TIDMINSG

RNS Number : 8541Y

Insig AI Plc

09 September 2022

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. It forms part of United Kingdom

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement, this inside information

is now considered to be in the public domain.

9 September 2022

Insig AI plc

("Insig AI" or the "Company")

Final results for the year ended 31 March 2022

and

Posting of the Annual Report and Accounts and Notice of General

Meeting

Insig AI plc (AIM:INSG), the data science and machine learning

solutions company and its subsidiaries (the "Group") is pleased to

announce its results for the year ended 31 March 2022.

The Group's Annual Report & Accounts, along with the

Company's Notice of General Meeting ("GM") will be posted to

shareholders later today and will be available shortly on the

Group's website: www.insg.ai/investor-relations/ . The GM will be

held at 9:45 a.m. on 30 September 2022 at 48 Warwick Street,

London, W1B 5AW.

Highlights

-- Loss for the year after income tax GBP4.2 million after

charging depreciation and amortisation of GBP2.2 million

-- New Funds Launch division in discussions with asset managers

with combined AUM of over $1 trillion dollars: Now targeting GBP4

million per annum run rate of recurring revenues by end of next

financial year from this division

-- Forecasting significant jump in second half revenues and for

following financial year and beyond

-- A number of contract wins expected by the end of next month

Insig AI's Chief Executive, Colm McVeigh commented: "Over the

last year, we have transformed and repositioned the business

converting a strong machine learning AI capability into customer

focused solutions which form the basis for asset management

partnerships, fintech data science high impact projects, and ESG

disclosure diagnostic reporting for the corporate market. We

anticipate that this will be reflected in strong and sustainable

revenue growth."

For further information, please visit www.insg.ai or contact:

Insig AI plc Via SEC Newgate

Colm McVeigh (CEO)

Zeus (Nominated Adviser & Broker)

David Foreman / James Hornigold

/ Danny Philips +44 (0) 20 3829 5000

SEC Newgate (Financial PR) +44 (0) 7540 106 366

Robin Tozer / Richard Bicknell insigai@secnewgate.co.uk

Chairman's statement

The year under review has been one of considerable change for

the Company as we have evolved and refined our technology offerings

and sales processes to better position us to take advantage of the

considerable opportunities available to us in our addressable

markets.

When I was appointed Chairman last August, two separate elements

of the business became clear. Firstly, that the Company has

developed scalable machine learning technology with a skilled,

talented and dedicated workforce. Secondly, that the executive team

at the time lacked experience in selling scalable software, being

more skilled in delivering consultancy and complex projects. The

business required commercial focus and leadership. I am pleased to

report that under Colm McVeigh, initially as Chief Commercial

Officer and now as CEO, this is what we now have. It is common for

young businesses to make missteps. What is important is that swift

and decisive action is taken. That is what we have done.

As the asset management industry itself increasingly uses

technology to deliver competitive differentiation and adapts to

evolving standards, we are able to apply our advanced analytical

tools, machine learning innovative data gathering and processing in

ways that can benefit our target customer base, offering asset

managers competitive advantage as well as efficiencies. We apply

our deep domain expertise in ESG, data science, machine learning

and cloud data infrastructure so our customers can achieve

sustainable investment decisions and high impact operational

transformation through AI and data solutions.

We have focused our strategy on securing high quality,

substantial recurring revenue, prioritising this over more modest

one-off contract wins. Whilst the former has a longer sales cycle,

if successfully delivered will, we believe, form the bedrock of a

valuable business.

Partnership opportunities with asset managers as they launch new

funds across the ESG spectrum provide potential revenues that are

of a magnitude several times more than the traditional product

licence sale. I am pleased to report tangible success in this

regard. In February, we announced a landmark agreement with CarVal

Investors, L.P. ("CarVal") to develop and launch a new line of high

yield ("HY") and investment grade ("IG") ESG scoring tools to be

used by CarVal to optimise HY and/or IG portfolios based on ESG

considerations. In April, these scoring tools were successfully

delivered. We now expect the coming quarters to begin the payback

of our considerable investment. Our share of fees are based on

CarVal's assets under management ("AUM") raised in connection with

these HY and/or IG focused investment pools. We anticipate that as

CarVal secures mandates, our fees will increase commensurably and

continue for several years.

In July, CarVal was acquired by Alliance Bernstein which we hope

will provide further opportunities.

In March, we announced that we were in early stage discussions

with a UK based investment manager with the objective of launching

an ESG Global Opportunities Equities Fund. The investment manager

undertook a detailed review of our entire fintech and machine

learning capability. This has included involvement from not only

the Head of Equities but also the CEO. I am pleased to report that

feedback from the CEO and investigating team was favourable, that

discussions continue and indeed have extended beyond a potential

fund launch.

In March, we also reported that we were establishing a New Funds

Launch division. In recent weeks, we have commenced early stage

discussions with two further investment asset managers, with

combined AUM of over $1 trillion dollars. Whilst it is important to

manage expectations as to the timelines and pathways required to

secure such substantial agreements, the transformation in our

ability to engage with and hopefully conclude and deliver such

agreements augurs well.

Alongside our desire and focus to conclude agreements with other

asset managers, we are now targeting recurring revenues of GBP4

million per annum from new fund launches. Taking account of lead

times and in particular those of establishing a new fund, we

believe that this run rate can be achieved before the end of our

next financial year. Of course, our longer-term aspirations are to

continue growing revenues substantially beyond this, but we need to

remain focused on the more immediate hurdles to overcome, not least

securing sufficient working capital and retaining the dedicated and

skilled team that Colm, Steve and Warren in particular have put

together.

Whilst our fintech capability can be applied to markets beyond

ESG disclosures, focus is critical. It is important to realise not

only our capability but our capacity. A year ago, our discussions

with a number of asset managers were met with the requirement to go

away with portfolio details and develop a data base of scores and

analysis for their portfolios. Then we had just 200 companies in

our database. Now, our repository stands at more than 2,000

companies. Using natural language processing machine readable

classifiers, we have an accessible and detailed analysis and

scoring of every public disclosure made by these companies dating

back several years. Source data can be instantly accessed. As a

result, now when we demonstrate our offering, we are able to show

portfolio constituents there and then.

Why does this matter? It is because it is all too easy for an

asset manager to label a fund "ESG compliant" but to do so, without

a methodology that drills down to each element of ESG, exposes the

asset manager to a lack of evidence of compliance . This can expose

not only a business but also its directors to immense reputational

and financial damage. In May 2022, the US Securities and Exchange

Commission ("SEC") fined investment adviser BNY Mellon. The SEC

stated that at the time of investment, 67 out of 185 investments

made by a mutual fund advised by BNY Mellon, allegedly lacked any

ESG quality review score. That did not prevent BNY Mellon profiting

by charging fees to manage these so called ESG compliant

investments. In June 2022, the SEC launched an investigation into

the asset management division of Goldman Sachs regarding potential

"greenwashing."

