Admission to AIM & First Day of Dealings

November 30 2009 - 1:00AM

UK Regulatory

TIDMPALM

RNS Number : 2471D

Asian Plantations Limited

30 November 2009

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN

news release

30 November 2009

ASIAN PLANTATIONS LIMITED

FIRST DAY DEALINGS

The Board of Asian Plantations Limited (the "Company"), a Singapore incorporated

company established to act as a holding company with subsidiaries (together the

"Group") involved in the acquisition, development, operation and management of

palm oil plantations in Malaysia, is pleased to announce its admission to the

AIM market of the London Stock Exchange ("Admission") and the first day of

dealings in its ordinary shares under ticker symbol PALM.

The Company has raised GBP5.26 million through a Company sponsored placing of

7,010,000 new ordinary shares representing 23.7% of the enlarged share capital

of the Company. The approximate market capitalisation of the Company at the

subscription price is GBP22.18 million.

Strand Hanson Limited is acting as nominated adviser in relation to the

Admission with Mirabaud Securities LLP as broker.

Overview

The Group owns 4,795 hectares of titled and agricultural land, zoned for palm

oil plantations in Sarawak, Malaysia (the "Sarawak Estate"). To date, the Group

has spent approximately RM42 million (US$12.43 million) in respect of the

acquisition and development of the Sarawak Estate.

Following the arrival of the first seedlings at the nursery in April 2008 and

the first planting of palm oil trees in April 2009, the directors of the Company

(the "Directors") expect to have approximately 2,000 hectares of the total

Sarawak Estate planted and developed by the end of 2009, with the expectation of

revenue-generating harvests commencing in December 2010.

In addition to the continued development and future operation of the Sarawak

Estate, the Group has identified a number of potential acquisition opportunities

which would increase the amount of land held for the development and operation

of palm oil plantations. The Directors intend to complete at least one

acquisition within six months of Admission and to pursue further opportunities

to increase the plantable area to in excess of 20,000 hectares within two years

of Admission.

Key investment opportunity

There is a significant valuation gap, on a per hectare basis, between the cash

cost of land acquisition and development of palm oil plantations and the market

valuations for mature businesses. The Directors believe mature palm oil

plantations offer attractive cash flow generation, from which the Group is well

positioned to benefit.

The Directors believe the following characteristics of the Group are attractive

to investors:

* an opportunity to invest in a developing Malaysian palm oil platform at a

substantial discount to mature land valuations for similar publicly listed

companies;

* the implicit valuation per plantable hectare of land held by the Group at the

time of Admission is RM23,311 (US$6,900). Institutional market research

estimates the value of the plantation business of comparable Malaysian palm oil

companies at between RM65,000 to RM100,000 (US$20,000 to US$30,000) per hectare;

* the Directors have substantial experience in the palm oil industry, including the successful pioneering of advanced milling technologies for the processing of fresh fruit bunches ("FFB"), planting a top-rated palm oil estate in Malaysia and undertaking new planting projects;

* palm oil is increasingly in demand, driven, in part, by its relative low cost of production compared to other major vegetable oils and health benefits when compared to alternative edible oils;

* the palm oil market is undergoing a period of rapid change, with the growth of new biofuel markets resulting in a distinct increase in demand for vegetable oil products, and a commensurate increase in global palm oil prices. The Directors believe that there is potential for prices to rise further;

* the Group has access to land in Malaysia on which palm oil trees have already been planted, at a time of increasing competition for agricultural land;

* the Group has committed to comply with the environmental guidelines relating to sustainable palm oil planting practices. The Directors and major shareholders of the Group have experience with the Roundtable on Sustainable Palm Oil ("RSPO") application process and the Group is currently seeking to become a member of the RSPO. In addition to acting in accordance with the RSPO membership guidelines, the Directors intend to observe guidance from other environmental organisations or groups which the Directors believe promote the growth, trade in and use of sustainable palm oil; and

* the Group intends to investigate the process of developing its own crushing mill, into which the Directors would incorporate methane recapture technologies. This technology has been tested and is eligible for carbon credits under the Kyoto protocol.

Commenting on Admission, Graeme Brown, Joint Chief Executive Officer, said:

"Palm oil is expected to provide up to two-thirds of the growth in worldwide

vegetable oil production over the next ten years. With strong growth in China

and India, combined with health concerns surrounding trans-fatty acids in the

developed markets, the outlook for the Group is exciting. The listing on AIM

provides an opportunity for investors to benefit from these key drivers, while

investing in the sector at a significant discount to its established peers.

With the first FFB harvest expected within 12 months and further potential land

acquisition opportunities available, the Group is well positioned to become a

significant producer of palm oil in the short to medium term."

Further information on the Company can be found at

www.asianplantationslimited.com.

Enquiries to:

Asian Plantations Limited Tel: +65 9878 4171

Dennis Melka

Strand Hanson Limited Tel: +44 20 7409 3494

James Harris

Angela Peace

Paul Cocker

Mirabaud Securities LLPTel: +44 20 7878 3360

Rory Scott

Bankside Consultants Tel: +44 20 7367 8888

Simon Rothschild

Oliver Winters

NOTE TO EDITORS:

Directors

Executive Directors

Graeme Brown, Co-Founder & Joint Chief Executive Officer, age 38

Graeme Brown is co-founder of the Company. Prior to this, he worked for eight

years at Keresa Plantations, where he remains the managing director, over which

time he planted and managed a 6,000 hectare palm oil plantation. He is a

specialist in plantation planting, palm species and plantation operations with

over 10 years' experience in the industry. He also founded Keresa Mills Sdn Bhd,

which has been a pioneer in the successful implementation of advanced milling

technologies for FFB processing.

Dennis Melka, Co-Founder & Joint Chief Executive Officer, age 36

Dennis Melka is also co-founder of the Company. Prior to this, and since 2005,

Mr Melka was a private venture capitalist and has founded companies in

Southeast Asia focused on limited service lodging, sustainable tree plantations

and financial services. From 1995 to 2005, he worked in Credit Suisse First

Boston's investment banking group.

Non-executive Director

Datuk Amar Leonard Linggi Jugah, Non-Executive Chairman, age 69

Datuk Amar Leonard Linggi Jugah has over 36 years' experience in the business

and legal sectors. He has served in a variety of political roles in Malaysia,

including Minister in the Sarawak State Cabinet, Member of Parliament, appointee

to the parliamentary Public Accounts Committee and until recently, Secretary

General of Parti Pesaka Bumiputra Bersatu Sarawak.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDGBDBDGDGGCR

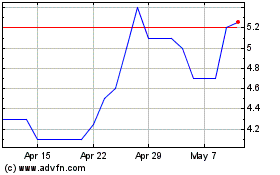

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

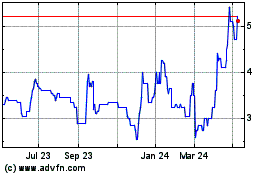

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024