TIDMRC2

RNS Number : 2543N

Reconstruction Capital II Ltd

04 September 2013

4(th) September 2013

Reconstruction Capital II Limited (the "Company")

Interim Unaudited Consolidated Financial Statements

for the six months ended 30 June 2013

Reconstruction Capital II Ltd ("RC2, the "Company" or the

"Group"), a closed-end investment company incorporated in the

Cayman Islands admitted to trading on the AIM market of the London

Stock Exchange, today announces its results for the for the six

months ended 30 June 2013.

Copies of the Company's interim financial statements will today

be posted to shareholders. The annual report is also available to

view on the Company's website

http://www.reconstructioncapital2.com/.

Financial highlights

-- The net asset value as at 30 June 2013 was EUR 0.3932 per

share (EUR 0.3933 per share as at 31 December 2012);

-- As at 30 June 2013 the Company's market capitalisation was

approximately EUR 32m, with a closing price of EUR 0.32 per

share;

-- The Directors do not recommend the payment of a dividend.

Operational highlights

The Private Equity Programme

RC2 did not make any new investments under its Private Equity

Programme, and continued its efforts to exit from its existing

private equity investments. Unfortunately, the progress on exits

was slow due to the low level of interest in the region from

strategic investors. The investments held under the Private Equity

Programme had a fair value of EUR 42.4m at the end of June, up 0.8%

since the 2012 year-end audit report.

The Trading Programme

RC2 marginally reduced its position in listed equities under the

Trading Programme. Efforts to sell down more shares were

unsuccessful, due to the low liquidity of the listed equities owned

by RC2. At the end of June, RC2's listed equities held under the

Trading Programme had a total market value of EUR 0.4m. All the

investments in the Trading Programme were in Romanian equities.

For further information, please contact:

Reconstruction Capital II Limited

Ion Florescu / Ivanka Ivanova

Tel: +44 (0) 207 244 0088

Grant Thornton Corporate Finance (Nominated Adviser)

Philip Secrett / David Hignell

Tel: +44 (0) 20 7383 5100

LCF Edmond de Rothschild Securities (Broker)

Hiroshi Funaki

Tel: +44 (0) 20 7845 5960

INVESTMENT MANAGER AND INVESTMENT ADVISORS' REPORT

On 30 June 2013, Reconstruction Capital II Limited ("RC2") had a

total unaudited net asset value ("NAV") of EUR 39.3m or EUR 0.3932

per share, virtually flat compared to the audited NAV at the

beginning of the year.

The comparative figures as at 30 June 2012 were restated due to

the early adoption of IFRS 10 "Consolidated Financial Statements",

IFRS 11 "Joint arrangements", IFRS 12 "Disclosure of Interests in

Other Entities" and amendments to IFRS 10, IFRS 12 and IAS 27 on

consolidation for investment entities, which exempt investment

companies from the need to consolidate their investments. The

Company took advantage of this exemption in order to give a clearer

view of the fair value of the various investments held by the

Company. Previously, the investments in Top Factoring Srl (and its

sister company Glasro Holdings Ltd) and Mamaia Resort Hotels Srl

had been consolidated.

RC2 did not make any new investments under its Private Equity

Programme, and continued its efforts to exit from its existing

private equity investments. Unfortunately, the progress on exits

was slow due to the low level of interest in the region from

strategic investors. The investments held under the Private Equity

Programme had a fair value of EUR 42.4m at the end of June, up 0.8%

since the 2012 year-end audit report.

RC2 marginally reduced its position in listed equities under the

Trading Programme. Efforts to sell down more shares were

unsuccessful, due to the low liquidity of the listed equities owned

by RC2. At the end of June 2013, RC2's listed equities held under

the Trading Programme had a total market value of EUR 0.4m. All the

investments in the Trading Programme were in Romanian equities.

Over the first half of the year, RC2 received EUR 1.4m in

dividends from its investee companies, of which EUR 1.1m from the

Top Factoring group and the balance of EUR 0.3m from Albalact SA.

The proceeds were used to repay EUR 0.8m of loans from related

parties, and for RC2's working capital needs. At the end of June

2013, RC2 had EUR 0.2m of cash, dividends receivable of EUR 0.4m,

borrowings of EUR 4.2m, and another EUR 4.2m of accrued liabilities

to its service providers, including investment management and

advisory fees.