Regulatory oversight is not confined to the US. In Europe, a

combined 50 officials from BaFin, the German regulator, the federal

criminal police office and the public prosecutor's office searched

the offices of Deutsche Bank and DWS regarding alleged false ESG

claims. In June 2022, DWS's Chief Executive resigned.

Whilst there is no shortage of asset managers who are

responsible investors, Insig AI is at the "coal face" of this ESG

mine(field) of corporate disclosures. The most reliable, comparable

and objective evidence based diagnosis of ESG compliance is how a

business sets out and explains its ESG credentials. This is our

positioning.

Our close interaction with asset managers allows us to

differentiate between those investment advisers who regard

responsible investing as both a commercial opportunity as well as

being a good corporate citizen and those making such claims but

lack the tools to do so. We consider that it will still be a number

of years until the global regulatory framework is sufficiently

advanced to provide comparable disclosure requirements. A

generation ago, international accounting standards required

developing and extending. ESG adherence will also adapt to evolving

standards of what is regarded as good practice. Until then, we

believe that our ESG scoring tools and machine learning based

analysis provide an essential measure of ESG corporate conduct.

We are also seeing the emergence of progressive asset managers

who are creating innovative ESG high impact thematic funds based on

selecting companies whose strategies are to substantially improve

their ESG outcomes. For such investment managers, our technologies

facilitate deep detailed analysis of company ESG issues,

optimisation for financial and ESG outcomes when creating the fund,

and in-life management for performance.

The year under review has been transformative. On 10 May 2021,

the Company acquired the entire issued share capital of Insight

Capital Partners Limited ("Insight"). The business is transitioning

from consulting as its sole revenue source to one with a higher

quality, recurring value stream, capable of delivering visible and

reliable growth over the medium and long term. In the shorter term,

this transition has had a disproportionate impact on our results as

we have increased our investment in sales and marketing alongside

the product development required to secure significant and

sustainable revenues.

Financial performance

For the year ended 31 March 2022, we are reporting a total

comprehensive loss from all activities of GBP4.2 million which

includes depreciation and amortisation of GBP2.2 million and a

profit from the Group's school sport coaching facility, Sport in

Schools Limited ("SSL") of GBP0.2 million. The Directors are not

recommending the payment of a dividend.

Board restructure

During the early part of the year under review, upon the

acquisition of Insight, directors David Hillel, David Coldbeck and

John Zucker resigned. The Company appointed two new Executive

Directors and one new Non-Executive Director. Steve Cracknell, the

Chief Executive of Insight was appointed as Chief Executive of the

Company and Warren Pearson was appointed as Chief Technology

Officer. Peter Rutter was also appointed as a Non-Executive

Director. In August 2021, Matthew Farnum-Schneider resigned as

Executive Chairman and I was appointed as interim Non-Executive

Chairman.

Shortly after my appointment, it was clear that changes were

required: most importantly, the need to bring greater commercial

focus. Having a strong machine learning capability and scalable

technology is a necessary condition for success. However, it is an

insufficient condition on its own. Hence in November, Colm McVeigh

was appointed to the Board, initially as Chief Commercial Officer

and in April 2022, as Chief Executive. This has enabled Colm to

lead the business, whilst Steve, as Chief Product Officer, is able

to focus on product development and delivery.

In December 2021, Peter Rutter stepped down as a director due to

his increasing responsibilities and workload as Head of Equities at

Royal London Asset Management. In April 2022, we were pleased to

announce that Richard Cooper was appointed to the Company's board

of directors as an independent non-executive director and chair of

the Audit Committee. Richard has over 25 years' experience as a

Chief Financial Officer across both publicly-traded and

privately-owned companies in a variety of service industries,

including gaming and financial services. He is currently CFO of

Equals Group plc, an AIM-quoted fintech company.

Acquisition of FDB Systems Limited

In November, the Company announced that it had entered into a

conditional share purchase agreement to acquire the entire issued

share capital of FDB Systems Limited ("FDB Systems"). FDB Systems

specialises in the collection and structuring of financial market

data for investors and other capital markets participants. which is

the process of transforming raw data so that it can be more easily

and effectively used as an input to machine learning, data science

and AI processes.

The initial consideration comprised GBP0.3 million cash plus the

issue of 7,022,471 ordinary shares at 52.7p per share.

FDB Systems has been successfully integrated allowing the

Company to offer a complete end-to-end financial data solution to

its customers. FDB Systems no longer operates as a stand alone

business and all of its activities have been combined with those of

Insig AI. The combination has directed greater focus to Insig AI's

existing clients as opposed to exclusively the FDB Systems clients

acquired.

Pantheon Leisure Plc ("Pantheon")

Insig holds 85.87% of the issued share capital of Pantheon which

in turn owns 100% of Sport in Schools Limited ("SSL"). Pantheon as

a group made a profit for the year ended 31 March 2022 of GBP0.1

million (15 months ended 31 March 2021: loss GBP0.01 million).

Pantheon's results are consolidated into the Group accounts.

Sport in Schools Limited ("SSL")

Profit recognised in the year was GBP0.2 million compared with

GBP0.1 million during the comparable pre-Covid 12 months.

Funding

In March 2022, we announced that the Board had decided to secure

a long-term revenue agreement based on AUM at the expense of

revenues that could have been recognised in the year under review.

Whilst this had a detrimental effect on immediate cash flows, the

quantum and longevity of receipts is expected to be considerably

more than those foregone short term revenues.

The Company ended its financial year on 31 March 2022 with net

cash of GBP0.5 million. In March 2022, the Company announced that I

was providing an unsecured convertible loan facility of GBP1.0

million. The key terms that the independent directors considered to

be fair and reasonable were conversion at the higher of 35p per

share and the prevailing share price at the time of conversion and

a coupon of 5 per cent. per annum on funds drawn down. The first

draw down took place in early May. In June, the Company announced

that it had been approached by David Kyte, a long term shareholder

with an offer of funding of GBP0.5 million, on the same terms as my

own facility. As at 8 September 2022, Group cash was approximately

GBP0.12 million and GBP0.31 million remained available for draw

down.

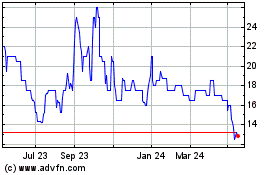

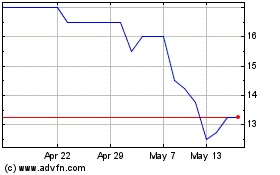

The Board recognises that further working capital is required to

support the Group over both the short and potentially medium term.

The Board notes that despite no adverse news announcements, since

the end of May, the share price has halved. Therefore, the Board

believes that it would not be in the best interests of all

stakeholders to carry out an equity raise in the very short term.

Instead, the Board is considering a proposal with regard to a new

convertible loan facility from myself of GBP0.75 million. The

facility terms include a conversion price of 35p, which represents

a premium of 62 per cent. to the current share price, interest of 5

per cent. per annum on amounts drawn down. The facility would also

be secured on the Group's shareholding in Sport in Schools Limited.

