NextEnergy Solar Fund Limited Interim Management Statement (9550N)

August 01 2014 - 1:00AM

UK Regulatory

TIDMNESF

RNS Number : 9550N

NextEnergy Solar Fund Limited

01 August 2014

1 August 2014

NextEnergy Solar Fund Limited

Interim Management Statement

NextEnergy Solar Fund Limited ("NESF" or the "Company"), a

specialist investment fund focused on operational solar

photovoltaic ("PV") assets located in the UK, is issuing this

Interim Management Statement ('IMS') in accordance with FCA

Disclosure and Transparency Rule 4.3 and in respect of the period

since the Company's admission to the Main Market of the London

Stock Exchange on 25 April up until 31 July 2014.

Highlights

-- GBP85.6 million initial public offering ("IPO") in April 2014

-- Approximately 73% of IPO proceeds committed to or invested in six solar assets

-- Majority of capital invested in operating assets

-- All operating assets performing in line with management expectations

-- NESF on track for full-year dividend payout of 5.25 pence per ordinary share

-- Significant pipeline of further investments under consideration

Background to the Company

NESF was admitted to trading on the Main Market of the London

Stock Exchange on 25 April 2014 and had an opening NAV of 100 pence

per ordinary share. The Company targets aggregate returns to

investors that equate to an unlevered net IRR of between 7 and 9%

and, with effect from the financial year beginning 1 April 2015, an

annual dividend of 6.25 pence per ordinary share (adjusted in

direct proportion to annual variations in RPI) in each financial

year. The Company expects to pay a dividend of 5.25 pence per

ordinary share for its first financial year ending 31 March 2015.

The Company's investment manager is NextEnergy Capital IM Limited,

part of the NextEnergy Capital Group (the "IM").

Portfolio

Since its IPO, NESF has acquired or committed to acquire six

solar PV plants located in the UK. The total investment value of

these six assets amounts to c. GBP62.5 million, or c. 73% of IPO

proceeds. The majority of investment relates to the acquisition of

operating solar power plants, while the remainder comprises plants

which will be acquired by NESF upon commissioning. NESF has

acquired or committed to acquire a 100% interest in each of the

plants. The operating plants are all performing, and construction

of the assets to be acquired at commissioning is progressing, in

line with expectations. The portfolio is set out in the table

below.

Project Name Status MW Acquisition Value

(GBPM)

------------------- ---------------- ---- -----------------

Higher Hatherleigh Operating 6.1 7.1

Shacks Barn Operating 6.3 8.0

Gover Farm In Construction 9.4 10.5

Bilsham In Construction 12.5 15.0

Brickyard In Construction 3.8 3.9

Ellough Operating 14.9 18.0

------------------- ---------------- ---- -----------------

Total 53.0 62.5

Pipeline

The Company, in conjunction with the IM, continues to progress

execution of transactions that will allow full deployment of the

IPO proceeds within four months from the IPO.

In addition, the IM has identified and is undertaking the due

diligence on a large set of additional opportunities for the

Company. These opportunities will enable the fund to present

attractive incremental growth options to its investors in due

course.

Outlook

Considering NESF's success in rapidly deploying capital to date,

the transactions currently under execution as well as the further

opportunities identified, the Directors believe that NESF continues

to offer investors an attractive investment opportunity.

The market conditions continue to be favourable for NESF due to

the number of assets currently under development and/or

construction by third parties. Given the proposed change to the

regulatory framework regarding the abolition of renewable energy

obligations ("ROCS") in April 2015, NESF has observed increased

levels of activity among developers and construction agents. The

increased level of activity appears to be due to these market

participants seeking to commission plants before the end of the

ROCS regime. In turn, an increased number of plants being

commissioned by short-term asset owners will result in more

opportunities for NESF to acquire operating plants in the current

tax year.

Enquiries

NextEnergy Capital Limited 020 3239 9054

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe 020 7894 7667

Sue Inglis

Gareth Price

Shore Capital 020 7408 4090

Bidhi Bhoma

Anita Ghanekar

MHP Communications 020 3128 8100

Rupert Trefgarne

Jamie Ricketts

Notes to Editors:

NextEnergy Solar Fund

NextEnergy Solar Fund (www.nextenergysolarfund.com) is a

specialist investment fund focused on operational solar

photovoltaic ("PV") assets located in the UK. The Company intends

to provide investors with a sustainable and attractive dividend

that increases in line with RPI over the long term and an element

of capital growth through the re-investment of net cash generated

in excess of the target dividend.

Further information on NextEnergy Capital and WiseEnergy is

available at www.nextenergycapital.com and www.wise-energy.eu.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSWGUAWMUPCGQG

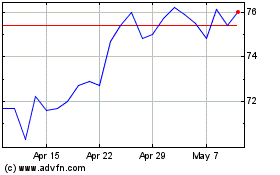

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jul 2023 to Jul 2024