TIDMMILA

RNS Number : 9036R

Mila Resources PLC

31 October 2023

Mila Resources Plc / Index: LSE / Epic: MILA / Sector: Natural

Resources

31 October 2023

Mila Resources Plc

('Mila' or the 'Company')

Final Results

Mila Resources Plc (LSE:MILA), the post-discovery gold

exploration accelerator, is pleased to announce its final results

for the year ended 30 June 2023.

Highlights

-- Significant progress towards achieving strategy of becoming a

post discovery exploration accelerator

-- Advanced the geological model for gold at the Company's first

asset, the Kathleen Valley Project

-- Entered into JV arrangement with leading ASX lithium company,

Liontown Resources, to begin exploration of lithium at Kathleen

Valley Project

-- Raised gross proceeds of GBP2m post year end to support work

at Kathleen Valley and assess additional development

opportunities

-- Bolstered technical team post year end with appointment of

Alastair Goodship, an exploration geologist with significant

experience in leading discovery-focussed exploration teams in a

diverse range of environments and jurisdictions globally

-- Cash position of GBP448,063 as at 30 June 2023

-- Loss for the financial year ended 30 June 2023 of GBP549,487 (2022: GBP1,011,445).

Statement from the Board

Dear Shareholder

We have made solid progress this year both on a corporate and

asset level. Since the financial year end, we have entered into an

exciting partnership with Australia's leading lithium company,

Liontown Resources, who will explore for lithium targets on our

acreage and (subject to shareholder approval on the 8th of

November), we will then complete the GBP2m fund raise (before

expenses) which will provide the Company with a robust balance

sheet. Our strategy is to build value from both the gold and

lithium at our Kathleen Valley Project in Western Australia (the

"Project") and move ahead with a number of new business

opportunities that have presented themselves this year.

We want Mila to become the "best in class" post-discovery

exploration accelerator through the careful identification and

development of proven projects that cannot access the traditional

routes of funding in the capital markets due to market conditions

for IPOs and equities generally. We recently added Alastair

Goodship, an exploration geologist with significant experience in

leading discovery-focussed exploration teams in a diverse range of

environments and jurisdictions globally, to bolster the team.

We have been approached by several business development

opportunities and continue to review these as we firmly believe

that we can mitigate risk by broadening the portfolio of projects.

The biggest single risk facing most junior mining companies is that

they are reliant on the success of a sole project, and we want to

differentiate Mila by providing companies and management with

proven projects with the support structure of a public company and

access to capital. By definition, exploration is high risk and high

reward, therefore, we want to mitigate and diversify risk by

building Mila particularly at the time where high quality

exploration and development projects are attractively valued with

limited scope to access the closed IPO market.

Gold

During this financial year, we have been highly active at the

Project. In the year ending 30 June 2022 we acquired 30% of the

Project with the ability to move up to 80% and we continue to

retain that flexibility.

We have now completed several drilling phases designed to test

the known mineralisation and test the "unknown" by drilling at

depth and stepping out from the previously tested mineralisation.

With each drilling phase, we are building a better and more

complete picture of the geological system which we believe is

highly structured, featuring concentrated zones of high-grade

mineralisation.

With the benefit of a clearer picture, our next objective will

be to conduct more low-cost exploration prior to conducting costly

drill programmes. We now believe we know the system sufficiently

well to be far more focused and efficient with the exploration

budget. Also, I believe we will be able to obtain technical and

operational efficiencies by working with the Liontown team. Whilst

they are focused on finding lithium they will be able to share

geological insights to assist our team on gold exploration.

We have a number of development routes given the Project is

surrounded by gold mining infrastructure and some of Australia's

leading gold companies.

Lithium

Earlier this year we were approached by Liontown, our neighbours

to the north, to explore for lithium on our Project. Liontown was

recently subject to a A$6.6bn takeover bid by American lithium

giant, Albemarle Corp. (NYSE: ALB) and is developing Australia's

leading lithium project, the Kathleen Valley Lithium Project ahead

of targeted production in 2024. Liontown has offtake agreements to

supply lithium to companies including LG, Ford and Tesla.

Liontown has mapped pegmatite swarms extending south from its

own project and the hypothesis is that this mineralisation corridor

covers our own licence area. With the identification of these

pegmatite swarms extending on to our own property, we reasoned that

it makes commercial sense to work with Liontown to explore for

lithium on our project. In addition, they bring a lot of intangible

value to our project by sharing geological and technical

information and their expertise in the region generally. On the

16th of October 2023 we announced that work is now underway with

Liontown on the acreage with the preliminary social and

environmental programmes before they can commence their exploration

which will initially entail mapping, trenching and sampling in

areas of the Project known to host lithium pegmatites.

Finance Review

In October 2022, the Company announced that it had raised

GBP908,000 (before expenses) through a placing of 30,266,651 New

Ordinary Shares of GBP0.01 each at a price of 3 pence per placing

share. Investors in the Placing will also receive one three-year

warrant per Placing Share to subscribe for one new ordinary share

at a cost of 4.8p per share. The Company will also issue 524,000

broker warrants that are exercisable at 3p for a period of 3 years.

The issue of the Investor Warrants and Broker Warrants is

conditional on shareholder approval to increase the Company's share

authorities.

Post year- end, in October 2023, the Company announced the

placing of 200,000,000 new ordinary shares at a price of 1 pence

per ordinary share to raise GBP2m. The placing shares have one

warrant attached with an exercise price of 2 pence for a period of

two years from the date of admission. The Placing is conditional on

approval by Shareholders of resolutions at a General Meeting

("GM").