Based upon the board's cash flow projections, which includes the

anticipated receipt of a substantial R&D Tax Credit, this

facility is expected to provide sufficient working capital through

to Q2 (calendar) 2023, by which time, the Company will hopefully

have secured and announced substantial contracts providing the

necessary visibility of the Company's sales growth trajectory.

Prospects

The corrective action we took is now expected to convert into a

number of contract wins: these are anticipated to close before the

end of October. Today, we have set out our expectations for revenue

from asset management partnerships: a run rate of GBP4 million per

annum before the end of our next financial year. We are also now

receiving positive feedback from the corporate market, with our ESG

proprietary scoring and comparison capabilities assisting

disclosure reporting requirements. Of greater significance will be

our ability to sell bespoke data science fintech projects which can

develop into long term partnerships. We therefore are expecting to

report a significant jump up in our second half revenues and for

the following financial year and beyond. Despite the current

unhelpful macro-economic background, the scale of our opportunity

combined with the solutions that we provide, gives us confidence

for the future.

Richard Bernstein

Chairman

8 September 2022

Consolidated statement of financial position

Group Company

---------------------------- ----------------------------

Note 31 March 31 March 31 March 31 March

2022 2021 2022 2021

GBP GBP GBP GBP

-------------------------------- ------ ------------- ------------- ------------- -------------

Non-Current Assets

Property, plant and equipment 11 66,000 3,000 - -

Right of Use Assets 12 38,000 51,000 - -

Intangible assets 13 38,217,000 60,000 - -

Unlisted investments - 1,500,000 - 1,500,000

Investment in subsidiaries 14 - - 39,179,000 220,000

38,321,000 1,614,000 39,179,000 1,720,000

-------------------------------- ------ ------------- ------------- ------------- -------------

Current Assets

Trade and other receivables 15 289,000 397,000 90,000 685,000

Cash and cash equivalents 16 473,000 935,000 61,000 484,000

-------------------------------- ------ ------------- ------------- ------------- -------------

762,000 1,332,000 151,000 1,169,000

-------------------------------- ------ ------------- ------------- ------------- -------------

Total Assets 39,083,000 2,946,000 39,330,000 2,889,000

-------------------------------- ------ ------------- ------------- ------------- -------------

Non-Current Liabilities

Lease liabilities 18 29,000 38,000 - -

Borrowings > 1 year 18 - 204,000 - -

Deferred tax liabilities 19 4,160,000 - - -

-------------------------------- ------ ------------- ------------- ------------- -------------

4,189,000 242,000 - -

Current Liabilities

Trade and other payables 17 809,000 566,000 308,000 304,000

Lease liabilities 18 8,000 8,000 - -

Unsecured convertible

loan notes 18 - 414,000 - 414,000

Borrowings < 1 year 18 - 36,000 - -

817,000 1,024,000 308,000 718,000

-------------------------------- ------ ------------- ------------- ------------- -------------

Total Liabilities 5,006,000 1,266,000 308,000 718,000

-------------------------------- ------ ------------- ------------- ------------- -------------

Net Assets 34,077,000 1,680,000 39,022,000 2,171,000

-------------------------------- ------ ------------- ------------- ------------- -------------

Equity attributable to

owners of the Parent

Share capital 21 3,110,000 2,480,000 3,110,000 2,480,000

Share premium 21 39,077,000 3,040,000 39,077,000 3,040,000

22,

Other reserves 23 326,000 428,000 326,000 428,000

Retained losses (8,383,000) (4,202,000) (3,491,000) (3,777,000)

-------------------------------- ------ ------------- ------------- ------------- -------------

Equity attributable to

shareholders of the parent

parent company 34,130,000 1,746,000 39,022,000 2,171,000

-------------------------------- ------ ------------- ------------- ------------- -------------

Non-controlling interests (53,000) (66,000) - -

-------------------------------- ------ ------------- ------------- ------------- -------------

Total Equity 34,077,000 1,680,000 39,022,000 2,171,000

-------------------------------- ------ ------------- ------------- ------------- -------------

The Company has elected to take the exemption under Section 408

of the Companies Act 2006 from presenting the Parent Company Income

Statement and Statement of Comprehensive Income. The profit for the

Company for the year ended 31 March 2022 was GBP269,000 (15 months

ended 31 March 2021: loss of GBP1,050,000).

The Financial Statements were approved and authorised for issue

by the Board of Directors on 8 September 2022 and were signed on

its behalf by:

Colm McVeigh

Chief Executive Officer

Consolidated Income statement

12 month 15 month

period ended period ended

31 March 31 March

2022 2021

Continued operations Note GBP GBP

------------------------------------------------ ------ --------------- --------------

Revenue 5 1,708,000 1,043,000

Cost of sales 5 (719,000) (798,000)

------------------------------------------------ ------ --------------- --------------

Gross profit 989,000 245,000

Administrative expenses 6 (5,256,000) (1,548,000)

Other gains/(losses) 7 7,000 -

Other income 8 119,000 602,000

Operating loss (4,141,000) (701,000)

Finance income 9 4,000 1,000

Finance costs 9 (14,000) (48,000)

Loss before exceptional item (4,151,000) (748,000)

Exceptional items 10 908,000 (314,000)

------------------------------------------------ ------ --------------- --------------

Loss before income tax (3,243,000) (1,062,000)

Deferred tax 26 (942,000) -

------------------------------------------------ ------ --------------- --------------

Loss for the year after income tax (4,185,000) (1,062,000)

------------------------------------------------ ------ --------------- --------------

Loss for the year attributable to owners

of the Parent (4,198,000) (1,060,000)

------------------------------------------------ ------ --------------- --------------

Profit/(Loss) for the year attributable

to Non-controlling interests 13,000 (2,000)

------------------------------------------------ ------ --------------- --------------

Basic and Diluted Loss Per Share attributable

to owners of the Parent during the period

(expressed in pence per share) 27 (3.55)p (2.67)p

------------------------------------------------ ------ --------------- --------------

12 month 15 month

period ended period ended

31 March 31 March

2022 2021

GBP GBP

------------------------------------------------- ---------------- ---------------

Loss for the year (4,185,000) (1,062,000)

Other Comprehensive Income:

Items that may be subsequently reclassified

to profit or loss

Currency translation differences - -

------------------------------------------------- ---------------- ---------------

Other comprehensive loss for the year,

net of tax - -

------------------------------------------------- ---------------- ---------------

Total comprehensive loss (4,185,000) (1,062,000)

-------------------------------------------------- ---------------- ---------------

Total comprehensive loss attributable

to owners of the Parent (4,198,000) (1,060,000)

-------------------------------------------------- ---------------- ---------------

Total comprehensive profit/(loss) attributable

to Non-controlling interests 13,000 (2,000)

-------------------------------------------------- ---------------- ---------------

Consolidated statement of changes in equity

Retained Non

Share Share Other earnings Controlling

capital premium reserves /(losses) Total Interest Total

Note GBP GBP GBP GBP GBP GBP GBP

-----------

Balance as

at 1 January

2020 2,409,000 1,048,000 326,000 (3,165,000) 618,000 (64,000) 554,000

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Loss for the

period - - - (1,060,000) (1,060,000) (2,000) (1,062,000)

