Asian Plantations Limited Final Results & Notice -10-

July 01 2014 - 3:30AM

UK Regulatory

An impairment exists when the carrying value of an asset or cash

generating unit exceeds its recoverable amount, which is the higher

of its fair value less costs to sell and its value in use. The

value in use calculation is based on a discounted cash flow model.

The cash flows are derived from projected net cash flows over a

period of 25 productive years of oil palms from financial budgets

approved by management and do not include restructuring activities

that the Group is not yet committed to or significant future

investments that will enhance the asset's performance of the cash

generating unit being tested. The recoverable amount is most

sensitive to the discount rate used for the discounted cash flow

model as well as the expected future cash inflows. Further details

of the key assumptions applied in the impairment assessment of

goodwill, are given in Note 18.

(d) Taxes

Uncertainties exist with respect to the interpretation of

complex tax regulations, changes in tax laws, and the amount and

timing of future taxable income. Given the wide range of

international business relationships and the long-term nature and

complexity of existing contractual agreements, differences arising

between the actual results and the assumptions made, or future

changes to such assumptions, could necessitate future adjustments

to tax income and expense already recorded. The Group establishes

provisions, based on reasonable estimates, for possible

consequences of audits by the tax authorities of the respective

counties in which it operates. The amount of such provisions is

based on various factors, such as experience of previous tax audits

and differing interpretations of tax regulations by the taxable

entity and the responsible tax authority. Such differences of

interpretation may arise for a wide variety of issues depending on

the conditions prevailing in the respective domicile of the Group

of companies.

The carrying amount of income tax recoverable at 31 December

2013 was USD36,000 (2012: USD99,000).

Deferred tax assets are recognised for all unused tax losses,

unabsorbed capital and agricultural allowances to the extent that

it is probable that taxable profit will be available against which

the losses, unabsorbed capital and agricultural allowances can be

utilised. Significant management judgement is required to determine

the amount of deferred tax assets that can be recognised, based

upon the likely timing and the level of future taxable profits

together with future tax planning strategies.

Further details on taxes are disclosed in Note 13.

(e) Share-based payment

The Group measures the cost of equity-settled transactions with

directors, employees and consultants by reference to the fair value

of the equity instruments at the date at which they are granted.

Estimating fair value for share-based payment transactions requires

determination of the most appropriate valuation model, which is

dependent on the terms and conditions of the grant. This estimate

also requires determination of the most appropriate inputs to the

valuation model including the expected life of the share option,

volatility and dividend yield and making assumptions about them.

The assumptions and models used for estimating fair value for

share-based payment transactions are disclosed in Note 29.

5. Standards issued but not yet effective

The standards and interpretations that are issued, but not yet

effective, up to the date of issuance of the Group's financial

statements are disclosed below. The Group intends to adopt these

standards, if applicable, when they become effective.

IFRS 9 Financial Instruments

IFRS 9, as issued, reflects the first phase of the IASB's work

on the replacement of IAS 39 and applies to classification and

measurement of financial assets and financial liabilities as

defined in IAS 39. The standard was initially effective for annual

periods beginning on or after 1 January 2013, but Amendments to

IFRS 9 Mandatory Effective Date of IFRS 9 and Transition

Disclosures, issued in December 2011, moved the mandatory effective

date to 1 January 2015. In subsequent phases, the IASB is

addressing hedge accounting and impairment of financial assets. The

adoption of the first phase of IFRS 9 will have an effect on the

classification and measurement of the Group's financial assets, but

will not have an impact on classification and measurements of the

Group's financial liabilities. The Group will quantify the effect

in conjunction with the other phases, when the final standard

including all phases is issued.

Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS

27)

These amendments are effective for annual periods beginning on

or after 1 January 2014 provide an exception to the consolidation

requirement for entities that meet the definition of an investment

entity under IFRS 10. The exception to consolidation requires

investment entities to account for subsidiaries at fair value

through profit or loss. It is not expected that this amendment

would be relevant to the Group, since none of the entities in the

Group would quality to be an investment entity under IFRS 10.

IAS 32 Offsetting Financial Assets and Financial Liabilities -

Amendments to IAS 32

These amendments clarify the meaning of "currently has a legally

enforceable right to set-off" and the criteria for non-simultaneous

settlement mechanisms of clearing houses to qualify for offsetting.

These are effective for annual periods beginning on or after 1

January 2014. These amendments are not expected to be relevant to

the Group.

IFRIC Interpretation 21 Levies (IFRIC 21)

IFRIC 21 clarifies that an entity recognises a liability for a

levy when the activity that triggers payment, as identified by the

relevant legislation, occurs. For a levy that is triggered upon

reaching a minimum threshold, the interpretation clarifies that no

liability should be anticipated before the specified minimum

threshold is reached. IFRIC 21 is effective for annual periods

beginning on or after 1 January 2014. These amendments are not

expected to be relevant to the Group.

IAS 39 Novation of Derivatives and Continuation of Hedge

Accounting - Amendments to IAS 39

These amendments provide relief from discontinuing hedge

accounting when novation of a derivative designated as a hedging

instrument meets certain criteria. These amendments are effective

for annual periods beginning on or after 1 January 2014. These

amendments are not expected to be relevant to the Group.

6. Revenue

2013 2012

USD'000 USD'000

Sale of crude palm oil ("CPO") 19,554 -

Sale of palm kernel ("PK") 2,451 -

Sale of fresh fruit bunches ("FFBs") 1,758 2,820

23,763 2,820

7. Cost of sales

2013 2012

USD'000 USD'000

FFBs harvesting 716 351

FFBs external transportation 400 245

Field upkeep and maintenance 3,594 766

Estate general charges 676 228

Direct production costs - CPO and

PK 18,319 -

Mill overheads 443 92

Mill transport 744 -

Employee benefits expense (Note 12) 1,147 432

Depreciation of property, plant and

equipment 1,376 100

Rental expense 62 11

27,477 2,225

8. Other operating income

2013 2012

USD'000 USD'000

Interest income 245 280

Gain on disposal of property, plant

and equipment 6 -

Sale of seedlings - 66

Gain arising on fair value changes

in biological assets 3,183 1,989

Gain arising from changes in fair

value of

embedded derivative of the convertible

bonds 721 172

Others 29 -

4,184 2,507

9. Administrative expenses

2013 2012

USD'000 USD'000

Professional fees:

- audit fee 106 129

- consultancy 392 631

- MTN Programme - 195

- others 302 391

Stamp duty on agreements 23 2

Bank charges 56 29

Employee benefits expense (Note 12) 1,514 2,812

Directors' fees (Note 31) 187 187

Loss on disposal of property, plant

and equipment - 1

Depreciation of property, plant and

equipment 132 151

Rental expense 17 55

Others 677 556

3,406 5,139

10. Other operating expenses

2013 2012

USD'000 USD'000

Amortisation of land use rights (Note

17) 1,002 924

Repair and maintenance 202 117

Motor vehicle running expenses - 10

Cost of seedlings sold 8 54

Impairment of goodwill (Note 1(b)) - 5

Net foreign exchange loss 82 444

1,294 1,554

11. Finance costs

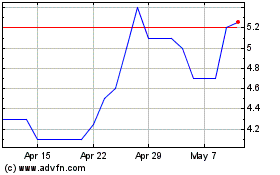

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

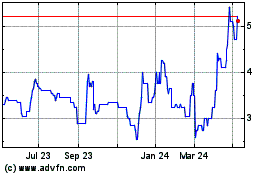

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024