processes.

Virtual Cabinet largely completed the transition of its customer

base to the "all-in" Unlimited pricing plan during the first

quarter; encouragingly, we have seen no adverse impact on churn

rates, which validates the value ascribed to the product by our

customers and confirms its position as a leading product in the

space. Virtual Cabinet Cloud, powered by the Group's Workiro

technology, now provides a richly capable cloud transition path for

customers, making Virtual Cabinet a compelling choice for

professional services firms with a wide variety of cloud and

on-premise core business applications.

Workiro has continued to make progress with its enterprise

content management ("ECM") offering for the ERP market. Over H1 we

more than doubled the number of partners within the NetSuite

ecosystem and sales pipelines are beginning to build. With the

feedback we have received from partners, customers and NetSuite

themselves, we are confident that Workiro's ECM capabilities, both

existing and those in the near-term roadmap, provide significant

value to large enterprises with complex document workflow

requirements and we are very excited about how Workiro is now

positioned in this attractive market. Whilst enterprise customers

tend to have longer sales cycles than those in the SME segment, in

which SmartVault operates, ultimately we expect deal sizes that are

an order of magnitude larger than has historically been the case in

the Group, together with lower churn rates. Over H2 we will

continue to invest in the enterprise capabilities of the product

and refine our go-to-market approach based on our interactions with

customers, partners and enterprise prospects.

Investing to capitalise on the long-term growth opportunity

Despite the current economic backdrop, the Group is committed to

sustained investment, from self-generated cash resources, in the

pursuit of both medium- and long-term growth.

We believe there is a substantial long-term growth opportunity

for software that supports the productivity of knowledge workers,

enhances their working day by improving workflows, and contributes

to the profitability of the organisations that employ them. This

opportunity is supported by enduring structural drivers such as

stricter regulatory requirements, a more hostile cybersecurity

landscape, tightening labour markets and increasing workforce

flexibility demands.

By remaining focused on specific, valuable markets, in

particular the accounting market, we can build a high quality,

sticky customer base for whom our products have infrastructural

characteristics. We believe our base of customers can become

strategically very attractive as a result of the access we have to

a very well-defined set of customers with similar software

requirements.

Whilst medium-term growth is expected to be driven largely by

the accounting market, in which we are experienced and proven,

growth over the longer-term is expected to be significantly

enhanced by the opening of larger enterprise markets and the

provision of ECM solutions via Workiro. As in accounting, we expect

success to come through the depth of our integrations with other

mission-critical software platforms, such as ERP. The scale of the

Workiro opportunity warrants the sustained investments we are

making with the expectation that the solution will open

substantially larger markets over the longer term.

Why accounting?

Through SmartVault and Virtual Cabinet, GetBusy is the largest

specialist provider of document management and workflow software

into the accounting sector in our chosen markets of the US, UK and

ANZ.

Our commitment to the accounting market is based on a number of

compelling factors that collectively evidence a substantial

opportunity on which we are very well placed to capitalise.

The US accounting sector alone employs 1.2 million people,

including over 650,000 Certified Public Accountants within over

130,000 firms. Cloud technology adoption across the sector,

particularly in the tax preparation market, is relatively early

stage. The market is dominated by a handful of large tax software

providers whose clients overwhelmingly use legacy on-premise

software due to its familiarity and rich functionality. The

transition of the sector to the cloud has been gradual but is

accelerating.

Specialist productivity tools are increasingly a priority for

small accounting firms. Declining numbers are entering the

profession in the US; the Bureau of Labor Statistics is projecting

an annual shortfall of some 50,000 newly qualified accountants over

the next decade. This labour shortage is a catalyst for two trends

that are favourable for our solutions. Firstly, firms are focusing

on optimising practitioner efficiency by implementing simple,

no-code workflow automations like those enabled through SmartVault

and its integrations into the major tax software applications.

Secondly, firms are making increasing use of outsourcing, including

through offshore providers, to plug the labour gap, making a

cloud-first technology stack essential for secure and efficient

collaboration.

