TIDMHPAC

RNS Number : 9350S

Hermes Pacific Investments PLC

30 September 2014

30 September 2014

HERMES PACIFIC INVESTMENTS PLC

(AIM: HPAC)

Final results for year ended 31 March 2014

Hermes Pacific Investments Plc today reports its financial

results for the year ended 31 March 2014.

Contacts

Hermes Pacific Investments Plc

Haresh Kanabar, Non-Executive Chairman Tel: +44 (0) 207 290 3340

WH Ireland Limited (Nominated Adviser

& Broker)

Mike Coe Tel: +44 (0) 117 945 3470

Chairman's Statement

I am pleased to report the results of Hermes Pacific Investments

Plc ("HPAC" or the "Company") for the 12 month period ended 31

March 2014. During the year the Company had no revenues as it does

not have any operating business and the Company made a loss of

GBP117,000, which has been reduced from a recorded loss of

GBP122,000 during the previous financial year. We are focussed on

our cost base and aim to keep it low particularly whilst we are in

the process of deploying our cash. At the year end the Company had

net assets of GBP4,128,000.

Review of the Company's Operations

The Company is an investing company and has made some

investments in line with its investing policy in companies involved

in financial activities within the emerging market sector. Our

principal focus is in the Far East as we believe that there are

good growth opportunities in that part of the world. These

investments have had a mixed performance with two performing in

line with our expectations and one rather poorly. We are in a

strong position from a Balance Sheet perspective and our cash

balance as at 31 March 2014 stands at GBP4.127 million. We continue

to evaluate other suitable opportunities in emerging markets and

with our strong Balance Sheet expect to make further investments in

the near future. Our total comprehensive loss for the year was

GBP183,000 compared to a loss of GBP99,000 for the previous

financial year. The increase in loss is largely due to the large

impairment of one of our investments.

The attractions of investing in emerging markets are that in

these markets the trend is to urbanise fairly rapidly. These

countries have young populations who aspire to the consumer

products in the same way as the more developed western economies.

These regions also tend to generally run sound public finances and

do not have the disadvantage of bloated welfare state or a culture

of state dependency. All of these factors create a sound platform

for increasing profits and dividends emanating from investments in

these emerging market companies.

Outlook

We are well positioned and look forward to the future with

confidence.

Haresh Kanabar

Chairman

statement OF COMPREHENSIVE INCOME

for the YEAR ended 31 march 2014

Year ended Year ended

31 March 31 March

Note 2014 2013

GBP'000 GBP'000

Continuing operations

Revenue - -

Cost of sales - -

gross profit - -

Other operating income - -

Administrative expenses (131) (122)

Operating loss (131) (122)

Finance income 14 -

Finance costs - -

Loss on ordinary activities before

tax 2 (117) (122)

Tax expense - -

Loss for the year from continuing

activities (117) (122)

Discontinued operations

Loss for the year from discontinued - -

operations

Loss for the year (117) (122)

Other comprehensive income

Available-for-sale financial assets:

Gains/(losses) arising in the year

(67) 23

Total comprehensive loss for the

year (183) (99)

Basic and diluted loss per share 3

From continuing operations (5)p (0.2)p

From discontinuing operations - -

(5)p (0.2)p

STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2014

As at As at

31 March 31 March

2014 2013

GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment - -

Investments 129 196

129 196

Current assets

Trade and other receivables 1 13

Cash and cash equivalents 4,127 57

4,128 70

LIABILITIES

Current liabilities

Trade and other payables (40) (25)

(40) (25)

Net current assets 4,088 45

NET ASSETS 4,218 241

SHAREHOLDERS' EQUITY

Issued share capital 3,576 1,496

Share premium account 5,781 3,701

Share based payments reserve 139 139

Revaluation reserve (43) 23

Retained earnings (5,235) (5,118)

TOTAL EQUITY 4,218 241

CASH FLOW STATEMENT

for the YEAR ended 31 March 2014

Year ended Year ended

31 March 31 March

2014 2013

GBP'000 GBP'000

Cash flows from operating activities (104) (106)

Cash flows from investing activities

Acquisition of investments - (173)

Income from disposal of subsidiary - -

undertakings

Net cash (used in)/from investing

activities - (173)

Cash flows from financing activities

Proceeds of share issues 4,160 320

Other income 14

Cost of share issue - (23)

Net cash from financing activities 4,174 297

Decrease in cash and cash equivalents 4,070 18

Cash and cash equivalents at start

of period 57 39

Cash and cash equivalents at end

of period 4,127 57

STATEMENT OF CHANGES IN EQUITY

for the YEAR ended 31 march 2014

Share

Ordinary Deferred based

share share Share payments Retained Revaluation

capital capital premium reserve earnings reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2012

Share 93 1,243 3,563 139 (4,996) - 42

re-organisation - - - - - - -

Share issue 160 - 138- - - - 298

Total

comprehensive

loss for the

period - - - - (122) 23 (99)

At 1 April 2013 253 1,243 3,701 139 (5,118) 23 241

Share - - - - - - -

re-organisation

Share issue 2,080 - 2,080 - - - 4,160

Total

comprehensive

loss for the

period - - - - (117) (66) (183)

At 31 March 2014 2,333 1,243 5,781 139 (5,235) (43) 4,218

1. Statement of compliance

The financial statements comply with International Financial

Reporting Standards as adopted by the European Union.

2. Operating loss

Year ended Year ended

31 March 31 March

2014 2013

GBP'000 GBP'000

The operating loss is stated after

charging the following, included

in administrative expenses:

Depreciation - -

Staff costs 59 68

Other admin costs 72 54

131 122

3. Loss per share

Year ended Year ended

31 March 31 March

2014 2013

Basic

Loss from continuing activities

(GBP'000) (117) (122)

Loss from discontinued activities - -

(GBP'000)

(117) (122)

Number of shares 2,333,295 50,658,844

Basic loss per share (p)

From continuing operations (5)p (0.2)p

From discontinued operations - -

_

(5)p (0.2)p

4. Publication of non-statutory accounts

The financial information set out in this announcement does not

comprise the Group's statutory accounts for the years ended 31

March 2014 or 31 March 2013. The financial information has been

extracted from the statutory accounts of the Company for the years

ended 31 March 2014 and 31 March 2013.

The auditors' opinion on those accounts was unmodified and did

not contain a statement under section 498 (2) or section 498 (3)

Companies Act 2006 and did not include references to any matters to

which the auditor drew attention by the way of emphasis.

The statutory accounts for the year ended 31 March 2014 have

been delivered to the Registrar of Companies, whereas those for the

year ended 31 March 2014 will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

5. Annual report

The Annual Report will be available from the Company's website

www.hermespacificinvestments.com from 30 September 2014 and will be

posted to shareholders on or before 30 September 2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UKUARSBAKUUR

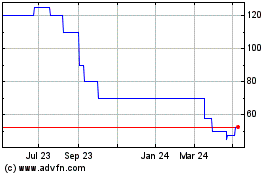

Hermes Pacific Investments (LSE:HPAC)

Historical Stock Chart

From Feb 2025 to Mar 2025

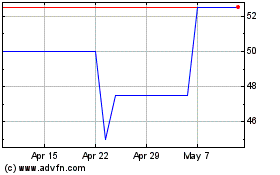

Hermes Pacific Investments (LSE:HPAC)

Historical Stock Chart

From Mar 2024 to Mar 2025