Decrease/(increase) in inventories 65 (1,366)

Increase in trade and other receivables

and prepayments (60) (2,417)

Increase in trade and other payables 3,780 6,822

Cash flows used in operating activities (1,931) (970)

Income taxes refund/(paid), net of refund 48 (89)

Interest received 245 280

Interest paid (5,540) (3,190)

Net cash flows used in operating activities (7,178) (3,969)

Investing activities

Purchase of property, plant and equipment (17,357) (37,056)

Proceeds from sale of property, plant and

equipment 7 20

Purchase of land use rights (870) (21,044)

Additions to biological assets (10,979) (27,912)

Acquisition of a subsidiary (Note 1(b)) (3,301) (3)

Net cash flows used in investing activities (32,500) (85,995)

Financing activities

Proceeds from exercise of share options 311 30

Repayment of term loan (38,611) (5)

Proceeds from term loans 12,284 45,349

Repayment of short-term revolving credit (1,828) -

Proceeds from Bank Guaranteed Medium Term

Notes Programme 46,675 31,954

Short-term deposit pledged for a banking

facility and supply of goods 76 (888)

Payment of finance lease liabilities (539) (380)

Proceeds from issuance of convertible bonds 14,981 -

Issuance expense on liability component

of convertible bonds (544) -

Net cash flows from financing activities 32,805 76,060

Net decrease in cash and cash equivalents (6,873) (13,904)

Net foreign exchange difference 158 714

Cash and cash equivalents at 1 January 14,188 27,378

Cash and cash equivalents at 31 December

(Note 22) 7,473 14,188

The accompanying accounting policies and explanatory notes form

an integral part of the financial statements.

1. General

(a) Corporate information

Asian Plantations Limited (the "Company") is a limited liability

company incorporated and domiciled in the Republic of Singapore and

listed on the Alternative Investment Market ("AIM") of the London

Stock Exchange.

The registered office of the Company is located at No. 14 Ann

Siang Road, #02-01, Singapore 069694.

The principal activity of the Company is that of investment

holding. The principal activities of the subsidiaries are as

disclosed in Note 1(b).

(b) Subsidiaries

As of 31 December 2013, the details of subsidiaries are as

follows:

Proportion

of ownership

interest

-----------------

Country

Subsidiaries of incorporation Activities 2013 2012

---------------------------------- ------------------ ------------ ------ -----

% %

Asian Plantations (Sarawak) Investment

Sdn. Bhd. ("APS") (1) Malaysia holding 100 100

Asian Plantations (Sarawak)

II Sdn. Bhd. ("APS II") Investment

(1) Malaysia holding 100 100

Asian Plantations (Sarawak)

III Sdn. Bhd. ("APS III") Investment

(1) Malaysia holding 100 100

South Asian Farms Sdn.

Bhd. Malaysia Dormant - 100

("SAF") (1) (2)

Held through APS:

BJ Corporation Sdn. Bhd. Oil-palm

("BJ") (1) Malaysia plantation 100 100

Incosetia Sdn. Bhd. ("Incosetia") Oil-palm

(1) Malaysia plantation 100 100

Fortune Plantation Sdn. Oil-palm

Bhd. Malaysia plantation 100 100

("Fortune") (1)

Asian Plantations Milling Oil-palm

Sdn. Bhd. ("APM") (1) Malaysia milling 100 100

Held through Incosetia

:

South Asian Farms Sdn.

Bhd. (1) (2) Malaysia Dormant 100 -

Proportion

of ownership

interest

Country

Subsidiaries of incorporation Activities 2013 2012

------- ------

% %

Held through APS II :

Kronos Plantation Sdn. Oil-palm

Bhd. ("KP") (1) Malaysia plantation 100 100

Grand Performance Sdn. Oil-palm

Bhd. ("GP") (1) Malaysia plantation 100 -

Held through APS III

:

Jubilant Paradise Sdn. Oil-palm

Bhd. ("JP") (1) Malaysia plantation 60 60

(1) Audited by member firm of Ernst & Young Global in

Malaysia.

(2) During the year, the ownership of SAF has been transferred

from the Company to Incosetia.

Acquisition in 2013

Acquisition of Grand Performance Sdn. Bhd.

On 19 August 2013, the Group acquired 100% equity interest in a

new subsidiary, GP, which has land use rights over 3,852 hectares

of agricultural land, for a purchase consideration of RM25.7

million (or approximately USD7,808,000), to be satisfied by cash.

The acquisition of this subsidiary increased the Group's

agricultural land bank at time of increasing scarcity of

agricultural land in Malaysia. At date of acquisition, GP has yet

to commence any planting activities or operations, and hence this

acquisition represents purchase of assets by the Group with no

goodwill arising on acquisition.

Assets acquired and liabilities assumed:

The fair values of the identifiable assets and liabilities of GP

at the date of the acquisition were:

USD'000

Assets

Land use rights 8,228

Cash at bank 303

8,531

Liabilities

Other payables (723)

Total identifiable net assets at fair

value 7,808

Purchase consideration transferred

Cash paid 3,604

Remaining consideration payable in

cash 4,204

7,808

Effect of the acquisition on cash flows

Net cash acquired with the subsidiary 303

Cash paid (3,604)

Net cash outflow on acquisition (3,301)

Transaction costs of USD68,000 have been expensed and are

included in administrative expenses.

Acquisitions in 2012

Acquisition of South Asian Farms Sdn. Bhd.

On 24 September 2012, the Group acquired a new subsidiary, SAF,

which was a dormant company, and therefore does not have a material

effect on the financial results and financial position of the

Group. There were no acquisition related expenses arising from the

acquisition of this subsidiary. As SAF is a dormant company, there

was no fair value adjustment to be recognised. At the date of

acquisition of SAF, the only identifiable assets and liabilities

are payables of USD2,000. Goodwill arising on initial recognition

of USD5,000 was subsequently impaired in view of the inactivity of

this company. The purchase consideration for the acquisition of SAF

amounted to USD3,000.

2. Fundamental accounting concept

For the financial year ended 31 December 2013, the Group

incurred a loss of USD10,401,000, and as at that date, the Group's

current liabilities exceeded its current assets by USD1,301,000.

These factors indicate the existence of a material uncertainty

which may cast doubt about the Group's ability to operate as a

going concern.

Nevertheless, these financial statements are prepared on a going

concern basis because of the following assumptions and measures

undertaken:

a) The Group will be able to generate adequate cash flows from operations in the future

b) The drawn and undrawn borrowing facilities from banks will

continue to be available to the Group. As at 31 December 2013, the

Group has available existing undrawn committed credit facilities

amounting to USD17,261,000;

c) Certain major shareholders have indicated its willingness to

provide financial support to the Group to meet its obligations as

and when required; and

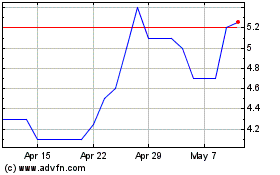

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

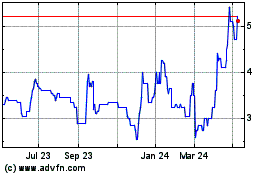

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024