Oakley Capital Investments Limited Inspired welcomes Warburg Pincus as an Investor (5333A)

May 30 2019 - 1:00AM

UK Regulatory

TIDMOCI

RNS Number : 5333A

Oakley Capital Investments Limited

30 May 2019

30 May 2019

Oakley Capital Investments Limited

Inspired welcomes Warburg Pincus as an investor in its next

phase of growth

Oakley Capital Investments Limited(1) (AIM: OCI, the "Company")

is pleased to announce that Inspired, a leading global group of

premium schools, has received a significant strategic growth

investment from Warburg Pincus, a global growth private equity

firm, and TA Associates, an existing shareholder, comprising both

primary and secondary investment. Oakley Capital Private Equity II

("Fund II")(2) is an investor in Inspired while OCI also holds a

direct stake in the business.

As part of the transaction Fund II has sold down a part of its

stake. OCI will continue to hold its direct stake in Inspired, as

well as its remaining indirect interest through Fund II. Financial

terms have not been disclosed, however the Company's share of

proceeds from this transaction will be approximately EUR40 million.

Following the transaction, OCI's interest in Inspired, through both

its direct investment and through Fund II, is valued at

approximately EUR102 million. This, combined with the sell down

proceeds, will add approximately 21 pence to the NAV per share

compared to the December 2018 position.

Inspired, founded by Nadim M Nsouli, is a co-educational,

non-denominational, independent school group designed to inspire

students to achieve their maximum potential in a nurturing,

progressive academic environment. Inspired has grown rapidly by

building new schools and acquiring existing successful ones around

the world. Inspired is one of the leading global groups of premium

schools educating over 38,000 students between the ages of 1 and 18

on 5 continents. The company has offices in London, Milan,

Johannesburg, Bogota and Auckland.

Peter Dubens, Managing Partner of Oakley Capital, commented:

"Since backing Nadim Nsouli when he founded Inspired in 2013

with four schools, we have seen him and his team develop the

business into one of the world's leading global premium schools

groups with more than 50 schools. We are excited to welcome Warburg

Pincus as an Inspired shareholder and look forward to working

together to support Inspired through the next stage of its

growth."

Nadim Nsouli, Founder, Chairman and CEO of Inspired,

commented:

"In seeking an investor to enable us to continue building and

acquiring leading schools around the world, our goal was to have an

international firm with a history of working with entrepreneurial

companies to accelerate growth. Since starting Inspired, we have

been fortunate to have shareholders that share our commitment to,

and passion for premium education and with a long-term investment

horizon. We now welcome Warburg Pincus as an investor in Inspired

for the next phase of our exciting journey in building the premier

global group of premium schools."

- ends -

For further information please contact:

Oakley Capital Investments Limited

+44 20 7766 6900

Steven Tredget, Investor Relations

Greenbrook Communications Ltd

+44 20 7952 2000

Alex Jones / Matthew Goodman / Gina Bell

Liberum Capital Limited (Nominated Adviser & Broker)

+44 20 3100 2000

Gillian Martin / Owen Matthews

Notes:

This announcement contains inside information for the purposes

of the Market Abuse Regulation (EU) No. 596/2014.

(1) About Oakley Capital Investments ("OCI")

OCI is an AIM listed investment vehicle, which provides access

to the Oakley Funds(2) . It is a liquid vehicle that provides

capital growth and dividends to investors.

LEI Number: 213800KW6MZUK12CQ815

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity III

and Oakley Capital IV, are unlisted focused mid-market private

equity funds with the aim of providing investors with significant

long-term capital appreciation. The investment strategy of the

funds is to focus on buy-out opportunities in industries with the

potential for growth, consolidation and performance

improvement.

The Investment Adviser

Founded in 2002 Oakley Capital has demonstrated the repeated

ability to acquire attractive growth assets at attractive prices.

To do this they rely on their sector and regional expertise, their

ability to tackle transaction complexity and their deal generating

entrepreneur network.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISBIGDUBDDBGCC

(END) Dow Jones Newswires

May 30, 2019 02:00 ET (06:00 GMT)

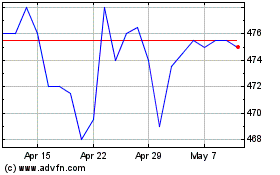

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Sep 2024 to Oct 2024

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Oct 2023 to Oct 2024