d) The Group is considering a range of funding options,

including raising additional capital through a rights issue.

If the Group is unable to continue in operational existence for

the foreseeable future, the Group may be unable to discharge its

liabilities in the normal course of business and adjustments may

have to be made to reflect the situation that assets may need to be

realised other than in the normal course of business and at amounts

which could differ significantly from the amounts at which they are

currently recorded on the balance sheet. In addition, the Group may

have to reclassify long term assets and liabilities as current

assets and liabilities. No such adjustments have been made to these

financial statements.

3.1 Basis of preparation

The consolidated financial statements of the Group have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as issued by the International Accounting

Standards Board ("IASB").

The consolidated financial statements have been prepared on a

historical cost basis, except as disclosed in the accounting

policies below.

The consolidated financial statements are presented in United

States Dollars ("USD") to facilitate the comparison of financial

results with companies in the oil-palm industry and all values are

rounded to the nearest thousand ("USD'000"), except where otherwise

indicated.

3.2 Basis of consolidation

The consolidated financial statements comprise the financial

statements of the Group and its subsidiaries as at 31 December

2013. Control is achieved when the Group is exposed, or has rights,

to variable returns from its involvement with the investee and has

the ability to affect those returns through its power over the

investee. Specifically, the Group controls an investee if and only

if the Group has:

- Power over the investee (i.e., existing rights that give it

the current ability to direct the relevant activities of the

investee)

- Exposure, or rights, to variable returns from its involvement with the investee; and

- The ability to use its power over the investee to affect its returns

When the Group has less than a majority of the voting or similar

rights of an investee, the Group considers all relevant facts and

circumstances in assessing whether it has power over an investee,

including:

- The contractual arrangement with the other vote holders of the investee

- Rights arising from other contractual arrangements

- The Group's voting rights and potential voting rights

The Group re-assesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements of control. Consolidation of a

subsidiary begins when the Group obtains control over the

subsidiary and ceases when the Group loses control of the

subsidiary. Assets, liabilities, income and expenses of a

subsidiary acquired or disposed of during the year are included in

the statement of comprehensive income from the date the Group gains

control until the date the Group ceases to control the

subsidiary.

Profit or loss and each component of other comprehensive income

("OCI") are attributed to the equity holders of the parent of the

Group and to the non-controlling interests, even if this results in

the non-controlling interests having a deficit balance. When

necessary, adjustments are made to the financial statements of

subsidiaries to bring their accounting policies into line with the

Group's accounting policies. All intra-group assets and

liabilities, equity, income, expenses and cash flows relating to

transactions between members of the Group are eliminated in full on

consolidation.

A change in the ownership interest of a subsidiary, without a

loss of control, is accounted for as an equity transaction. If the

Group loses control over a subsidiary, it:

- Derecognises the assets (including goodwill) and liabilities of the subsidiary

- Derecognises the carrying amount of any non-controlling interests

- Derecognises the cumulative translation differences recorded in equity

- Recognises the fair value of the consideration received

- Recognises the fair value of any investment retained

- Recognises any surplus or deficit in profit or loss

- Reclassifies the parent's share of components previously

recognised in OCI to profit or loss or retained earnings, as

appropriate, as would be required if the Group had directly

disposed of the related assets or liabilities

3.3 Summary of significant accounting policies

a) Business combinations and goodwill

Other than business combinations involving entities under common

control, business combinations are accounted for using the

acquisition method. The cost of an acquisition is measured as the

aggregate of the consideration transferred measured at acquisition

date fair value and the amount of any non-controlling interest in

the acquiree. For each business combination, the Group elects

whether to measure the non-controlling interests in the acquiree at

fair value or at the proportionate share of the acquiree's

identifiable net assets. Acquisition-related costs are expensed as

incurred and included in other operating expenses.

When the Group acquires a business, it assesses the financial

assets and liabilities assumed for appropriate classification and

designation in accordance with the contractual terms, economic

circumstances and pertinent conditions as at the acquisition date.

This includes the separation of embedded derivatives in host

contracts by the acquiree.

If the business combination is achieved in stages, any

previously held equity interest is re-measured at its acquisition

date fair value and any resulting gain or loss is recognised in

profit or loss. It is then considered in the determination of

goodwill.

Any contingent consideration to be transferred by the acquirer

will be recognised at fair value at the acquisition date.

Contingent consideration classified as an asset or liability that

is a financial instrument and within the scope of IAS 39 Financial

Instruments: Recognition and Measurement, is measured at fair value

with changes in fair value recognised in either profit or loss or

as a change to OCI. If the contingent consideration is not within

the scope of IAS 39, it is measured in accordance with the

appropriate IFRS. Contingent consideration that is classified as

equity is not re-measured and subsequent settlement is accounted

for within equity.

Goodwill is initially measured at cost, being the excess of the

aggregate of the consideration transferred and the amount

recognised for non-controlling interests, and any previous interest

held, over the net identifiable assets acquired and liabilities

assumed. If the fair value of the net assets acquired is in excess

of the aggregate consideration transferred, the Group re-assesses

whether it has correctly identified all of the assets acquired and

all of the liabilities assumed and reviews the procedures used to

measure the amounts to be recognised at the acquisition date. If

the re-assessment still results in an excess of the fair value of

net assets acquired over the aggregate consideration transferred,

then the gain is recognised in profit or loss.

After initial recognition, goodwill is measured at cost less any

accumulated impairment losses. For the purpose of impairment

testing, goodwill acquired in a business combination is, from the

acquisition date, allocated to each of the Group's cash-generating

units that are expected to benefit from the combination,

irrespective of whether other assets or liabilities of the acquiree

are assigned to those units.

Where goodwill has been allocated to a cash-generating unit and

part of the operation within that unit is disposed of, the goodwill

associated with the disposed operation is included in the carrying

amount of the operation when determining the gain or loss on

disposal. Goodwill disposed in this circumstance is measured based

on the relative values of the disposed operation and the portion of

the cash-generating unit retained.

Business combinations involving entities under common control:

Pooling of interest method

Business combinations involving entities under common control

are accounted for by applying the pooling of interest method. The

assets and liabilities of the combining entities are reflected at

their carrying amounts reported in the consolidated financial

statements of the controlling holding company. No adjustments are

made to reflect the fair values or recognise any new assets or

liabilities. No goodwill is recognised as a result of the

combination. Any difference between the consideration paid and the

equity of the "acquired" entity is reflected within equity as

"merger reserve". The statement of comprehensive income reflects

the results of the combining entities for the full year,

irrespective of when the combination took place. Comparatives are

restated to reflect the combination as if it had occurred from the

beginning of the earliest period presented in the financial

statements or from the date the entities had come under common

control, if later.

b) Transactions with non-controlling interests

Non-controlling interest represents the equity in subsidiaries

not attributable, directly or indirectly, to owners of the Company,

and are presented separately in the consolidated statement of

comprehensive income and within equity in the consolidated

statement of financial position, separately from equity

attributable to owners of the Company.

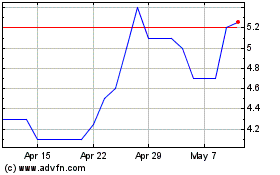

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

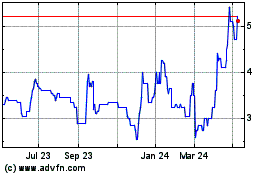

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024