TIDMLVCG

RNS Number : 1401M

Live Company Group PLC

17 September 2021

17 September 2021

LIVE COMPANY GROUP PLC

("LVCG", the "Company" or the "Group")

HALF-YEARLY RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Live Company Group Plc (AIM: LVCG), a leading live events and

entertainment group, announces its half-yearly results for the

six-month period ended 30 June 2021.

HIGHLIGHTS

- Approval by the FIA and Formula E of the Formula E Cape Town race for February 2022.

- Return of BRICKLIVE events with 28 events confirmed for 2021

despite lockdown for first six months of the year.

- Investment in START.ART and soft launch of the online art platform (www.start.art)

David Ciclitira, Chairman, said:

"I am delighted that the green shoots of recovery are starting

to come through, with 28 BRICKLIVE events confirmed for 2021, a

year when we and our clients were unable to operate for the first

six months; and with the confirmation of the Formula E Cape Town

race by the FIA and Formula E for February 2022, we are well placed

to benefit from that recovery."

Enquiries:

Live Company Group Plc Tel: 020 7225 2000

Beaumont Cornish Limited (Nominated Adviser) Tel: 020 7628 3396

Monecor (London) Limited (Broker) Tel: 020 7392 1436

LIVE COMPANY GROUP

Live Company Group Plc ("LVCG", the "Company" or the "Group") is

a live events, entertainment and sports events company, that has

been trading on AIM since 2017.

The Group is divided into two divisions the first, BRICKLIVE,

consisting of a network of partner-driven fan-based and touring

shows using BRICKLIVE created content worldwide. The Company owns

the rights to BRICKLIVE - an interactive experience built around

the creative ethos of the world's most popular construction toy

bricks. The Group is an independent producer of BRICKLIVE and is

not associated with the LEGO Group.

The second, LCSE, manages a number of global sports,

entertainment and lifestyle events. LCSEs main focus for 2021 has

been the successful launch of the Formula E Cape Town race for

series 8 in 2022.

It also has a minority investment in Start Art Global Ltd an

on-line art and digital art platform (www.start.art).

Website: www.livecompanygroup.com .

CHAIRMAN'S STATEMENT

The first half of 2021 continued to be challenging for the Group

and the sector with lockdown continuing for some of our clients

well into June. Diversification of revenue remains a key part of

the Group strategy and the investment into START.ART, a digital art

platform, cements this.

BRICKLIVE

In H1 2021, our business continued to be severely impacted by

continued COVID-19 restrictions. Despite this we capitalised on the

global nature of our business and we opened BRICKLIVE Supersized

Creatures in March at the John Ball Zoo in Michigan, USA.

Supersized Creatures will remain in the USA and after Michigan will

travel on to Naples Zoo in Florida in November this year (a

contract we signed in April 2021) remaining there until April 2022

- the second time we are working with Naples Zoo. BRICKLIVE Animal

Paradise is also in the USA and about to open in, Houston, its

first non zoo destination in North America and I believe the USA

will continue to be an important strategic market for the Group

going forward.

While the number of events pre the end of lockdown were

relatively low we started to see a return to business in June and

July. In total 28 events will have taken place or are to take place

in 2021 and 6 are contracted for 2022 (some of which are

postponements from 2021).

Projects we are particularly pleased with include a climate

change model for the Environment Agency and a major new contract we

announced for Singapore Zoo - our first in Singapore and our first

time at a zoo in Asia.

LCSE

It has been a busy six months for LCSE with the majority of work

being focussed on the completion of the Formula E approvals and

preparation for the Cape Town based race. In July 2021 we announced

that the FIA and Formula E ratified the 2021/2022 calendar to

include South Africa (Cape Town) as the fourth race in Series 8.

The team in South Africa led by Bruce Parker-Forsyth have been

extremely busy finalising the arrangements to ensure a world class

event in February 2022.

Additionally, the Cape Town Cycle Tour is now set to take place

in October 2021 and then again in March 2022. LCSE has a long term

and long standing contract and relationship with Pick 'n Pay the

presenting sponsor of this event.

