NB Private Equity Partners Announces Results of Annual General

Meeting

12 June 2024

NB Private Equity Partners Limited (the

“Company”) is pleased to announce that at the Annual General

Meeting of its Class A Shareholders held at 1.45 p.m. on 12 June

2024, each of the Resolutions tabled were duly passed without

amendment.

The details of each resolution are as

follows:

ORDINARY RESOLUTIONS

Resolution 1

THAT the Audited Financial

Statements, the Directors’ report, and the auditors’ report for the

financial year ended 31 December 2023 be received and

considered.

|

For (including discretionary) |

28,005,526 votes |

|

Against |

4,357 votes |

|

Withheld |

28,426 votes |

Resolution 2

THAT the Directors’

Remuneration Report as set out in the Annual Report for year ended

31 December 2023 be approved.

|

For (including discretionary) |

27,999,999 votes |

|

Against |

9,053 votes |

|

Withheld |

29,257 votes |

Resolution 3

THAT William Maltby as a

Director of the Company, retiring in accordance with the AIC Code

and Article 26.2 of the Company’s Articles of Incorporation be

re-elected.

|

For (including discretionary) |

27,770,165 votes |

|

Against |

238,218 votes |

|

Withheld |

29,926 votes |

Resolution 4

THAT John Falla as a Director

of the Company, retiring in accordance with the AIC Code and

Article 26.2 of the Company’s Articles of Incorporation be

re-elected.

|

For (including discretionary) |

27,740,286 votes |

|

Against |

268,097 votes |

Withheld

|

29,926 votes |

Resolution 5

THAT Trudi Clark as a Director

of the Company, retiring in accordance with the AIC Code and

Article 26.2 of the Company’s Articles of Incorporation be

re-elected.

|

For (including discretionary) |

24,094,026 votes |

|

Against |

3,915,856 votes |

|

Withheld |

28,426 votes |

Resolution 6

THAT Wilken von Hodenberg as a

Director of the Company, retiring in accordance with the AIC Code

and Article 26.2 of the Company’s Articles of Incorporation be

re-elected.

|

For (including discretionary) |

27,772,165 votes |

|

Against |

237,718 votes |

|

Withheld |

28,426 votes |

Resolution 7

THAT Louisa Symington-Mills as

a Director of the Company, retiring in accordance with the AIC Code

and Article 26.2 of the Company’s Articles of Incorporation be

re-elected.

|

For (including discretionary) |

27,772,165 votes |

|

Against |

237,718 votes |

|

Withheld |

28,426 votes |

|

|

|

Resolution 8

THAT Pawan Dhir as a Director

of the Company, in accordance with the AIC Code and Article 20.5 of

the Articles, be elected.

|

For (including discretionary) |

28,003,071 votes |

|

Against |

5,288 votes |

|

Withheld |

29,950 votes |

Resolution 9

THAT KPMG Channel Islands

Limited, who have indicated their willingness to continue in

office, be re-appointed as auditors of the Company and to hold

office from the conclusion of this AGM until the conclusion of the

next AGM to be held in 2025.

|

For (including discretionary) |

26,242,736 votes |

|

Against |

1,765,635 votes |

|

Withheld |

29,938 votes |

Resolution 10

THAT the Directors be

authorised to determine the remuneration of KPMG Channel Islands

Limited.

|

For (including discretionary) |

27,711,821 votes |

|

Against |

298,062 votes |

|

Withheld |

28,426 votes |

Resolution 11

THAT the interim dividend paid

on 31/08/2023 of $0.47 per share and the interim dividend paid on

29/02/2024 of $0.47 per share approved.

|

For (including discretionary) |

28,005,526 votes |

|

Against |

4,357 votes |

|

Withheld |

28,426 votes |

In accordance with LR 9.6.18, details of those

resolutions passed, which were not ordinary business of the AGM,

follow:-

|

Resolution Type |

Votes For

(including discretionary) |

Votes Against |

Votes Withheld* |

|

12 - Special |

28,002,775 |

7,108 |

28,426 |

|

13 - Special |

27,555,766 |

452,617 |

29,926 |

|

14 - Special |

28,000,604 |

7,779 |

29,926 |

*A vote withheld is not a vote in law and is

therefore not counted towards the proportion of votes “for” or

“against” the Resolution.

The full wording of these resolutions can be

found below:

SPECIAL RESOLUTIONS

Resolution 12

THAT the Company be and is

hereby authorised, in accordance with section 315 of the Companies

(Guernsey) Law, 2008, as amended (the “Companies Law”), subject to

the Listing Rules made by the United Kingdom Financial Conduct

Authority and all other applicable legislation and regulations, to

make market acquisitions (within the meaning of section 316 of the

Companies Law) of its own Class A Shares (as defined in the

Company’s Articles of Incorporation) which may be cancelled or held

as treasury shares, provided that:

- the maximum number of Class A Shares authorised to be purchased

under this authority shall be 6,931,034 Class A Shares (being 14.99

per cent of the Class A Shares in issue (excluding Class A Shares

held in treasury)) as at the Latest Practicable Date;

- the minimum price (exclusive of expenses) which may be paid for

a Class A Share is US$0.01;

- the maximum price (exclusive of expenses) which may be paid for

a Class A Share shall be not more than an amount equal to the

higher of (a) 5 per cent. above the average mid-market value of the

Class A Shares on the regulated market where the repurchase is

carried out for the five business days prior to the day the

purchase is made and (b) the higher of (i) the price of the last

independent trade and (ii) the highest current independent bid

price, in each case on the regulated market where the purchase is

carried out; and

such authority to expire on the date which is 15

months from the date of passing of this resolution or, if earlier,

at the end of the Annual General Meeting of the Company to be held

in 2025 (unless previously renewed, revoked or varied by the

Company by special resolution) save that the Company may make a

contract to acquire Class A Shares under this authority before its

expiry which will or may be executed wholly or partly after its

expiration and the Company may make an acquisition of Class A

Shares pursuant to such a contract.

