TIDMKOO

RNS Number : 1166N

Kooth PLC

21 September 2023

21 September 2023

Kooth Plc

("Kooth", the "Company" or the "Group")

Half Year Results

Strategic momentum and revenue growth of 29%

Full year revenue guidance of at least GBP34m

Kooth (AIM: KOO), a global leader in youth digital mental

well-being, announces unaudited half year results for the six

months ended 30 June 2023. All figures relate to this period unless

otherwise stated.

Strategic and post period end highlights

-- Transformational US contract win in California, $188m minimum value

-- On track for California go-live in January 2024, notably with the Kooth mobile app and hires

-- Number one provider of mental health access for children and young people to NHS England

-- Significant uptake of Kooth in Pennsylvania pilot, providing

access to c.100,000 school students

-- Ongoing investment in business development, platform investment and US expansion

Financial Highlights

-- Revenues up 29% to GBP11.7m (2022: GBP9.0m)

-- Annual Recurring Revenue (ARR) up 16% to GBP21.4m (2022: GBP18.5m)

-- Gross margin of 66.8% (2022: 68.4%)

-- Adjusted EBITDA of GBP0.01m (2022: GBP0.5m) reflecting

investment in US setup and business development

-- Recurring Revenue from contracts 12 months or longer 94% (2022: 95%)

-- Robust balance sheet; net cash of GBP5.9m plus successful

gross fundraise of GBP10m post half-year end supports investment

for long-term growth

Outlook

-- Significant opportunity for Kooth in the US driven by the

continued need from both US State governments and Medicaid payers

to invest further in youth mental health

-- For the UK, we expect the headwinds to remain, reflecting a

focus on NHS cost saving and acute care backlog. Our focus remains

on continuing to demonstrate the impact and savings that Kooth

generates when commissioned in a region

-- The Group remains confident of delivering revenue for the

full year in line with our revised market guidance of no less than

GBP34 million

-- Our robust balance sheet enables us to invest to meet

long-term, increasing demand for Kooth's services

Tim Barker, Chief Executive Officer of Kooth, said:

The first six months of 2023 have been a period of significant,

and positive, change for Kooth. In March we announced our largest

contract to date with the State of California which was finalised,

post-period end, as a four year, $188m minimum value agreement.

This marked Kooth's second major engagement in the US, alongside

Pennsylvania, which was agreed in October 2022. During the period,

and over the last 12 months, we have developed a significant

operation in the United States as we look to capture the

opportunity this major healthcare market brings. We look forward to

leveraging our platform to increase the size of our business

further and, more importantly, help improve mental health provision

to as many young people as possible.

In the UK, we are not immune to the broader healthcare and

economic environment, which sees commissioning across the NHS

structure under stress as Integrated Care Systems prioritise a

reduction in costs and tackling an acute mental healthcare backlog.

In response, we have taken proactive steps to position ourselves to

best respond to this environment, including developing new services

to help tackle waiting lists.

I would like to thank our team for their work which has

delivered transformational gains during the period and beyond as we

look to leverage our position as a pioneer and innovator in digital

mental healthcare to deliver the care needed to help tackle the

growing crisis in global mental health.

