Panther Securities Trading update

March 07 2018 - 1:00AM

UK Regulatory

TIDMPNS

7 March 2018

Prior to publication, the information contained within this announcement was

deemed by the Company to constitute inside information as stipulated under the

Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the publication of

this announcement, this information is now considered to be in the public

domain.

Panther Securities PLC

(the "Company" or the "Group")

Trading update

The Board of Panther Securities PLC is pleased to announce that, based on

preliminary unaudited information, it expects the profit after taxation for the

year ended 31 December 2017 to be of the order of GBP20 million, which has arisen

as a result of the following principal factors:

* The Directors sought an independent revaluation of the Group's entire

portfolio at 31 December 2017 which will likely result in an increase in

valuation at 31 December 2017 of approximately GBP16 million;

* The Group's interest rate swaps liability at 31 December 2017 showed a

positive movement of approximately GBP2 million over the financial year;

* The Board expects to report a profit of approximately GBP1 million on the

sale of a number of investment properties. In addition, the sale of most

of our investment shares produced a profit of over GBP1 million; and

* Rental income has held up very well in a tough environment for retailers.

The above expected Group profit after taxation in the order of GBP20 million does

not include any additional profit that would arise on the completion of the

sale of Holloway Head, Birmingham. On 30 November 2017, the Company announced

that the contract had been extended, with the purchaser seeking to complete at

the beginning of March 2018. The purchaser was not in a position to complete

and has been granted a further extension of five weeks, at a cost of GBP40,000

per week. In the event that completion takes place before the accounts for the

year ended 31 December 2017 are signed, under the accounting standards, an

additional profit after taxation of GBP3.8 million would be achieved as part of

the results for the year ended 31 December 2017.

The Board expect to announce the audited results for the year ended 31 December

2017 in late April 2018.

For further information:

Panther Securities plc: Tel: 01707 667 300

Andrew Perloff/ Simon Peters

Allenby Capital Limited (Nomad and Joint Tel: 020 3328 5656

Broker)

David Worlidge/ Alex Brearley

END

(END) Dow Jones Newswires

March 07, 2018 02:00 ET (07:00 GMT)

Panther Securities (LSE:PNS)

Historical Stock Chart

From Apr 2024 to May 2024

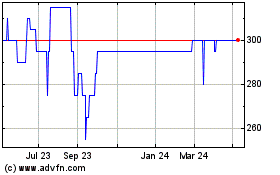

Panther Securities (LSE:PNS)

Historical Stock Chart

From May 2023 to May 2024