Kooth PLC Awards under Incentive Plan & PDMR dealing (5620R)

October 27 2023 - 4:19AM

UK Regulatory

TIDMKOO

RNS Number : 5620R

Kooth PLC

27 October 2023

27 October 2023

Kooth plc

("Kooth" or the "Company" or the "Group")

Awards under Long Term Incentive Plan and PDMR dealing

Kooth (AIM: KOO), a leading provider of digital mental health

services announces the third grant of options to Executive

Directors and certain senior management under the Long-Term

Incentive Plan ("LTIP") as outlined in Kooth's admission document

dated 26 August 2020.

The LTIP was established to incentivise management to deliver

long-term value creation for shareholders and ensure alignment with

shareholder interests.

Background

The LTIP is a discretionary share plan. Under the LTIP the Board

may, within certain limits and subject to any applicable

performance conditions, grant to eligible employees (i) options

over Shares ("LTIP Options") and/or (ii) an immediate award of

Shares, subject to restrictions or forfeiture (together "LTIP

Awards").

Award size, performance conditions and dilution

On 27 October 2023, options over 340,000 shares in aggregate

(the "2023 Awards") were granted under the LTIP, including those

set out below which were granted to directors:

Director / PDMR Role Number of shares over

which 2023 Awards made

Tim Barker Chief Executive Officer 71,197

------------------------- ------------------------

Sanjay Jawa Chief Financial Officer 59,331

------------------------- ------------------------

Kate Newhouse Chief Operating Officer 59,331

------------------------- ------------------------

The vesting of the 2023 Awards is subject to the achievement of

performance conditions based upon the growth in Kooth's adjusted

EBITDA over the three-year performance period commencing 1 January

2023 and the Company's total shareholder return over the three-year

performance period commencing 2 September 2023. The awards will

vest (subject to the achievement of the performance conditions) on

2 September 2026. To the extent they vest, awards held by Executive

Directors will be subject to a post-vesting holding period of two

years. The awards granted to other senior management will be

released at vesting.

Each award has been granted in the form of an option with an

exercise price per share of GBP0.05.

If the maximum targets are met in 2026, the total dilutive

impact of the 2023 Awards will be c. 0.9%. The maximum aggregate

dilutive effect of awards currently in issue that can be exercised

under the LTIP remains below 10% of issued share capital.

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Tim Barker

-------------------------- --------------------------------------

2 Reason for the notification

------------------------------------------------------------------

a) Position/status Chief Executive Officer

-------------------------- --------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------

a) Name Kooth plc

-------------------------- --------------------------------------

b) LEI 2138001YLGO1L8UYOM90

-------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------

a) Description of the Ordinary shares of GBP0.001 each

financial instrument,

type of instrument ISIN: GB00BMCZLK30

Identification code

-------------------------- --------------------------------------

b) Nature of the transaction Grant of options over ordinary shares

under the Company's LTIP

-------------------------- --------------------------------------

c) Price(s) and volume(s) 71,197 at nil price point

-------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume n/a

- Price

-------------------------- --------------------------------------

e) Date of the transaction 27 October 2023

-------------------------- --------------------------------------

f) Place of the transaction Off market transaction

-------------------------- --------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Sanjay Jawa

-------------------------- --------------------------------------

2 Reason for the notification

------------------------------------------------------------------

a) Position/status Chief Financial Officer

-------------------------- --------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------

a) Name Kooth plc

-------------------------- --------------------------------------

b) LEI 2138001YLGO1L8UYOM90

-------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------

a) Description of the Ordinary shares of GBP0.001 each

financial instrument,

type of instrument ISIN: GB00BMCZLK30

Identification code

-------------------------- --------------------------------------

b) Nature of the transaction Grant of options over ordinary shares

under the Company's LTIP

-------------------------- --------------------------------------

c) Price(s) and volume(s) 59,331 at nil price point

-------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume n/a

- Price

-------------------------- --------------------------------------

e) Date of the transaction 27 October 2023

-------------------------- --------------------------------------

f) Place of the transaction Off market transaction

-------------------------- --------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Kate Newhouse

-------------------------- --------------------------------------

2 Reason for the notification

------------------------------------------------------------------

a) Position/status Chief Operating Officer

-------------------------- --------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------

a) Name Kooth plc

-------------------------- --------------------------------------

b) LEI 2138001YLGO1L8UYOM90

-------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------

a) Description of the Ordinary shares of GBP0.001 each

financial instrument,

type of instrument ISIN: GB00BMCZLK30

Identification code

-------------------------- --------------------------------------

b) Nature of the transaction Grant of options over ordinary shares

under the Company's LTIP

-------------------------- --------------------------------------

c) Price(s) and volume(s) 59,331 at nil price point

-------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume n/a

- Price

-------------------------- --------------------------------------

e) Date of the transaction 27 October 2023

-------------------------- --------------------------------------

f) Place of the transaction Off market transaction

-------------------------- --------------------------------------

- Ends -

Enquires:

Kooth plc investorrelations@kooth.com

Tim Barker, CEO

Sanjay Jawa, CFO

Stifel, Nominated Adviser and Sole

Broker

Ben Maddison, Nick Adams, Nicholas

Harland, Richard Short +44 (0) 20 7710 7600

FTI Consulting

Jamie Ricketts, Alex Shaw, Usama kooth@fticonsulting.com

Ali

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHUBAKROVURURA

(END) Dow Jones Newswires

October 27, 2023 05:19 ET (09:19 GMT)

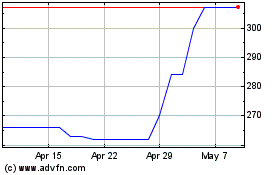

Kooth (LSE:KOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Kooth (LSE:KOO)

Historical Stock Chart

From Jan 2024 to Jan 2025