Financial headlines

Six months Six months Change

ended 30 June ended 30 June

2023 2022

GBP'000 GBP'000

Revenue

Total revenue 11,660 9,022 +29.2%

Annual Recurring Revenue 21,376 18,483 +15.7%

Gross profit 7,788 6,170 +26.2%

Gross margin 66.8% 68.4% -2.3ppt

Adjusted EBITDA 9 539 -98.3%

Profit/(Loss) after tax for

the period (525) (342) -53.5%

Cash generation (2,642) 1,231 -314.6%

Cash position 5,850 8,310 -29.6%

Earnings per share (GBP) (0.02) (0.01) -58.8%

Enquiries

Kooth plc

Tim Barker, CEO investorrelations@kooth.com

Sanjay Jawa, CFO

Panmure Gordon, Nominated Adviser and

Joint Broker

Corporate Finance: Dominic Morley, James

Sinclair-Ford, Daphne Zhang

Corporate Broking: Rupert Dearden, James

Todd +44 (0) 20 7886 2500

Stifel Nicolaus Europe Limited, Joint

Broker

Ben Maddison, Nick Adams, Nicholas Harland,

Richard Short +44 (0) 20 7710 7600

FTI Consulting kooth@fticonsulting.com

Jamie Ricketts, Alex Shaw, Usama Ali

About Kooth

Kooth (AIM:KOO) is a global leader in youth digital mental

well-being. Our mission is to provide accessible and safe spaces

for everyone to achieve better mental health. Our platform is

clinically robust and accredited to provide a range of therapeutic

support and interventions. All our services are predicated on easy

access to make early intervention and prevention a reality.

Our three services are:

-- Kooth: for children and young people

-- Kooth: for adults

-- Kooth Work: for frontline employees

Kooth is a fully safeguarded and pre-moderated community with a

library of peer and professional created content, alongside access

to experienced online counsellors. There are no thresholds for

support and no waiting lists. Currently, Kooth sees more than 4,000

logins a day.

Kooth is the only digital mental health provider to hold a

UK-wide accreditation from the British Association of Counselling

and Psychotherapy (BACP) and according to NHS England data for

2021/22 is now the largest single access provider for mental health

support for under 18s.

In 2021, Kooth began executing on its international expansion

strategy, with an initial focus on the US market. This focus is due

to the growing recognition of the importance of improving youth

mental health in this key global healthcare market, with 1-in-6

people aged 6-17 experiencing a mental health disorder each year.

Kooth's first major pilot contract in the US was signed in October

2022 with the State of Pennsylvania followed in July 2023 by a

four-year contract to cover all six million 13-25 year-olds in the

State of California.

Chief Executive's Review

Transformational strategic progress

With the award of a $188m four-year state-wide contract with

California, the last six months demonstrate the significant

opportunity for Kooth in the US as federal and state governments

invest to transform youth mental health care.

As one of the work streams within the State of California's $4.7

billion youth masterplan, this investment arguably represents the

world's most progressive initiative to improve youth mental health.

This was evident at the September UN Congress General Assembly

meeting, to which Kooth was invited. The key question is "how"

rather than "if" this problem should be addressed. We remain deeply

humbled to be entrusted with the opportunity to be at the forefront

of supporting a landmark programme in the most populous state in

the US, in what we believe will be a template for future

governments and health care systems on how to safeguard the mental

health of the next generation.

I have been very proud to see how our whole team has stepped up

to the opportunity in California, with both the work undertaken to

win the contract in March and then subsequently the shift into the

delivery phase. This is hard but purposeful work across 30

workstreams spanning the development of our next-generation

platform, marketing and promotion strategy, as well as building our

workforce and organisational infrastructure.

We are on track for the launch of our contract in California in

January 2024, with all major milestones and deliverables to date

met:

- All our US VP-level hires are in place to support go-live,

with talent joining the existing team from organisations including

Headspace, Crisis Text Line and Oracle Cerner. Hiring for other

roles is broadly on track, with Kooth's fiscal rigour, transparency

and growth as a public company adding appeal to candidates, in a

market where many VC backed organisations are shedding staff to

reduce cash burn.

- A beta version of Kooth's new mobile app is live in two

counties in California as part of a 'soft launch' test. Over the

next few months we will be adding, iterating, and gathering

feedback from young people to help optimise the app and experience

ahead of go-live in January.

Beyond California, our pilot project in Pennsylvania reached a

significant milestone with almost 100,000 students having access to

Kooth in the school year, with 1 in 10 high school students having

used the platform, an uptake which surpassed our expectations based

on our UK experience.

In the UK, following on from the reorganisation of NHS England

from 135 Care Commissioning Groups into 42 Integrated Care Systems

("ICSs"), the headwinds in commissioning remain challenging, as

ICSs adapt to a new funding environment. In 2023/24, ICSs must

deliver 6% in real term efficiency savings, at a time when there is

a 16% annual increase in demand for mental health support.

