Disposal

May 03 2002 - 2:08AM

UK Regulatory

RNS Number:4705V

Blacks Leisure Group PLC

3 May 2002

Embargoed until 0700 Friday 3 May 2002

Blacks Leisure Group plc

Proposed disposal of Blacks Sport & Fashion Division

Highlights

• Proposed disposal of Blacks Sport & Fashion Division to John David

Sports plc ("J D Sports") for £53.2 million in cash

- First Sport, AV and Pure Woman fascias, together 209 stores

• Blacks Sport & Fashion Division continues to experience difficult

trading conditions - results for the division for the year to 28 February 2002

to be below market expectations

• Proposed disposal provides Blacks with an exit from an increasingly

competitive sports retail market and concentrates resources on growing outdoor

and boardwear markets

• Disposal proceeds to be used to reduce gearing and strengthen the

Group's balance sheet

• Transaction repositions Group to focus on its market leading positions

in outdoor retail (Millets and Blacks Outdoor) and boardwear (O'Neill and Free

Spirit)

• Board to be realigned to reflect the new focus of the Group

- Simon Bentley to step down as Chief Executive

- Roy Crosland, currently Managing Director of the Outdoor Division, to

become Chief Executive

• Current trading in continuing operations in line with management's

expectations

- Like-for-like sales in the eight weeks since the year end

significantly ahead of the equivalent prior year period

- Outdoor retail market continues to recover from impact of foot and

mouth epidemic

- O'Neill order book significantly ahead of the same period last year

• Group to report preliminary results for the year to 28 February 2002 on

22 May 2002

David Bernstein, Chairman of Blacks, commented: "The Group's Sport & Fashion

Division has continued to report difficult trading conditions as competitive

pressures in its marketplace have intensified. The proposed disposal to J D

Sports will enable Blacks to exit from the sports retail market and concentrate

its resources and management effort on its market leading positions in outdoor

and boardwear. Trading in the continuing group in the current year has been

encouraging with our outdoor and boardwear businesses continuing to recover from

the effect of last year's foot and mouth epidemic and O'Neill and Free Spirit

growing strongly. Following the transaction the Group will have strong

positions in two growth markets, a significantly stronger balance sheet and

continued growth prospects."

Enquiries:

Blacks Leisure Group plc (03/05/02) 020 7950 2883

Roy Crosland (Thereafter) 01604 441 111

HSBC Investment Bank plc 020 7336 9000

Julian Gray

Weber Shandwick Square Mile 020 7950 2883

Josh Royston

This summary should be read in conjunction with the full text of this

announcement.

Introduction

The Board of Blacks Leisure Group plc ("Blacks" or "the Company") announces

today that it has reached agreement on the sale of the companies comprising its

Sport & Fashion Division ("Blacks Sport & Fashion Division") to John David

Sports plc ("J D Sports"), through its wholly owned subsidiary Athleisure

Limited, for £53.2 million to be satisfied in cash (the "Proposed Disposal").

Under the terms of the Agreement relating to the Proposed Disposal, Blacks will

receive a total sum of £53.2 million, representing £11.0 million in respect of

the entire issued share capitals of the relevant companies that comprise Blacks

Sport & Fashion Division and the repayment of inter-group debt of £42.2 million

owed by Blacks Sport & Fashion Division to the continuing operations of Blacks

Leisure Group following completion of the proposed disposal (the "Continuing

Group"). The £11.0 million is subject to an uncapped upward or downward revision

on a pound for pound basis to the extent that the net asset value of Blacks

Sport & Fashion Division (excluding amounts owed by Blacks Sport & Fashion

Division to the Blacks) as at 30 April 2002, which will ultimately be agreed

between the Company and Athleisure Limited, differs from £48.2 million, being

the current expected value. No adjustment will be made either upwards or

downwards unless the amount of such adjustment is greater than £250,000.

Background to and reasons for the Proposed Disposal

In December 1999, Blacks acquired The Outdoor Group Limited, combining it with

the existing Blacks outdoor business to create the UK market leader, in terms of

turnover, in outdoor retail. Since this acquisition the Group has further

developed this business through a combination of store openings, refurbishment

and some closures, resulting in a net increase of 32 stores in the period from

that date to February 2002. This organic expansion has been complemented

recently by the acquisition of 47 outlets from the administrative receivers of

Famous Army Stores Limited. Following these acquisitions, the Blacks outdoor

division now trades from 338 stores, under the Millets, Blacks, Free Spirit and

Famous Army Stores fascias (the "Outdoor Division"). It is intended that the

acquired stores will be converted to the Millets and Blacks fascias over the

next few weeks.