As South Africa comes out of lockdown and advances its

vaccination programme the team also managed to secure a contract to

manage the Discovery Vaccination Centre of Hope at the Cape Town

International Convention Centre in Cape Town - showing their

ability to seek alternative revenue streams.

INVESTMENT IN START.ART

In May the Company announced that it had subscribed to a

non-controlling stake in Start Art Global Ltd (START.Art) an online

art sales and news platform. The subscription of 16.3% of issued

share capital has an option to increase to 20% based on an agreed

valuation formula within the next 6 months.

START.ART, which soft launched in June 2021, is an online art

sales platform with several potential revenue streams including

non-fungible tokens (NFTs). A collaboration with three K-Pop stars

- Henry Lau, Ohnim (Mino) and yooyeon (Seungyoon) as featured

artists selling limited edition prints and merchandise has meant

that START.ART is already revenue producing.

A hard launch is set for 13 October 2021 at START art fair at

the Saatchi Gallery, London, and will see more celebrity artists,

extended merchandise lines and additional features.

CORPORATE

Chairman's Loan

In February 2021 the extension of the loan terms for my

Chairman's loan were announced and in June I agreed to convert a

further GBP30,000 of my loan into equity which was issued post

balance sheet.

Funding

In January 2021 a general meeting was held granting the

Directors authority to issue shares and warrants in accordance with

the December 2020 share placing of GBP600,000 at 5p per Ordinary

share.

In May 2021 the Company raised a further GBP1.5 million at 5p

per Ordinary share for the investment in START.ART and additional

working capital for the BRICKLIVE and LCSE divisions. The placing

and investment were approved by a general meeting in May 2021.

Board Changes

In February 2021 we announced the resignation of three members

of our Board. We committed to shareholders that we would nominate

an additional independent director onto the Board and to that end

we announced in July 2021 the addition of Stephen Birrell as an

independent non-executive director.

Stephen is a seasoned AIM director who brings a broad experience

of corporate governance, project management, stakeholder relations,

joint venture management and business development. Additionally he

brings a passion and experience in business performance

optimisation and has a background in staging and promoting live

events. We are delighted that Stephen has joined the team and look

forward to working with him.

The full board review, announced in May 2021, is ongoing and we

anticipate this being completed by the end of October 2021.

The Next 18 Months

The last 18 months have been incredibly challenging as a direct

result of COVID-19. Looking forward into 2022 I am cautiously

optimistic based on the hunger for the BRICKLIVE content and the

diversity of our business into sports and entertainment. Whilst

uncertainty remains, I am cautiously optimistic that we can return

to a sustainable trading base.

I would like to take this opportunity to thank our staff who

have weathered the storm and our shareholders who remain

supportive. I am personally excited by our new areas of business

especially in the digital space and I look forward to updating

investors over the coming quarter.

David Ciclitira

Chairman

16 September 2021

FINANCIAL REVIEW

REVENUE AND OPERATIONS

The ongoing effects of COVID-19 continue to be felt across the

markets and geographies in which the Group operates resulting in

revenues significantly below pre COVID-19 levels.

Revenue for the six months to 30 June 2021, including LCSE was

GBP622,000, 36% down on the six months to 30 June 2020 (which

included two full months of pre COVID-19 trading), and 30% down on

the immediately preceding six months to 31 December 2020 reflecting

the increased uncertainty as COVID-19 restrictions were re-imposed

across the UK, EU and other geographic markets in which the Group

operates.

BRICKLIVE

Whilst the number of events, and thus revenue, was significantly

reduced by the impact of COVID-19, a material component of cost of

sales comprises depreciation on content assets which are not

dependent on the number of events or revenue. This together with

the higher operating costs of remaining COVID-19 compliant and the

more than 200% increase in international shipping costs resulted in

a gross loss for the six months to 30 June 2021 of GBP542,000 (six

months to June 2020 gross profit of GBP157,000).