While Kooth is an advocate for digital transformation to address

this challenge, we have seen Commissioners faced with tough

short-term decisions to divert funds into acute care and reduce

investments elsewhere. This is a challenge being experienced across

the industry and is not unique to Kooth. While we have seen an

increase in contracts that expand upon renewal to 52% (2022: 32%),

gains were offset by GBP2.4m of churn, a combination of funding

unavailable to continue pilot contracts, reductions as contracts

consolidated and increased competition. Overall net revenue

retention was 100% (2022: 107%).

In response to the current commissioning environment, we have

used our market leading position to take action and better position

ourselves for the future:

-- We have restructured our commercial team with a focus on

adding seniority and stakeholder management to engage NHS

commissioners and Integrated Care Boards ("ICBs").

-- We have grown and invested further in both our

commissioner-marketing and user-marketing teams.

-- We have launched an Integrated Digital Pathway ("IDP")

service to help reduce pressure on CAMHS and IAPT services by

providing support to individuals while on a waiting list, with the

goal of discharging individuals if appropriate, or preventing

further deterioration while awaiting treatment. We are currently

piloting this unique service in two regions.

Management believes that these actions will help Kooth respond

to the long-term opportunity that remains in helping ICSs to

deliver on their vision to transform healthcare services, focus on

prevention, and support the population health of their regions.

Kooth Adult (UK)

As a result of the pressures described above, our Kooth Adult

services have been impacted more so than our service for children

and young people, with ARR standing at GBP2.6m (FY2022: GBP3.0m).

This is primarily due to newer contracts not being continued after

a first year of piloting, as local commissioners seek to make

budget available for acute service delivery.

Kooth Children and Young People (UK)

In contrast to the challenging commissioning environment in

England, Kooth continues to expand in Scotland with new commissions

in East Ayrshire, Inverclyde and North Lanarkshire.

From a product/service perspective, we anticipate strong

interest from both children and young people, and commissioners in

learning how our enhanced platform could better serve their needs.

When California is live we intend to use this showcase to better

demonstrate the step change that is possible through digital

transformation in delivering a population-wide mental health

strategy.

Current trading and outlook

Kooth will continue to invest significantly in its technology

platform, systems and talent to deliver on our next generation

platform for California. We will then bring these innovations to

all US and UK customers to deliver enhanced support for all.

We continue to see both US State governments and Medicaid payers

recognise the need to invest further in youth mental health and are

optimistic about the significant opportunity that Kooth has in the

US. For the UK, we expect the current situation to remain for some

time, with our focus being on continuing to demonstrate the impact

and savings that result when Kooth is commissioned in a region.

The Group remains confident of delivering revenue for the full

year in line with our revised market guidance of no less than GBP34

million.

Our robust balance sheet enables us to invest to meet long-term,

increasing demand for Kooth's services. We will continue this

investment in our talent and technology to enable us to scale up to

tackle what is one of the world's biggest challenges.

Tim Barker

Chief Executive

Chief Financial Officer's review

Kooth delivered a strong performance in the period supported by

an increase across revenue and annual recurring revenue, a good

gross margin as well as continuing to invest in our platform and

the business for the half year ended 30 June 2023 as compared to

the six months ended 30 June 2022.

Key Performance Indicators

Total Revenue

GBP11.7m GBP9.0m GBP8.0m GBP5.9m

H1 2023 H1 2022 H1 2021 H1 2020

As we continue to invest in and grow our business, revenue

growth demonstrates the progress we are making.

Annual Recurring Revenue

GBP21.4m GBP18.5m GBP16.6m GBP13.1m

H1 2023 H1 2022 H1 2021 H1 2020

Annual Recurring Revenue ("ARR") is the annualised revenue of

customers engaged or closed as at the period end and is an

indication of the upcoming annual value of the recurring revenue.

This is used by management to monitor the long term revenue growth

of the business.

Gross Margin

66.8% 68.4% 69.4% 69.6%

H1 2023 H1 2022 H1 2021 H1 2020

Gross Profit as a percentage of revenue. Direct costs are the

costs of our practitioners directly involved in the delivery of our

services.