Cash Position

At 30 June 2023, cash and cash equivalents amounted to

GBP448,063 (2022: GBP1,096,084).

Outlook

Mila is now in the most solid position of its brief life since

we listed in November 2021. This of course assumes that the

shareholders vote in favour of the GBP2m fund raise on the 8th of

November.

We have a clear strategy and are well capitalised to deliver the

strategy to fruition. We expect the next 12 months to be highly

active on both a corporate and asset level as we continue to assess

business development opportunities and how to deliver value from

both the gold and lithium at our project.

Whilst the financial period has proven to be difficult for

junior mining companies given the challenges in the capital

markets, we now look forward to building Mila from the

opportunities that present themselves from such circumstances.

Ultimately, Mila will continue to be highly entrepreneurial, and I

would like to take this opportunity to thank our existing

shareholders, and those new to our register, as we look forward

with excitement and confidence, to a period of increased activity

in the forthcoming financial year.

Mark Stephenson

Executive Chairman

31 October 2023

Statements of Comprehensive Income

For the year Ended 30 June 2023

Year ended Year ended

30 June 30 June

Notes 2023 2022

GBP GBP

Administrative expenses (549,487) (518,213)

Share warrant and options expense 3 - (493,232)

Loss on ordinary activities before

taxation (549,487) (1,011,445)

Income tax expense 6 - -

----------- ------------

Loss and total comprehensive income

for the year attributable to the

owners of the company (549,487) (1,011,445)

=========== ============

Earnings per share (basic and diluted)

attributable to the equity holders

(pence) 7 (0.17) (0.52)

Statements of Financial Position

For the year Ended 30 June 2023

Year ended Year ended

30 June 30 June

Notes 2023 2022

GBP GBP

NON-CURRENT ASSETS

Exploration and evaluation assets 8 5,605,870 4,698,625

------------ ------------

5,605,870 4,698,625

------------ ------------

CURRENT ASSETS

Trade and other receivables 9 135,459 22,568

Cash and cash equivalents 10 448,063 1,096,084

583,522 1,118,652

------------ ------------

TOTAL ASSETS 6,189,392 5,817,277

------------ ------------

CURRENT LIABILITIES

Trade and other payables 11 312,938 210,760

TOTAL LIABILITIES 312,938 210,760

------------ ------------

NET ASSETS 5,876,454 5,606,517

============ ============

EQUITY

Share capital 12 3,368,177 3,065,511

Share premium 12 4,784,603 4,267,846

Share based payment reserve 13 539,093 543,813

Retained loss (2,815,420) (2,270,653)

TOTAL EQUITY 5,876,454 5,606,517

============ ============

Statements of Cash Flow

For the year Ended 30 June 2023

12 months 12 months

to 30 June to 30 June

2023 2022

GBP GBP

Cash flows from operating activities

Loss for the year (549,487) (1,011,445)

Adjustments for:

Warrants / Options expense (non-cash) - 493,232

Operating cashflow before working capital

movements (549,487) (518,213)

(Increase)/Decrease in trade and other

receivables (112,891) 1,616

Increase in trade and other payables 102,178 4,427

Shares issued for services - 30,000

Interest expense - 3,801

------------ ------------

Net cash outflow from operating activities (560,200) (478,369)

Cash flow from investing activities

Acquisition of Kathleen Valley - cash

component - (300,000)

Acquisition costs - (336,732)

Funds used for drilling and exploration

(net of GST recovered) (907,245) (1,408,108)

------------ ------------

Net cash outflow from investing activities (907,245) (2,044,840)

Cash flow from financing activities

Proceeds from share issues 908,000 3,358,740

Issue costs paid in cash (88,576) (69,075)

------------ ------------

Net cash inflow from financing activities 819,424 3,289,665

Net (Decrease)/Increase in cash and cash

equivalents (648,021) 766,456

Cash and cash equivalents at beginning

of the year 1,096,084 329,628

Cash and cash equivalents at end of the

year 448,063 1,096,084

------------ ------------

Statements of Changes in Equity

For the year Ended 30 June 2023

Share Share Share Retained Total

Capital Premium Based Payment Loss

Reserve

GBP GBP GBP GBP GBP

Balance at 30 June

2021 232,000 849,300 4,720 (1,259,208) (173,188)

---------- ---------- --------------- ------------ ------------

Total comprehensive

income for the year - - - (1,011,445) (1,011,445)

Capital Raising -

Issue of shares 1,458,333 2,041,667 - - 3,500,000

Capital Raising -

Issue of shares in

lieu of fees 59,792 83,708 - - 143,500

Capital Raising -

Issue Costs - (221,135) - - (221,135)

Acquisition of Kathleen

Valley 835,432 1,169,605 - - 2,005,037

Conversion of convertible

loan notes 477,754 382,203 - - 859,957

Conversion of warrants 2,200 8,360 - - 10,560

Share warrants and

options expense - (45,861) 539,093 - 493,232

---------- ---------- --------------- ------------ ------------

Balance at 30 June

2022 3,065,511 4,267,846 543,813 (2,270,653) 5,606,517

Total comprehensive

income for the year - - - (549,487) (549,487)

Transactions with

Shareholders

Expired Warrants - - (4,720) 4,720 -

Capital Raising -

Issue of shares 302,667 605,333 - - 908,000

Capital Raising -

Issue costs - (88,576) - - (88,576)

Balance at 30 June

2023 3,368,178 4,784,603 539,093 (2,815,420) 5,876,454

---------- ---------- --------------- ------------ ------------

Notes to the Financial Statements

For the year Ended 30 June 2023

1 GENERAL INFORMATION

Mila Resources Plc (the "Company") was listed on the London

Stock Exchange in 2016 with a view to acquiring projects in the

natural resources sector that have a significant innate value that

could be unlocked without excessive capital. In November 2021, the

Company acquired an interest in a gold exploration project in

Western Australia.