New Europe Capital Ltd

New Europe Capital S.R.L.

New Europe Capital DOO

INVESTMENT POLICY

Private Equity Programme

Under the Private Equity Programme, the Company takes

significant or controlling stakes in companies operating primarily

in Romania, Serbia, Bulgaria and neighbouring countries (the

"Target Region"). The Company invests in investee companies where

it believes its Investment Advisers can add value by implementing

operational and/or financial restructuring over a 3 to 5 year

horizon. The Company only makes an investment under the Private

Equity Programme if its Investment Advisers believe there is a

clear exit strategy available, such as trade sale, break up and

subsequent disposal of different divisions or assets, or a

flotation on a stock exchange.

Trading Programme

Under the Trading Programme, the Company aims to generate short

and medium term returns by investing such portion of its assets as

determined by the Directors from time to time in listed equities

and fixed income securities, including convertible and other

mezzanine instruments, issued by entities in the Target Region. The

Investment Manager is responsible for identifying and executing

investments and divestments under the Trading Programme. The

Trading Programme differs from the Private Equity Programme in the

key respect that the Company will typically not take significant or

controlling stakes in investee companies and will typically hold

investments for shorter periods of time than investments made under

the Private Equity Programme.

Value Creation

Under its Private Equity Programme, the Investment Advisers are

involved at board level in the investee company to seek to

implement operational and financial changes to enhance returns. As

part of the Company's pre-acquisition due diligence, the Investment

Advisers seek to identify specific actions that they believe will

create value in the target investee company post acquisition and,

where appropriate, seek to work with third party professionals to

develop, in combination with the proposed management team of the

target, a value creation plan with clear and identifiable short and

medium term targets. These plans are likely to address different

parts of the business and are tailored to reflect the specific

challenges of the relevant target company. Both the Investment

Advisers and the Investment Manager believe that the investment

strategies under the Private Equity and Trading Programme can

achieve returns which are different than the returns of the

relevant market indices.

Investing Restrictions and Cross-Holdings

The Directors, the Investment Advisers and the Investment

Manager will seek to ensure that the portfolio of investments is

sufficiently diversified to spread the risks of those investments.

The Investment Strategy does not restrict the Company from

investing in other closed-ended funds operating in the Target

Region. In line with the Company's investment policy, the Board

does not normally authorise any investment in a single investee

company that is greater than 20 per cent of the Company's net asset

value at the time of effecting the investment and in no

circumstances will it approve an investment in a single investee

company that is greater than 25 per cent of the Company's net asset

value at the time of effecting the investment.

Change of investment objective and policy of the Company

Following the annual general meeting of the Company on 14

December 2012, the investment objective and policy of the Company

was amended such that no new investments will be made, further

investments into existing portfolio companies will be permitted in

certain circumstances pending their realisation and, following each

realisation, all proceeds will be returned to Shareholders after

paying outstanding liabilities and setting aside a sufficient

amount for working capital purposes.

Gearing

The Company may borrow up to a maximum level of 30 per cent of

its gross assets (as defined in its articles).

Distribution Policy

The Company's investment objective is focused principally on the

provision of capital growth. For further details of the Company's

distribution policy, please refer to the Admission Document on the

Company's website.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 30 JUNE 2013

30-Jun-13 30-Jun-12 31-Dec-12

As Restated

EUR EUR EUR

Unaudited Unaudited Audited

Investment gain / (loss)

Gain / (loss) on investments

at fair value through profit

or loss 237,252 (2,327,609) (49,389,415)

Interest income 216,387 152,055 329,387

Dividend income 1,416,918 1,278 1,282

Other income 55,792 101,269 197,958

------------ ------------ -------------

Total investment gain / (loss) 1,926,349 (2,073,007) (48,860,788)

Expenses

Impairment of loans receivable (428,921) - (943,143)

Operating expenses (966,770) (1,467,538) (2,764,984)

Total operating expenses (1,395,691) (1,467,538) (3,708,127)

Operating gain / (loss) 530,658 (3,540,545) (52,568,915)

Financial expenses (506,786) (198,254) (612,149)

------------ ------------ -------------

Profit / (loss) before taxation 23,872 (3,738,799) (53,181,064)

Income tax expense (8,715) (28,105) (71,733)

------------ ------------ -------------

Net profit / (loss) for the

period 15,157 (3,766,904) (53,252,797)

Other comprehensive (loss)

