NEOVIA completes acquisition of Optimal Payments (5327A)

February 02 2011 - 3:10AM

UK Regulatory

TIDMNEO

RNS Number : 5327A

Neovia Financial PLC

02 February 2011

Press release For immediate release

NEOVIA Financial Plc

NEOVIA announces the completion of the acquisition of Optimal

Payments

Wednesday 2 February 2011 - NEOVIA Financial Plc (LSE: NEO) (the

"Company"), the leading alternative payments business, is pleased

to announce that the Company has completed the acquisition of

Optimal Payments (the "Acquisition") which was announced on 20

January 2011.

Admission

The admission of 5,367,378 ordinary shares of 0.01 pence

("Ordinary Shares") in the Company to trading on the AIM market of

the London Stock Exchange ("Admission") issued in relation to the

Acquisition occurred on 31 January 2011.

Directors and directors' shareholdings

Following completion of the Acquisition and pursuant to the

terms thereof, Joel Leonoff's appointment as an executive director

of the Company became effective.

Following Admission and pursuant to the terms of the

Acquisition, Joel Leonoff is now beneficially interested in 330,178

Ordinary Shares (representing 0.26% of the Company's issued share

capital). Following Admission Keith Butcher is beneficially

interested in 84,530 Ordinary Shares (representing 0.07% of the

Company's issued share capital).

Following completion of the Acquisition and pursuant to the

terms thereof, Joel Leonoff is also indirectly interested in

warrants having the right to be converted into Ordinary Shares

dependent on certain performance criteria being achieved over each

of the next two years. The total value of these warrants may be up

to US$ 2.5 million and depending on the timing and circumstances of

any conversion, the exercise price of these warrants will be either

62.6990 pence or 66.2480 pence.

Issued share capital and voting rights

Following Admission, the Company will have a total of

125,288,331 Ordinary Shares in issue each with voting rights. The

Company does not hold any shares in treasury. Therefore the total

number of voting rights in the Company is 125,288,331.

Shareholder meeting

As announced on 20 January 2011, the Company intends to change

the name of NEOVIA Financial Plc to Optimal Payments Plc. An

extraordinary general meeting of the Company's shareholders will be

held on Monday 28 February 2011 at the Company's offices in the

Isle of Man to consider this proposal. A circular and proxy form

setting out the terms of the resolution to be considered and full

details of the meeting will be sent to the Company's shareholders

later today, and copies of these documents will be available on the

Company's website at www.neovia.com.

Enquiries:

NEOVIA Financial Plc

Andrew Gilchrist VP Communications

Email: investorrelations@neovia.com

Twitter: https://twitter.com/neovia + 44 (0) 1624 698 713

Citigate Dewe Rogerson

Sarah Gestetner + 44 (0) 207 638 9571

Daniel Stewart & Co Plc

Paul Shackleton + 44 (0) 207 776 6550

* * * * *

About NEOVIA Financial

Trusted by consumers and merchants in over 160 countries to move

and manage billions of dollars each year, NEOVIA Financial Plc

operates the world's leading independent online payments business.

Through its Payment Suite, featuring NETELLER(R), NETBANX(R) and

Net+(TM) brands, NEOVIA specialises in providing innovative and

instant payment services where money transfer is difficult or risky

due to identity, trust, currency exchange, or distance. Being

independent has allowed NEOVIA to support thousands of retailers

and merchants in many geographies and across multiple

industries.

NEOVIA Financial Plc is quoted on the London Stock Exchange's

AIM market with a ticker symbol of NEO. Subsidiary company NETELLER

(UK) Limited is authorised by the Financial Services Authority

(FSA) to operate as a regulated e-money issuer. For more

information about NEOVIA Financial visit www.neovia.com or

subscribe at www.neovia.com/feeds/.

About Optimal Payments

Optimal Payments is a leading global payment processor that

provides credit/debit card and e-check (Direct Debit) solutions to

Internet and mail-order/telephone-order (MOTO) merchants in Canada,

the United States Europe, and the Caribbean, processing in excess

of US$ 2.5 billion in transactions annually. In operation for over

10 years, Optimal Payments was one of the first technology

companies to provide services in the electronic payment business.

Its head office is in Montreal, with additional offices in the

United States; Gatineau, Quebec; and the United Kingdom. Optimal

Payments develops and maintains proprietary software, which enables

its merchant clients to interface with various banks, credit and

debit card providers, and other entities involved in the payment

processing chain. Its software has advanced and highly effective

fraud- and risk-management components built into it, allowing the

company to assist clients in mitigating the risk of fraudulent

transactions. Its software and payment solutions are tailored to

the needs of individual clients so that the services match their

needs in a wide range of businesses with varying requirements.

Visit www.optimalpayments.com for more information.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQUGUPUPUPGUBP

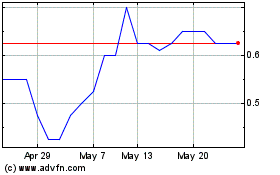

Neo Energy Metals (LSE:NEO)

Historical Stock Chart

From Jun 2024 to Jul 2024

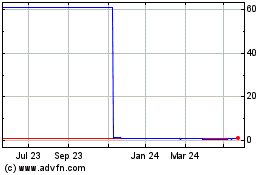

Neo Energy Metals (LSE:NEO)

Historical Stock Chart

From Jul 2023 to Jul 2024