TIDMKCR

RNS Number : 7961H

KCR Residential REIT PLC

27 March 2020

27 March 2020

KCR Residential REIT plc

("KCR" or the "Company")

Interim Results

KCR Residential REIT plc, the residential REIT group, is pleased

to announce its interim results for the six months to 31 December

2019.

Operational Highlights

-- Revenue for the six months increased to GBP427,057 (2018:

GBP269,113) and gross margin improved to 76% (2018: 45%).

-- Portfolio level occupancy is high, rental values have

increased and capital values remain firm.

-- KCR recurring administrative expenses for the period fell to

GBP706,177 (2018: GBP800,583) with further reductions to come.

-- Current liabilities at 31 December 2019 were down to

GBP930,062 (2018: GBP7,904,125) and total liabilities were lower at

GBP10,404,715 (2018: GBP14,710,415).

-- Incentive preference shares have been cancelled and negative

share based payment charges will no longer appear in the profit and

loss account.

-- The GBP7.9m refinancing of property in February 2020

delivered GBP2.9m of free cash to the Company, significantly

strengthening KCR's liquidity position.

-- We expect the ongoing uncertainty in the market to lead to more acquisition opportunities.

Contacts:

KCR Residential REIT plc info@kcrreit.com

Dominic White, Chief Executive +44 20 3793 5236

Arden Partners plc

Richard Johnson

Benjamin Cryer +44 20 7614 5900

Notes to Editors:

KCR's objective is to build a substantial residential property

portfolio that generates secure income flow for shareholders. The

Directors intend that the group will acquire, develop and manage

residential property assets in a number of jurisdictions including

the UK.

CHAIRMAN'S STATEMENT

FOR THE SIX MONTHSED 31 DECEMBER 2019

KCR Residential REIT plc ("KCR" or the "Company") and its

subsidiaries (together the "Group") operate in the private rented

residential investment market. The Company acquires whole blocks of

studio, one- and two-bed apartments that are rented to private

tenants. The Company currently focuses on the UK residential

sector.

Since the year end report to 30 June 2019, the UK has had an

election result (12 December 2019) that hands a clear majority to

the Conservative Party, and the first stage of the UK's exit from

the European Union has been implemented (31 January 2020). This has

removed some of the uncertainty that held back consumer and

business confidence in recent years which has translated into, we

believe, a firming up of house prices but not the "bounce" that the

press has reported.

Although the election and the first phase of Brexit are behind

us, there remains significant uncertainty.

- The reality of the next phase of Brexit is that it will be

complicated to agree the detail of a trade deal with Europe by 31

December 2020 without which the UK will fall back onto World Trade

Organisation (WTO) rules.

- The Coronavirus has had a global negative impact on demand,

supply chains, stock markets and consumer and business confidence.

Whilst the full impact is yet to be seen it is expected that travel

restrictions and reduced leisure travel in the near term will have

a negative impact on demand for short let accommodation in the

United Kingdom. This has potential to negatively impact the

occupancy profile and rentals that can be achieved in KCR's

portfolio if stock that is currently used predominantly for short

let leisure travel is repositioned for longer term lease. Further

information can be found in note 11 of these interim financial

statements.

- On 11 March 2020 in the UK's Budget further changes were made

to UK stamp duty (a 2% surcharge on foreign buyers) which is

expected to negatively affect demand in the medium to high value

residential property price range.

The UK residential rented property market, however, remains

fundamentally under-supplied. KCR continues to target a specific

segment of rented residential property that is in high demand and

relatively short supply. The Company acquires blocks of flats for

rent aimed at early-stage professionals and continues to experience

positive rental growth and high occupancy rates across the

portfolio.

CHIEF EXECUTIVE'S REPORT

FOR THE SIX MONTHSED 31 DECEMBER 2019

We are pleased to report on the progress of the Group in the

six-month period since 30 June 2019.

Property portfolio

KCR achieved its objective of increasing rental revenue across

the portfolio. Revenue for the six months increased to GBP427,057

(2018: GBP269,113) and gross margin improved to 76% (2018:

45%).

At the time of writing, portfolio level occupancy is high,

rental values have increased and capital values remain firm.

- The Company's investment in 27 units at Deanery Court,

Southampton is fully occupied. The wider Chapel Riverside

development upon which Deanery Court is located is proceeding well

which we expect to enhance the value of the property over time as

cafes and retailers move-in alongside the new residents.

