Majedie Investments PLC Mid-Month Estimated Net Asset Value

August 23 2024 - 9:45AM

RNS Regulatory News

RNS Number : 6466B

Majedie Investments PLC

23 August 2024

Majedie Investments PLC

Legal Entity Identifier:

2138007QEY9DYONC2723

23 August 2024

Mid-Month Estimated Net Asset Value (NAV)

The unaudited net asset value estimate

per share at the close of business on 16 August 2024 was as

follows:

With debentures at par value: 273.12

per share

With debentures at fair value: 273.09

per share

The net asset value published is on a

cum-income basis, ex the Q3 2024 interim dividend of 2.00p per

share, and is calculated on 52,998,795 ordinary shares, being the

number of shares in issue.

The fair value of the March 2025

debenture is calculated by using the yield of UK Treasury Bonds of

an equal duration plus a 2.5% risk premium. The Board sees

this mechanism as transparent, market related and consistent with

best practice.

Enquiries

Juniper Partners

Company Secretary

Ph: 0131 378 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NAVUOSSRSOUWUAR

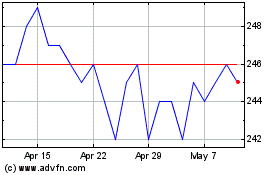

Majedie Investments (LSE:MAJE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Majedie Investments (LSE:MAJE)

Historical Stock Chart

From Nov 2023 to Nov 2024