/ income

Exchange differences on translating

foreign operations (7,253) 14,358 10,458

Total comprehensive income

/ (loss) for the period 7,904 (3,752,546) (53,242,339)

============ ============ =============

Net profit / (loss) for the

period attributable to:

- Equity holders of the

parent (12,074) (3,840,617) (53,392,784)

- Non-controlling interest 27,231 73,713 139,987

15,157 (3,766,904) (53,252,797)

============ ============ =============

Total comprehensive income

/ (loss) attributable to:

- Equity holders of the

parent (12,618) (3,839,525) (53,392,000)

- Non-controlling interest 20,522 86,979 149,661

------------ ------------ -------------

Total comprehensive income

/ (loss) for the period 7,904 (3,752,546) (53,242,339)

============ ============ =============

Earnings Per Share attributable

to the equity shareholders

of the Company

Basic and diluted earnings

per share (0.0001) (0.0384) (0.5339)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS OF 30 JUNE

2013

30-Jun-13 30-Jun-12 31-Dec-12

As Restated

EUR EUR EUR

Unaudited Unaudited Audited

Assets

Non-current assets

Property, plant and equipment 11,618 14,206 13,458

Financial assets at fair value

through profit or loss 42,377,362 89,103,386 42,041,100

Loans receivable 576,702 571,192 560,501

------------- ------------- -------------

Total non-current assets 42,965,682 89,688,784 42,615,059

------------- ------------- -------------

Current assets

Financial assets at fair value

through profit or loss 382,994 500,360 456,773

Trade and other receivables 683,887 195,561 277,777

Loans receivable 3,893,376 4,387,832 3,366,167

Cash and cash equivalents 150,389 880,950 1,318,380

------------- ------------- -------------

Total current assets 5,110,646 5,964,703 5,419,097

Total assets 48,076,328 95,653,487 48,034,156

============= ============= =============

Liabilities

Current liabilities

Trade and other payables (4,203,198) (2,616,564) (3,754,477)

Loans and borrowings (4,126,344) (832,715) (1,541,870)

Corporation tax payable (4,993) (76,282) (44,651)

------------- ------------- -------------

Total current liabilities (8,334,535) (3,525,561) (5,340,998)

------------- ------------- -------------

Non-current liabilities

Loans and borrowings (40,731) (2,872,979) (3,000,000)

------------- ------------- -------------

Total non-current liabilities (40,731) (2,872,979) (3,000,000)

------------- ------------- -------------

Total liabilities (8,375,266) (6,398,540) (8,340,998)

============= ============= =============

Total net assets 39,701,062 89,254,947 39,693,158

============= ============= =============

Capital and reserves attributable to

equity holders

Share capital 1,000,000 1,000,000 1,000,000

Share premium reserve 121,900,310 121,900,310 121,900,310

Retained deficit (83,553,275) (33,989,034) (83,541,201)

Foreign exchange reserve (28,510) (27,658) (27,966)

------------- ------------- -------------

Total equity and reserves 39,318,525 88,883,618 39,331,143

Non-Controlling Interests 382,537 371,329 362,015

Total equity 39,701,062 89,254,947 39,693,158

============= ============= =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY AS OF 30 JUNE

2013

Foreign Retained Non-

Share Share exchange (Deficit)/ controlling

Capital Premium reserve Earnings Sub-total Interest Total

EUR EUR EUR EUR EUR EUR EUR

Balance at 1

January

2012 - as

previously

reported 1,000,000 121,900,310 (1,642,979) (40,174,182) 81,083,149 2,985,364 84,068,513

Prior year

adjustment

- (Note 2) - - 1,614,229 10,025,765 11,639,994 (2,625,218) 9,014,776

---------- ------------ ------------ -------------- -------------- ------------ --------------

Balance at 1

January

2012 - as

restated 1,000,000 121,900,310 (28,750) (30,148,417) 92,723,143 360,146 93,083,289

(Loss) / Profit

for

the period - - - (3,840,617) (3,840,617) 73,713 (3,766,904)

Other

comprehensive

income /

(loss) - - 1,092 - 1,092 13,266 14,358

---------- ------------ ------------ -------------- -------------- ------------ --------------

Total

comprehensive

income /

(loss) for

the period - - 1,092 (3,840,617) (3,839,525) 86,979 (3,752,546)

Dividends paid

to

non-controlling

interests - - - - - (75,796) (75,796)