Adjusted EBITDA

GBP0.0m GBP0.5m GBP1.1m GBP0.5m

H1 2023 H1 2022 H1 2021 H1 2020

Earnings before interest, tax, depreciation and amortisation in

the period, adjusted for share based payments and exceptional

costs. This metric provides a more comparable indication of the

Group's core business performance by removing the impact of

non-trading items that are reported separately.

Number of customers

149 141 142 104

H1 2023 H1 2022 H1 2021 H1 2020

The total number of live contracts with customers. As the NHS

finalised the consolidation from 135 Clinical Commissioning Groups

to 42 Integrated Care Systems in the last year, we are seeing a

shift to fewer, larger contracts spanning the whole population

within an ICS region.

Service user logins

1.4m 1.4m 1.2m 1.0m

H1 2023 H1 2022 H1 2021 H1 2020

The number of logins to Kooth from users, demonstrating uptake

of our service.

Revenue

Revenue increased by 29% to GBP11.7m (2022 H1: GBP9.0m), Annual

Recurring Revenue grew by 16% to GBP21.4m (2022 H1: GBP18.5m), with

ten new contracts won in the first half of 2023. The revenue

increase is predominantly attributable to US revenue of GBP1.8m in

H1 2023 (2022 H1: GBPNil) where we now have three contracts and

included non-recurring revenue from the state of California for

one-off research and pilot study work. This led to a slight

decrease in recurring revenue (which comprises income invoiced for

services that are repeatable, consumed and delivered on a monthly

basis over the term of a customer contract) as a percentage of

overall revenue from 95% to 94%.

Churn was 13% giving net revenue retention (measured by the

total value of on-going ARR at the period-end from clients in place

12 months earlier as a percentage of the opening ARR from those

clients) for the period to 30 June 2023 of 100%. This has decreased

from 107% recorded in H1 2022 which is a result of an increase in

churn within our English contracts where we are seeing the impact

of funding being redirected to more acute care, a resizing of pilot

adult contracts and a slowdown in uplifts as well as budgetary

pressures as the NHS transitioned from a CCG to ICS structure.

Gross Profit

Gross Profit increased 26% from GBP6.2m to GBP7.8m with gross

margin slightly down at 66.8% (2022 H1: 68.4%). Direct costs are

the costs of the practitioners directly involved in the delivery of

our services, a total of 251 at the period-end (2022 H1: 213

heads). Gross margin dropped in the UK as salary increases at the

start of 2023 reflected inflationary pressures and we took a

decision to enhance contract performance for the protection of

longer-term growth. These were partially offset by the end of the

1.25% Health and Social Care Levy and a positive mix impact as our

new US contracts ramped up.

Adjusted EBITDA

Adjusted EBITDA in the period decreased from GBP0.5m to GBP0.01m

with an increased gross profit offset by a 38% increase in

administrative expenses (excluding amortisation, depreciation and

share based payments). Whilst UK costs increased in line with

salary inflation and revenue growth requiring increased promotion

spend, the majority of the increase related to the build out of the

US teams supporting our Pennsylvania and California contracts.

The total charge for share based payments in the period was

GBP0.4m (2022 H1: GBP0.02m). The increase reflects the annual issue

of three year grants to all staff and a credit in 2022 following a

reassessment of those grants subject to performance criteria.

Depreciation and amortisation increased to GBP1.5m (2022 H1

GBP1.1m) as capital expenditure commenced on the US platform

build.

Taxation

The overall tax credit for the six months ended 30 June 2023

(GBP1.2m) and 2022 (GBP0.2m) relate to Research and Development

expenditure credits in addition to the movement in the deferred tax

asset with the increase reflecting greater R&D spend and an

increase in the effective tax rate on losses.

Loss after tax

The Group loss after tax for the period was GBP0.5m (2022 H1:

GBP0.3m).

Balance Sheet

The strength of the Group's balance sheet with net assets of

GBP10.6m (30 June 2022: GBP10.6m), plus a successful gross

fundraise of GBP10m post half year end, and high levels of

recurring revenue provide the Group with financial strength to

execute on its investment strategy which continues to focus on US

business development and platform investment.