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Other

comprehensive

loss for the

period

Items that

may be

subsequently

reclassified

to profit or

loss

---------------- ------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Total comprehensive

loss for the

period - - - (1,060,000) (1,060,000) (2,000) (1,062,000)

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Issue of new

shares 71,000 1,992,000 - - 2,063,000 - 2,063,000

Equity component

of CLN issued

in period - - 124,000 - 124,000 - 124,000

Share based

payments - - - 23,000 23,000 - 23,000

Share issue

costs - - (22,000) - (22,000) - (22,000)

Total transactions

with owners,

recognised

directly in

equity 71,000 1,992,000 102,000 23,000 2,188,000 - 2,188,000

Balance as

at 31 March

2021 2,480,000 3,040,000 428,000 (4,202,000) 1,746,000 (66,000) 1,680,000

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Balance as

at 1 April

2021 2,480,000 3,040,000 428,000 (4,202,000) 1,746,000 (66,000) 1,680,000

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Profit/(Loss)

for the year - - - (4,198,000) (4,198,000) 13,000 (4,185,000)

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Other

comprehensive

loss for the

year

Items that

may be

subsequently

reclassified

to profit or

loss

Total comprehensive

loss for the

year - - - (4,198,000) (4,198,000) 13,000 (4,185,000)

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Issue of shares 630,000 36,201,000 - - 36,831,000 - 36,831,000

Equity component

of CLN redeemed

in period - - (124,000) - (124,000) - (124,000)

Share based

payments - - - 17,000 17,000 - 17,000

Share issue

costs - (164,000) 22,000 - (142,000) - (142,000)

Total transactions

with owners,

recognised

directly in

equity 630,000 36,037,000 (102,000) 17,000 36,582,000 - 36,582,000

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Balance as

at 31 March

2022 3,110,000 39,077,000 326,000 (8,383,000) 34,130,000 (53,000) 34,077,000

------------------------- ----------- ------------ ----------- ------------- ------------- ------------- -------------

Share Share Other Retained Total

capital premium reserves losses equity

Note GBP GBP GBP GBP GBP

Balance as at 1 January

2020 2,409,000 1,048,000 326,000 (2,750,000) 1,033,000

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Loss for the period - - - (1,050,000) (1,050,000)

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Total comprehensive loss

for the period - - - (1,050,000) (1,050,000)

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Issue of new shares 71,000 1,992,000 - - 2,063,000

Share based payments - - - 23,000 23,000

Share issue costs - - (22,000) - (22,000)

Equity component of CLN

issued in the period - - 124,000 - 124,000

Total transactions with

owners, recognised directly

in equity 71,000 1,992,000 102,000 23,000 2,188,000

Balance as at 31 March

2021 2,480,000 3,040,000 428,000 (3,777,000) 2,171,000

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Balance as at 1 April

2021 2,480,000 3,040,000 428,000 (3,777,000) 2,171,000

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Profit for the year - - - 269,000 269,000

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Total comprehensive loss

for the year - - - 269,000 269,000

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Issue of shares 630,000 36,201,000 - - 36,831,000

Equity component of CLN

redeemed in period - - (124,000) - (124,000)

Share based payments - - - 17,000 17,000

Share issue costs - (164,000) 22,000 - (142,000)

Total transactions with

owners, recognised directly

in equity 630,000 36,037,000 (102,000) 17,000 36,582,000

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Balance as at 31 March

2022 3,110,000 39,077,000 326,000 (3,491,000) 39,022,000

---------------------------------------- ----------- ------------ ----------- ------------- -------------

Group Company

---------------------------- ----------------------------

12 month 15 month 12 month 15 month

period period period period

ended 31 ended 31 ended 31 ended 31

March 2022 March 2021 March 2022 March 2021

Note GBP GBP GBP GBP

----------------------------------------- ------ ------------- ------------- ------------- -------------

Cash flows from operating activities

(Loss)/profit before income

tax (4,185,000) (1,062,000) 269,000 (1,050,000)

Adjustments for:

Depreciation and amortisation 2,239,000 20,000 - -

Share based payments 22 17,000 23,000 17,000 23,000

Net finance (income)/costs 13,000 47,000 (58,000) 17,000

Indebtness with subsidiaries

(waived)/written off - - - (193,000)

Investment in subsidiaries written

off - - - 192,000

Provision for deferred tax liabilities 942,000 - - -

Proceeded from R&D tax credits 683,000 - - -

Fair value uplift on unlisted

investment (1,759,000) - (1,759,000) -

Loss on disposal of lease liability (7,000) - - -

Changes in working capital:

(Increase)/Decrease in trade

and other receivables 36,000 (288,000) 52,000 (335,000)

Increase/(Decrease) in trade

and other payables (172,000) 299,000 (57,000) 277,000

Net cash used in operating

activities (2,193,000) (961,000) (1,536,000) (1,069,000)

----------------------------------------- ------ ------------- ------------- ------------- -------------

Cash flows from investing activities

Sale/(Purchase) of property,

plant and equipment 11 (34,000) (2,000) - -

Investment in unlisted shares - (1,500,000) - (1,500,000)

Acquisition of subsidiaries

net of cash acquired 30 (1,529,000) - (1,742,000) -

Purchase of intangible assets 13 (2,304,000) - - -

Loans granted to subsidiaries - - (3,148,000) -

Finance income - 1,000 - 1,000

----------------------------------------- ------ ------------- ------------- ------------- -------------

Net cash used in investing

activities (3,867,000) (1,501,000) (4,890,000) (1,499,000)

----------------------------------------- ------ ------------- ------------- ------------- -------------

Cash flows from financing activities

Proceeds from issue of share

capital 6,145,000 2,063,000 6,145,000 2,063,000

Transaction costs of share issue (142,000) (22,000) (142,000) (22,000)

Proceeds from Borrowings - 740,000 - 500,000

Repayment of borrowings (290,000) - -

Repayment of leasing liabilities (115,000) (11,000) - -

Finance expense - (10,000) - -

Net cash generated from financing

activities 5,598,000 2,760,000 6,003,000 2,541,000

----------------------------------------- ------ ------------- ------------- ------------- -------------

Net decrease/(increase) in

cash and cash equivalents (462,000) 298,000 (423,000) (27,000)

Cash and cash equivalents at

beginning of year 935,000 637,000 484,000 511,000

Cash and cash equivalents at

end of year 12 473,000 935,000 61,000 484,000

----------------------------------------- ------ ------------- ------------- ------------- -------------

Major Non-Cash Transactions:

On 10 May 2021, 44,819,161 new ordinary shares were issued at 59

pence per share, as consideration shares to the owners of Insig

Partners Limited for total consideration of GBP26,448,000.

On 10 May 2021, convertible loan notes issued by the Company

were converted, resulting in 2,000,000 new ordinary shares issued

at 25 pence per share for a total consideration of GBP500,000.