- The Ladbroke Grove portfolio of 17 units is fully let apart

from one unit which is being refurbished. This will be complete in

the next two weeks.

- The block of ten apartments at Coleherne Road has three units

undergoing a light refurbishment that will be complete during

March.

- The Heathside property with 37 flats in Golders Green, London

has four new lettings on assured shorthold tenancies (AST) in place

alongside the 31 historic long leases. Two flats remain available

to let on ASTs.

KCR is analysing the opportunity to provide all-inclusive rental

contracts that include utilities and furniture, that can be let for

periods of 1 week to 12 months plus. This walk-in-walk-out (WIWO)

strategy is designed to be frictionless for tenants, making the

move-in move-out process simple and quick. We believe there is

demand for this type of residential offering in London and that a

premium rental can be achieved for delivering this service. We will

trial the WIWO strategy at the 10 units in Coleherne Road in the

coming months following a full refurbishment at the property.

Should the WIWO strategy be successful, the Company will implement

it progressively in its other London assets.

Financial

For the six months to 31 December 2019:

- Revenue increased to GBP427,057 (GBP269,113 at 31 December 2018) an increase of 58.7 per cent.

- Consolidated operating loss before separately disclosed

administrative items was GBP382,183 (GBP24,736 profit at 31

December 2018)

At 31 December 2019:

- KCR's investment properties were valued at GBP23.4 million

(GBP23.9 million at 30 June 2019) a decrease in portfolio value of

GBP0.5 million due to a disposal of a single flat at Heathside,

Golders Green.

- The Group's net asset value per share was 47.84p (60.67p at 30

June 2019) following the issue of new shares as part of the

Torchlight Fund LP transaction (See RNS 12 July 2019).

Corporate activity

The corporate transaction with Torchlight Fund LP was reported

in detail in the Circular (12 July 2019) and outlined in the year

end accounts to 30 June 2019 post balance sheet events.

Since the release of the Annual Report, on 12 February 2020 KCR

successfully completed a GBP7.9m refinancing of its Coleherne Road,

Ladbroke Grove and Lomond Court, London assets. The refinancing,

which has a 25-year term and a five year fixed rate, is interest

only and is secured on the refinanced assets. The interest rate on

loans relating to these properties moved from 3.75% p.a. to 3.5%

p.a. This transaction delivered GBP2.9m of free capital to KCR post

repayment of the existing bank facility.

Post completion of this KCR maintains a strong liquidity profile

and is well placed to complete upgrades to the existing portfolio

and pursue acquisitions to grow the portfolio.

Outlook

Given the ongoing resilience of the UK rented residential

property sector, the potential equity available through its

shareholder Torchlight Fund, and capital delivered through the

refinancing of its London portfolio, the Board remains positive

about investing in new opportunities to grow its portfolio and

resulting revenue stream.

Our near term focus is on improving rental income from existing

assets through the WIWO letting strategy, refurbishment to improve

building quality and the optimisation of property management to

reduce direct costs. We are also implementing a strategy to reduce

corporate overheads.

KCR continues to source and analyse potential acquisitions that

fit its portfolio strategy. The Company is also initiating a full

refurbishment at its Coleherne Road, London property which it

expects to complete in early 2021.

The Board looks forward to updating shareholders on these

activities in due course

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 DECEMBER 2019 (unaudited)

Six months

ended 31

December

2018

Six months

ended 31 Year ended

December 30 June 2019

2019 (as restated*) (audited)

Notes GBP GBP GBP

Revenue 427,057 269,113 777,827

Cost of sales (103,063) (148,794) (212,743)

------------ ---------------- --------------

Gross profit 323,994 120,319 565,084

Administrative expenses (706,177) (800,583) (1,446,565)

Fair value through profit and

loss - Revaluation of investment

properties 6 - 705,000 3,268

------------ ---------------- --------------

Operating (loss)/profit before

separately disclosed items (382,183) 24,736 (878,213)

Share-based payment charge 8 (1,599,678) (1,180,918) (1,387,441)

Costs associated with third-party

fundraising and issue of shares

Loss on disposal of property

SPV 3 (300,835) (167,817) (407,616)

- (325,002) (340,753)

------------ ---------------- --------------

Operating loss (2,282,696) (1,649,001) (3,014,023)

Finance costs (229,527) (263,853) (732,984)