In view of the increasingly competitive nature of the sport and fashion retail

market, which has impacted upon the recent trading performance of Blacks Sport &

Fashion Division, the Directors believe it appropriate to refocus the Group,

concentrating its resources in markets in which it has leading positions. The

Directors believe that the Proposed Disposal will have the following benefits

for the Company and its Shareholders:

• it will enable the Continuing Group to focus its strategy and resources

upon its market leading position in outdoor sportswear & equipment, together

with its rapidly growing O'Neill and Free Spirit businesses in boardwear;

• the Group is withdrawing from a highly competitive market with

significant margin pressure;

• the cash proceeds from the Proposed Disposal will enable the Group to

reduce significantly its gearing levels which the Board believed were too high

in view of the poor recent performance of Blacks Sport & Fashion Division; and

• the significant reduction in debt levels will provide the Continuing

Group with the financial strength to take advantage of future opportunities

within its chosen markets.

Following the Proposed Disposal, the Continuing Group will be represented in two

growing markets, outdoor sportswear and equipment, through its Millets and

Blacks fascias, and boardwear, through its Free Spirit fascia and O'Neill.

Outdoor Sportswear and Equipment

A recent Mintel report identifies the retail market for outdoor sportswear to be

worth some £855 million in 2001, or 28 per cent. of the total UK sportswear

market. Moreover, the report suggests that this market will grow by 6.6 per

cent. in 2002 and will continue to show strong growth thereafter. The Directors

estimate that the outdoor equipment market is currently worth an additional £220

million giving a total outdoor sportswear and equipment market of approximately

£1.075 billion. Mintel identifies a number of key factors which will drive

growth in the outdoor sportswear market, namely:

• increasing participation in outdoor sports activities such as walking,

hiking and cycling by the population generally;

• an increase in the number of young adults (comprising 15-24 year-olds),

with a corresponding increase in participation in outdoor sports activities such

as climbing and hiking;

• a significant increase in the number of 55-64 year-olds, traditionally

the most important group to the outdoor market as they are particularly keen

walkers and enjoy visiting the countryside;

• continued growth in the activity holiday and adventure holiday markets;

• growing awareness of the health benefits of outdoor activities;

• a growing desire to "escape" from an urban, office environment into the

"great outdoors"; and

• a continuation of the trend towards outdoor sportswear being worn as

everyday casual wear.

The Outdoor Division is the market leader in terms of turnover in this important

market, with sales (excluding those at Free Spirit) of around £125 million in

the year to 28 February 2002 from over 250 Millets and Blacks stores. The Blacks

fascia is positioned at the premium specialist end of the market, with Millets

occupying the mid-market. The integration of the 47 outlets recently acquired

from the administrative receivers of Famous Army Stores is expected to provide

further growth in the year ended 28 February 2003 and thereafter. This market

remains highly fragmented, however, and with an estimated current market share

of around 15 per cent. (once the Famous Army Stores outlets are included), the

Directors believe there are significant opportunities for continued growth.

Boardwear

A recent report on the UK boardwear market by Sovereign Market Research

estimates it to be worth £383 million and to have grown by some 16 per cent.

during 2001.

The Group's Free Spirit fascia, which is the leader in this market in terms of

turnover, is growing rapidly, and achieved sales of some £26 million in 30

stores in the year to 28 February 2002.

O'Neill, for which the Group holds the UK distribution rights, is one of the

leading brands in the boardwear market worldwide as well as in the UK. The

O'Neill business is also growing rapidly. The last financial year saw the

opening of a store in Carnaby Street, London as well as a further three stores

in Birmingham, Leeds and Bromley bringing the total number of owned stores to

eight. Also in the last financial year the number of O'Neill branded areas

within other retailers' stores has been increased from 20 to 32. In total,

O'Neill sales in the last financial year increased by 42 per cent. to £23

million.

Overall, the Group has a commanding position in this exciting and fast growing

market which the Directors believe provides a sound base for continued future

growth.

Information on Blacks Sport & Fashion

Blacks Sport & Fashion Division comprises the First Sport, AV and Pure Woman

formats. First Sport is a high street sports retailer with 183 stores located

throughout the UK. First Sport offers a range of exclusive sports apparel,

footwear, accessories and equipment. AV is a chain of 24 menswear stores selling

footwear and clothing from lifestyle brands. Pure Woman operates from 2 stores

and offers a mix of both sportswear and more lifestyle orientated casual wear.

A summary of the trading results of Blacks Sport & Fashion Division for the two

years ended 28 February 2001 and 2002 is set out below.

Year ended February 2001 2002

(£000) (£000)

Turnover 176,972 190,919

Operating profit 7,083 5,028

Profit on ordinary activities before tax 6,200 4,054

At 28 February 2002, Blacks Sport & Fashion Division had net assets of £32.7

million.