1. General information

Insig AI plc is a public company limited by shares, domiciled

and incorporated in England and Wales and its activities are as

described in the strategic report on pages 7 to 12.

These financial statements are prepared in pounds sterling being

the currency of the primary economic environment in which the Group

operates. Monetary amounts are rounded to the nearest thousand.

2. Summary of significant accounting policies

The principal Accounting Policies applied in the preparation of

these Consolidated Financial Statements are set out below. These

Policies have been consistently applied to all the periods

presented, unless otherwise stated.

2.1. Basis of preparation of Financial Statements

The Group and Company Financial Statements have been prepared in

accordance with UK-adopted international accounting standards. The

Group and Company Financial Statements have also been prepared

under the historical cost convention, except as modified for assets

and liabilities recognised at fair value on an asset

acquisition.

The Financial Statements are presented in Pound Sterling rounded

to the nearest pound.

The preparation of Financial Statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise its judgement in the process of

applying the Accounting Policies. The areas involving a higher

degree of judgement or complexity, or areas where assumptions and

estimates are significant to the Group and Company Financial

Statements are disclosed in Note 4.

2.2. New and amended standards

(i) New and amended standards adopted by the Group and Company

The International Accounting Standards Board (IASB) issued

various amendments and revisions to International Financial

Reporting Standards and IFRIC interpretations. The amendments and

revisions were applicable for the period ended 31 March 2022 but

did not result in any material changes to the financial statements

of the Group or Company.

Of the other IFRS and IFRIC amendments, none are expected to

have a material effect on future Group or Company Financial

Statements.

(ii) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

Standards, amendments and interpretations that are not yet

effective and have not been early adopted are as follows:

Standard Impact on initial application Effective date

-------------------- ------------------------------- -----------------

IAS 8 (Amendments) Accounting estimates 1 January 2023

------------------------------- -----------------

None are expected to have a material effect on the Group or

Company Financial Statements.

2.3. Basis of Consolidation

The Consolidated Financial Statements consolidate the financial

statements of the Company and its subsidiaries made up to 31 March

2022. Subsidiaries are entities over which the Group has control.

Control is achieved when the Group is exposed, or has rights, to

variable returns from its involvement with the investee and has the

ability to affect those returns through its power over the

investee.

Generally, there is a presumption that a majority of voting

rights result in control. To support this presumption and when the

Group has less than a majority of the voting or similar rights of

an investee, the Group considers all relevant facts and

circumstances in assessing whether it has power over an investee,

including:

-- The contractual arrangement with the other vote holders of the investee;

-- Rights arising from other contractual arrangements; and

-- The Group's voting rights and potential voting rights

The Group re-assesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements of control. Subsidiaries are fully

consolidated from the date on which control is transferred to the

Group. They are deconsolidated from the date that control ceases.

Assets, liabilities, income and expenses of a subsidiary acquired

or disposed of during the period are included in the consolidated

financial statements from the date the Group gains control until

the date the Group ceases to control the subsidiary.

Investments in subsidiaries are accounted for at cost less

impairment within the parent company financial statements. Where

necessary, adjustments are made to the financial statements of

subsidiaries to bring the accounting policies used in line with

those used by other members of the Group. All significant

intercompany transactions and balances between Group enterprises

are eliminated on consolidation.

2.4. Revenue recognition

Revenue is measured at the fair value of the consideration

received or receivable, and represent amounts receivable for goods

supplied, stated net of discounts, returns and value added taxes.

Under IFRS 15 there is a five-step approach to revenue recognition

which is adopted across all revenue streams. The process is:

-- Step 1: Identify the contract(s) with a customer;

-- Step 2: Identify the performance obligations in the contract;

-- Step 3: Determine the transaction price;

-- Step 4: Allocate the transaction price to the performance obligations in the contract; and

-- Step 5: Recognise revenue as and when the entity satisfies the performance obligation.

The Group has two types of revenue streams being machine

learning and data services and sports activities.

Machine learning and Data services revenue comprises of:

1. ESG Research Tool

Charged on a licence fee basis and the fees are recognised once

the services have been provided to the client over the period of

time the work is conducted.

2. Machine Readable Data

Charged on a licence fee basis and the fees are recognised once

the services have been provided to the client over the period of

time the work is conducted.

3. Bespoke Data Science Solutions

Charged on a project basis and includes work related to data

migration, design fees, communication fees and technological

services. The fees are recognised once the services have been

provided to the client over the period of time the work is

conducted.

Sports activities revenue is recognised once performance

obligations have been satisfied and work is completed with payment

due in advance of the performance obligations. Under the Group's

standard contract terms, customers may be offered refunds for

cancellation of sports and leisure activities. It is considered

highly probable that a significant reversal in the revenue

recognised will not occur given the consistent low level of refunds

in prior years.

2.5. Going concern

The preparation of financial statements requires an assessment

on the validity of the going concern assumption. The Directors have

reviewed projections for a period of at least 12 months from the

date of approval of the financial statements as well as potential

opportunities. Any potential short falls in funding have been

identified and the steps to which Directors are able to mitigate

such scenarios and/or defer or curtail discretionary expenditures

should these be required have been considered.

In approving the financial statements, the Board have recognised

that these circumstances create a level of uncertainty. However,

having made enquiries and considered the uncertainties outlined

above, the Directors have a reasonable expectation that the Group

will continue to be able to raise finance as required over this

period to enable it to continue in operation and existence for the

foreseeable future. Accordingly, the Board believes it is

appropriate to adopt the going concern basis in the preparation of

the financial statements.

2.6. Foreign currencies

(a) Functional and presentation currency

Items included in the Financial Statements of each of the

Group's entities are measured using the currency of the primary

economic environment in which the entity operates (the 'functional

currency'). The functional currency of the UK parent entity and UK

subsidiaries is Pounds Sterling, The Financial Statements are

presented in Pounds Sterling which is the Company's functional and

Group's presentational currency.

(b) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where such items are re-measured. Foreign

exchange gains and losses resulting from the settlement of such

transactions and from the translation at period-end exchange rates

of monetary assets and liabilities denominated in foreign

currencies are recognised in the income statement.

2.7. Intangible assets

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the Group's interest in the fair value of

the identifiable assets and liabilities of subsidiary entities at

the date of acquisition. Goodwill is initially recognised as an

asset at cost and is subsequently measured at cost less any

accumulated impairment losses. Goodwill which is recognised as an

asset is reviewed for impairment at least annually. Any impairment

is recognised immediately in the statement of comprehensive income

and is not subsequently reversed .

For the purpose of impairment testing, goodwill is allocated to

each of the Group's cash generating units expected to benefit from

synergies of the combination. Cash-generating units to which

goodwill has been allocated are tested for impairment annually, or

more frequently when there is an indication that the unit may be

impaired. If the recoverable amount of the cash generating unit is

less than the carrying amount of the unit, the impairment loss is

allocated first to reduce the carrying amount of any goodwill

allocated to the unit then to the other assets of the unit pro-rata

on the basis of the carrying amount of each asset in the unit. An

impairment loss recognised for goodwill is not reversed in a

subsequent period.