Technology adoption is also being driven by the rising

participation of private equity in the accounting sector. This is

leading to a consolidation of accounting firms across the size

spectrum and a concerted drive for mandated technology adoption, as

the "lifestyle" model of partnerships gives way to the growth- and

efficiency-focused mindset of professional management installed by

private equity. All firms will need to follow to remain

competitive. Cloud technologies that optimise the productivity of

expensive and scarce knowledge-workers are clear beneficiaries of

this shift.

These accounting-specific trends are in addition to the broader

drivers of the productivity and security software market for

professional services firms:

-- Strengthening data privacy regulation and more robust

enforcement means accounting firms are expected by their clients to

adopt technologies that safeguard sensitive data.

-- A more hostile cybersecurity environment has driven data

security to the top of the agenda at even the smallest of firms.

Accounting firms have become a focus for cyber attacks due to the

exceptionally sensitive data held; the relatively unsophisticated

IT practices that persist in a proportion of the sector makes those

firms particularly vulnerable.

-- Hybrid working and the increasing mobility of the workforce

are prevalent in the accounting sector, in which a competitive

labour market forces firms to adopt employee-friendly work policies

to make them more attractive to scarce talent. This trend drives

the adoption of cloud technologies that enable remote employees to

work securely and efficiently.

Competition in the space, particularly in the automation of

document workflows, remains relatively benign. Generic document

management providers - though sometimes substantially larger than

GetBusy - lack the depth of integration with accounting and tax

preparation software that specialist providers can offer and that

are critical to workflow optimisation. The document capabilities

embedded within many of the accounting practice management software

suites are usually ageing, limited in functionality and starved of

investment. Specialist providers, like SmartVault and Virtual

Cabinet, are few as the barriers to entry, both technically and in

brand recognition, are high.

All of these factors reinforce our commitment to building a

highly valuable business focused on the accounting sector.

Custodians of rich content for AI

Artificial intelligence ("AI") technology within GetBusy's

products has the potential to bring significant value to our

customers, enabling them to leverage deep insights from the highly

valuable content secured within our applications, substantially

enhancing their productivity.

Our product roadmaps include radically re-engineered intelligent

content "search and answer" capabilities, client sentiment

analytics and smart suggestions for the creation and prioritisation

of tasks.

Keeping our customers' content secure is the foundation of our

business and so we have created a set of strict development

principles that prioritise the privacy and security of customer

content to ensure our customers always retain full control around

the application of AI to their content.

Financial review

Group H1 2023 H1 2022 Change

Reported Constant

currency currency

---------- ----------

ARR at 30 June GBP20.1m GBP18.1m 11% 14%

----------- ---------- ---------- ----------

Recurring revenue GBP10,102k GBP8,519k 19% 16%

----------- ---------- ---------- ----------

Total revenue GBP10,521k GBP9,070k 16% 13%

----------- ---------- ---------- ----------

Adjusted EBITDA GBP164k GBP24k 583%

----------- ---------- ----------------------

Adjusted loss before

tax GBP(603)k GBP(724)k 17%

----------- ---------- ----------------------

Paying users at 30

June 73,126 73,667 (1)%

----------- ---------- ----------------------

ARPU at 30 June GBP275 GBP245 12% 14%

----------- ---------- ---------- ----------

Net revenue retention 100.5% 100.6% n/a

----------- ---------- ----------------------

Recurring revenue was up 16% at constant currency (19% at

reported currency) to GBP10.1m (H1 2022: GBP8.5m), with good

contributions from across the Group aided by strong opening ARR

positions. The UK was up 23% to GBP3.9m (H1 2022: GBP3.2m), buoyed

by the migration of a large proportion of our clients to the

Virtual Cabinet Unlimited "all-in" pricing plan in the second half

of 2022. The US was up 14% at constant currency (20% at reported

currency) to GBP5.2m (H1 2022: GBP4.3m), with a combination of new

business and improved churn.

