TIDMKEFI

RNS Number : 9833G

Kefi Gold and Copper PLC

21 November 2022

21 November 2022

KEFI Gold and Copper plc

("KEFI" or the "Company")

Agreement of Tulu Kapi Gold Project Finance Plan

KEFI (AIM: KEFI), the gold exploration and development company

with projects in the Federal Democratic Republic of Ethiopia and

the Kingdom of Saudi Arabia, is pleased to announce that the

updated US$320 million Tulu Kapi Gold Project ("Tulu Kapi" or the

"Project") costings and finance plan has now been agreed by all the

Tulu Kapi syndicate lead contractors, investors and lenders. It is

currently being processed for final reviews and entry into

definitive documentation to be signed as soon as possible, with the

expectation to achieve this next month.

It remains that financing is to be almost entirely at the

project or subsidiary level and remains consistent with previous

guidance (see 2021 Annual Report, page 6). The detailed breakdown

of the sources and uses of the US$320 million Project funding will

be announced at the time of signing definitive documentation.

Harry Anagnostaras-Adams, Executive Chairman of KEFI, commented:

"The Tulu Kapi Gold Project is designed to world-leading standards

technically, socially, environmentally and in terms of financing

arrangements acceptable to international capital markets.

"Today's important milestone of the debt and equity leads

approving the finalised finance plan allows all the respective

Boards to formally approve the definitive documentation. I am

pleased to report the Project is now up and away.

"Ethiopia's readiness for foreign direct investment has

continued to improve since early 2022 and recent well-publicised

positive developments have only served to reinforce that. The

Company is confident that we can lift the work programmes to full

construction in the new year and be in full production from the

open pit in 2025 and from the combined open pit-underground

operation a few years later.

"We have been long-standing and resilient supporters of the

Ethiopian Government's efforts to develop its minerals sector and

we feel a great sense of responsibility and honour to now be able

to push forward at a time which is particularly important for all

stakeholders."

Tulu Kapi Background

Now Focusing on Increased Production and Longer Mine Life at

Tulu Kapi

The Company is pleased to report that the plans now contemplate

an enlarged Tulu Kapi operation, integrating both an open pit and

underground mine, with consequential increases in planned gold

exports to US$300 million per annum (at current gold prices when

both mines are in production) and with combined mine production

extended from 8 to 10 years starting in 2025. KEFI will also

request permission from the Ethiopian Ministry of Mines to

recommence district exploration during construction to further

extend the mine life to well over 10 years for the benefit of all

stakeholders.

Initial Project development activities have already started and

include camp upgrading for construction, local recruitment,

community resettlement, plant procurement engineering and

work-programmes and legal formalities to satisfy the many standard

conditions precedent for finance drawdowns. An official Project

launch is planned for early 2023, the timing to be determined with

the Ministry of Mines.

Conditionality of Project Plans

Since signing the syndicate Umbrella Agreement in June 2022, we

have updated all Project costings with international fabricators

and other suppliers, updated contract documentation, had both of

our banks confirm there are no more policy impediments to their

participation, adjusted intra-syndicate finance contributions and

started assembling completed documentation for lender review before

execution.

As with any project financings standard conditions must be

satisfied before and after signing of definitive agreements by all

parties, including completion/registration of documents with the

various Government agencies, opening international project bank

accounts in collaboration with the National Bank of Ethiopia,

placing insurances internationally through the Ethiopian agents,

registering loan-security, receiving confirmations of tenure for

mining and exploration and the independent experts' confirmation

that conditions on the ground remain conducive to the planned

operations.

Economic Benefits of the Tulu Kapi Gold Project include:

* Showcase project as first mover in a high-priority

sector

* A business enterprise that will be the single largest

Ethiopian exporter, starting at c. US$250 million per

annum ("pa") and rising over the first four years to

US$300 million pa, at current gold prices

* Direct employment of 1,000 people and indirect

employment 5-10 times that number in a high

unemployment area of rural West Welega

* Emphasis on local procurement for production inputs,

with annual operating expenses exceeding US$140

million which will have a huge impact on local

economic opportunity

* Emphasis on creation of micro-enterprise in

collaboration with appropriate experts, such as the

Ethiopian Evangelical Church of Mekane Yesus

("EECMY")

* A showcase project in all respects, backed by leading

African development banks and encouraging other

minerals developers to proceed in Ethiopia.

