KCR Residential REIT PLC Acquisition of Karlind Management Services Ltd (1567T)

July 02 2018 - 1:00AM

UK Regulatory

TIDMKCR

RNS Number : 1567T

KCR Residential REIT PLC

02 July 2018

2 July 2018

KCR Residential REIT Plc

("KCR" or "the Company")

Completed acquisition of Karlind Management Services Limited

("Karlind")

Further to the announcement on 3 April 2018, KCR Residential

REIT ("KCR") is pleased to announce that it has completed the

acquisition of the entire issued share capital of Karlind, a

company that owns 16 studio, one-and-two bedroom apartments in

Ladbroke Grove, Kensington and one leasehold two-bedroom apartment

in Harrow, for a total consideration of GBP5.35 million. KCR will

satisfy the consideration through its banking facilities and cash

reserves.

KCR intends to deploy its proven active management skills to

increase property values and rental yield through internal

refurbishment and by obtaining planning consent for roof and rear

extensions to the Kensington properties.

The apartments, which are fully let, are situated in desirable

locations for tenants given the close proximity to transport links

and local retail and leisure amenities. The portfolio has a total

rental income of over GBP0.25 million, and delivers a gross annual

yield on consideration of 4.8 per cent. The average unit value of

the acquired properties is GBP314,700 and the average monthly rent

is approximately GBP1,250 (GBP32 per sq. ft. per annum).

Dominic White, the chief executive of KCR, commented:

"This important acquisition fits perfectly within KCR's

acquisition and growth strategy and will significantly increase the

Company's net asset value per share. We are confident that we can

further grow property value and rental yields through active

management and our planned refurbishments."

Contacts:

KCR Residential REIT plc info@kcrreit.com

Dominic White, Chief executive +44 20 3793 5236

www.kcrreit.com

Arden Partners plc

Steve Douglas

Benjamin Cryer +44 20 7614 5917

Yellow Jersey PR

Charles Goodwin +44 7747 788 221

Abena Affum +44 7555 159 808

Notes to Editors:

KCR's objective is to build a substantial residential property

portfolio that generates secure income flow for shareholders

through the acquisition of SPVs (Special Purpose Vehicles) with

inherent historical capital gains. The Directors intend that the

group will acquire, develop and manage residential property assets

in residential areas in the UK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQEAPKNASNPEFF

(END) Dow Jones Newswires

July 02, 2018 02:00 ET (06:00 GMT)

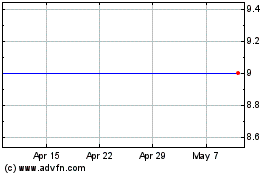

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Apr 2024 to May 2024

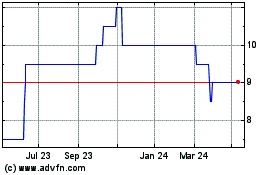

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From May 2023 to May 2024