Cash flow and financing

Cash outflow during the six months was GBP2.6m (2022 H1: GBP1.2m

inflow). The focus on US platform investment gave rise to capital

expenditure of GBP3.5m (2022 H1: GBP1.3m), offset by cash inflows

from operating activities of GBP0.8m including receipt of an

R&D government tax credit of GBP0.6m giving a net cash position

at 30 June 2023 of GBP5.9m (2022 H1: GBP8.3m).

The Group remains debt free.

Forward-looking statements

Certain statements in this half year report are forward looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to have been correct.

Because these statements involve risks and uncertainties, actual

results may differ materially from those expressed or implied by

these forward-looking statements.

Dividends

The Group's intention in the short to medium term is to invest

in order to deliver capital growth for shareholders. The Board has

not recommended an interim dividend payment in respect of the six

months ended 30 June 2023 (2022: GBPnil) and does not anticipate

recommending a dividend within the next year but may do so in

future years.

Sanjay Jawa

Chief Financial Officer

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 8 11,660 9,022 20,120

Cost of sales (3,872) (2,852) (6,265)

Gross profit 7,788 6,170 13,855

Administrative expenses (9,606) (6,758) (14,767)

Operating loss (1,818) (588) (912)

Analysed as:

Adjusted EBITDA 9 539 1,612

Depreciation & amortisation 11 (1,451) (1,109) (2,232)

Share based payment expense (376) (18) (292)

Operating loss (1,818) (588) (912)

------------------------------- ---- -------------- -------------- ------------

Interest income 91 17 81

Loss before tax (1,727) (571) (831)

Tax 9 1,202 229 115

Total comprehensive loss for

the period (525) (342) (716)

-------------- -------------- ------------

Loss per share - basic (GBP) 10 (0.02) (0.01) (0.02)

Loss per share - diluted (GBP) 10 (0.02) (0.01) (0.02)

Condensed Consolidated Balance Sheet

As at 30 June 2023

31 December

30 June 2023 30 June 2022 2022

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Goodwill 511 511 511

Development costs 11 5,794 3,075 3,681

Right of use asset 53 - 68

Property, plant and equipment 150 96 122

Deferred tax asset 1,626 420 -

Total non-current assets 8,134 4,102 4,382

Current assets

Trade and other receivables 12 2,355 2,632 2,618

Contract assets 180 426 649

Cash and cash equivalents 5,850 8,310 8,492

Total current assets 8,385 11,368 11,759

Total assets 16,519 15,470 16,141

Liabilities

Current liabilities

Trade payables (1,047) (331) (680)

Contract liabilities (3,096) (2,797) (2,583)

Lease liability (54) - (68)

Accruals and other creditors (913) (737) (977)

Deferred tax liabilities - - (348)

Tax liabilities (769) (956) (967)

Total current liabilities (5,879) (4,821) (5,623)

Net current assets 2,506 6,547 6,136

Net assets 10,640 10,649 10,518

------------ ------------ -----------

Equity

Share capital 1,653 1,653 1,653

Share premium account 14,229 14,229 14,229

Retained earnings (3,120) (2,221) (2,595)

Share-based payment reserve 1,867 977 1,221

Capital redemption reserve 115 115 115

Merger reserve (4,104) (4,104) (4,104)

Total equity 10,640 10,649 10,518

------------ ------------ -----------

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Loss for the period (525) (342) (716)

Adjusted for:

Depreciation & amortisation 1,451 1,109 2,232

Income tax received 569 330 330

Share based payment expense 376 18 292

Tax income recognised (1,202) (229) (115)

Interest income (91) - (81)

Movements in working capital:

(Increase) / decrease in trade and other

receivables 651 (369) 78

Increase / (decrease) in trade and other

payables (384) 2,009 2,364

---------- ---------- ------------

Net cashflow from operating activities 845 2,527 4,384

Cash flows from investing activities

Purchase of property, plant and equipment (70) (28) (100)

Additions to intangible assets (3,508) (1,268) (2,952)

---------- ---------- ------------

Net cash used in investing activities (3,578) (1,296) (3,052)