Finance income 1,541 9,590 9,635

------------ ---------------- --------------

Loss before taxation (2,510,682) (1,903,264) (3,737,372)

Taxation - - -

------------ ---------------- --------------

Loss for the period/year (2,510,682) (1,903,264) (3,737,372)

------------ ---------------- --------------

Total comprehensive expense for

the period/year (2,510,682) (1,903,264) (3,737,372)

============ ================ ==============

Basic and diluted loss per

ordinary share (pence) 4 (9.94) (13.93) (24.66)

============ ================ ==============

* The disposal of KCR (Cygnet) Limited in the period to 31

December 2018 was previously accounted for as a business

combination with the loss on disposal shown as a loss from

discontinued operations. This disposal has been restated as an

asset disposal. Details of the prior period adjustment are included

within the audited annual report for the year ended 30 June

2019.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2019 (unaudited)

31

31 December December 30 June 2019

2019 2018 (audited)

Notes GBP GBP GBP

Non-current assets

Property, plant and equipment 57,927 33,165 61,370

Investment properties 6 23,385,000 24,600,000 23,923,000

23,442,927 24,633,165 23,984,370

------------ ----------- -------------

Current assets

Trade and other receivables 127,855 1,221,412 77,078

Cash and cash equivalents 24,218 63,521 29,298

------------ ----------- -------------

152,073 1,284,933 106,376

------------ ----------- -------------

Total assets 23,595,000 25,918,098 24,090,746

============ =========== =============

Equity

Shareholders' equity

Share capital 7 2,756,963 2,029,178 2,029,178

Share premium 13,535,468 10,018,986 10,018,986

Capital redemption reserve 344,424 67,500 67,500

Other reserves 14,930 14,930 14,930

Retained earnings (3,461,500) (922,911) (2,550,496)

------------ ----------- -------------

Total equity 13,190,285 11,207,683 9,580,098

------------ ----------- -------------

Non-current liabilities

Interest bearing loans and

borrowings 9,474,653 6,806,290 9,881,344

------------ ----------- -------------

Current liabilities

Trade and other payables 754,944 6,327,574 2,737,010

Interest bearing loans and

borrowings 175,118 1,576,551 1,892,294

930,062 7,904,125 4,629,304

------------ ----------- -------------

Total liabilities 10,404,715 14,710,415 14,510,648

------------ ----------- -------------

Total equity and liabilities 23,595,000 25,918,098 24,090,746

============ =========== =============

Net asset value per share

(pence) 47.84 70.97 60.67

============ =========== =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 DECEMBER 2019 (unaudited)

Unissued Capital

Share Share share capital redemption Retained Other

capital premium (as restated) reserve earnings reserves Total equity

GBP GBP GBP GBP GBP GBP GBP

Balance at 1

July 2018 1,435,721 7,358,244 1,260,299 67,500 (200,565) 29,862 9,951,061

Changes in

equity

Transactions

with owners:

Issue of share

capital 593,457 2,660,742 (1,260,299) - - - 1,993,900

Share-based

payment

charge - - - - 1,180,918 - 1,180,918

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Total

transactions

with owners: 593,457 2,660,742 (1,260,299) - 1,180,918 - 3,174,818

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Total

comprehensive

expense - - - - (1,903,264) - (1,903,264)

Equity element

of loan

finance - - - - - (14,932) (14,932)

Balance at 31

December 2018 2,029,178 10,018,986 - 67,500 (922,911) 14,930 11,207,683

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Changes in

equity

Transactions

with owners:

Share-based

payment

charge - - - - 206,523 - 206,523

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Total

transactions

with owners: - - - - 206,523 - 206,523

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Total

comprehensive

expense - - - - (1,834,108) - (1,834,108)

Balance at 30

June 2019 2,029,178 10,018,986 - 67,500 (2,550,496) 14,930 9,580,098

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Changes in

equity

Transactions

with owners:

Issue of share

capital 1,004,709 3,516,482 - - - - 4,521,191

Restricted

Preference

Shares gifted

to company (276,924) - - 276,924 - - -

Share-based

payment

charge - - - - 1,599,678 - 1,599,678

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Total

transactions

with owners: 727,785 3,516,482 - 276,924 1,599,678 - 6,120,869

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Total

comprehensive

expense - - - - (2,510,682) - (2,510,682)

