Kefi Gold and Copper PLC Presentation in Addis Ababa, Riyadh and Dubai (3952V)

April 05 2023 - 1:00AM

UK Regulatory

TIDMKEFI

RNS Number : 3952V

Kefi Gold and Copper PLC

05 April 2023

5 April 2023

KEFI Gold and Copper plc

("KEFI" or the "Company")

Presentation to Regional Investors in Addis Ababa, Riyadh and

Dubai

KEFI Gold and Copper (AIM: KEFI), the gold and copper

exploration and development company with projects in the Federal

Democratic Republic of Ethiopia and the Kingdom of Saudi Arabia, is

pleased to provide an updated corporate presentation to be used in

meetings with regional investors in Addis Ababa, Riyadh and Dubai.

The presentation has been uploaded to the Company's website:

https://www.kefi-goldandcopper.com.

The presentation incorporates information on the maiden Al

Godeyer resource announced on 3 April 2023, which has increased the

metal content in the Open Pit Scenario for the Hawiah project in

Saudi Arabia by over US$200 million, bringing the total Hawiah

project metal content to c.US$4.8 billion and the aggregate of

KEFI's three advanced projects to c.US$9.6 billion, at current

metal prices (gold: 3.1Moz at US$1,980/oz, 266KT copper at

US$8,888/T, 284KT zinc at US$2,948/T and 9.7Moz silver at

US$23/oz). KEFI's aggregate beneficial interest in this metal

content is approximately 50% of the total or US$4.8 billion.

The Ethiopian project, Tulu Kapi, has an in-situ metal content

of US$3.4 billion and is development-ready. The two Saudi projects

have combined in-situ metal content of US$6.2 billion and are

undergoing feasibility studies for development.

The presentation also provides details of the c.US$390 million

development financing (including the mining fleet and all other

capital requirements) for the Tulu Kapi gold project in Ethiopia

where last week the Tulu Kapi syndicate's two development banks

visited Addis Ababa for the second time in the last month, to meet

with the newly-appointed Ethiopian Minister of Mines, H.E Habtamu

Tegegn, with whom it was jointly undertaken to quickly resolve any

loose ends in respect of the final substantive conditions precedent

ahead of expected signing within the next month or so of the Final

Umbrella Agreement.

As with the initial Umbrella Agreement signed in June 2022, the

Final Umbrella Agreement will set out all syndicate member roles

and finance contributions and conditions precedent to final formal

approval being granted. However, the Final Umbrella Agreement is

also intended to confirm that project costs and financial

contributions will have been updated, along with technical and

legal due diligence having been updated, definitive agreements

prepared and that the key required government actions will have

been agreed and being duly followed through with. These regulatory

aspects include matters far-reaching for the minerals sector and

not just for the Project, such as the in-country protective rights

of our development banks, project security, community preparation,

operation of project bank accounts in international financial

centres and various procedural matters which are standard for

mining project finance. Accordingly, it would then be possible to

proceed to parties' respective final approvals to execute and

launch full project development.

Entering into the individual definitive agreements for all

syndicate members will be conditional on mutually interdependent

formal shareholder and lender approvals to be called in compliance

with their respective notice provisions. As with any such

international mining project finance transactions, these approvals

will require independent certification of security and community

readiness, placement of insurances, mortgage registration and

similar standard procedural conditions precedent and subsequent.

All parties are again targeting full construction start to coincide

with the next dry season (October 2023), after having already

prepared the community and procured the plant and equipment, with

full production targeted to start in 2025.

KEFI Executive Chairman, Harry Anagnostaras-Adams,

commented:

"For fifteen years, KEFI Gold and Copper has been diligently

building its foundations in the two largest countries of this world

class minerals region known as the Arabian Nubian Shield. We are

proud to now have three advanced projects coming on stream over the

next few years with combined metal content of nearly US$10 billion,

approximately 50% of which is to KEFI's account.

"The Tulu Kapi gold project in Ethiopia will be the first to

trigger its start-up, preparing now for finance closing and launch.

We expect the project finance syndicate to sign the Final Umbrella

Agreement later this month, reflecting the progress of intense

preparations by each party including far-reaching initiatives taken

by the Government in respect of matters which are critically

important and most encouraging for the minerals sector and not just

our Project. We are extremely grateful for the Ethiopian

Government's vigorous support and collaboration.

"We have assembled a first-class regional platform across Saudi

Arabia and Ethiopia, with strong local partners and with leading

regional development banks and contractors for each country,

between them providing over 95% of the development capital for the

three start-ups that we plan.

"KEFI is proud to be honouring its commitment to bring to its

joint ventures in Ethiopia and Saudi Arabia the human and financial

resources required to spur the development of their respective

modern mining sectors. In Ethiopia, where we are about to start

development, we are especially honoured to have the strong backing

of the local community.

"Under our social performance programmes at the Tulu Kapi gold

project in Ethiopia, we have already installed the local school,

water supply and roads in the project area. This is just the

beginning of what we plan to be a long-term community development

programme built around thousands of training and employment

opportunities, preferred local supply and related programmes for

sustainable long-term development in accordance with World Bank IFC

Performance Standards."

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Managing Director) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated

Adviser and Joint Broker) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Joint Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

WH Ireland Limited (Joint Broker) +44 (0) 20 7220 1666

Katy Mitchell, Andrew de Andrade

IFC Advisory Ltd (Financial PR and IR)

Tim Metcalfe, Florence Chandler +44 (0) 20 3934 6630

Notes to Editor

KEFI Gold and Copper plc

KEFI is focused primarily on the development of the Tulu Kapi

Gold Project in Ethiopia and its pipeline of highly prospective

exploration and development projects in the Kingdom of Saudi

Arabia, also in the Arabian-Nubian Shield. KEFI targets that Tulu

Kapi Gold, along with its two most advanced Saudi projects Jibal

Qutman Gold and Hawiah Copper-Gold will come into production over

the period 2025-2027 and will generate cash flows for capital

repayments, further exploration and dividends to shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFZLLBXZLFBBV

(END) Dow Jones Newswires

April 05, 2023 02:00 ET (06:00 GMT)

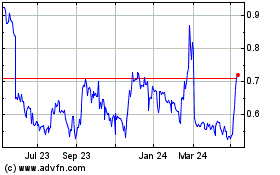

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Feb 2025 to Mar 2025

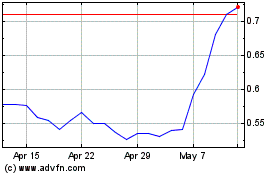

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Mar 2024 to Mar 2025