The Company is domiciled in the United Kingdom and incorporated

and registered in England and Wales, with registration number

09620350.

2 ACCOUNTING POLICIES

2.1 Basis of preparation

The financial statements have been prepared on a going concern

basis using the historical cost convention and in accordance with

the UK-Adopted International Accounting Standards, and in

accordance with the provisions of the Companies Act 2006.

The Company's financial statements for the year ended 30 June

2023 were authorised for issue by the Board of Directors on 31

October 2023 and were signed on the Board's behalf by Mr L

Daniels.

The Company's financial statements are presented in pounds

Sterling and presented to the nearest pound.

2.2 Business Combinations

Acquisitions of business are accounted for using the acquisition

method. At the acquisition date, the identifiable assets acquired,

and the liabilities assumed are recognised at their fair value.

Consideration is also measured at fair value at the acquisition

date. This is calculated as the sum of the fair values of assets

transferred less the fair value of the liabilities incurred by the

Company.

Goodwill is measured as the excess of the sum of the

consideration transferred, the amount of any non -- controlling

interests in the acquiree, and the fair value of the acquirers

previously held equity interest in the acquiree (if any) over the

net of the acquisition -- date amounts of the identifiable assets

acquired, and the liabilities assumed. If, after reassessment, the

net of the acquisition -- date amounts of the identifiable assets

acquired and liabilities assumed exceeds the sum of the

consideration transferred, the amount of any non -- controlling

interests in the acquiree and the fair value of the acquirers

previously held interest in the acquiree (if any), the excess is

recognised immediately in profit or loss as a bargain purchase

gain.

Acquisition -- related costs are recognised in profit or loss as

incurred.

2.3 Going concern

The Financial Statements have been prepared under the going

concern assumption, which presumes that the Company will be able to

meet its obligations as they fall due for at least the next twelve

months from the date of the signing of the Financial

Statements.

The Company had a net cash outflow for the year of GBP648,021

(2022: inflow of GBP766,456) and at 30 June 2023 had cash and cash

equivalents balance of GBP448,063 (2022: GBP1,096,084).

An operating loss of GBP549,487 has been made and although the

Company was in a net current asset position at 30 June 2023 and has

raised GBP908,000 (before expenses).

Post year end, the Company announced (2 October 2023) that it

raised GBP2m (before expenses) through a Placing of 200m New

Ordinary Shares of GBP0.01 each. This placing is subject to the

approval by shareholders at a general meeting to be held on 8

November 2023.

The Company's current cash reserves are less than the forecasted

expenditure over the 12 months from the date of this report and

therefore further funding needs to be received in this period to

enable the Company to continue to meet its obligations as they fall

due. Due to the aforementioned GBP2m raise, which is subject to

approval by shareholders at a general meeting being obtained,

management are confident that the required funding will be

obtained. For this reason, the Directors continue to adopt the

going concern basis in preparing the financial statements .

However, the Directors acknowledge that the receipt of the funding

is contingent on the approval by shareholders at a general meeting

and therefore a material uncertainty exists which may cause

significant doubt about the ability to continue to trade as a going

concern.

The auditors have made reference to going concern by way of a

material uncertainty within the financial statements.

2.4 Standards, amendments and interpretations to existing

standards that are not yet effective and have not been early

adopted by the Company

New standards, amendments to standards and interpretations:

No new standards, amendments or interpretations, effective for

the first time for the financial year beginning on or after 1

January 2022 have had a material impact on the Company.

Standards issued but not yet effective:

At the date of authorisation of these financial statements, the

following standards and interpretations relevant to the Company and

which have not been applied in these financial statements, were in

issue but were not yet effective.

Standard Impact on initial application Effective date

--------------------- ----------------------------------- ----------------

IAS 1 Amendments - presentation TBC

and classification of liabilities

as current or non current

IAS 8 Amendments - Definition of 01 January 2023

accounting policies

IAS 1 Amendments - Disclosure of 01 January 2023

accounting policies

IFRS 17 Insurance Contracts 01 January 2023

IFRS 17 (amendments) Insurance contracts 01 January 2023

The directors do not consider that these standards will impact

the financial statements of the Company.

2.5 Asset acquisition

Where an acquisition transaction constitutes the acquisition of

an asset and not a business, the consideration paid is allocated to

assets and liabilities acquired based on their relative fair

values, with transaction costs capitalised. No gain or loss is

recognised.

Consideration paid in the form of equity instruments is measured

by reference to the fair value of the asset acquired. The fair

value of the assets acquired would be measured at the point control

is obtained.

The Company recognises the fair value of contingent

consideration in respect to an asset acquisition, where it is

probable that a liability has been incurred, and the amount of that

liability can be reasonably estimated. Such contingent

consideration is recognized at the time control of the underlying

asset is obtained, and such an amount is included in the initial

measurement of the cost of the acquired assets.

The Company recognises contingent consideration in the form of

cash, and contingent consideration in the form of equity

instruments. Contingent consideration in the form of cash is

recognised as a liability, and contingent consideration in the form

of equity instruments is recognised in the contingent share

reserve.

For contingent cash consideration milestones, the Company

estimates a probability for the likelihood of completion to

estimate the total liability for the expected variable payments.

The probability estimated for the likelihood of completion is

considered at each reporting period. Movements in the fair value of

contingent cash consideration payable is capitalised as part of the

asset.