ARR, which is our recurring revenue runrate, grew by 7% at

constant currency over the six months to 30 June 2023 to GBP20.1m,

which is up 14% at constant currency compared to 30 June 2022. ARR

growth over H1 was driven largely by higher ARPU, up 10% at

constant currency since 1 January 2023 to GBP275, and a 3%

reduction in users as we continue our strategy of focusing on

higher-value accounting and professional services customers with

strong integrations. Non-professional services customers have a

disproportionate impact on user numbers (particularly in SmartVault

in which non-accountant plans typically have higher minimum user

counts) but bring a fraction of the lifetime value to the Group of

an accounting or professional services customer. Accounting

per-user pricing is typically double that of non-accounting and

accountants are less than a third as likely to churn as

non-accountants. Net revenue retention remained strong in the

period due to improving churn rates across the Group (0.8% per

month, compared to 0.9% in H1 2022) coupled with the final set of

UK customers moving to the Virtual Cabinet Unlimited pricing plan,

averaging 100.5% per month (H1 2022: 100.6%). We expect net revenue

retention to return to more normalised levels over H2.

Non-recurring revenue of GBP0.4m was, as expected, down a little

compared to H1 2022 following the effective completion of the

process to convert older Virtual Cabinet customers onto pure SaaS

models. Total revenue was up 16% (13% at constant currency) to

GBP10.5m (H1 2022: GBP9.1m).

Gross margin of 89.9% (H1 2022: 90.4%) reflects the greater

proportion of revenue from our cloud products, most notably

SmartVault, as opposed to on-premise products for which there is

very little ongoing cost of sale.

SG&A costs of GBP7.7m (H1 2022: GBP6.8m) largely reflect the

investments made in the customer acquisition teams in the US, for

SmartVault, and the UK, for Workiro.

Total development expenditure was up 11% to GBP2.4m (H1 2022:

GBP2.1m), driven principally by a small headcount increase. GBP0.8m

of development costs were capitalised (H1 2022: GBP0.7m) across

Workiro and SmartVault.

Adjusted EBITDA was GBP0.2m (H1 2022: GBPnil), whilst Adjusted

Loss, which is stated before development capitalisation, was

GBP(0.6)m (H1 2022: GBP(0.7)m).

Depreciation and amortisation was down fractionally at GBP0.4m

(H1 2022: GBP0.5m) following 2022's change to the useful economic

life of capitalised development costs to 5 years (previously 3

years).

Long-term incentive costs of GBP0.3m were a little higher (H1

2022: GBP0.2m), reflecting new long-term incentive schemes

implemented in the period, offset by a reduction in the share-based

payment charge.

Non-underlying costs of GBP0.2m (H1 2022: GBP0.1m) comprise

corporate restructuring costs linked to the creation of separate

intermediate holding company structures and trading companies for

each of the Group's businesses and management support functions,

together with costs associated with the settlement of historic US

sales tax liabilities.

Non-lease finance costs relate to the Group's new GBP2m

revolving credit facility, which remained undrawn over the

period.

The loss before tax was GBP0.8m (H1 2022: GBP0.9m). The tax

credit of GBP0.1m (H1 2022: credit of GBP0.3m) reflects a

conservative estimate of the expected UK research and development

tax credit offset by overseas tax payable in the US, Australia and

New Zealand. The reduction is a result of the ongoing changes being

made to the calculation of tax credits for UK SMEs, the first of

which came into effect from 1 April 2023.

Cashflow and working capital

In addition to the GBP0.6m adjusted loss, the GBP1.3m cash

outflow comprised:

-- A deferred revenue reduction of GBP0.6m, largely reflecting

the seasonality of annual subscription renewals (which are

H2-weighted) and the timing of billing;

-- A GBP0.3m increase in payables, including employee incentive accruals;

-- GBP0.3m of capital expenditure, including in subcontracted software development work;

-- GBP0.1m of non-underlying restructuring cash costs;

-- A GBP0.6m net tax inflow, comprising GBP1.0m in research and

development tax credits in the UK offset by foreign tax

payments.

Cash at 30 June 2023 was GBP1.7m (30 June 2022: GBP2.1m),

underpinned by a GBP2m undrawn revolving credit facility committed

until February 2027, which remained undrawn over the period.