The Group continued to take steps to control operating expenses,

reducing staff numbers by a further 15% since 31 December 2020, and

continues its participation in the Coronavirus Job Retention Scheme

('CJRS'), receiving grants in the six months to 30 June 2021

totalling GBP162,000 (six months to June 2020: GBP216,000).

The lifting of COVID-19 restrictions in the UK, albeit partly

offset by reintroduction of restrictions in other geographic

markets, sets an optimistic note for the second half of the year

particularly for BRICKLIVE Tours and Trails as zoos, shopping

centres and other visitor attractions return to full capacity.

LCSE

Market conditions in South Africa remain challenging due to the

continued prevalence of COVID-19 with a number of events planned

for the six months to 30 June 2021, including the Cape Town Cycle

Tour, (for which LCSE represents Pick n Pay the event presenting

partner), are now expected to take place in the second half of the

year.

Preparation continues for the inaugural Cape Town E-Prix which

has now been confirmed for Race 4, Series 8 of the ABB FIA Formula

E World Championship and due to take place on 26 February 2022.

LCSE is the project manager and delivery partner for E Movement

(Pty) Limited, the race promoter and the Group, via its 100%

subsidiary E Movement Holdings Limited (EMHL), is the exclusive

worldwide representative for the commercial and sponsorship

rights.

START.Art

In May 2021 the Company acquired a minority interest of 16.3% in

START.Art, for GBP1,000,000, funded from the proceeds of the

GBP1,500,000 share placing completed on 24 May 2021. Prior to the

transaction 100% of the issued share capital of START.ART was owned

by David Ciclitira and Ranjit Murugason.

The investment gives the Group access to digital and

merchandising expertise as well as a broader base more able to

withstand future market instability. The START Art platform

(www.start.art) was launched in June 2021.

PXEBITDA

The Group uses PXEBITDA (Pre-Exceptional Item EBITDA) to allow

the users of the consolidated financial statements to gain a

clearer understanding of the underlying performance of the business

without the impact of one off non-recurring costs of an exceptional

nature.

Six months to Six months to

Consolidated 30 June 2021 30 June 2020

GBP'000 GBP'000

Revenue 622 968

Pre-Exceptional items EBITDA (1,349) (969)

Impairment of investments and goodwill - (3,497)

Share option and warrant charge (139) (139)

Other exceptional costs (33) (345)

-------------- --------------

Total Exceptional Items (172) (3,981)

-------------- --------------

Depreciation and amortisation expense (558) (393)

Finance costs (33) (28)

Loss after tax (2,112) (5,371)

-------------- --------------

Exceptional items

As set out in Note 3 exceptional items includes non-cash charges

of GBP139,000 being the share option and warrant charge (six months

to 30 June 2020: GBP3,636,000, being the share option and warrant

charge and impairment of investments and goodwill).

POST BALANCE SHEET EVENTS

In July 2021 the Company announced the issue of 600,000 Ordinary

1p shares to David Ciclitira in settlement of GBP30,000 of the

outstanding balance of his loan and 514,668 Ordinary 1p shares in

settlement of GBP25,733 of salary and fees due to employees,

Directors and suppliers.

Richard Collett

Finance Director

16 September 2021

UNAUDITED CONDENSED CONSOLIDATED INCOME STATEMENT FOR SIX MONTHS

TO 30 JUNE 2021

Notes 30 June 2021 30 June 2020

GBP'000 GBP'000

Revenue 2 622 968

Cost of sales (1,164) (811)

Gross (loss)/profit (542) 157

Administrative expenses

Foreign exchange (11) 28

Depreciation and amortisation of

non-financial assets (193) (59)

Other administrative expenses (1,161) (1,488)

Total administrative expenses (1,365) (1,520)

Operating loss before exceptional

items (1,907) (1,362)

Exceptional items 3 (172) (3,981)

Operating loss after exceptional

items (2,079) (5.343)

Finance costs (33) (28)

Loss for the period before tax (2,112) (5,371)

Taxation - -

Loss for the period after tax (2,112) (5,371)