For contingent share consideration milestones, the Company

estimates a probability for the likelihood of completion to

estimate the total contingent share consideration payable. The

probability estimated for the likelihood of completion is not

reassessed in subsequent reporting periods.

Deferred tax is not recognised upon an asset acquisition.

2.6 Foreign currency translation

The financial information is presented in Sterling which is the

Company's functional and presentational currency.

Transactions in currencies other than the functional currency

are recognised at the rates of exchange on the dates of the

transactions. At each balance sheet date, monetary assets and

liabilities are retranslated at the rates prevailing at the balance

sheet date with differences recognised in the Statement of

comprehensive income in the period in which they arise.

2.7 Financial instruments

Initial recognition

A financial asset or financial liability is recognised in the

statement of financial position of the Company when it arises or

when the Company becomes part of the contractual terms of the

financial instrument.

Classification

Financial assets at amortised cost

The Company measures financial assets at amortised cost if both

of the following conditions are met:

(1) the asset is held within a business model whose objective is

to collect contractual cash flows; and

(2) the contractual terms of the financial asset generating cash

flows at specified dates only pertain to capital and interest

payments on the balance of the initial capital.

Financial assets which are measured at amortised cost, are

measured using the Effective Interest Rate Method (EIR) and are

subject to impairment. Gains and losses are recognised in profit or

loss when the asset is de-recognised, modified or impaired.

Financial liabilities at amortised cost

Financial liabilities measured at amortised cost using the

effective interest rate method include current borrowings and trade

and other payables that are short term in nature. Financial

liabilities are derecognised if the Company's obligations specified

in the contract expire or are discharged or cancelled.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the effective interest rate ("EIR"). The EIR amortisation

is included as finance costs in profit or loss. Trade payables

other payables are non-interest bearing and are stated at amortised

cost using the effective interest method.

Derecognition

A financial asset is de-recognised when:

(1) the rights to receive cash flows from the asset have expired, or

(2) the Company has transferred its rights to receive cash flows

from the asset or has undertaken the commitment to fully pay the

cash flows received without significant delay to a third party

under an arrangement and has either (a) transferred substantially

all the risks and the assets of the asset or (b has neither

transferred nor held substantially all the risks and estimates of

the asset but has transferred the control of the asset.

Impairment

The Company recognises a provision for impairment for expected

credit losses regarding all financial assets. Expected credit

losses are based on the balance between all the payable contractual

cash flows and all discounted cash flows that the Company expects

to receive. Regarding trade receivables, the Company applies the

IFRS 9 simplified approach in order to calculate expected credit

losses. Therefore, at every reporting date, provision for losses

regarding a financial instrument is measured at an amount equal to

the expected credit losses over its lifetime without monitoring

changes in credit risk. To measure expected credit losses, trade

receivables and contract assets have been grouped based on shared

risk characteristics.

Trade and other receivables

Trade and other receivables are initially recognised at fair

value when related amounts are invoiced then carried at this amount

less any allowances for doubtful debts or provision made for

impairment of these receivables.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand and

are subject to an insignificant risk of changes in value.

Trade payables

These financial liabilities are all non-interest bearing and are

initially recognised at the fair value of the consideration

payable.

2.8 Equity

Share capital is determined using the nominal value of shares

that have been issued.

The Share premium account includes any premiums received on the

initial issuing of the share capital. Any transaction costs

associated with the issuing of shares are deducted from the Share

premium account, net of any related income tax benefits.

Equity-settled share-based payments are credited to a

share-based payment reserve as a component of equity until related

options or warrants are exercised or lapse.

Retained losses includes all current and prior period results as

disclosed in the statement of comprehensive income.

2.9 Share-based payments

The Company records charges for share-based payments.

For warrant-based or option-based share-based payments, to

determine the value of the warrants or options, management estimate

certain factors used in the Black Scholes Pricing Model, including

volatility, vesting date exercise date of the warrants or option

and the number likely to vest. At each reporting date during the

vesting period management estimate the number of shares that will

vest after considering the vesting criteria. If these estimates

vary from actual occurrence, this will impact on the value of the

equity carried in reserves.

2.10 Taxation

Tax currently payable is based on taxable profit for the period.

Taxable profit differs from profit as reported in the income

statement because it excludes items of income and expense that are

taxable or deductible in other years and it further excludes items

that are never taxable or deductible. The Company's liability for

current tax is calculated using tax rates that have been enacted or

substantively enacted by the balance sheet date.

Deferred tax is recognised on differences between the carrying

amounts of assets and liabilities in the financial statements and

the corresponding tax bases used in the computation of taxable

profit, and is accounted for using the balance sheet liability

method. Deferred tax liabilities are generally recognised for all

taxable temporary differences and deferred tax assets are

recognised to the extent that it is probable that taxable profits

will be available against which deductible temporary differences

can be utilised. Such assets and liabilities are not recognised if

the temporary difference arises from initial recognition of

goodwill or from the initial recognition (other than in a business

combination) of other assets and liabilities in a transaction that

affects neither the taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in subsidiaries and associates,

and interests in joint ventures, except where the Company is able

to control the reversal of the temporary difference and it is

probable that the temporary difference will not reverse in the

foreseeable future.

The carrying amount of deferred tax assets is reviewed at each

balance sheet date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled, or the asset

realised. Deferred tax is charged or credited to profit or loss,

except when it relates to items charged or credited directly to

equity, in which case the deferred tax is also dealt with in

equity.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Company intends to settle

its current tax assets and liabilities on a net basis.