Resolution 13

THAT the Directors be and are

hereby authorised, pursuant to Article 5.7 of the Articles of

Incorporation, to allot and issue or make offers or agreements to

allot and issue, grant rights to subscribe for, or to convert any

securities into, Class A Shares (including by way of sale of Class

A Shares from treasury) (“Relevant Securities”) for cash up to the

aggregate number of Class A Shares equal to 4,619,148 (being 9.99

per cent. of the Class A Shares in issue as at the Latest

Practicable Date) (excluding any Class A Shares held in treasury

and after giving effect to the exercise of any warrants, options or

other convertible securities outstanding as at such date) as if

Article 5.2 of the Articles did not apply to any such allotment and

issue, such authority to expire on the date which is 15 months from

the date of the passing of this resolution or, if earlier, at the

end of the Annual General Meeting of the Company to be held in 2025

(unless previously renewed, revoked or varied by the Company by a

special resolution) save that the Company may, before such expiry,

make an offer or agreement which would or might require Relevant

Securities to be allotted and issued after such expiry and the

Directors may allot and issue Relevant Securities in pursuance of

such an offer or agreement as if the authority conferred by this

resolution had not expired.

Resolution 14

THAT in accordance with Section

42 of the Companies Law, the new articles of the Company (a copy of

which will be produced to the meeting and signed by the Chairman of

the meeting for the purposes of identification) be and are hereby

approved and adopted as the new articles of incorporation of the

Company in substitution for and to the exclusion of the existing

articles of incorporation of the Company.

For further information, please

contact:

NBPE Investor

Relations +44

20 3214 9002

Luke

Mason

NBPrivateMarketsIR@nb.com

Kaso Legg

Communications +44

(0)20 3882 6644

Charles

Gorman

nbpe@kl-communications.com

Luke Dampier

Charlotte Francis

About NB Private Equity Partners

Limited

NBPE invests in direct private equity investments alongside market

leading private equity firms globally. NB Alternatives Advisers LLC

(the “Investment Manager”), an indirect wholly owned subsidiary of

Neuberger Berman Group LLC, is responsible for sourcing, execution

and management of NBPE. The vast majority of direct investments are

made with no management fee / no carried interest payable to

third-party GPs, offering greater fee efficiency than other listed

private equity companies. NBPE seeks capital appreciation through

growth in net asset value over time while paying a bi-annual

dividend.

LEI number: 213800UJH93NH8IOFQ77

About Neuberger Berman

Neuberger Berman is an employee-owned, private, independent

investment manager founded in 1939 with over 2,800 employees in 26

countries. The firm manages $474 billion of equities, fixed income,

private equity, real estate and hedge fund portfolios for global

institutions, advisors and individuals. Neuberger Berman’s

investment philosophy is founded on active management, fundamental

research and engaged ownership. UNPRI named the firm a Leader, a

designation awarded to fewer than 1% of investment firms for

excellence in environmental, social and governance practices.

Neuberger Berman has been named by Pensions & Investments as

the #1 or #2 Best Place to Work in Money Management for each of the

last ten years (firms with more than 1,000 employees). Visit

www.nb.com for more information. Data as of April 30, 2024.

| This press release appears as a matter of record only and does

not constitute an offer to sell or a solicitation of an offer to

purchase any security. NBPE is established as a closed-end

investment company domiciled in Guernsey. NBPE has received the

necessary consent of the Guernsey Financial Services Commission.

The value of investments may fluctuate. Results achieved in the

past are no guarantee of future results. This document is not

intended to constitute legal, tax or accounting advice or

investment recommendations. Prospective investors are advised to

seek expert legal, financial, tax and other professional advice

before making any investment decision. Statements contained in this

document that are not historical facts are based on current

expectations, estimates, projections, opinions and beliefs of

NBPE's investment manager. Such statements involve known and

unknown risks, uncertainties and other factors, and undue reliance

should not be placed thereon. Additionally, this document contains

"forward-looking statements." Actual events or results or the

actual performance of NBPE may differ materially from those

reflected or contemplated in such targets or forward-looking

statements. |

Nb Private Equity Partners (LSE:NBPU)

Historical Stock Chart

From Nov 2024 to Dec 2024

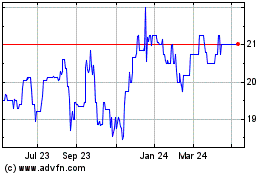

Nb Private Equity Partners (LSE:NBPU)

Historical Stock Chart

From Dec 2023 to Dec 2024