On disposal of a subsidiary, associate or jointly controlled

entity, the amount of goodwill is included in the determination of

the profit or loss on disposal.

Goodwill arising on acquisitions before the date of transition

to IFRS's has been retained at the previous UK GAAP amounts subject

to being tested for impairment at that date.

Development costs are expensed in arriving at the operating

profit or loss for the year unless the Directors are satisfied as

to the technical, commercial and financial viability of individual

project. In this situation, the expenditure is recognised as an

asset and is reviewed for impairment on an annual basis.

Amortisation is provided on all development costs to write off the

cost less estimated residual value of each asset over its expected

useful economic life on a straight line basis at the following

annual rates:

Technology assets - 7 years straight line

Customer relationships - 13 years straight line

Databases - 7 years straight line

Any impairment is recognised immediately in the income statement

in administrative expenses and is not subsequently reversed.

2.8. Investments in subsidiaries

Investments in Group undertakings are stated at cost, which is

the fair value of the consideration paid, less any impairment

provision.

2.9. Property, plant and equipment

Property, Plant and equipment is stated at cost less accumulated

depreciation and any accumulated impairment losses. Depreciation is

provided on all property, plant and equipment to write off the cost

less estimated residual value of each asset over its expected

useful economic life on a straight line basis at the following

annual rates:

Office Equipment - 25% and 10% straight line

Plant and Equipment - 25% and 10% straight line

Subsequent costs are included in the asset's carrying amount or

recognised as a separate asset, as appropriate, only when it is

probable that future economic benefits associated with the item

will flow to the Group and the cost of the item can be measured

reliably. The carrying amount of the replaced part is derecognised.

All other repairs and maintenance are charged to the income

statement during the financial period in which they are

incurred.

The assets' residual values and useful lives are reviewed, and

adjusted if appropriate, at the end of each reporting period.

An asset's carrying amount is written down immediately to its

recoverable amount if the asset's carrying amount is greater than

its estimated recoverable amount. If an impairment review is

conducted following an indicator of impairment, assets which are

not able to be assessed for impairment individually are assessed in

combination with other assets within a cash generating unit.

Gains and losses on disposal are determined by comparing the

proceeds with the carrying amount and are recognised within 'Other

(losses)/gains' in the Income Statement.

2.10. Impairment of non-financial assets

Assets that have an indefinite useful life, for example,

intangible assets not ready to use, and goodwill, are not subject

to amortisation and are tested annually for impairment. Property,

plant and equipment is reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount may not

be recoverable. An impairment loss is recognised for the amount by

which the asset's carrying amount exceeds its recoverable amount.

The recoverable amount is the higher of an asset's fair value less

costs to sell and value in use. For the purposes of assessing

impairment, assets are grouped at the lowest levels for which there

are separately identifiable cash flows (cash generating units).

Non-financial assets that suffered impairment are reviewed for

possible reversal of the impairment at each reporting date.

2.11. Financial Instruments

Financial assets and financial liabilities are recognised in the

Group's statement of financial position when the Group becomes a

party to the contractual provisions of the instrument. Financial

assets and financial liabilities are only offset and the net amount

reported in the consolidated statement of financial position and

income statement when there is a currently enforceable legal right

to offset the recognized amounts and the Group intends to settle on

a net basis or realise the asset and liability simultaneously.

Financial assets and financial liabilities are initially

measured at fair value. Transaction costs that are directly

attributable to the acquisition or issue of financial assets and

financial liabilities (other than financial assets and financial

liabilities at fair value through profit or loss) are added to or

deducted from the fair value of the financial assets or financial

liabilities, as appropriate, on initial recognition. Transaction

costs directly attributable to the acquisition of financial assets

or financial liabilities at fair value through profit or loss are

recognised immediately in profit or loss.

Debt instruments are classified as financial assets measured at

fair value through other comprehensive income where the financial

assets are held within the company's business model whose objective

is achieved by both collecting contractual cash flows and selling

financial assets, and the contractual terms of the financial asset

give rise on specified dates to cash flows that are solely payments

of principal and interest on the principal amount outstanding.

A debt instrument measured at fair value through other

comprehensive income is recognised initially at fair value plus

transaction costs directly attributable to the asset. After initial

recognition, each asset is measured at fair value, with changes in

fair value included in other comprehensive income. Accumulated

gains or losses recognised through other comprehensive income are

directly transferred to profit or loss when the debt instrument is

recognised.

Financial assets

All Group's recognised financial assets are measured

subsequently in their entirety at either amortised cost or fair

value, depending on the classification of the financial assets.

Classification of financial assets

Financial assets that meet the following conditions are measured

subsequently at amortised cost using the effective interest rate

method:

-- the financial asset is held within a business model whose

objective is to hold financial assets in order to collect

contractual cash flows; and

-- the contractual terms of the financial asset give rise on

specified dates to cash flows that are solely payments of principal

and interest on the principal amount outstanding

The company classifies the following financial assets at fair

value through profit or loss (FVPL):

-- debt instruments that do not qualify for measurement at

either amortised cost (see above) or FVOCI;

-- equity investments that are held for trading; and

-- equity investments for which the entity has not elected to

recognised fair value gains and losses through OCI.

The Group does not hold any financial assets that meet

conditions for subsequent recognition at fair value

through other comprehensive income ("FVTOCI").

Impairment of financial assets

The Group recognises a financial asset only when the contractual

rights to the cash flows from the asset expire, or when it

transfers the financial asset and substantially all the risks and

rewards of ownership of the asset to another entity. If the Group

neither transfers nor retains substantially all the risks and

rewards of ownership and continues to control the transferred

asset, the Group recognises its retained interest in the asset and

an associated liability for amounts it may have to pay. If the

Group retains substantially all the risks and rewards of ownership

of a transferred financial asset, the Group continues to recognise

the financial asset and also recognises a collateralised borrowing

for the proceeds received.

Financial liabilities

The classification of financial liabilities at initial

recognition depends on the purpose for which the financial

liability was issued and its characteristics. All purchases of

financial liabilities are recorded on trade date, being the date on

which the Group becomes party to the contractual requirements of

the financial liability. Unless otherwise indicated the carrying

amounts of the Group's financial liabilities approximate to their

fair values.

The Group's financial liabilities consist of financial

liabilities measured at amortised cost and financial liabilities at

fair value through profit or loss.

Financial liabilities measured subsequently at amortised

cost

Financial liabilities that are not (i) contingent consideration

of an acquirer in a business combination, (ii) held for trading, or

(iii) designated as at FVTPL, are measured subsequently at

amortised cost using the effective interest method. The Group's

financial liabilities measured at amortised cost comprise

convertible loan notes, trade and other payables, and accruals.

The effective interest method is a method of calculating the

amortised cost of a financial asset/liability and of allocating

interest income/expense over the relevant period. The effective

interest rate is the rate that discounts estimated future cash

receipts/payments through the expected life of the financial

asset/liability or, where appropriate, a shorter period.