2.11 Intangible assets - Exploration and evaluation expenditures (E&E) Development expenditure

The Company applies the successful efforts method of accounting,

having regard to the requirements of IFRS 6 'Exploration for and

Evaluation of Mineral Resources'. Costs incurred prior to obtaining

the legal rights to explore an area are expensed immediately to the

Statement of Comprehensive Income.

Expenditure incurred on the acquisition of a licence interest is

initially capitalised within intangible assets on a licence by

licence basis. Costs are held, unamortised, until such time as the

exploration phase of the field area is complete or commercial

reserves have been discovered. The cost of the licence is

subsequently transferred into property, plant and equipment and

depreciated over its estimated useful economic life.

Exploration expenditure incurred in the process of determining

exploration targets is capitalised initially within intangible

assets as drilling costs. Drilling costs are initially capitalised

on a licence by licence basis until the success or otherwise has

been established. Drilling costs are written off unless the results

indicate that reserves exist and there is a reasonable prospect

that these reserves are commercially viable. Drilling costs are

subsequently transferred into 'Drilling expenditure' within

property, plant and equipment and depreciated over their estimated

useful economic life.

2.12 Impairment of Exploration and Evaluation assets

The Company assesses at each reporting date whether there is an

indication that an asset may be impaired. This includes

consideration of the IFRS 6 impairment indicators for any

intangible exploration and evaluation expenditure capitalised as

intangible assets. Examples of indicators of impairment include

whether:

a) the period for which the entity has the right to explore in

the specific area has expired during the period or will expire in

the near future and is not expected to be renewed.

b) substantive expenditure on further exploration for and

evaluation of mineral resources in the specific area is neither

budgeted nor planned.

c) exploration for and evaluation of mineral resources in the

specific area have not led to the discovery of commercially viable

quantities of mineral resources and the entity has decided to

discontinue such activities in the specific area.

d) sufficient data exist to indicate that, although a

development in the specific area is likely to proceed, the carrying

amount of the exploration and evaluation asset is unlikely to be

recovered in full from successful development or by sale.

If any such indication exists, or when annual impairment testing

for an asset is required, the Company makes an estimate of the

asset's recoverable amount, which is the higher of its fair value

less costs to sell and its value in use. Any impairment identified

is recorded in the statement of comprehensive income.

2.13 Critical accounting judgements and key sources of uncertainty

In the process of applying the entity's accounting policies,

management makes estimates and assumptions that have an effect on

the amounts recognised in the financial information. Although these

estimates are based on management's best knowledge of current

events and actions, actual results may ultimately differ from those

estimates.

The areas involving a higher degree of judgement or complexity,

or areas where assumptions and estimates are significant to the

financial statements are as follows:

Impairment of intangible assets

For details on the accounting policy for the impairment of

exploration and evaluation assets, see note 2.12 "Impairment of

Exploration and Evaluation Assets" in the "Notes to the Financial

Statements" on page 40.

The first stage of the impairment process is the identification

of an indication of impairment. Such indications can include

significant geological or geophysical information which may

negatively impact the existing assessment of a project's potential

for recoverability, significant reductions in estimates of

resources, significant falls in commodity prices, a significant

revision of the Company Strategy, operational issues which may

require significant capital expenditure, political or regulatory

impacts and others. This list is not exhaustive and management

judgement is required to decide if an indicator of impairment

exists.

The Company regularly assesses the intangible assets for

indicators of impairment. For more information on impairment

indicators see note 2.12 "Impairment of Exploration and Evaluation

Assets" in the "Notes to the Financial Statements" on page 40. Also

see IFRS 6 'Exploration for and Evaluation of Mineral

Resources'

When an impairment indicator exists an impairment test is

performed; the recoverable amount of the asset, being the higher of

the asset's fair value less costs to sell and value in use, is

compared to the asset's carrying value. Any excess of the asset's

carrying value over its recoverable amount is expensed to the

income statement.

2.14 Earnings per share

Basic earnings per share is calculated as profit or loss

attributable to equity holders of the Company for the period,

adjusted to exclude any costs of servicing equity (other than

dividends), divided by the weighted average number of ordinary

shares, adjusted for any bonus element. The diluted profit per

share is the same as the basic profit per share for 2023 because,

although certain warrants and options in issue were in the money as

at the year end, the Company reported a loss, hence including the

additional dilution would have resulted in a reduction of the loss

per share.

2.15 Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating

decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board as a whole.

All operations and information are reviewed together therefore

at present there is only one reportable operating segment.

The Company's strategy is to act as a post discovery

accelerator, where the Company identifies target(s) that have

already had an early-stage geological discovery. To date the

Company has identified and invested on one target, namely the

Kathleen Valley Project. Hence at the moment there is only one

reportable operating segment.

3. OPERATING LOSS

This is stated after charging:

2023 2022

GBP GBP

Auditor's remuneration

Audit of the Company 40,000 30,000

Other services - 2,000

Directors' remuneration 250,000 266,585

Stock exchange and regulatory

expenses 10,536 47,486

Share warrant and options expense

(1) - 493,232

Other expenses 248,951 172,142

-------- ----------

Operating expenses 549,487 1,011,445

-------- ----------

(1) This is a non-cash accounting expense for the issue of share

warrants and options.

4. AUDITOR'S REMUNERATION

2023 2022

GBP GBP

Fees payable to the Company's

current auditor:

* audit of the Company's financial statements

40,000 30,000

- 2,000

* other services 40,000 32,000

--------- ---------

5. DIRECTORS AND STAFF COSTS

During the year the only staff of the Company were the Directors

and as such key management personnel. Management remuneration,

other benefits supplied and social security costs to the Directors

during the year was as follows below. For Directors costs see the

Directors remuneration report from page 21.