------------ ------------ ----------------------- ----------- -------------- --------- --------------

Balance at 31

December 2019 2,756,963 13,535,468 - 344,424 (3,461,500) 14,930 13,190,285

============ ============ ======================= =========== ============== ========= ==============

*In the prior period unissued share capital was presented within

current liabilities. This has been restated in the current period

to re-classify the balance to equity. Details of the prior period

adjustment are included in the audited annual report for the year

ended 30 June 2019.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 31 DECEMBER 2019 (unaudited)

Six months

Six months ended Year

ended 31 December ended

31 December 2018 30 June

2019 2019

(*as restated) (audited)

GBP GBP GBP

Cash flows from operating activities

Loss for the period/year from continuing

operations (2,510,682) (1,903,264) (3,737,372)

Adjustments for

Depreciation charges 11,621 5,828 18,074

Share-based payment charge 1,599,678 1,180,918 1,387,441

Loss on disposal of property SPV - 360,081 340,753

Revaluation of investment properties - (705,000) (3,268)

Finance costs 229,527 263,853 732,984

Finance income (1,541) (9,590) (9,635)

(Increase)/decrease in trade and

other receivables (50,777) (517,985) 626,349

Decrease in trade and other payables (1,982,066) (1,977,431) (4,315,992)

Cash used in operations (2,704,240) (3,302,590) (4,960,666)

Interest paid (229,527) (263,853) (732,984)

Net cash used in operating activities (2,933,767) (3,566,443) (5,693,650)

-------------- ---------------- ------------

Cash flows from investing activities

Proceeds from sale of investment 538,000 - -

properties

Purchase of property, plant and

equipment (8,178) - (40,451)

Purchase of investment properties - - (24,732)

Disposal of property SPV - 1,140,000 1,140,000

Interest received 1,541 9,590 9,635

-------------- ---------------- ------------

Net cash from/(used in) investing

activities 531,363 1,149,590 1,084,452

-------------- ---------------- ------------

Cash flows from financing activities

Loan repayments in period (2,123,867) (130,250) (796,079)

New loans in year - - 3,434,250

Shares issued 4,521,191 2,604,199 1,993,900

-------------- ---------------- ------------

Net cash from financing activities 2,397,324 2,473,949 4,632,071

-------------- ---------------- ------------

Increase/(decrease) in cash and

cash equivalents (5,080) 57,096 22,873

-------------- ---------------- ------------

Cash and cash equivalents at beginning

of period 29,298 6,425 6,425

============== ================ ============

Cash and cash equivalents at end

of period 24,218 63,521 29,298

============== ================ ============

*The disposal of KCR (Cygnet) Limited in the period to 31

December 2018 was previously accounted for as a business

combination with the loss on disposal shown as a loss from

discontinued operations. This disposal has been restated as an

asset disposal. Details of the prior period adjustment are included

in the audited annual report for the year ended 30 June 2019.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 31 DECEMBER 2019 (unaudited)

1. Basis of preparation

The Company is registered in England and Wales. The consolidated

interim financial statements for the six months ended 31 December

2019 comprise those of the Company and subsidiaries. The Group is

primarily involved in UK property ownership and letting.

Statement of compliance

This consolidated interim financial report has been prepared in

accordance with the measurement principles of IFRS adopted in the

EU. AIM-listed companies are not required to comply with IAS 34

Interim Financial Reporting and the Group has taken advantage of

this exemption. Selected explanatory notes are included to explain

events and transactions that are significant to an understanding of

the changes in financial performance and position of the Group

since the last annual consolidated financial statements for the

year ended 30 June 2019. This consolidated interim financial report

does not include all the information required for full annual

financial statements prepared in accordance with International

Financial Reporting Standards. The financial statements are

unaudited and do not constitute statutory accounts as defined in

section 434(3) of the Companies Act 2006.

A copy of the audited annual report for the year ended 30 June

2019 has been delivered to the Registrar of Companies. The

auditor's report on these accounts was unqualified and did not

contain statements under s498(2) or s498(3) of the Companies Act

2006.

This consolidated interim financial report was approved by the

Board of Directors on 26 March 2020.

New standards and interpretations adopted

These interim financial statements are the first under which the

Group is adopting IFRS 16 'Leases', which is effective for periods

commencing after 1 January 2019.