Cash flows from financing activities

Interest income 91 - 81

---------- ---------- ------------

Net cash from financing activities 91 - 81

Net increase / (decrease) in cash and

cash equivalents (2,642) 1,231 1,413

Cash and cash equivalents at the beginning

of the period 8,492 7,079 7,079

---------- ---------- ------------

Cash and cash equivalents at the end

of the period 5,850 8,310 8,492

---------- ---------- ------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Share Share Share Retained Capital Merger Total

Capital Premium Based earnings Redemption reserve Equity

Payment Reserve

Reserve

Balance at 1 January 2022 1,653 14,229 959 (1,879) 115 (4,104) 10,973

Share based payments - - 18 - - - 18

Total comprehensive income

for the period - - - (342) - - (342)

-------- -------- -------- --------- ----------- -------- -------

As at 30 June 2022 1,653 14,229 977 (2,221) 115 (4,104) 10,649

Balance at 1 July 2022 1,653 14,229 977 (2,221) 115 (4,104) 10,649

Share based payments - - 244 - - - 244

Total comprehensive income

for the period - - - (374) - - (374)

-------- -------- -------- --------- ----------- -------- -------

As at 31 December 2022 1,653 14,229 1,221 (2,595) 115 (4,104) 10,519

Balance at 1 January 2023 1,653 14,229 1,221 (2,595) 115 (4,104) 10,519

Share based payments - - 646 - - - 646

Total comprehensive income

for the period - - - (525) - - (525)

-------- -------- -------- --------- ----------- -------- -------

As at 30 June 2023 1,653 14,229 1,867 (3,120) 115 (4,104) 10,640

Notes to the half year financial statements

1. General information

The unaudited interim consolidated financial statements for the

six months ended 30 June 2023 and the six months ended 30 June 2022

do not constitute statutory accounts within the meaning of Section

434 of the Companies Act 2006. Statutory accounts for the year

ended 31 December 2022 were approved by the Board of Directors on 3

April 2023 and delivered to the Registrar of Companies. The

auditor's report on those accounts was unqualified, did not contain

an emphasis of matter paragraph and did not contain any statement

under Section 498 (2) or (3) of the Companies Act 2006.

These condensed half year financial statements were approved for

issue by the Board of Directors on 21 September 2023.

2. Basis of preparation

This unaudited condensed consolidated financial information

which incorporate the financial information of the Group, have been

prepared in accordance with Accounting Standard IAS 34 'Interim

Financial Reporting' as contained in UK - adopted International

Accounting Standards and IFRIC interpretations and with those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS.

The interim condensed consolidated financial statements do not

include all the information and disclosures required in the annual

financial statements and should be read in conjunction with the

Group's annual consolidated financial statements prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 for the year ended

31 December 2022.

Trading for the half year ended 30 June 2023 is aligned with the

Board's expectations, and expectations for the full year remain

unchanged. Further details are given in the CEO's overview, the

operational review and the financial review.

The Group is in a net asset position of GBP10.6m as at 30 June

2023 (2022: net assets of GBP10.6m) and has no debt facilities in

place. Management have prepared forecasts up until 12 months from

the date of approval of these financial statements which have been

approved by the Board, and after enquiry and review of these

forecasts and other available financial information, the Directors

have formed the conclusion that the Group has adequate resources to

continue to operate for the foreseeable future and that it is

therefore appropriate to continue to adopt the going concern basis

of accounting in the preparation of these interim condensed

consolidated half year financial statements.

The financial information is presented in sterling, which is the

functional currency of Kooth plc. All financial information

presented has been rounded to the nearest thousand.

3. Accounting policies

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's annual

report and accounts for the year ended 31 December 2022.

Current taxes on income in the half year period are accrued

using the tax rates that would be applicable to expected total

annual profits. Deferred taxes on income are calculated based on

the standard rates that are enacted as at the balance sheet date

.

4. Critical accounting judgements and key sources of estimation

uncertainty

Any critical accounting judgements and key sources of estimation

uncertainty that carry a significant risk of material change to the

carrying value of assets and liabilities within the next year are

the same as those applied in the 2022 Group Annual Report.