Other comprehensive income - -

Total comprehensive income attributable

to the equity holders of the parent

company (2,112) (5,371)

------------- -------------

Loss per share

Basic and diluted 4 (1.8p) (6.7p)

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 30 JUNE 2021

Notes 30 June 2021 31 December 2020

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 6 3,910 4,144

Intangible assets 7 1,374 1,516

Right of use asset 200 231

Investments 8 1,000 -

Goodwill 896 896

Total non current assets 7,380 6,787

------------- -----------------

Current assets

Inventories 4,329 4,831

Trade and other receivables 524 404

Cash and cash equivalents 91 168

Total current assets 4,944 5,403

------------- -----------------

Total assets 12,324 12,190

------------- -----------------

Current liabilities

Borrowings 9 485 615

Trade and other payables 2,137 2,364

Lease liabilities 63 60

Deferred income and accruals 1,592 1,120

Total current liabilities 4,277 4,159

------------- -----------------

Net current assets 667 1,244

------------- -----------------

Non current liabilities

Deferred tax 644 644

Borrowings 1,397 1,430

Lease liabilities 156 188

2,197 2,262

------------- -----------------

Net assets 5,850 5,769

------------- -----------------

Equity

Share capital 10 5,544 5,165

Share premium 26,682 25,004

Other reserves (23,700) (23,697)

Own shares reserve (2,151) (2,151)

Merger reserve 14,472 14,472

Capital redemption reserve 5,034 5,034

Share option reserve 418 496

Retained earnings (20,449) (18,554)

Equity attributable to equity

holders of the parent 5,850 5,769

------------- -----------------

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASHFLOWS FOR THE

SIX MONTHSED 30 JUNE 2021

30 June 2021 30 June 2020

GBP'000 GBP'000

Cash flows from operating activities

Operating loss (1,907) (1,362)

Depreciation 385 358

Amortisation of trademarks 142 5

Depreciation of right of use assets 31 31

Corporation tax paid - (20)

Cash flow from exceptional items (33) (345)

Decrease in inventories 502 283

Increase in receivables (195) (242)

Increase in payables 895 1,182

Cash used in operations (180) (110)

------------- -------------

Cash flow from investing activities

Acquisition of investments (1,000) -

Acquisition of property, plant

and equipment (151) (595)

Net cash used in investing activities (1,151) (595)

------------- -------------

Cash flow from financing activities

Issue of equity 1,500 -

Repayment of lease liabilities (29) (27)

Proceeds from borrowings 143 750

Repayment of loans (237) -

Interest paid (33) (27)

Share issue costs (90) -

Net cash generated from financing

activities 1,254 696

------------- -------------

Net cash outflow (77) (9)

------------- -------------

Cash and cash equivalents at beginning

of the period 168 98

------------- -------------

Net decrease in cash and cash equivalents (77) (9)

------------- -------------

Cash and cash equivalents at end

of the period 91 89

------------- -------------

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS TO 30 JUNE 2021

Ordinary Share Reverse Forex and Merger Capital Option Retained Total

share premium acquisition other reserve redemption and earnings

capital reserve reserves reserve warrant

reserve

GBP.000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1

January

2020 4,878 23,480 (24,268) 572 14,067 5,034 218 (10,309) 13,672

Loss for

the

period - - - - - - - (5,371) (5,371)

Changes

in fair

value

from

bricks

used in

product

sales - - - - - - - (168) (168)

Equity

settled

payments 16 216 - - - - - - 232

Warrant

charge - - - - - - 27 - 27

Options

charge - - - - - - 111 - 111

As at 30

June

2020 4,894 23,696 (24,268) 572 14,067 5,034 356 (15,848) 8,503

---------- ---------- ------------ ---------- ---------- ----------- --------- ---------- --------

As at 1 January 2021 5,165 25,004 (24,268) (1,580) 14,472 5,034 496 (18,554) 5,769

Loss for the period - - - - - - - (2,112) (2,112)