Consolidated income statement

For the six months ended 30 June 2023

H1 2023 H1 2022 FY 2022

Note GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Revenue 3 10,521 9,070 19,293

Cost of sales (1,058) (873) (1,952)

Gross profit 9,463 8,197 17,341

Operating costs (10,176) (9,010) (17,754)

Net finance costs (69) (67) (130)

Loss before tax 3 (782) (880) (543)

Loss before tax (782) (880) (543)

Depreciation and amortisation

on owned assets 408 487 563

Long-term incentive costs 262 157 329

Social security on long-term

incentives 61 130 (120)

Non-underlying costs 173 99 389

Finance costs not related

to leases 42 31 74

----------- ----------------- -----------------

Adjusted EBITDA 164 24 692

Capitalised development costs (767) (748) (1,438)

----------- ----------------- -----------------

Adjusted loss before tax (603) (724) (746)

--------------------------------- ----- ----------- ----------------- -----------------

Tax 140 332 571

(Loss)/profit for the period

attributable to owners of

the Company (642) (548) 28

=========== ================= =================

(Loss)/profit per share (pence)

Basic 4 (1.28) (1.10) 0.06

=========== ================= =================

Diluted 4 (1.28) (1.10) 0.05

=========== ================= =================

Consolidated statement of comprehensive income

For the six months ended 30 June 2023

H1 2023 H1 2022 FY 2022

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

(Loss)/profit for the period (642) (548) 28

----------- ----------- ----------

Other comprehensive items that

may be subsequently reclassified

to profit or loss

Exchange differences on translation

of foreign operations net of tax 168 (335) (380)

Other comprehensive income net

of tax 168 (335) (380)

----------- ----------- ----------

Total comprehensive income for

the period (474) (883) (352)

=========== =========== ==========

Consolidated balance sheet

At 30 June 2023

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Non-current assets

Intangible assets 3,144 1,591 2,486

Right of use assets - leases 995 1,463 1,184

Property, plant and equipment 345 426 382

-----------

4,484 3,480 4,052

----------- ----------- --------------

Current assets

Trade and other receivables 2,001 1,939 2,104

Current tax receivable 426 451 1,064

Cash and bank balances 1,659 2,131 2,972

----------- ----------- --------------

4,086 4,521 6,140

----------- ----------- --------------

Total assets 8,570 8,001 10,192

----------- ----------- --------------

Current liabilities

Trade and other payables (4,264) (3,865) (4,473)

Deferred revenue (6,021) (5,701) (6,659)

Lease liabilities (373) (373) (371)

Current tax payable (361) (280) (536)

----------- --------------

(11,019) (10,219) (12,039)

----------- ----------- --------------

Non-current liabilities

Lease liabilities (904) (1,465) (1,131)

----------- ----------- --------------

(904) (1,465) (1,131)

----------- ----------- --------------

Total liabilities (11,923) (11,684) (13,170)

----------- ----------- --------------

Net assets (3,353) (3,683) (2,978)

=========== =========== ==============

Equity

Share capital 76 74 75

Share premium account 3,018 3,018 3,018

Demerger reserve (3,085) (3,085) (3,085)

Retained earnings (3,362) (3,690) (2,986)

----------- ----------- --------------

Equity attributable to shareholders

of the parent (3,353) (3,683) (2,978)

=========== =========== ==============

Consolidated statement of changes in equity

For the six months ended 30 June 2023

Share

Share premium Demerger Retained

capital account reserve earnings Total

2023 Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2023 75 3,018 (3,085) (2,986) (2,978)

---------- --------- ----------- ----------- --------

Loss for the period - - - (642) (642)

Exchange differences on intercompany

balances shown in reserves - - - 168 168

Total comprehensive income

for the period - - - (474) (474)

Issue of ordinary shares 1 - - - 1

Long-term incentive costs - - - 98 98

---------- --------- ----------- ----------- --------

Total transactions with owners

of the Company 1 - - 98 99

At 30 June 2023 76 3,018 (3,085) (3,362) (3,353)

========== ========= =========== =========== ========

Share

Share premium Demerger Retained

capital account Reserve earnings Total

2022 Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 74 3,018 (3,085) (2,963) (2,956)