2023 2022

GBP GBP

Salaries 250,000 266,585

Social security costs 25,369 29,016

Share based payments - 59,658

-------- --------

275,369 355,259

-------- --------

6. TAXATION

2023 2022

GBP GBP

The charge / credit for the year

is made up as follows:

Current tax - -

Deferred tax - -

Taxation charge / credit for the - -

year

----------- ------------

A reconciliation of the tax charge / credit appearing in the

income statement to the tax that would result from applying the

standard rate of tax to the results for the year is:

Loss per accounts (549,487) (1,011,445)

----------- ------------

Tax credit at the standard rate

of corporation tax in the UK of

19% (2022: 19%) (104,403) (192,175)

Impact of costs disallowed for

tax purposes 2,809 17,919

Deferred tax in respect of temporary - -

differences

Impact of unrelieved tax losses

carried forward 101,594 174,256

- -

----------- ------------

Estimated tax losses of GBP2,651,344 (2022: GBP2,116,641) are

available for relief against future profits and a deferred tax

asset of GBP503,756 (2022: GBP402,162) has not been provided for in

the accounts due to the uncertainty of future profits.

Factors affecting the future tax charge

The standard rate of corporation tax in the UK for Companies

making less than GBP250,000 annual profit is 19%. Accordingly, the

Company's effective tax rate for the period was 19% (2022:

19%).

Deferred taxation

No deferred tax asset has been recognised by the Company due to

the uncertainty of generating sufficient future profits and tax

liability against which to offset the tax losses. Note 6 above sets

out the estimated tax losses carried forward

7. EARNINGS PER SHARE

The calculation of the earnings per share is based on the loss

for the financial period after taxation of GBP549,487 (2022:

GBP1,011,445) and on the weighted average of 327,554,881 (2022:

193,873,021 ordinary shares in issue during the period.

The diluted profit per share is the same as the basic profit per

share because the Company reported a loss, hence including the

additional dilution would have resulted in a reduction of the loss

per share.

Earnings Weighted average Per-share

GBP number of amount

shares pence

unit

30 June 2023: Loss per share

attributed to ordinary shareholders (549,487) 327,554,881 (0.17)

30 June 2022: Loss per share

attributed to ordinary shareholders (1,011,445) 193,873,021 (0.52)

8. EXPLORATION AND EVALUATION ASSETS

At 30 At 30

June 2023 June 2022

GBP GBP

Opening balance 4,698,625 -

Cost of acquisition including

transaction costs - 3,290,517

Exploration costs capitalised

in the year 1,092,201 1,408,108

Other movements (184,956) -

----------- -----------

Net book value 5,605,870 4,698,625

=========== ===========

In November 2021, the Company acquired a 30% interest in the

Kathleen Valley (Gold) Project for GBP2,812,500. The consideration

was GBP300,000 in cash and the balance in new Mila shares.

Transaction costs of GBP478,017 have also been capitalised. The

principal assets are leases with rights to exploration of those

leases in Western Australia. At the year end the capitalised

exploration and evaluation assets totalled GBP5.6m (2022: GBP4.7m).

All Exploration costs capitalised in the year relate to the

Kathleen Valley Project.

During the year the Company was able to register for Australian

"GST" (Goods and Services Tax). Unfortunately, registration was a

long drawn out process, however, as this has now been completed the

Company can recover the GST paid. This has been show in "Other

movement" in the table above.

Exploration and evaluation assets are regularly reviewed for

indicators of impairment. If an indicator of impairment is found an

impairment test is required, where the carrying value of the asset

is compared with its recoverable amount. The recoverable amount is

the higher of the assets fair value less costs to sell and value in

use. The Directors are satisfied that no impairments are required

for the current year.

9. TRADE AND OTHER RECEIVABLES

2023 2022

GBP GBP

Prepayments and other receivables 135,459 22,568

135,459 22,568

-------- -------

The Directors consider that the carrying value amount of trade

and other receivables approximates to their fair value.

10. CASH AND CASH EQUIVALENTS

2023 2022

GBP GBP

Cash at bank 448,063 1,096,084

448,063 1,096,084

-------- ----------

Cash at bank comprises balances held by the Company in current

bank accounts. The carrying value of these approximates to their

fair value.

11. TRADE AND OTHER PAYABLES

2023 2022

GBP GBP

Trade payables 55,457 36,722

Accruals and other payables 257,481 174,038

312,938 210,760

-------- --------

12. SHARE CAPITAL / SHARE PREMIUM

Number Share Share

of shares capital premium Total

on issue GBP GBP GBP

Balance as at 30 June 2021 23,200,000 232,000 849,300 1,081,300

Capital Raising 151,812,495 1,518,125 1,904,240 3,422,365

Acquisition of Kathleen Valley 83,543,197 835,432 1,169,605 2,005,037

Conversion of convertible

loan notes 47,775,365 477,754 382,203 859,957

Conversion of warrants 220,000 2,200 8,360 10,560

Warrants issued in lieu of

share issue costs - - (45,861) (45,861)

------------ ---------- ---------- ----------

Balance as at 30 June 2022 306,551,057 3,065,511 4,267,846 7,333,357

Capital Raising 30,266,651 302,667 516,757 819,424

------------ ---------- ---------- ----------

Balance as at 30 June 2023 336,817,708 3,368,178 4,784,603 8,152,781

The Company issued a total of 30,266,651 new fully paid ordinary

shares during the year.