The directors considered the adoption of IFRS 16 for the period

beginning 1 July 2019. The Group currently has a small number of

operating leases concerning office premises and plant and equipment

as set out in Note 5. IFRS 16 provides an exemption for short term

operating leases and leases of low value. As its leases are short

term and not material, the Group will take advantage of the

exemption rather than establish a right to use asset and related

liability as required for relevant leases under IFRS 16.

The accounting policy is disclosed below.

Significant accounting policies

The accounting policies applied by the Group in this

consolidated interim financial report are the same as those applied

by the Group in its consolidated financial statements for the year

ended 30 June 2019, with the following exceptions:

Basis of consolidation

The interim financial statements include the financial

statements of the Company and its subsidiary undertakings. The

subsidiaries included within the consolidated financial statements,

from their effective date of acquisition, are K&C (Newbury)

Limited, K&C (Coleherne) Limited, K&C (Osprey) Limited, KCR

(Kite) Limited and KCR (Southampton) Limited.

Leases

The costs of operating leases of low value items and those with

a short term at inception are recognised as incurred.

2. Operating segments

The Group is involved in UK property ownership and letting and

is considered to operate in a single geographical and business

segment.

3. Operating loss

The loss before taxation is stated after charging:

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2019 2018 2019 (audited)

GBP GBP GBP

Costs associated with

third party fundraising 300,835 167,817 407,616

Directors' remuneration 137,050 304,000 486,300

During the six months ended 31 December 2019, the Group incurred

costs of GBP300,835 relating to the Torchlight Fund transaction.

The transaction with Torchlight Fund LP was reported in detail in

the Circular (12 July 2019) and outlined in the year end accounts

to 30 June 2019 post balance sheet events.

During the period, the Company paid DGS Capital Partners LLP, a

business partly owned by Michael Davies, fees of GBP21,600 (2018:

GBP21,600) and Naylor Partners, a business owned by Russell Naylor,

fees of GBP20,000 (2018: GBPnil).

The directors are considered to be key management personnel.

4. Basic and diluted loss per share

Basic

The calculation of loss per share for the six months to 31

December 2019 is based on the loss for the period attributable to

ordinary shareholders of GBP2,510,682 divided by a weighted average

number of ordinary shares in issue.

The weighted average number of shares used for the six months

ended 31 December 2019 was 25,265,268 (June 2019 - 15,156,059)

(December 2018 - 13,658,423).

5. Lease arrangements

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2019 2018 2019 (audited)

GBP GBP GBP

Expense relating to

short-term lease 16,813 13,616 31,282

============= ============= ======================

The total cash outflow relating to leases in the period amounted

to GBP16,813 (2018: GBP13,616).

At 31 December 2019 the Group is committed to GBP46,202 (2018:

GBP54,561) relating to leases classified as short term where the

right-of-use asset and corresponding lease liabilities are not

recognised in the statement of financial position.

6. Investment properties

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2019 2018 2019 (audited)

GBP GBP GBP

At start of period 23,923,000 26,695,000 26,695,000

Additions - - 24,732

Revaluations - 705,000 3,268

Disposals (538,000) (2,800,000) (2,800,000)

----------- ------------ ----------------

At end of period 23,385,000 24,600,000 23,923,000

=========== ============ ================

The investment properties were procured upon acquisition of

subsidiaries.

Investment properties were valued by professionally qualified

independent external valuers at the date of acquisition and were

recorded at the values that were attributed to the properties at

acquisition date. The investment properties were independently

valued at, or within three months of the financial year ended 30

June 2019. Fair value is based on current prices in an active

market for similar properties in the same location and condition.

The current price is the estimated amount for which a property

could be exchanged between a willing buyer and willing seller in an

arm's length transaction after proper marketing wherein the parties

had each acted knowledgeably, prudently and without compulsion.

Valuations are based on a market approach which provides an

indicative value by comparing the property with other similar

properties for which price information is available. Comparisons

have been adjusted to reflect differences in age, size, condition,

location and any other relevant factors.

The fair value for investment properties has been categorised as

a Level 3 inputs under IFRS 13.