Social Benefits of the Tulu Kapi Gold Project include:

* A full spectrum of social programmes in compliance

with International Finance Corporation (World Bank)

Performance Standards

* Education, training and employment starting some

years ago with the construction of the local school

and now expanding into local technical college

courses in collaboration with a leading mining

colleges and universities in global mining centres

* Local infrastructure which started some years ago

with provision of local fresh water and expansion to

include an all-weather road to the highway, mains

electricity to site with extra capacity for local

reticulation by the authorities for appropriate

applications, health clinics and an airstrip

* Tulu Kapi Charitable Foundation started and is in

operation

The Environmental impact:

* The Tulu Kapi Gold Project has been designed in

accordance with the highest international standards

and will involve monitoring by global leading experts

* The site itself was chosen by KEFI because of its

environmental and social characteristics, as much as

its mineralisation and potential to generate wealth

* The site has no interest to artisanal miners because

of the depth and nature of the gold particles, i.e.,

unrecoverable by artisanal techniques and only by

industrial-scale processes

* No sulphide mineralisation which therefore avoids the

issue of managing potential acid mine drainage

* The Environmental Impact and Assessment Report has

been widely reviewed and the Company is not aware of

any negative comment

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Executive Chairman) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated

Adviser and Joint Broker) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Joint Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

WH Ireland Limited (Joint Broker) +44 (0) 20 7220 1666

Katy Mitchell, Andrew de Andrade

IFC Advisory Ltd (Financial PR and IR) +44 (0) 20 3934 6630

Tim Metcalfe, Florence Chandler

KEFI Gold and Copper plc

KEFI is focused primarily on the advancement of its three

development projects in Ethiopia and Saudi Arabia, plus its

pipeline of highly prospective exploration projects in these two

large jurisdictions of the under-explored Arabian-Nubian

Shield.

KEFI targets that production at Tulu Kapi in Ethiopia and Jibal

Qutman in Saudi Arabia will, between them, generate cash flows for

capital repayments, further organic growth and, ultimately,

dividends to shareholders.

Both TKGM and G&M are technically guided and supported by

KEFI so that each of these operating joint venture companies as

soon as possible builds the local organisational structure suitable

for long term production as well as exploration and future

development opportunities.

KEFI Gold and Copper in Ethiopia

Ethiopia is currently undergoing a remarkable transformation

both politically and economically.

The Tulu Kapi gold project in western Ethiopia is being

progressed towards development, following a grant of a Mining

Licence in April 2015. No other mining project of this scale in

Ethiopia has been brought to Tulu Kapi's stage of advancement

during recent years and Tulu Kapi will be the first industrial

scale mine development in Ethiopia in over 30 years. It has taken

years of extensive technical re-design of the project, years of

overhaul by the Ethiopian authorities of financial policies which

previously hindered mining project finance and the patient and

cautious traversing by the Company of recent well-publicised events

within the country. The project has imposed many demands on a

regulatory system which the Ethiopian Government continues to

upgrade, determined to build a modern minerals sector. KEFI is

honored to play its part in this process and has assembled a

first-tier syndicate of international industry expert management,

contractors, banks and investors.

The Company has now refined contractual terms for construction

and operation of the open pit mine. Management has also developed

preliminary plans to develop the underground mine once open-pit

production has started and to produce.

All aspects of the Tulu Kapi (open pit) gold project have been

reported in compliance with the JORC Code (2012) and subjected to

reviews by appropriate independent experts. The underground project

is defined based on internal PEA-level analyses which have yet to

be subjected to DFS-level investigation and independent review,

which is planned to be carried out during the construction of the

open pit.

KEFI remains keen to re-commence its exploration of the

additional prospects it has successfully identified within the Tulu

Kapi district exploration area from within which the mining licence

was duly excised as a result of the successful discovery of the

Tulu Kapi deposit. Whilst most historical drilling was naturally of

the Tulu Kapi deposit, there was significant work done on many

further prospects which await follow-up.

Whilst awaiting regulatory permission to re-activate the

Company's Ethiopian exploration, which is critical for long term

planning for all stakeholders in the community as well as the

Company, the exploration focus has been successfully switched to

Saudi Arabia.

KEFI Gold and Copper in the Kingdom of Saudi Arabia

In 2009, KEFI formed Gold & Minerals Limited ("G&M") in

Saudi Arabia with local Saudi partner, ARTAR, to explore for gold

and associated metals in the Arabian-Nubian Shield. KEFI has a c.

30% interest in G&M.

ARTAR, on behalf of G&M, and G&M directly held over 16

Exploration Licence (EL) applications pending the introduction of

the new Mining Law. These new regulations have recently been

proclaimed and G&M has had ten new licences issued in the past

twelve months - more licence grants than in the previous 14 years

and all highly prospective and strategically important for G&M,

ELs are renewable for up to five years and bestow the exclusive

right to explore and to obtain a 30-year exploitation (mining)

licence within the area.

In addition, G&M has a Mining Licence Application over the

Jibal Qutman Gold Project which recent informal indications by the

authorities provide some confidence that the licence will be

granted shortly.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRPPGBCGUPPGMU

(END) Dow Jones Newswires

November 21, 2022 02:00 ET (07:00 GMT)

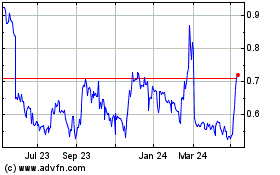

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Feb 2025 to Mar 2025

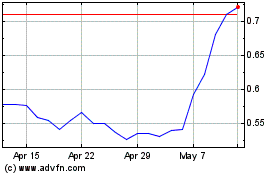

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Mar 2024 to Mar 2025