Gresham House Renewable EnergyVCT1 Dividend and Update (3883K)

December 21 2022 - 1:00AM

UK Regulatory

TIDMGV1O TIDMGV2O

RNS Number : 3883K

Gresham House Renewable EnergyVCT1

21 December 2022

21 December 2022

GRESHAM HOUSE RENEWABLE ENERGY VCT 1 PLC

(the "Company", "VCT 1")

Dividend and Update

The Directors of Gresham House Renewable Energy VCT 1 PLC ("VCT

1") and Gresham House Renewable Energy VCT 2 PLC ("VCT 2") announce

a dividend of 2p per share for the year ended 30 September 2022.

The dividend will be paid on 27 January 2023 to Shareholders on the

register as at the close of business on 20 January 2023. The

ex-dividend date is 19 January 2023.

This level of dividend is lower than has been paid historically

in years up to 2020 (no dividend was paid in 2021) but the Company

has faced exceptional costs in the past two financial years. These

costs have mainly been associated with the need for remediation

work on the portfolio of solar assets, which are aging and hence

needed expenditure to replace old equipment to restore their

performance levels. The Board is pleased to report that the results

of these works have been positive and that indications are that

performance levels are satisfactory and in line with expectations.

In addition, there have been costs associated with the proposed

winding down of the Company and the sale of investment assets in

accordance with shareholders wishes as expressed in the

Continuation Vote in March 2021.

The Board appointed EY to manage the sale of the solar assets in

June 2021. Selling solar assets such as those owned by the Company

is typically a prolonged process but this sale has not run as

smoothly as we would have wished. One complicating factor has been

the uncertainty surrounding the grid connection at South Marston,

as referred to in the Interim Report. The situation at South

Marston is not yet fully resolved and it could still delay the

completion of the sale of a significant proportion of the

portfolio. In addition, widespread political and economic turmoil

in 2022 has led to volatility and turbulence, which makes it more

difficult to complete a sale in an orderly fashion at good

value.

Exclusivity for the purchase of the solar assets by a well-

regarded buyer expired just before the market turmoil caused by the

mini budget. The resulting uncertainty in financial markets,

combined with the proposed price caps and taxes on electrical

generation have made negotiations hard to progress. However, it is

hoped that with more settled markets in the New Year, and certainty

over the terms of the new taxes that a sale can be progressed.

A further update will be given when we announce the year-end

results at the end of January. The Board will also consider an

interim dividend later in the year.

END

For further information, please contact:

Gresham House Asset Management Renewablevcts@greshamhouse.com

Investor Relations Tel: 020 7382 0999

JTC (UK) Limited GreshamVCTs@jtcgroup.com

Company Secretary Tel: 020 3846 9774

LEI: 213800IVQHJXUQBAAC06

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVPPGCGPUPPGRU

(END) Dow Jones Newswires

December 21, 2022 02:00 ET (07:00 GMT)

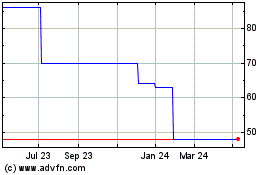

Gresham House Renewable ... (LSE:GV1O)

Historical Stock Chart

From Oct 2024 to Nov 2024

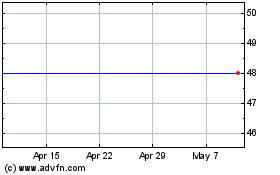

Gresham House Renewable ... (LSE:GV1O)

Historical Stock Chart

From Nov 2023 to Nov 2024