5. Principal risks and uncertainties

The 2022 Group annual report and accounts describes the

principal risks and uncertainties that could impact the Group's

performance. These risks primarily relate to system outages,

safeguarding incidents, cyber security and data protection and

clinical safety. These remain unchanged since the annual report was

published and are not expected to change for the remaining six

months of the financial year.

The Group actively manages these risks through risk management

procedures and actions are taken to mitigate risk wherever

possible.

6. Financial risk management

The Group is exposed to financial risks including market risk,

currency risk, credit risk and liquidity risk.

These interim condensed consolidated financial statements do not

include all financial risk management information and disclosures

required in the annual financial statements and therefore should be

read in conjunction with the 2022 Group annual report and

accounts.

7. Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the executive directors that make

strategic decisions. Kooth plc opened its first international

subsidiary in the USA at the start of 2022. The Group won a

contract with Pennsylvania Department of Human Services in

September 2022 and a contract with the Department of Healthcare

Services in California which was finalised in July 2023, and

launches at the start of 2024. Segmental reporting of the USA

operation is not deemed appropriate at this stage as operations

remain relatively small in comparison to UK operations. Segmental

reporting may be deemed to be appropriate for the full year 2023

results.

8. Revenue analysis

Revenue relates to the provision of online counselling

services.

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Provision of online counselling

- UK 9,817 9,022 18,648

Provision of online counselling

- US 1,843 - 1,472

---------- ---------- ------------

11,660 9,022 20,120

---------- ---------- ------------

9. Taxation

The income tax credit recognised of GBP1.2m (2022 H1: GBP0.2m)

reflects management's estimate of the tax credit for the current

period. This calculation takes into consideration the estimated

taxable loss incurred from operational activities during the

period, as well as additional relief under the UK R&D scheme.

The assessment utilises the average UK corporation tax rate for the

current financial year of 23.5% (2022: 19%).

10. Earnings per share (EPS)

The calculation of basic and diluted EPS is based on the

following earnings and number of shares:

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Earnings used in calculation of earnings

per share

Loss for the purposes of basic and

diluted loss per share being net loss

attributable to owners of the Company (525) (342) (716)

Number of shares

Weighted average number of ordinary

shares for the purposes of basic and

diluted earnings per share 33,055,776 33,055,776 33,055,776

Loss per share (GBP) (0.02) (0.01) (0.02)

The loss per ordinary share and diluted loss per share are equal

because share options are only included in the calculation of

diluted earnings per share if their issue would decrease the net

profit per share. The number of potentially dilutive shares not

included in the calculation above due to being anti-dilutive in the

periods presented was 1,943,400 (2022 H1: 1,011,867).

11. Development costs

GBP'000

Cost

At 1 January 2022 7,363

Additions 1,268

At 30 June 2022 8,631

Additions 1,684

At 31 December 2022 10,315

Additions 3,508

-------

At 30 June 2023 13,823

-------

Amortisation

At 1 January 2022 (4,496)

Amortisation (1,060)

At 30 June 2022 (5,556)

Amortisation (1,078)

At 31 December 2022 (6,634)

Amortisation (1,395)

-------

At 30 June 2023 (8,029)

-------

Carrying amount

At 1 January 2022 2,867

At 30 June 2022 3,075

At 31 December 2022 3,681

-------

At 30 June 2023 5,794

-------

12. Trade and other receivables

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Trade receivables 1,767 1,909 1,110

Prepayments and other receivables 588 723 1,508

-------------- -------------- ------------

2,355 2,632 2,618

-------------- -------------- ------------

All amounts shown above are short term. The net carrying value

of trade receivables is considered a reasonable approximation of

fair value.

13. Post balance sheet events

A significant four year US contract was finalised in July 2023

with the Department of Healthcare Services of California for a

minimum net revenue value of $188m.

In July 2023, the Group completed an equity fundraise with gross

proceeds of GBP10m to accelerate investment within the

business.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDCUXDDGXG

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

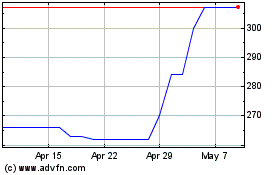

Kooth (LSE:KOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Kooth (LSE:KOO)

Historical Stock Chart

From Jan 2024 to Jan 2025