Convertible loan notes

On issue of a convertible loan, the fair value of the liability

component is determined by discounting the contractual future cash

flows using a market rate for a non-convertible instrument with

similar terms. This value is carried as a liability on the

amortised cost basis unless is designated as a Fair Value Through

Profit and Loss ("FVTPL") at inception.

Financial instruments designated as FVTPL are classified in this

category irrevocably at inception and are derecognised when

extinguished. They are initially measured at fair value and

transaction costs directly attributable to their acquisition are

recognised immediately in profit or loss. Subsequent changes in

fair values are recognised in the income statement with profit or

loss.

Equity instruments are instruments that evidence a residual

interest in the assets of an entity after deducting all of its

liabilities. Therefore, when the initial carrying amount of a

compound financial instrument is allocated to its equity and

liability components, the equity component is assigned the residual

amount after deducting from the fair value of the instrument as a

whole the amount separately determined for the liability component.

The value of any derivative features (such as a call option)

embedded in the compound financial instrument other than the equity

component (such as an equity conversion option) is included in the

liability component.

Derecognition of financial liabilities

A financial liability (in whole or in part) is recognised when

the Group has extinguished its contractual obligations, it expires

or is cancelled. Any gain or loss on derecognition is taken to the

income statement.

Fair value measurement hierarchy

The Group classifies its financial assets and financial

liabilities measured at fair value using a fair value hierarchy

that reflects the significance of the inputs used in making the

fair value measurement (note 7). The fair value hierarchy has the

following levels:

-- quoted prices (unadjusted) in active markets for identical

assets or liabilities (Level 1);

-- inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived from prices) (level 2); and

-- inputs for the asset or liability that are not based on

observable market data (unobservable inputs) (Level 3).

The level in the fair value hierarchy within the financial asset

or financial liability is determined on the basis of the lowest

level input that is significant to the fair value measurement.

2.12. Leases

The Group leases certain property, plant and equipment.

The lease liability is initially measured at the present value

of the lease payments that are not paid. Lease payments generally

include fixed payments less any lease incentives receivable. The

lease liability is discounted using the interest rate implicit in

the lease or, if that rate cannot be readily determined, the

Group's incremental borrowing rate. The Group estimates the

incremental borrowing rate based on the lease term, collateral

assumptions, and the economic environment in which the lease is

denominated. The lease liability is subsequently measured at

amortized cost using the effective interest method. The lease

liability is remeasured when the expected lease payments change as

a result of new assessments of contractual options and residual

value guarantees.

The right-of-use asset is recognised at the present value of the

liability at the commencement date of the lease less any incentives

received from the lessor. Added to the right-of-use asset are

initial direct costs, payments made before the commencement date,

and estimated restoration costs. The right-of-use asset is

subsequently depreciated on a straight-line basis from the

commencement date to the earlier of the end of the useful life of

the right-of-use asset or the end of the lease term. The

right-of-use asset is periodically reduced by impairment losses, if

any, and adjusted for certain remeasurements of the lease

liability.

Each lease payment is allocated between the liability and

finance charges. The corresponding rental obligations, net of

finance charges, are included in lease liabilities, split between

current and non-current depending on when the liabilities are due.

The interest element of the finance cost is charged to the

Statement of Profit and Loss over the lease period so as to produce

a constant periodic rate of interest on the remaining balance of

the liability for each period. Assets obtained under finance leases

are depreciated over their useful lives. The lease liabilities are

shown in Note 18.

Exemptions are applied for short life leases and low value

assets, with payment made under operating leases charged to the

Consolidated Statement of Comprehensive Income on a straight-line

basis of the period of the lease.

2.13. Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand.

2.14. Equity

Equity comprises the following:

-- "Share capital" represents the nominal value of the Ordinary shares;

-- "Share Premium" represents consideration less nominal value

of issued shares and costs directly attributable to the issue of

new shares;

-- "Other reserves" represents the merger reserve, revaluation

reserve and share option reserve where;

o "Merger reserve" represents the difference between the fair

value of an acquisition and the nominal value of the shares

allotted in a share exchange;

o "Revaluation reserve" represents a non-distributable reserve

arising on the acquisition of Insig Partners Limited;

o "Share option reserve" represents share options awarded by the

group;

-- "Retained earnings" represents retained losses.

2.15. Share capital and share premium

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new shares or options are

shown in equity, as a deduction, net of tax, from the proceeds

provided there is sufficient premium available. Should sufficient

premium not be available placing costs are recognised in the Income

Statement.

2.16. Share based payments

The Group operates a number of equity-settled, share-based

schemes, under which the Group receives services from employees or

third party suppliers as consideration for equity instruments

(options and warrants) of the Group. The fair value of the third

party suppliers' services received in exchange for the grant of the

options is recognised as an expense in the Income Statement or

charged to equity depending on the nature of the service provided.

The value of the employee services received is expensed in the

Income Statement and its value is determined by reference to the

fair value of the options granted:

-- including any market performance conditions;

-- excluding the impact of any service and non-market

performance vesting conditions (for example, profitability or sales

growth targets, or remaining an employee of the entity over a

specified time period); and

-- including the impact of any non-vesting conditions (for

example, the requirement for employees to save).

The fair value of the share options and warrants are determined

using the Black Scholes valuation model.

Non-market vesting conditions are included in assumptions about

the number of options that are expected to vest. The total expense

or charge is recognised over the vesting period, which is the

period over which all of the specified vesting conditions are to be

satisfied. At the end of each reporting period, the entity revises

its estimates of the number of options that are expected to vest

based on the non-market vesting conditions. It recognises the

impact of the revision to original estimates, if any, in the Income

Statement or equity as appropriate, with a corresponding adjustment

to a separate reserve in equity.

When the options are exercised, the Group issues new shares. The

proceeds received, net of any directly attributable transaction

costs, are credited to share capital (nominal value) and share

premium when the options are exercised.

2.17. Taxation

No current tax is yet payable in view of the losses to date.

Deferred tax is recognised for using the liability method in

respect of temporary differences arising from differences between

the carrying amount of assets and liabilities in the consolidated

financial statements and the corresponding tax bases used in the

computation of taxable profit. However, deferred tax liabilities

are not recognised if they arise from the initial recognition of

goodwill; deferred tax is not accounted for if it arises from

initial recognition of an asset or liability in a transaction other

than a business combination that at the time of the transaction

affects neither accounting nor taxable profit or loss.

In principle, deferred tax liabilities are recognised for all

taxable temporary differences and deferred tax assets (including

those arising from investments in subsidiaries), are recognised to

the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be

utilised.

Deferred income tax assets are recognised on deductible

temporary differences arising from investments in subsidiaries only

to the extent that it is probable the temporary difference will

reverse in the future and there is sufficient taxable profit

available against which the temporary difference can be used.

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in except where the Group is

able to control the reversal of the temporary difference and it is

probable that the temporary difference will not reverse in the

foreseeable future.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to offset current tax assets against

current tax liabilities and when the deferred tax assets and

liabilities relate to income taxes levied by the same taxation

authority on either the same taxable entity or different taxable

entities where there is an intention to settle the balances on a

net basis.