Shares issued for cash 300 1,200 - - - - - - 1,500

Equity settled payments 79 568 - - - - - - 647

Warrant charge - - - - - - 28 - 28

Options charge - - - - - - (106) 217 111

Currency translation - - - (3) - - - - (3)

Share issue costs - (90) - - - - - - (90)

As at 30 June 2021 5,544 26,682 (24,268) (1,583) 14,472 5,034 418 (20,449) 5,850

------ ------- --------- -------- ------- ------ ------ --------- --------

NOTES TO THE FINANCIAL INFORMATION

1. Basis of preparation

The condensed consolidated interim financial report for the

half-year reporting period ended 30 June 2021 are unaudited and

have been prepared in accordance with Accounting Standard IAS 34

Interim Financial Reporting and the same accounting policies and

methods of computation are followed in the interim financial report

as compared with the most recent annual financial statements. They

do not constitute statutory accounts as defined in section 434 of

the Companies Act 2006. The financial statements for the year ended

31 December 2020 were prepared in accordance with International

Financial Reporting Standards as adopted by the EU. The report of

the auditor on those financial statements was unqualified and did

not draw attention to any matters by way of emphasis of matter.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2020 and any public announcements made by

the Live Company Group Plc during the interim reporting period.

1.1 Going Concern

The Directors have prepared trading and cash flow forecasts for

the Group up to and including the year ending 31 December 2025. The

forecasts incorporate a number of trading assumptions and show that

the Group has sufficient cash to meet its liabilities as they fall

due.

The Directors consider these forecasts to be realistic and they

have considered the continued impact of the COVID-19 pandemic, and

the measures taken to contain it. However, because the situation

regarding the COVID-19 outbreak and related containment measures is

constantly evolving, there can be no certainty in respect of these

cash flows, as tours and shows may continue to be delayed or

cancelled in the geographical locations in which the Group

operates. However, in the event that further funding is required

the Directors consider that both further debt finance or an equity

fund raise are viable options at the date of signing these

condensed consolidated interim financial statements.

2. Segment Information

The Group has three operating segments, namely: BRICKLIVE Tours

and Trails (previously Tours, Events, Shows, Licences and Content

rental fees), BRICKLIVE Models and Sets (previously Product and

Content Sales) and the new Sports and Entertainment division (LCSE)

formed in December 2020.

BRICKLIVE Models and BRICKLIVE Tours and Sports and Unallocated Total

Sets Trails Entertainment

Six months to 30 June GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

2020

Revenue 233 735 - - 968

Cost of sales (195) (616) - - (811)

Administrative

expenses* (230) (726) - (563) (1,520)

Finance costs - - - (28) (27)

Exceptional items - - - (3,981) (3,981)

Segment loss for

period (192) (607) - (4,572) (5,371)

---------------------- --------------------- --------------------- ---------------------- ------------ --------

PXEBITDA (183) (244) - (542) (969)

---------------------- --------------------- --------------------- ---------------------- ------------ --------

BRICKLIVE Models and BRICKLIVE Tours and Sports and Unallocated Total

Sets Trails Entertainment

Six months to 30 June GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

2021

Revenue 381 167 74 - 622

Cost of sales (554) (609) (1) - (1,164)

Administrative

expenses* (353) (154) (149) (709) (1,365)

Finance costs - - - (33) (33)

Exceptional items - - - (172) (172)

Segment loss for

period (526) (596) (76) (914) (2,112)

---------------------- --------------------- --------------------- ---------------------- ------------ --------

PXEBITDA (470) (205) (76) (598) (1,349)

---------------------- --------------------- --------------------- ---------------------- ------------ --------

* Other Administrative Expenses which are not directly related

to the running of the Plc are allocated to each segment in

proportion to recognised revenue.

The Group uses PXEBITDA as a measure to assess the performance

of the segments. This excludes discontinued operations and the

effects of significant items of expenditure which may have an

impact on the quality of earnings such as restructuring costs,

fundraising costs, legal expenses and impairments when the

impairment is the result of an isolated, non-recurring event.

Interest expenditure is not allocated to segments as this type

of activity is driven by the central treasury function which

manages the cash position of the Group.