In October and November 2022, the Company completed a placing of

30,266,651 new fully paid ordinary shares with a nominal value of

GBP0.01, raising gross proceeds of GBP908,000 before expenses.

The Directors held the following warrants at the beginning and

end of the year:

Director At 30 Granted At 30 Exercise Earliest Last date

June 2022(1) during the June 2023 price date of of exercise

year exercise

22 Nov 31 Dec

M. Stephenson 7,500,000 - 7,500,000 GBP0.024 2021 2026

22 Nov 31 Dec

L. Daniels 7,500,000 - 7,500,000 GBP0.024 2021 2026

22 Nov 31 Dec

N. Hutchison 5,000,000 - 5,000,000 GBP0.024 2021 2026

22 Nov 31 Dec

L. Mair 2,000,000 - 2,000,000 GBP0.024 2021 2026

------------ -----------

- 22,000,000

(1) as outlined in the prospectus dated 29 October 2021.

The Directors held the following EMI Options at the beginning

and end of the year:

Director At 30 Granted At 30 Exercise Earliest Last date

June 2022 during the June 2023 price date of of exercise

year exercise

M. Stephenson 3,500,000 - 3,500,000 GBP0.024 10 Dec 2021 10 Dec 2026

L. Daniels 2,500,000 - 2,500,000 GBP0.024 10 Dec 2021 10 Dec 2026

=========== ------------ -----------

6,000,000 - 6,000,000

13. SHARE BASED PAYMENT RESERVE AND SHARE BASED PAYMENTS

SHARE BASED PAYMENT RESERVE

2023 2022

GBP GBP

At 1 July 543,813 4,720

Issue of Warrants per prospectus - 479,435

Issue of EMI Options per prospectus - 59,658

Expired Warrants (4,720) 543,813

-------- --------

At 30 June 539,093 543,813

-------- --------

Warrants and Options Number of Number Weighted

in Issue Options in of Warrants average exercise

Issue in Issue price Expiry date

Balance at 30 June - 11,425,000 GBP0.048 31 Dec 2022

2021

Warrants issued during

the year - per the

prospectus - 242,264,111 GBP0.0432 31 Dec 2026

EMI options scheme

issued during the year

- per the prospectus 6,000,000 - GBP0.024 10 Dec 2026

Warrants exercised

during the year - (220,000)

------------ ------------- ------------------

At 30 June 2022 6,000,000 253,469,111 GBP0.0429

------------ ------------- ------------------

Expired during the - (11,425,000) GBP0.048 31 Dec 2022

year

------------ ------------- ------------------

At 30 June 2023 6,000,000 242,044,111 GBP0.0432

------------ ------------- ------------------

During the year the Company raised GBP908,000 (before expenses)

through a Placing of 30,266,651 New Ordinary Shares of GBP0.01 each

("Placing Shares") at a price of 3 pence per Placing Share (the

"Placing"). Investors in the Placing will also receive one

three-year warrant per Placing Share to subscribe for one new

ordinary share at a cost of 4.8p per share. In addition the Company

has also issued 524,000 broker warrants that are exercisable at 3p

for a period of 3 years. Both the investor warrants and broker

warrants are conditional on shareholder approval to increase the

Company's share authorities. At the time of writing, the Prospectus

has been issued and the shareholder approval is being sought at a

general meeting to be held on 8 November 2023.

The market price of the shares at year end was 1.2 pence per

share.

During the year, the minimum and maximum prices were 0.825 pence

and 4.25 pence per share respectively.

SHARE BASED PAYMENTS - WARRANTS AND OPTIONS

No Warrants or Options were issued during the period.

14. CAPITAL COMMITMENTS

There were no capital commitments at 30 June 2022 and 30 June

2023.

15. CONTINGENT LIABILITIES

There were no contingent liabilities at 30 June 2022 and 30 June

2023.

16. COMMITMENTS UNDER LEASES

There were no commitments under operating leases at 30 June 2023

and 30 June 2022.

17. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

The Company's financial instruments comprise primarily cash and

various items such as trade debtors and trade payables which arise

directly from operations. The main purpose of these financial

instruments is to provide working capital for the Company's

operations. The Company does not utilise complex financial

instruments or hedging mechanisms.

Financial assets by category

2023 2022

GBP GBP

Current Assets:

Cash and cash equivalents 448,063 1,096,084

Trade and other receivables 135,459 11,520

-------- ----------

Categorised as financial assets at

amortised cost 583,522 1,107,604

-------- ----------

Financial liabilities by category

2023 2022

GBP GBP

Current Liabilities:

Trade and other payables 312,938 210,760

Categorised as financial liabilities

measured at amortised cost 312,938 210,760

-------- --------

All amounts are short term and payable in 0 to 6 months.

Credit risk

The maximum exposure to credit risk at the reporting date by

class of financial asset was:

2023 2022

GBP GBP

Trade and other receivables 123,297 11,520

Cash and cash equivalents 448,063 1,096,084

-------- ----------

571,360 1,107,604

Capital management

The Company considers its capital to be equal to the sum of its

total equity. The Company monitors its capital using a number of

key performance indicators including cash flow projections, working

capital ratios, the cost to achieve development milestones and

potential revenue from partnerships and ongoing licensing

activities.

The Company's objective when managing its capital is to ensure

it obtains sufficient funding for continuing as a going concern.

The Company funds its capital requirements through the issue of new

shares to investors.

Interest rate risk

The maximum exposure to interest rate risk at the reporting date

by class of financial asset was:

2023 2022

GBP GBP

Bank balances 448,063 1,096,084

-------- ----------

The Company is not financially dependent on the income earned on

these resources and therefore the risk of interest rate

fluctuations is not significant to the business and the Directors

have not performed a detailed sensitivity analysis.

