KCR Residential REIT PLC Result of GM, Issue of Equity and Board changes (0808H)

July 29 2019 - 8:42AM

UK Regulatory

TIDMKCR

RNS Number : 0808H

KCR Residential REIT PLC

29 July 2019

29 July 2019

KCR Residential REIT plc

("KCR" or the "Company")

Result of General Meeting, Issue of Equity and Board changes

KCR Residential REIT plc (AIM: KCR), the residential real estate

investment trust group, is pleased to make the following

announcement.

GM Result

At the Company's General Meeting held earlier today, all

resolutions put to the meeting were duly passed. Voting was on a

poll and the number of votes for each of the resolutions was

11,405,369 (representing approximately 99.99% of the votes cast)

and the number of votes against each resolution was 1,000

(representing approximately 0.01% of the votes cast). The total

number of votes cast was 11,406,369 (representing 72.2 % of the

total voting rights in the Company).

Issue of Equity & Option

Following the Company's announcement on 12 July 2019, the

Company will issue and allot 9,000,000 New Ordinary Shares to

Torchlight pursuant to the Proposals, conditional on Admission, and

grant an option to Torchlight to subscribe for a further 50,000,000

New Ordinary Shares during the Option Period.

Application for admission for the Torchlight Subscription

Shares, the Redesignation Shares, the Conversion Shares, the

Ladbroke Grove Shares and the Thornton Shares, as set out in the 12

July 2019 announcement, has been made and Admission is expected to

take place on 6 August 2019.

RCL & Strategic Partnership Agreement

The Company has also entered into a Strategic Agreement with

Torchlight's investee, RCL, a residential land developer in

Australia and New Zealand. The intention of the Company and RCL is

that RCL will diligently progress the preparatory design and

planning work necessary for the development of relevant properties

so as to be available for purchase by the Company for rental

purposes.

Board of Directors

Pursuant to the provisions of the Relationship Agreement, on

completion of the Proposals, expected on 6 August 2019, Russell

Naylor will join the Board at the request of Torchlight as an

executive director and Richard Boon and James Thornton will both

join as non-executive directors. Further details of each proposed

director's experience can be found in the 12 July announcement and

the details required Schedule 2(g) of the AIM Rules will be

notified in due course.

Timothy James, James Cane and Oliver Vaughan will resign from

the board at completion of the Proposals. KCR would like to thank

them for their service to the Company since its inception. Timothy

James will remain an employee of the Company.

Ongoing Strategy

The Proposals are expected to provide the Company with access to

capital, international property development expertise and

refinancing options which will accelerate the Company's objective

of providing capital growth and dividend streams to investors

through the acquisition of PRS assets not only in the United

Kingdom but also in new residential markets, including Australia,

New Zealand and Germany.

The Company would ultimately like to achieve a diversified

portfolio in these countries with the aim of an approximate

apportionment of one third of such portfolio in each jurisdiction

(with Australia and New Zealand treated as one jurisdiction).

During the period that the portfolio is being established, there

may be significant temporary variances between such jurisdictions

depending on where the investment opportunities arise.

Interest in shares

Two shareholders (holding a total of 3,942,857 shares in the

Company) gave Michael Davies, the chairman of the Company,

discretion as to how to vote at the General Meeting. The giving of

such discretion to Mr Davies increased his interest (for the

purposes of the Disclosure Guidance and Transparency Rules) in

shares in the Company from 195,428 shares (representing

approximately 1.2% of the issued share capital before the issue (on

Admission) of any New Ordinary Shares) to 4,138,285 shares

(representing approximately 26.2% of the issued share capital

before the issue (on Admission) of any New Ordinary Shares).

Following the exercise by Mr Davies of such discretion (by

completing his poll card), his interest in shares in the Company

has reverted to 195,428 shares (representing approximately 1.2% of

the issued share capital before the issue (on Admission) of any New

Ordinary Shares).

Definitions used in this announcement are the same as set out in

the Circular to shareholders and RNS dated 12 July 2019.

Dominic White, CEO of KCR Residential REIT said: "This

investment by Torchlight is a significant development for KCR and

will enable the business to continue its strategy of acquiring

private rented sector assets not only in the United Kingdom but

internationally, making KCR one of the few UK quoted

multi-jurisdiction private rented sector REITs. Our aim is that

acquisitions made through the strategic partnership with RCL, and

through other strategic partners, will enable us to grow the

portfolio size and rental income stream in the short to medium

term."

Contacts:

KCR Residential REIT plc info@kcrreit.com

Dominic White, Chief Executive +44 20 3793 5236

Arden Partners plc

Tom Price

Aimee Kerslake (Sales) +44 20 7614 5900

Notes to Editors:

KCR's objective is to build a substantial residential property

portfolio that generates secure income flow for shareholders. The

Directors intend that the group will acquire, develop and manage

residential property assets in a number of jurisdictions including

the UK, Australia, New Zealand and Germany.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFMGZNFLLGLZM

(END) Dow Jones Newswires

July 29, 2019 09:42 ET (13:42 GMT)

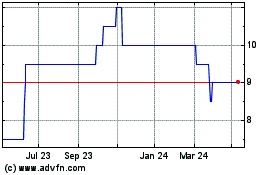

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Mar 2024 to Mar 2025