The valuation technique used in measuring the fair value, as

well as the significant inputs and significant unobservable inputs

are summarised in the following table -

Fair Value Valuation Technique Significant Significant Unobservable

Hierarchy Inputs Used Inputs

Level Income capitalisation Adopted gross 3.29% - 5.39%

3 and or capital value yield

on a per square foot

basis

Adopted rate

per square foot GBP332 - GBP825

7. Share capital

31 December 31 December 30 June

Allotted, issued and fully paid: 2019 2018 2019 (audited)

Nominal

Number: Class: value: GBP GBP GBP

27,569,631 Ordinary GBP0.10 2,756,963 1,579,178 1,579,178

- Restricted preference GBP0.10 - 450,000 450,000

------------ ------------ ----------------

2,756,963 2,029,178 2,029,178

============ ============ ================

At 1 July 2019, the Company had 15,791,777 Ordinary shares of

GBP0.10 each and 4,500,000 Restricted Preference shares of GBP0.10

each in issue.

On 6 August 2019, the Company converted 1,730,765 Restricted

Preference shares to Ordinary shares. The remaining 2,769,235

Restricted Preference shares were cancelled.

On 6 August 2019, 10,047,089 Ordinary shares of GBP0.10 each

were allotted, at a premium of GBP0.35 per share. 9,000,000 of the

shares were issued to Torchlight Fund LP. Of the remaining

1,047,089 shares issued, 1,024,867 were issued to settle

liabilities of the Company.

The Ordinary shares carry no rights to fixed income.

8. Share-based payments

The expense recognised during the period is shown in the

following table:

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2019 2018 2019 (audited)

GBP GBP GBP

Expense arising from

restricted preference

shares 1,599,678 1,180,918 1,387,441

=========== =========== ================

Restricted Preference shares:

Restricted Preference shares were granted to certain directors

and other senior managers on 2 February 2017, 24 April 2017 and 5

September 2018. Upon the achievement by the Group of certain

milestones, the Restricted Preference shares were convertible into

Ordinary shares at GBP0.10 each. On 6 August 2019, in order to

simplify the share structure of the Company, the Company entered

into an agreement with the holders of the Restricted Preference

Shares whereby 5 out of every 13 Restricted Preference Shares held

would be converted into Ordinary Shares. The remaining Restricted

Preference Shares were acquired by the Company for nil

consideration and subsequently cancelled.

The executive directors' interests in Restricted Preference

shares were as follows:

Granted Balance Balance

Balance at at

at 31 December 30 June Gifted 31 December

2018 Converted 2019 Converted to Company 2019

Dominic

White 1,500,000 265,357 (500,000) 1,265,357 (486,675) (778,682) -

Timothy

James 960,000 265,357 (320,000) 905,357 (348,214) (557,143) -

James

Cane 30,000 10,000 (10,000) 30,000 (11,538) (18,462) -

Oliver Vaughan 810,000 265,357 (270,000) 805,357 (309,752) (495,605) -

Timothy

Oakley 300,000 265,357 (100,000) 465,357 (178,983) (286,374) -

Christopher

James 600,000 214,286 (200,000) 614,286 (236,263) (378,023) -

Employees 300,000 214,286 (100,000) 414,286 (159,340) (254,946) -

--------------- --------- ----------- ----------- ----------- ----------- ------------

Total 4,500,000 1,500,000 (1,500,000) 4,500,000 (1,730,765) (2,769,235) -

=============== ========= =========== =========== =========== =========== ============

The principal inputs and assumptions used in the calculation of

the share-based payment charge are unchanged from those detailed in

the consolidated financial statements for the year ended 30 June

2019. Due to the conversion and cancellation of the Restricted

Preference Shares, the vesting period was accelerated and therefore

the share-based payment charge has been recognised fully in these

interim financial statement.

9. Convertible Loan Notes

As at 1 July 2019, the Company had GBP200,000 convertible loan

notes in issue. On 22 August 2019, GBP100,000 of the loan notes

were converted into 222,223 Ordinary shares at an issue price of

GBP0.45 per share. At 31 December 2019, the Company had GBP100,000

convertible loan notes still in issue.

10. Related Party Transactions

On 24 June 2018, the Company entered into a loan agreement

arranged by DGS Capital Partners LLP, a limited liability

partnership in which Michael Davies is a member, with certain

investors. The loan was for GBP1,475,000 and was subject to an

interest rate of 12 per cent per annum. The capital and interest

outstanding at 30 June 2019 was GBP1,520,826. Interest and charges

charged in the period to 31 December 2019 totalled GBP33,485. The

loan and outstanding interest were repaid on 22 August 2019. The

repayment consisted of GBP1,425,000 cash and GBP129,311 of Ordinary

shares.

