2013 2012

USD'000 USD'000

Interest expense on loans and borrowings 5,373 3,115

Interest expense on convertible bonds 254 75

Accretion of interest on the convertible

bonds 1,596 291

7,223 3,481

12. Employee benefits expense

2013 2012

USD'000 USD'000

Included in cost of sales (Note 7):

Salaries, bonus and allowances 971 342

Contributions to defined contribution

plans 105 50

Social security costs 12 2

Share-based payment transaction

(Note 29) 59 38

1,147 432

Included in cost of biological assets

(Note 16):

Salaries, bonus and allowances 1,291 1,461

Contributions to defined contribution

plans 156 173

Social security costs 10 10

Share-based payment transaction

(Note 29) 144 150

1,601 1,794

Included in cost of administrative

expenses (Note 9):

Salaries, bonus and allowances 1,427 1,738

Contributions to defined contribution

plans 79 107

Social security costs 3 4

Share-based payment transaction

(Note 29) 5 963

1,514 2,812

Total employee benefits expense 4,262 5,038

13. Income tax benefit

Major components of income tax benefit

The major components of income tax benefit for the financial

years ended 31 December are as follows:

2013 2012

USD'000 USD'000

Income tax:

- Under/(over) provision in prior

year 9 (3)

2013 2012

USD'000 USD'000

Deferred tax:

- relating to origination and reversal

of temporary differences (1,125) (242)

- Under provision in prior year 64 52

(1,061) (190)

(1,052) (193)

Relationship between tax benefit and accounting loss

The reconciliation between income tax benefit and the product of

accounting loss multiplied by the applicable corporate tax rate for

the financial years ended 31 December is as follows:

2013 2012

USD'000 USD'000

Accounting loss before tax (11,453) (7,072)

Tax benefit at domestic rate applicable

to losses

in the countries where the Group operates (2,603) (1,461)

Adjustments:

Non-deductible expenses 1,478 1,219

Under/(over) provision of income tax

in prior year 9 (3)

Under provision of deferred tax in

prior year 64 52

(1,052) (193)

For the current financial year, the corporate income tax rate

applicable to the Singapore and Malaysian companies in the Group

was 17% (2012: 17%) and 25% (2012: 25%) respectively.

The above reconciliation is prepared by aggregating separate

reconciliations for each national jurisdiction.

Included in non-deductible expenses is the tax effects of

share-based payment transaction of USD13,000 (2012:

USD173,000).

Deferred tax

Deferred tax relates to the following:

Consolidated statement Consolidated income

of financial position statement

2013 2012 2013 2012

USD'000 USD'000 USD'000 USD'000

Accelerated depreciation

for tax purposes (5,408) (3,765) 1,967 1,619

Biological assets (11,468) (7,987) 4,171 3,419

Revaluation of land

use rights to fair

value (6,621) (7,245) (134) (137)

Capital items expensed

off 105 - (109) -

Unutilised tax losses 7,408 4,649 (3,187) (1,941)

Unabsorbed capital

and agricultural

allowances 11,065 7,970 (3,769) (3,150)

Deferred tax benefit (1,061) (190)

Net deferred tax

liabilities (4,919) (6,378)

Reflected in the

statement of financial

position as follows:

Deferred tax assets 511 178

Deferred tax liabilities (5,430) (6,556)

Deferred tax liabilities,

net (4,919) (6,378)

Reconciliation of deferred tax liabilities, net

2013 2012

USD'000 USD'000

Opening balance as of 1 January (6,378) (6,325)

Recognised in profit or loss 1,061 190

Exchange differences 398 (243)

Closing balance as at 31 December (4,919) (6,378)

The Group offsets tax assets and liabilities if and only if it

has a legally enforceable right to set off current tax assets and

current tax liabilities and the deferred tax assets and deferred

tax liabilities relate to income taxes levied by the same tax

authority.

The Group has unutilised tax losses and unabsorbed capital and

agricultural allowances totaling USD73,896,000 (2012:

USD50,476,000). The availability of the unutilised tax losses and

unabsorbed capital and agricultural allowances for offsetting

against future taxable profits of the subsidiaries are subject to

the provisions of the Malaysian Income Tax Act, 1967.

14. Loss per share

Basic loss per share amounts are calculated by dividing loss for

the year, net of tax, attributable to owners of the Company by the

weighted average number of ordinary shares outstanding during the

financial year.

Diluted loss per share amounts are calculated by dividing loss

for the year, net of tax, attributable to owners of the Company by

the weighted average number of ordinary shares outstanding during

the financial year plus the weighted average number of ordinary

shares that would be issued on the conversion of all the dilutive

potential ordinary shares into ordinary shares. There is no

dilutive potential ordinary share as at year ended 2013 and

2012.

The following tables reflect the loss and share data used in the

computation of basic loss and diluted per share for the years ended

31 December:

2013 2012

USD'000 USD'000

Loss, net of tax, attributable to

owners of the Company (10,400) (6,879)

-

============= =============

No. of shares No. of shares

'000 '000

Weighted average number of ordinary

shares for basic and diluted loss

per share computation* 46,663 46,382

-

============= =============

* The weighted average number of ordinary shares takes into

account the weighted average effect of changes in ordinary shares

transactions during the year

The potential ordinary shares from unsecured convertible bonds

and options granted pursuant to the Company's share option scheme

have not been included in the calculation of diluted loss per share

because they are anti-dilutive.

15. Property, plant and equipment

Office

equipment,

computers,

furniture

Motor and Plant and Assets under

Building vehicles fittings Renovation machinery Infrastructure construction Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Cost

At 1 January 2012 2,338 721 340 39 1,548 10,173 1,856 17,015

Additions 220 396 261 - 1,799 9,823 25,817 38,316

Disposal - (24) - - - - - (24)

Reclassifications 2,640 1 32 - (37) 1 (2,637) -

Exchange

differences 90 35 18 2 75 484 292 996

At 31 December

2012 and

1 January 2013 5,288 1,129 651 41 3,385 20,481 25,328 56,303

Additions 1,104 265 305 - 698 4,976 10,769 18,117

Disposal - (26) - - - - - (26)

Reclassifications 13,035 (32) 59 - 1,683 2,120 (16,865) -

Exchange

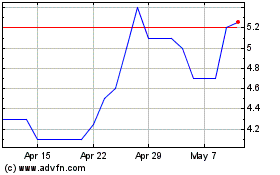

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

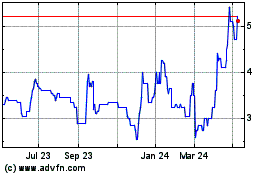

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024