3. Exceptional items

30 June 2021 30 June 2020

GBP'000 GBP'000

Share option and warrant charge 139 139

Transactional and reorganisational costs 33 345

Impairment of associate and intangible assets - 3,497

172 3,981

------------- -------------

Share option and warrant charge

The Group uses the Black-Scholes model to value its share

options and warrants. Certain judgement is required in determining

the assumptions such as the risk-free interest rate and standard

deviation rate used. The charge for the six months to 30 June 2021

is GBP139,000 (six months to 30 June 2020: GBP139,000).

In January 2021 4,075,000 warrants with an exercise price of 15p

were repriced to an exercise price of 10p, the variation did not

result in an additional charge to the condensed consolidated income

statement.

In May 2021 3,953,840 warrants with an exercise price of 80p

were repriced to an exercise price of 15p, the variation did not

result in an additional charge to the condensed consolidated income

statement.

During the six months to 30 June 2021 1,341,889 options lapsed

resulting in a reclassification of GBP217,000 from share option

reserve to retained earnings (six months to June 2020: GBPnil).

Transactional and reorganisational costs

Transactional costs relate to the acquisition of a minority

interest in Start Art Global Ltd and GBP1,500,000 placing in May

2021 (RNS Number : 3348X 04 May 2021).

Impairment of associate and intangible assets

The Directors have considered the carrying value of investments,

intangible assets and the share of net assets of associates in

light of the continued impact of COVID-19 and circumstances

prevailing in the markets in which the Group operates and have

determined no impairment is necessary at 30 June 2021.

4. Earnings per share

The basic loss per share is calculated by dividing the loss

attributable to equity shareholders by the weighted average number

of shares in issue during the period. In calculating the diluted

loss per share, any outstanding share options and warrants are

considered where the impact of these is dilutive.

Six months to Six months to

30 June 2021 30 June 2020

Loss for the period after tax (GBP'000) (2,112) (5,371)

Weighted average number of shares in issue (000's) 115,381 79,875

Basic and diluted loss per share* (pence) (1.8p) (6.7p)

* Diluted loss per share in both 2021 and 2020 are the same as

basic loss per share, as the options in issue had no dilutive

effect on continuing operations.

5. Dividends

No dividend was recommended or paid for the period under

review.

6. Property, plant and equipment

Show Content Other Total

30 June 31 December 30 June 31 December 30 June 31 December

2021 2020 2021 2020 2021 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- ------------ -------- ------------ -------- ------------

Cost

Cost at start 5,557 5,016 177 178 5,734 5,194

Additions 149 921 2 14 151 935

Disposals - (380) - (15) - (395)

5,706 5,557 179 177 5,885 5,734

-------- ------------ -------- ------------ -------- ------------

Depreciation

At start 1,488 971 102 71 1,590 1,042

Charge 366 705 19 46 385 751

Disposals - (188) - (15) - (203)

1,854 1,488 121 102 1,975 1,590

-------- ------------ -------- ------------ -------- ------------

Net book value

at end 3,852 4,069 58 75 3,910 4,144

Net book value

at start 4,069 4,045 75 107 4,144 4,152

7. Intangible assets

30 June 2021 31 December 2020

GBP'000 GBP'000

------------- -----------------

Cost

Cost at start 1,539 88

Additions - 1,451

------------- -----------------

1,539 1,539

------------- -----------------

Amortisation

At start 23 12

Charge 142 11

------------- -----------------

165 23

------------- -----------------

Net book value at end of the period 1,374 1,516

Net book value at start of the period 1,516 76

Trademarks

Trademarks are obtained for each show in each jurisdiction

around the world. Trademarks are amortised over their estimated

useful lives, which is on average 10 years. The carrying value of

trademarks at 30 June 2021 is GBP62,000 (31 December 2020:

GBP66,000).