Deferred tax is calculated at the tax rates (and laws) that have

been enacted or substantively enacted by the statement of financial

position date and are expected to apply to the period when the

deferred tax asset is realised or the deferred tax liability is

settled.

Deferred tax assets and liabilities are not discounted.

3. Financial risk management

3.1. Financial risk factors

The Group's activities expose it to a variety of financial

risks: market risk, credit risk and liquidity risk. The Group's

overall risk management programme focuses on the unpredictability

of financial markets and seeks to minimise potential adverse

effects on the Group's financial performance. None of these risks

are hedged.

Risk management is carried out by the management team under

policies approved by the Board of Directors.

Market risk

The Group is exposed to market risk, primarily relating to

interest rate and foreign exchange. The Group has not sensitised

the figures for fluctuations in interest rates and foreign exchange

as the Directors are of the opinion that these fluctuations would

not have a significant impact on the Financial Statements at the

present time. The Directors will continue to assess the effect of

movements in market risks on the Group's financial operations and

initiate suitable risk management measures where necessary.

Credit risk

Credit risk arises from cash and cash equivalents as well as

loans to subsidiaries and outstanding receivables. Management does

not expect any losses from non-performance of these receivables.

The amount of exposure to any individual counter party is subject

to a limit, which is assessed by the Board.

The Group considers the credit ratings of banks in which it

holds funds in order to reduce exposure to credit risk.

Impairment provisions for loans to subsidiaries are recognised

based on a forward-looking expected credit loss model. The

methodology used to determine the amount of the provision is based

on whether there has been a significant increase in credit risk

since initial recognition of the financial asset. At year end it

was assessed credit risk was low due to future profits forecast

therefore no provision was required.

For those where the credit risk has not increased significantly

since initial recognition of the financial asset, twelve month

expected credit losses along with gross interest income are

recognised. For those for which credit risk has increased

significantly, lifetime expected credit losses along with the gross

interest income are recognised. For those that are determined to be

credit impaired, lifetime expected credit losses along with

interest income on a net basis are recognised. At year end all

receivables were less than 60 day outstanding and deemed highly

likely to be received therefore no provision was required.

Liquidity risk

In keeping with similar sized groups, the Group's continued

future operations depend on the ability to raise sufficient working

capital through the issue of equity share capital or debt. The

Directors are reasonably confident that adequate funding will be

forthcoming with which to finance operations. Controls over

expenditure are carefully managed.

With exception to deferred taxation, financial liabilities are

all due within one year.

3.2. Capital risk management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern, to enable the

Group to continue its activities, and to maintain an optimal

capital structure to reduce the cost of capital. In order to

maintain or adjust the capital structure, the Group may adjust the

issue of shares or sell assets to reduce debts.

The Group defines capital based on the total equity of the

Company. The Group monitors its level of cash resources available

against future activities and may issue new shares in order to

raise further funds from time to time.

4. Critical accounting estimates and judgements

The preparation of the Financial Statements in conformity with

IFRS requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amount of expenses during the

period.

Estimates and judgements are regularly evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

Items subject to such estimates and assumptions, that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial years,

include but are not limited to:

Impairment of goodwill

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash generating units to which the

goodwill has been allocated. The value in use calculation requires

the entity to estimate the future cash flows expected to arise from

the cash generating unit and a suitable discount rate in order to

calculate present value. The carrying amount of goodwill is the

deemed cost on first time application of IFRS.

Details of the carrying value of goodwill at the period end and

the impairment review assessment are given in Note 13.

Identification of intangible assets

The Company follows the guidance of IAS 36 to determine when

impairment indicators exist for its intangible assets. When

impairment indicators exist, the Company is required to make a

formal estimate of the recoverable amount of its intangible

assets.This determination requires significant judgement. In making

this judgement, management evaluates external and internal factors,

such as significant adverse changes in the technological market,

economic or legal environment in which the Company operates as well

as the results of its ongoing development programs. Management also

considers the carrying amount of the Company's net assets in

relation to its market capitalisation as a key indicator.

Share based payment transactions

The Company has granted options to acquire its shares to a

Director. On valuing the fair value of the share options granted

and hence the cost charged to profit or loss, judgements are

required regarding key assumptions applied.

The valuation of these options and warrants involves making a

number of critical estimates relating to price volatility, future

dividend yields, expected life of the options and forfeiture rates.

These assumptions have been described in more detail in Note

22.

Deferred tax asset

At the present time the Directors' do not consider that there is

sufficient certainty regarding the utilisation of tax losses

available in the Group. As a result, no deferred tax asset has been

recognised.

Intangibles

The allocation of the value of the excess consideration less the

net assets acquired are identified as intangible assets arising as

part of a business combination; these require judgement in respect

of the separately identifiable intangible assets that have been

acquired. These judgements are based upon the directors' opinion of

the identifiable assets from which economic benefits are

derived.

5. Segment information

Business segments are identified according to the different

trading activities in the Group.

During the year, the Group's trading segments were machine

learning and data services representing revenue of GBP374,000 and

its sports and leisure activities, comprising sports tuition at

schools representing its revenue of GBP1,334,000 (15 months to 31

March 2021: GBP1,043,000). All revenue was generated in the UK. The

prior period had one segment which was sports and leisure

activities, therefore no comparative has been provided.

Machine learning Sport in

and Data services Schools Total

31 March 2022 GBP GBP GBP

--------------------------------- -------------------- ----------- -------------

Revenue 374,000 1,334,000 1,708,000

Cost of sales (14,000) (705,000) (719,000)

Administrative expenses (4,697,000) (559,000) (5,256,000)

Other gains/(losses) 7,000 - 7,000

Other income 10,000 109,000 119,000

Finance income 4,000 - 4,000

Finance costs (11,000) (3,000) (14,000)

Exceptional items 908,000 - 908,000

---------------------------------- -------------------- ----------- -------------

Profit/(Loss) before tax

per reportable segment (3,419,000) 176,000 (3,243,000)

---------------------------------- -------------------- ----------- -------------

Additions to intangible

asset 38,217,000 - 38,217,000

---------------------------------- -------------------- ----------- -------------

Reportable segment assets 38,633,000 450,000 39,083,000

---------------------------------- -------------------- ----------- -------------

Reportable segment liabilities 4,780,000 226,000 5,006,000

---------------------------------- -------------------- ----------- -------------

6. Administrative expenses

15 months

Year ended ended

31 March 31 March

2022 2021

GBP GBP

---------------------------------- ------------ -----------

Employee salaries and costs 1,149,000 559,000

Director remuneration 430,000 477,000

Office and expenses 77,000 32,000

Travel & subsistence 30,000 5,000

Professional & consultancy fees 927,000 335,000

IT & Software 71,000 15,000

Subscriptions 175,000 17,000

Insurance 85,000 29,000

Depreciation and amortisation 2,239,000 20,000

Share option expense 17,000 24,000

Other expenses 56,000 35,000

---------------------------------- ------------ -----------

Total administrative expenses 5,256,000 1,548,000