---------- --------- ----------- ----------- --------

Loss for the period - - - (548) (548)

Exchange differences on translation

of foreign operations, net

of tax - - - (335) (335)

Total comprehensive income

for the period - - - (883) (883)

Long-term incentive costs - - - 156 156

---------- --------- ----------- ----------- --------

Total transactions with owners

of the Company - - - 156 156

At 30 June 2022 74 3,018 (3,085) (3,690) (3,683)

========== ========= =========== =========== ========

Share

Share premium Demerger Retained

capital account Reserve earnings Total

2022 Audited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 74 3,018 (3,085) (2,963) (2,956)

---------- --------- ----------- ----------- --------

Profit for the year - - - 28 28

Exchange differences on translation

of foreign operations, net

of tax - - - (380) (380)

---------- --------- ----------- ----------- --------

Total comprehensive income

for the year - - - (352) (352)

Issue of ordinary shares 1 - - - 1

Long-term incentive costs - - - 329 329

---------- --------- ----------- ----------- --------

Total transactions with owners

of the Company - - - 329 330

At 31 December 2022 75 3,018 (3,085) (2,986) (2,978)

========== ========= =========== =========== ========

Consolidated cash flow statement

For the six months ended 30 June 2022

H1 2023 H1 2022 FY 2022

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

(Loss)/profit for the period (642) (548) 28

Finance costs 42 31 130

Income tax credit (140) (332) (571)

Depreciation of - property, plant

and equipment 82 87 163

Depreciation on right of use asset

- leases 179 194 277

Amortisation on intangible assets 326 400 400

Long-term incentive costs 323 287 329

Decrease/(increase) in receivables 103 (31) (197)

(Decrease)/increase in payables (235) (288) 428

(Decrease)/increase in deferred

income (639) 228 1,187

Cash used in operations (601) 28 2,174

Net income taxes received 628 790 675

Interest paid (42) (25) (74)

----------- ----------- ---------

Net cash from operating activities (15) 793 2,775

----------- ----------- ---------

Purchases of property, plant and

equipment (45) (76) (118)

Purchases of other intangible assets (217) (143) (339)

Capitalised internal development

costs (767) (748) (1,438)

----------- ----------- ---------

Net cash used in investing activities (1,029) (967) (1,895)

----------- ----------- ---------

Principal portion of lease payments (179) (130) (306)

Interest on lease liabilities (27) (36) (56)

Proceeds on issue of shares 1 - 1

----------- ----------- ---------

Net cash from financing activities (205) (166) (361)

----------- ----------- ---------

Net increase/(decrease) in cash (1,249) (340) 519

Cash and bank balances at beginning

of period 2,972 2,670 2,670

Effects of foreign exchange rates (64) (199) (217)

----------- ----------- ---------

Cash and bank balances at end

of period 1,659 2,131 2,972

=========== =========== =========

Net cash reconciliation

At 1 January Cash Interest Foreign At 30

2023 flow accretion exchange June 2023

movement

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Finance lease

liability (1,502) 206 (27) 46 (1,277)

Cash and cash

equivalents 2,972 (1,251) - (62) 1,659

------------- -------- ----------- ---------- -----------

Net cash (including

lease liabilities) 1,470 (1,045) (27) (17) 381

============= ======== =========== ========== ===========

Notes to the financial information

1. General information

These interim financial statements are for the six months ended

30 June 2023. They do not require all the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Group for the

year ended 31 December 2022.

These financial statements are presented in pounds sterling

because that is the currency of the country in which the Group has

its stock market listing and where most of its investors

reside.

2. Basis of preparation and accounting policies

The financial information set out above does not constitute

statutory accounts within the meaning of section s434(3) of the

Companies Act 2006 or contain sufficient information to comply with

the disclosure requirements of UK-adopted International Accounting

Standards ("IFRS").

The financial statements of GetBusy plc for the year ended 31

December 2022 were authorised for issue by the Board of Directors

on 28 February 2023. The auditors have reported on these accounts

and their reports were unqualified, did not draw attention to any

matters by way of emphasis and did not contain any statements under

s498 (2) or (3) of the Companies Act 2006.