LCSE

In December 2020 the Company acquired the entire issued share

capital of Live Company Sports and Entertainment Limited together

with its wholly owned subsidiary Live Company Sports and

Entertainment (Pty) Limited and 50% interest in K-Pop Europa

Limited for GBP650,000 and purchased certain contracts from World

Sport South Africa (Pty) Limited for GBP500,000 to create a new

Sports and Entertainment division (RNS Number : 3562H 03 December

2020).

In December 2020 the Company acquired the entire issued share

capital of E Movement Holdings Ltd for GBP300,000 (RNS Number :

3562H 03 December 2020).

The substance of these transactions is the acquisition of a

series of contracts rather than a business combination as defined

in IFRS 3 "Business Combinations". The transactions were therefore

accounted for as additions to intangible fixed assets of

GBP1,450,000. The acquired contracts are amortised over the period

of the rights acquired, where contracts are renewable and are

likely to be renewed for a further period such further period, but

no subsequent periods, is considered to be part of the period of

the rights acquired. The carrying value of such rights at 30 June

2021 is GBP1,312,000 (31 December 2020: GBP1,450,000).

8. Investments

30 June 2021 31 December 2020

GBP'000 GBP'000

------------- -----------------

Cost

Cost at start - -

Additions 1,000 -

------------- -----------------

1,000 -

------------- -----------------

Impairment

At start - -

Impairment - -

------------- -----------------

- -

------------- -----------------

Net book value at end of the period 1,000 -

Net book value at start of the period - -

In May 2021 LVCG acquired a 16.3% interest in Start Art Global

Ltd. (START.Art) for GBP1,000,000 (RNS Number : 3348X 04 May 2021).

David Ciclitira and Ranjit Murugason are directors of both LCVG and

START.ART and own the remaining 83.7% of START.Art. The Directors

of LVCG have assessed whether LVCG exercises significant influence

over START.ART and have concluded that it does not and thus it has

not been accounted for as an associate under IAS 28.

9. Borrowings

30 June 2021 31 December 2020

GBP'000 GBP'000

------------- -----------------

Loan due within one year 485 615

Loan due after one year 1,397 1,430

------------- -----------------

1,882 2,045

------------- -----------------

In May 2021 the Group agreed a variation in the terms of the

GBP250,000 CBILS loan agreement with NatWest Bank Plc such that the

principal became repayable by way of 54 monthly instalments

commencing November 2021, therefore the full amount remained

outstanding at 30 June 2021.

In June 2021 the Group agreed a variation and second partial

conversion of the GBP500,000 loan agreement with David Ciclitira.

At 30 June 2021, and following the conversion, the principal of the

loan outstanding was GBP90,823.

In August 2020 the Group entered into an agreement with Close

Leasing Limited whereby stock totalling GBP1,500,000 included under

Inventories in the Statement of Financial Position in these

condensed consolidated financial statements was sold to Close

Leasing Limited and purchased back under the terms of a Hire

Purchase Facility (HP Agreement) provided in conjunction with the

CBILS. At 30 June 2021 the principal outstanding under the HP

Agreement was GBP1,467,670.

Between March 2021 and April 2021 the Company entered into an

agreement with the trustees of the Live Company Group Employee

Benefit Trust (the EBT) whereby the EBT advanced a series of

unsecured non interest bearing loans to the Company totalling

GBP74,046 at 30 June 2021.

10. Share capital

During the six months to 30 June 2021 2,363,219 Ordinary 1p

shares were issued in satisfaction of GBP96,900 of salary and fees

due to employees, Directors and suppliers, an additional 5,500,000

Ordinary 1p shares were issued in satisfaction of deferred

consideration relating to the acquisition of Live Company Sports

and Entertainment Ltd and novation of contracts from World Sport

South Africa (Pty) Limited.

In May 2021 new equity totalling GBP1,500,000 was injected into

the Company via a placing of 30,000,000 new Ordinary 1p shares.