During the 2019 financial year, Oliver Vaughan, a director of

the Company, loaned the Company GBP150,000. The loan was unsecured

and was due for repayment on 15 May 2019. The loan was extended in

June 2019 for which a fee of GBP10,000 was charged to the Company.

The total liability at 30 June 2019 totalled GBP160,000. The loan

was interest free. GBP110,000 of the loan was repaid via the issue

of Ordinary shares in the Company on 6 August 2019. The remaining

GBP50,000 was repaid on 8 August 2019.

During the 2019 financial year, the Company issued GBP50,000 of

convertible loan notes to Kimono Investments Limited, an entity in

which Oliver Vaughan's children have a financial interest. At 30

June 2019 the total loan notes and interest outstanding totalled

GBP52,616. Interest charged in the period to 31 December 2019 was

GBP340. The principal loan was repaid on 22 August 2019. The

repayment consisted of GBP50,000 of Ordinary shares.

During the 2019 financial year, the Company issued convertible

loan notes to White Amba Pension Scheme of GBP25,000. At 30 June

2019 the total loan notes and interest outstanding totalled

GBP26,050. Interest charged in the period to 31 December 2019 was

GBP170. The principal loan was repaid on 22 August 2019. The

repayment consisted of GBP25,000 of Ordinary shares.

During the 2019 financial year, the Company issued convertible

loan notes to Katie James, relative of Timothy James of GBP25,000.

At 30 June 2019 the total loan notes and interest outstanding

totalled GBP26,050. Interest charged in the period to 31 December

2019 was GBP170. The principal loan was repaid on 22 August 2019.

The repayment consisted of GBP25,000 of Ordinary shares.

During the 2019 financial year, Timothy Oakley, a director of a

number of subsidiary companies, received remuneration of GBP30,200

(2018 - GBP30,000). GBP15,000 of this remuneration was included in

accruals at 30 June 2019. During the 2019 financial year Timothy

Oakley also loaned the Company GBP50,000 as part of the loan

arranged by DGS Capital Partners LLP, as detailed above. The loan

and outstanding remuneration were repaid on 22 August 2019. The

repayment consisted of GBP62,375 of Ordinary shares.

During the 2019 financial year, Christopher James, a director of

a number of subsidiary companies, received remuneration of

GBP51,200 (2018 - GBP14,000). GBP44,000 of this remuneration was

included in accruals at 30 June 2019. This was settled during the

period to 31 December 2019. Part of the settlement consisted of the

issue of GBP6,050 of Ordinary shares.

11. Post Balance Sheet Events

The following material events have occurred subsequent to 31

December 2019 to the date when these interim condensed consolidated

financial statements were authorised for issue -

-- On 12 February 2020, the Group completed a GBP7.9m

refinancing of its Coleherne Road, Ladbroke Grove and Lomond court

assets. The refinancing has a term of 25 years, a five-year fixed

interest rate and is secured on the assets concerned. The interest

rates relating to these properties reduces from 3.75% per annum to

3.5% per annum.

This transaction delivered GBP2.9m of free capital to KCR post

repayment of the existing bank facility providing KCR with a strong

liquidity position.

-- In January 2020, an outbreak of a novel coronavirus, now

classified as COVID-19, was detected in China's Hubei province.

During the following months, COVID-19 has spread steadily

throughout the World and on 11 March 2020, The World Health

Organisation ("WHO") declared the outbreak a global pandemic. At

the date of signing of this report, confirmed cases were in excess

of 460,000 and deaths caused by COVID-19 were in excess of 20,000.

In order to stem the spread of the virus, Governments around the

World are taking drastic steps which include compulsory closure of

various businesses, shops and schools and are also heavily

restricting of movement of people.

-- Due to the rapid development of COVID-19, the degree of

uncertainty involved and the unprecedented nature of the challenges

posed by the coronavirus situation, the Directors are of the

opinion that it is too soon to quantify what financial impact that

the COVID-19 pandemic will cause but are monitoring the situation

closely.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LQLLLBXLBBBL

(END) Dow Jones Newswires

March 27, 2020 03:00 ET (07:00 GMT)

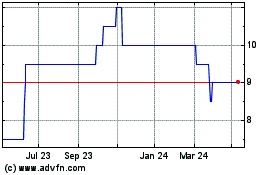

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Mar 2024 to Mar 2025