These interim financial statements are prepared on the same

basis as the financial statements for the year ended 31 December

2022, in which our full set of accounting policies, including

critical judgements and key sources of estimation uncertainty, can

be found.

Alternative performance measures and glossary of terms

The Group uses a series of non-IFRS alternative performance

measures ("APMs") in its narrative and financial reporting. These

measures are used because we believe they provide additional

insight into the performance of the Group and are complementary to

our IFRS performance measures. This belief is supported by the

discussions that we have on a regular basis with a wide variety of

stakeholders, including shareholders, staff and advisers.

The APMs used by the Group, their definition and the reasons for

using them, are provided below:

Recurring revenue . This includes revenue from software

subscriptions and support contracts. A key part of our strategy is

to grow our high-quality recurring revenue base. Reporting

recurring revenue allows shareholders to assess our progress in

executing our strategy.

Adjusted Profit / Loss before Tax . This is calculated as profit

/ loss before tax and before certain items, which are listed below

along with an explanation as to why they are excluded:

Depreciation and amortisation of owned assets. These non-cash

charges to the income statement are subject to judgement. Excluding

them from this measure removes the impact of that judgement and

provides a measure of profit that is more closely aligned with

operating cashflow. Only depreciation on owned assets is excluded;

depreciation on leased assets remains a component of adjusted

profit / loss because, combined with interest expense on lease

liabilities, it is a proxy for the cash cost of the leases.

Long-term incentive costs. Judgement is applied in calculating

the fair value of long-term incentives, including share options,

and the subsequent charge to the income statement, which may differ

significantly to the cash impact in quantum and timing. The impact

of potentially dilutive share options is also considered in diluted

earnings per share. Therefore, excluding long-term incentive costs

from Adjusted Loss before Tax removes the impact of that judgement

and provides a measure of profit that is more closely aligned with

cashflow.

Capitalised development costs . There is a very broad range of

approaches across companies in applying IAS38 Intangible assets in

their financial statements. For transparency, we exclude the impact

of capitalising development costs from Adjusted Loss before Tax in

order that shareholders can more easily determine the performance

of the business before the application of that significant

judgement. The impact of development cost capitalisation is

recorded within operating costs.

Non -underlying costs. Occasionally, we incur costs that are not

representative of the underlying performance of the business. In

such instances, those costs may be excluded from Adjusted Profit /

Loss before Tax and recorded separately. In all cases, a full

description of their nature is provided.

Finance costs / (income) not related to leases . These are

finance costs and income such as interest on bank balances. It

excludes the interest expense on lease liabilities under IFRS16

because, combined with depreciation on leased assets, it is a proxy

for the cash cost of the leases.

Adjusted EBITDA . This is calculated as Adjusted Profit / Loss

before Tax with capitalised development costs added back.

Constant currency measures . As a Group that operates in

different territories, we also measure our revenue performance

before the impact of changes in exchange rates. This is achieved by

re-stating the comparative figure at the exchange rate used in the

current period.

Glossary of terms

The following terms are used within these financial

statements:

MRR. Monthly recurring revenue. That is, the monthly value of

subscription and support revenue, both of which are classified as

recurring revenue.

ARR . Annualised MRR. For a given month, the MRR multiplied by

12.

CAC . Customer acquisition cost. This is the average cost to

acquire a customer account, including the costs of marketing staff,

content, advertising and other campaign costs, sales staff and

commissions.

LTV. Lifetime value, calculated as the average revenue per

account multiplied by the average gross margin and divided by gross

MRR churn.

MRR churn . The average percentage of MRR lost in a month due to

customers leaving our platforms.

Net revenue retention . The average percentage retained after a

month due to the combined impact of customers leaving our

platforms, customers upgrading or downgrading their accounts and

price increases or reductions.

ARPU . Annualised MRR per paid user at a point in time.

3. Revenue and operating segments

The Group's chief operating decision maker is considered to be

the Board of Directors. Performance of the business and the

deployment of capital is monitored on a group basis. Additional

revenue analysis is presented by territory.