Shares issued Avg. Price per Value Nominal per Nominal Premium per Premium

share share share

No. '000 GBP GBP'000 GBP GBP'000 GBP GBP'000

February 2021 1,863 0.04 72 0.01 19 0.03 53

May 2021 36,000 0.06 1,985 0.01 360 0.05 1,625

37,863 0.06 2,057 0.01 379 0.05 1,678

-------------- ----------------- -------- ----------------- -------- ----------------- --------

Issued share capital as at 30 June 2021 is comprised as

follows:

No. of shares GBP'000

Ordinary shares of 1p 146,001,763 1,460

Deferred shares of 51.8p 2,047,523 1,061

Deferred Ordinary shares of 0.5p 199,831,545 999

Deferred B shares of GBP19.60 103,260 2,024

347,984,091 5,544

-------------- --------

The Deferred shares do not entitle their holders to receive

dividend or other distribution nor do they entitle their holders to

receive notice, attend speak or vote at any General Meeting of the

Group. The rights of Deferred shareholders are set out in full in

the financial statements for the year ended 31 December 2020.

11. Related Parties

The following amounts were owed to/(due from) Directors of the

Group:

Unpaid balances 30 June 2021 31 December 2020

GBP'000 GBP'000

David Ciclitira* 72 318

Serenella Ciclitira 18 8

Ranjit Murugason 66 20

Bryan Lawrie 9 11

Trudy Norris-Grey (resigned 14 February 2021) - (15)

Mark Freebairn (resigned 14 February 2021) 12 10

Simon Horgan (resigned 17 February 2021) 12 10

189 362

------------- -----------------

*Includes the outstanding loan balance of GBP90,823 as detailed

in Note 9.

Remuneration Six months Six months

30 June 2021 30 June 2020

GBP'000 GBP'000

David Ciclitira 136 248

Serenella Ciclitira 10 5

Ranjit Murugason 47 10

Bryan Lawrie 11 60

Trudy Norris-Grey (resigned 14 February 2021) 15 12

Mark Freebairn (resigned 14 February 2021) 2 5

Simon Horgan (resigned 17 February 2021) 2 5

------------- -------------

223 345

------------- -------------

David Ciclitira

During the period David Ciclitira agreed to accepted 600,000 new

Ordinary 1p shares, in settlement of GBP30,000 of the loan facility

detailed in note 9.

David Ciclitira injected funds during the period as set out

below:

Six months Six months

30 June 2020 30 June 2020

GBP'000 GBP'000

Loan conversion (RNS Number : 4199A 01 June 2021) 30 -

Loan facility (RNS Number : 6990J 15 April 2020). - 500

Salary shares (RNS Number: 9396L 05 May 2020) - 28

30 528

------------- -------------

David Ciclitira received payments during the period as set out

below:

Six months Six months

30 June 2021 30 June 2020

GBP'000 GBP'000

Business expenses and healthcare costs 7 7

Rental arrangements for use of Venturi Formula E Car - 17

Fees and interest in relation to the provision of loan facility described in Note 9 15 72

Settlement of certain historic creditors (RNS Number : 6990J 15 April 2020) - 29

Partial repayment of loan facility (includes GBP30,000 partial loan conversion (RNS 204 -

Number

: 4199A 01 June 2021)

226 125

------------- -------------

12. Other

Copies of the unaudited half-yearly results have not been sent

to shareholders, however copies are available at

www.livecompanygroup.com or on request from the Company's

Registered Office.

13. Approval of Half-Yearly Financial Statements

The half-yearly financial statements were approved by the Board

on 16 September 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFFTASIDLIL

(END) Dow Jones Newswires

September 17, 2021 04:27 ET (08:27 GMT)

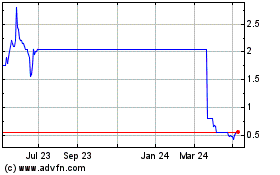

Live (LSE:LVCG)

Historical Stock Chart

From Jun 2024 to Jul 2024

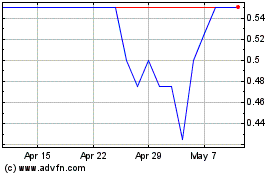

Live (LSE:LVCG)

Historical Stock Chart

From Jul 2023 to Jul 2024