Information on J D Sports

J D Sports is one of the UK's leading specialist retailers of fashionable

branded sports and leisure wear. Operating through the J D Sports retail chain,

it is solely focused on the sports fashion market with over 155 stores at the

end of September 2001, and is a competitor of Blacks Sport & Fashion Division.

In the year ended 31 March 2001 it had sales of £204 million and as at 30

September 2001 it had net assets of £51.2 million. As at close of business on 1

May 2002, J D Sports had a market capitalisation of approximately £133 million.

Use of the Proceeds and Financial Effects of Proposed Disposal

The proceeds, net of costs, of the Proposed Disposal are estimated at £51.7

million and will be used to repay in full the Group's term loan which amounted

to approximately £24 million at 28 February 2002. The remaining proceeds will be

retained in order to fund ongoing working capital requirements and the continued

development of the outdoor sportswear & equipment and boardwear businesses in

line with the Continuing Group's strategy as set out above. In addition, the

Continuing Group has the benefit of a £23 million revolving credit facility

together with standby overdraft facilities to cater for working capital

fluctuations within the Continuing Group to the extent not covered by the

retained disposal proceeds. There is currently no intention of returning

proceeds from the Proposed Disposal to shareholders.

Management

In view of the Proposed Disposal of Blacks Sport & Fashion Division, the

Directors have determined that the Board of Blacks should be restructured to

reflect the new focus of the Continuing Group. Accordingly, Simon Bentley has

decided, with effect from the later of completion of the Proposed Disposal and 4

June 2002 to step down as Chief Executive of the Company. At that time Roy

Crosland, currently Managing Director of the Outdoor Division, will become Chief

Executive.

In addition, it is intended that the Board will be strengthened through the

appointments as main Board directors of Darren Spurling, currently Managing

Director of O'Neill, and Terry Maywood, currently Operations Director of the

Outdoor Division.

Tom Knight, currently Managing Director of the Sport and Fashion Division will

be leaving the Group as part of the Proposed Disposal.

Current Trading and Prospects

The Directors expect Group profit before tax for the year ended 28 February 2002

will be below current market expectations but not to a significant extent. The

Group will provide further information in its full year results which are

expected to be announced on 22 May 2002.

In its trading statement of 16 January 2002 the Group reported that Blacks Sport

& Fashion Division was experiencing an adverse trend in gross margin. This trend

continued in the remaining period of the year ended 28 February 2002 and as a

result, Blacks Sport & Fashion Division's operating profit of £5 million for the

year was significantly below that of the previous year and of market

expectations. Trading continues to be difficult in that division, with like for

like sales and margins in the eight weeks since the year end below the levels

seen in the corresponding period last year.

The disappointing performance in Blacks Sport & Fashion Division was partially

offset by a stronger performance in the Continuing Group. With regard to the

Outdoor Division, turnover for the year ended 28 February 2002 was ahead of the

previous year, with like-for-like sales increasing by 5.8 per cent. Gross

margins, which had fallen in the first half as a result of the foot and mouth

epidemic, have recovered in the final six months to finish the year slightly

below last year's level. O'Neill continued its strong growth with turnover for

the year ended 28 February 2002 substantially ahead of the previous year.

Although the current financial year is at an early stage, trading to date for

the Continuing Group has been in line with management's expectations.

Like-for-like sales for the Continuing Group in the eight weeks since the year

end were significantly ahead of the equivalent prior year period. The Outdoor

Division has continued to benefit from the recovery in the rural economy

following last year's foot and mouth epidemic and outdoor clothing and equipment

sales have now returned to a more normal pattern. O'Neill's forward order book

is significantly ahead of the same period last year. The Board is encouraged by

trading in the year to date and believes the prospects for the Continuing Group

for the current financial year are promising. Furthermore, the Board believes

that the benefits of improved financial and management focus following the

Proposed Disposal will further enhance the Continuing Group's prospects.

A further update on current trading will be provided in the announcement of the

Group's preliminary results for the year ended 28 February 2002.

Extraordinary General Meeting

Due to its size, the Proposed Disposal is conditional, inter alia, upon

obtaining the approval of Blacks Shareholders at an Extraordinary General

Meeting. A circular and notice of Extraordinary General Meeting will be sent to

Blacks' shareholders shortly.

This information is provided by RNS

The company news service from the London Stock Exchange

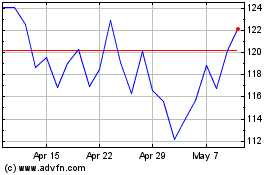

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

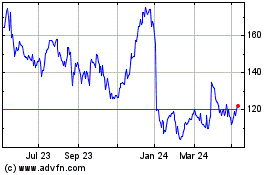

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024