All deposits are placed with main clearing banks, with 'A'

ratings, to restrict both credit risk and liquidity risk. The

deposits are placed for the short term, between one and three

months, to provide flexibility and access to the funds.

Credit and liquidity risk

Credit risk is managed on a Company basis. Funds are deposited

with financial institutions with a credit rating equivalent to, or

above, the main UK clearing banks. The Company's liquid resources

are invested having regard to the timing of payment to be made in

the ordinary course of the Company's activities. All financial

liabilities are payable in the short term (between 0 to 3 months)

and the Company maintains adequate bank balances to meet those

liabilities. A liquidity analysis is not therefore considered

material to disclose.

Currency risk

The Company operates in a global market with income and costs

possibly arising in a number of currencies. The Company's strategic

aim of acquiring asset(s) or business(es) acting as a post

discovery accelerator, is not limited to any specific geo-political

area or jurisdiction. Currently the majority of the Company's

overhead costs are incurred in GBPGBP. The Kathleen Valley Project

is located in Western Australia, and hence the majority of the

exploration and evaluation costs relating to this project are

incurred in $AUD. The Company has not hedged against any currency

depreciation but continues to keep the matter under review.

18. RELATED PARTY TRANSACTIONS

Key management personnel compensation

The Directors are considered to be key management personnel.

Detailed remuneration disclosures are provided in the remuneration

report on pages 21 - 23.

There were no other related party transactions.

19. EVENTS SUBESQUENT TO YEAR

Fund Raise - post year end

Post year end, the Company announced on the 2(nd) of October

2023 that it raised GBP2m (before expenses) through a Placing of

200m New Ordinary Shares of GBP0.01 each ("Placing Shares") at a

price of 1 pence per Placing Share (the "Placing"). Investors in

the Placing will also receive one two year warrant per Placing

Share to subscribe for one new ordinary share at a cost of 2p per

share ("Investor Warrants").

The Placing has not been underwritten and is conditional on

approval by Shareholders of resolutions, inter alia, granting

authority for the Directors to issue ordinary shares at a General

Meeting ("GM") to be held on 8 November 2023 at 11.00 a.m. at 13th

Floor, 88 Wood Street, London EC2V 7DA.

Appointment of Exploration Geologist

The Company appointed Alastair Goodship, an exploration

geologist with over 14 years of industry experience of leading

discovery-focussed exploration teams in a diverse range of

environments and jurisdictions globally. Alastair has worked across

the exploration spectrum from greenfield and brownfield exploration

to resource definition and feasibility studies. Alistair most

recently worked as a Senior Exploration Consultant with RSCMME Ltd

and technical advisor to Trinity Metals Group.

Appointment of Joint Broker

Shard Capital Partners LLP was appointed as joint broker,

alongside SI Capital.

Option Agreement with Liontown Resources to Explore for

Lithium

Post year end the Company announced that, together with the

other owners of the Kathleen Valley licence ("Licence"), it had

entered into an option agreement with LBM (Aust) Pty Limited, a

subsidiary of Liontown Resources Limited (ASX: LTR) ('Liontown'),

granting Liontown the option to explore for lithium on the Kathleen

Valley Licence Area in Western Australia ('KV Project').

Liontown to invest AUD$100,000 in Mila through a convertible

loan

This is based on the following principal terms:

1. the Notes are repayable by conversion into Mila Shares at a

price to be determined on Mila's next fundraise;

2. Mila may repay the Notes without penalty after 31 December

2023;

3. Liontown may redeem the Notes following the occurrence of

usual events of default or if the Notes have not been converted

into Mila Shares by 30 November 2023; and

4. the Notes carry no interest except on the occurrence an event

of default, when interest at 10% per annum will become payable.

Amendments to Kathleen Valley Earn-In Agreement

Post year end the Company announced that it has entered into a

deed of amendment with Trans Pacific Energy Group Pty Ltd ("TPE")

and New Generation Minerals Limited ("NGM"), the other owners of

the Licence, making certain amendments to the Earn-In Agreement

between them dated 29 October 2021 ("Earn-In Agreement") as part of

the re-listing of the Company on the LSE in November 2021.

Summary of key amendments

-- increase its Participating Interest in the Licence from its

current 30% to 80% on the issue of the Stage Two Consideration

Shares;

-- increase its ownership of the current Lithium rights from 50%

to 80% on the issue of the Stage Three Consideration Shares,

representing 16% of the Lithium Rights following full exercise by

Liontown of its option; and

-- at any time when the Parties are not conducting a physical

drilling campaign, reduce Mila's liability for expenditure to

maintain the Licence to its Participating Interest (currently

30%).

20. CONTROL

In the opinion of the Directors there is no single ultimate

controlling party.

**ENDS**

For more information visit www.milaresources.com or contact:

Mark Stephenson info@milaresources.com

Mila Resources Plc

Jonathan Evans

Tavira Financial Limited +44 (0) 20 7100 5100

Nick Emerson

SI Capital +44 (0) 20 3143 0600

Susie Geliher

St Brides Partners Limited +44 (0) 20 7236 1177

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UASOROWUROAA

(END) Dow Jones Newswires

October 31, 2023 10:00 ET (14:00 GMT)

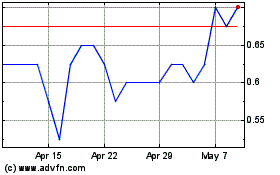

Mila Resources (LSE:MILA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mila Resources (LSE:MILA)

Historical Stock Chart

From Nov 2023 to Nov 2024