---------- ------------ ------------ -------------- -------------- ------------ --------------

Balance at 30

June

2012 - as

restated 1,000,000 121,900,310 (27,658) (33,989,034) 88,883,618 371,329 89,254,947

(Loss) / Profit

for

the period - - - (49,552,167) (49,552,167) 66,274 (49,485,893)

Other

comprehensive

(loss) / income - - (308) - (308) (3,592) (3,900)

---------- ------------ ------------ -------------- -------------- ------------ --------------

Total

comprehensive

(loss) /

income for

the year - - (308) (49,552,167) (49,552,475) 62,682 (49,489,793)

Dividends paid

to

non-controlling

interests - - - - - (71,996) (71,996)

---------- ------------ ------------ -------------- -------------- ------------ --------------

Balance at 31

December

2012 1,000,000 121,900,310 (27,966) (83,541,201) 39,331,143 362,015 39,693,158

(Loss) / Profit

for

the period - - - (12,074) (12,074) 27,231 15,157

Other

comprehensive

(loss) / income - - (544) - (544) (6,709) (7,253)

---------- ------------ ------------ -------------- -------------- ------------ --------------

Total

comprehensive

(loss) /

income for

the period - - (544) (12,074) (12,618) 20,522 7,904

Dividends paid

to

non-controlling

interests - - - - - - -

Balance at 30

June

2013 1,000,000 121,900,310 (28,510) (83,553,275) 39,318,525 382,537 39,701,062

========== ============ ============ ============== ============== ============ ==============

Share premium is stated net of share issue costs and is not

distributable by way of dividend.

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE SIX MONTHS ENDED 30

JUNE 2013

30-Jun-13 30-Jun-12 31-Dec-12

As Restated

EUR EUR EUR

Unaudited Unaudited Audited

Cash flows from operating activities

Net profit / (loss) before tax 23,872 (3,738,799) (53,181,064)

Adjustments for:

Depreciation and amortisation 1,608 2,545 3,243

(Gain)/ loss on financial assets

at fair value through profit or

loss (237,252) 2,327,609 49,389,415

Impairment / revaluation of fixed

assets 428,921 - 943,143

Interest income (216,387) (152,055) (329,387)

Interest expense 365,967 128,189 430,520

Dividend income (1,416,918) (1,278) (1,282)

------------ ------------ -------------

Net cash outflow before changes in

working capital (1,050,189) (1,433,789) (2,745,412)

(Increase) / decrease in trade

and other receivables (401,559) (8,049) (90,265)

Increase/ (decrease) in trade and

other payables 448,721 938,192 2,076,105

Sale of financial assets 5,772 1,354,887 1,365,234

Interest income received - - 12,118

Dividends received 1,412,366 1,278 1,282

------------ ------------ -------------

Cash generated by operating activities 415,111 852,519 619,062

Income tax paid (48,373) (4,790) (80,049)

Net cash generated by operating

activities 366,738 847,729 539,013

Cash flows from investing activities

Purchase of property, plant and

equipment (485) (8,684) (8,631)

Payments of loans granted to subsidiaries (756,000) (2,268,000) (2,268,000)

Proceeds from loans granted to

subsidiaries - 2,294,706 550,186

------------ ------------ -------------

Net Cash flow used in investing

activities (756,485) 18,022 (1,726,445)

Cash flows from financing activities

Dividends paid to non-controlling

interests - (75,796) (147,792)

Proceeds from loans granted by

related parties 40,000 - 3,000,000

Repayments of loans granted by

related parties (781,341) (200,000) (400,000)

Interest paid on loans - (11,222) (244,953)

------------ ------------ -------------

Net Cash flow used in financing

activities (741,341) (287,018) 2,207,255

(Decrease)/increase in cash and

cash equivalents (1,131,088) 578,733 1,019,823

Cash at beginning of period/ year 1,318,380 296,040 296,040

Foreign exchange gain (36,903) 6,177 2,517

------------ ------------ -------------

Cash at end of period/ year 150,389 880,950 1,318,380

============ ============ =============

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZZLFBXKFEBBL

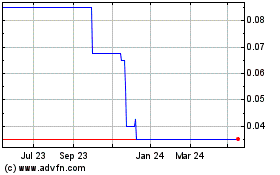

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jun 2024 to Jul 2024

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jul 2023 to Jul 2024