K&C REIT PLC Disposal of 49 Cheap Street, Newbury (5800Z)

May 27 2016 - 9:00AM

UK Regulatory

TIDMKCR

RNS Number : 5800Z

K&C REIT PLC

27 May 2016

27 May 2016

K&C REIT plc

("K&C" or the "Company")

Disposal of 49 Cheap Street, Newbury, Berkshire

K&C REIT plc, the residential real estate investment trust

("REIT") group, is pleased to announce that its subsidiary,

Kensington & Chelsea REIT Limited ("K&C Ltd"), exchanged

contracts yesterday evening for the sale of 49 Cheap Street, the

last of the group's three 'non-core' properties, for a gross cash

consideration of GBP210,000. The sale is expected to complete by 24

June 2016.

49 Cheap Street is a retail premises with a first-floor flat

above that was acquired in March 2014 for GBP215,000. The property

is being sold with vacant possession and is therefore not currently

generating any rental income.

K&C Ltd acquired three properties in Berkshire, including 49

Cheap Street, to make up the initial portfolio prior to admission

of the Company's ordinary shares to trading on AIM on 3 July 2015.

As stated in the Company's Admission Document, these properties

were not intended to form a material part of the Company's ongoing

property portfolio and the directors are pleased to confirm that

the disposal of 49 Cheap Street completes the planned disposal of

these original properties. The three 'non-core' properties were in

total sold for approximately GBP55,000 more than the aggregate

purchase price, generating a profit of approximately GBP43,000.

The net proceeds of the disposal of 49 Cheap Street will be

available for general corporate purposes.

Contacts:

K&C REIT info@kandc-reit.co.uk

Tim James, Managing Director +44 (0) 7768 833

029

www.kandc-reit.co.uk

Stockdale Securities

Robert Finlay/Rose Ramsden +44 (0) 20 7601 6115

Yellow Jersey PR

Philip Ranger/Harriet Jackson +44 (0) 7768 534 641

Notes to Editors:

K&C's objective is to build a substantial residential

property portfolio that generates secure income flow for

shareholders through the acquisition of SPVs (Special Purpose

Vehicles) with inherent historical capital gains. The Directors

intend that the group will acquire, develop and manage residential

property assets in Central London and other key residential areas

in the UK.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISPGURAAUPQGWM

(END) Dow Jones Newswires

May 27, 2016 10:00 ET (14:00 GMT)

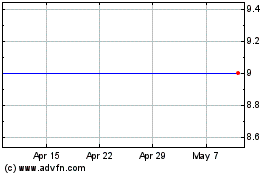

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Apr 2024 to May 2024

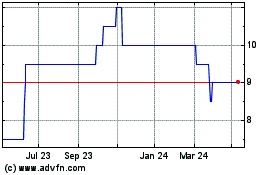

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From May 2023 to May 2024