H1 2023 Unaudited UK USA AUS/NZ Total

GBP'000 GBP'000 GBP'000 GBP'000

Recurring revenue 3,941 5,179 982 10,102

Non-recurring

revenue 155 251 13 419

--------- --------- --------- ---------

Revenue from

contracts with

customers 4,096 5,430 995 10,521

Cost of sales (1,058)

---------

Gross profit 9,463

Sales, general

and admin costs (7,701)

Development

costs (2,365)

---------

Adjusted loss

before tax (603)

Capitalisation of development

costs 767

---------

Adjusted EBITDA 164

Depreciation and amortisation on

owned assets (408)

Long-term incentive

costs (262)

Social security on long-term incentives (61)

Non-underlying

costs (173)

Other finance

income / (costs) (42)

---------

Loss before

tax (782)

=========

H1 2022 Unaudited UK USA AUS/NZ Total

GBP'000 GBP'000 GBP'000 GBP'000

Recurring revenue 3,207 4,330 982 8,519

Non-recurring

revenue 275 233 43 551

--------- --------- --------- ---------

Revenue from

contracts with

customers 3,482 4,563 1,025 9,070

Cost of sales (873)

---------

Gross profit 8,197

Sales, general

and admin costs (6,792)

Development

costs (2,129)

---------

Adjusted loss

before tax (724)

Capitalisation of development

costs 748

---------

Adjusted EBITDA 24

Depreciation and amortisation on

owned assets (487)

Long-term incentive

costs (157

Social security on long-term incentive

costs (130)

Non-underlying

costs (99)

Other finance

income / (costs) (31)

---------

Loss before

tax (880)

=========

2022 Audited UK USA AUS/NZ Total

GBP'000 GBP'000 GBP'000 GBP'000

Recurring revenue 6,739 9,498 2,044 18,281

Non-recurring

revenue 511 419 82 1,012

----------------- --------- --------- ---------

Revenue from

contracts with

customers 7,250 9,917 2,126 19,293

Cost of sales (1,952)

---------

Gross profit 17,341

Sales, general

and admin costs (13,526)

Development

costs (4,561)

---------

Adjusted loss

before tax (746)

Capitalisation of development

costs 1,438

---------

Adjusted EBITDA (692)

Depreciation and amortisation on

owned assets (563)

Long-term incentive

costs (329)

Social security costs on share options 120

Non-underlying

costs (389)

Other finance

income / (costs) (74)

---------

Loss before

tax (543)

=========

4. Loss per share

The calculation of loss per share is based on the loss for the

period of GBP642k (H1 2022: loss of GBP548k, 2022: profit of

GBP28k).

Weighted number of shares calculation H1 2023 H1 2022 FY 2022

'000 '000 '000

Unaudited Unaudited Audited

Weighted average number of ordinary

shares 50,175 49,580 49,621

Effect of potentially dilutive

share options in issue n/a n/a 7,341

----------- ----------- ---------

Weighted average number of ordinary

shares (diluted) 50,175 49,580 56,962

=========== =========== =========

Loss per share H1 2023 H1 2022 FY 2022

pence pence pence

Unaudited Unaudited Audited

Basic (1.28) (1.10) 0.06

=========== =========== =========

Diluted (1.28) (1.10) 0.05

=========== =========== =========

At 30 June 2023 there were 7,058,705 shares under option. As

required by IAS33 (Earnings per Share), the impact of potentially

dilutive options was disregarded for the purposes of calculating

diluted loss per share in the Period as the Group was loss

making.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSLFULEDSEEU

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

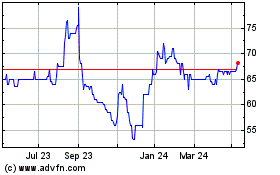

Getbusy (LSE:GETB)

Historical Stock Chart

From Nov 2024 to Dec 2024

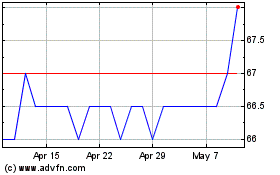

Getbusy (LSE:GETB)

Historical Stock Chart

From Dec 2023 to Dec 2024