TIDMRCOI

RNS Number : 1930G

Riverstone Credit Opps. Inc PLC

23 July 2021

Riverstone Credit Opportunities Income Announces 2Q21 Quarterly

Portfolio Valuations & Recent Activity

London, UK (23 July 2021) - Riverstone Credit Opportunities

Income ("RCOI") announces its quarterly portfolio summary as of 30

June 2021, inclusive of updated quarterly unaudited fair market

valuations:

As of 30 June 2021, the unaudited net asset value per Ordinary

Share, including net revenue for the quarter ended 30 June, was

$1.03.

Business Update

In June 2021, RCOI launched a new webcast, called "Energy

Expansion", that will be focused on important themes within our

sector and include interviews with executives and thought leaders

in the industry. Two interviews, one with a community solar CEO and

one with counsel discussing sustainable finance, have been

completed to date with others expected in the near future. You can

find the interviews here:

https://www.riverstonecoi.com/market/energy-expansion-webcast

Cumulative Portfolio Summary

Unrealised Portfolio [1]

Investment Subsector Commitment Cumulative Cumulative Gross Gross Gross % of Gross

Name Date Committed Invested Realised Unrealised Realised Par as MOIC

Capital Capital Capital Value Capital & of 30

($mm) ($mm) ($mm)(1) ($mm) Unrealised June

Value 2021(2)

($mm)

Project Infrastructure

Mariners Services Jul-19 13.2 13.2 6.4 10.5 16.9 107.43% 1.25 x

Caliber

Midstream Midstream Aug-19 3.4 3.4 0.4 2.0 2.4 49.07% 0.71 x

Caliber

Midstream

Revolver Midstream Apr-21 0.6 0.6 0.0 0.6 0.6 91.75% 1.01 x

Epic Propane

Pipeline Midstream Dec-19 14.8 14.8 1.9 15.4 17.3 101.33% 1.17 x

FS Crude Midstream Mar-20 13.7 13.7 9.1 6.7 15.8 98.89% 1.15 x

Hoover

Circular Infrastructure

Solutions Services Oct-20 7.4 7.4 4.0 4.0 8.0 100.64% 1.08 x

Aspen Power Energy

Partners Transition Dec-20 6.9 3.4 0.3 3.6 3.9 103.03% 1.16 x

U.S.

Shipping Midstream Feb-21 6.5 6.5 0.4 6.5 6.9 100.35% 1.07 x

Roaring Fork

Midstream Midstream Mar-21 5.9 2.7 0.2 2.8 3.0 99.81% 1.11 x

Imperium3NY Energy

LLC Transition Apr-21 6.8 5.4 1.3 4.8 6.1 109.90% 1.14 x

Blackbuck

Resources Infrastructure

LLC Services Jun-21 9.9 8.9 0.2 8.9 9.0 98.50% 1.02 x

-------

$89.0 $79.8 $24.2 $65.7 $89.9 1.12 x

Realised Portfolio

Investment Subsector Commitment Realisation Cumulative Cumulative Gross Gross

Name Date Date Committed Invested Realised MOIC(2)

Capital Capital Capital

($mm) ($mm) ($mm)(1)

Rocky Creek Exploration &

Resources Production Jun-19 Dec-19 6.0 4.3 4.9 1.15 x

CIG Infrastructure

Logistics Services Jan-20 Jan-20 8.7 8.7 8.9 1.02 x

Mallard Exploration &

Exploration Production Nov-19 Apr-20 13.8 6.8 7.7 1.13 x

Market Based Multiple Aug-20 Nov-20 13.4 13.4 13.6 1.01 x

Project

Yellowstone Midstream Jun-19 Mar-21 5.8 5.8 7.2 1.23 x

Ascent Exploration &

Energy Production Jun-19 Jun-21 13.3 13.3 16.1 1.21 x

Pursuit Oil Exploration &

& Gas Production Jul-19 Jun-21 12.3 12.3 15.0 1.22 x

-------------

$73.4 $64.6 $73.4 1.14 x

The Gross Realised Capital column includes interest, fee income,

and principal received. The Gross Unrealised Value column includes

the amortization of OID, accrued interest, fees and any unrealised

change in the value of the investment.

Direct Lending Consolidated Portfolio Key Stats at Entry As of 30 June

2021 (4)

Weighted Avg. Entry Basis 97.1%

-----------------------

Weighted Avg. All-in Coupon at Entry 9.34 p.a.

-----------------------

Weighted Avg. Undrawn Spread at Entry 4.4% p.a.

-----------------------

Weighted Avg. Tenor at Entry 3.0 years

-----------------------

Weighted Avg. Call Premium at Entry 108.5

-----------------------

Security 100% Secured

-----------------------

Coupon Type 100% Floating Rate

-----------------------

Manager Outlook

-- The second quarter continued to see an uptick in oil prices

and strengething in supply and demand fundamentals in the market.

The portfolio has continued to show resiliency throughout the past

year and RCOI is well positioned to capitalise on the increasing

market fundamentals through an opportunistic investment strategy

and diversified portfolio.

-- The Investment Manager believes the focus on infrastructure,

infrastructure services and energy transition investment

opportunities will provide downside protection and allow the

portfolio to continue to generate positive returns and income for

shareholders.

Reuben Jeffery III, Chairman of RCOI, commented:

"Given the vastly improving commodity sector and strong

realisations in the first half of 2021, we remain optimistic about

RCOI's ability to generate value for shareholders. The Company

currently has a net asset value per share of $1.03 and has returned

over 17 cents per share to investors since the IPO".

Christopher Abbate and Jamie Brodsky, Co-Founders of Riverstone

Credit, added:

"Following the Q2 2021 realisations in Ascent Energy and Pursuit

Oil & Gas, we are very pleased with our overall performance in

the upstream sector, as well as the fact there is no upstream

exposure today. We believe there remains a very attractive pipeline

of investment opportunities within the infrastructure,

infrastructure services and energy transition sectors, which will

allow us continued consistency of yield and principal preservation

across our portfolio.

Although RCOI's position in the Caliber Midstream Term Loan was

marked down in Q2 2021 as a result of their largest customer

declaring bankruptcy in March of 2021, Riverstone remains active in

its conversations with the Company, remain confident in our

investment and believe an improving macro environment will

strengthen the financial health of Caliber in 2H 2021."

About Riverstone Credit Opportunities Income Plc :

RCOI seeks to generate consistent Shareholder returns

predominantly in the form of income distributions, principally by

making senior secured loans to small and middle-market energy

companies, which span conventional energy as well as low carbon and

renewable sources. The investment strategy is predicated on

asset-based lending, with conservative loan-to-value ratios and

structural protective features to mitigate risk. The Company will

invest broadly across energy subsectors globally, with a primary

focus on infrastructure businesses and going forward those with

de-carbonization strategies in North America. RCOI intends to

create a diversified portfolio across basins, commodities,

technologies and end-markets to provide natural synergies and

hedges that could enhance the overall stability of the

portfolio.

For further details, see https://www.riverstonecoi.com/ .

Neither the contents of RCOI's website nor the contents of any

website accessible from hyperlinks on the

websites (or any other website) is incorporated into, or forms part of, this announcement.

Media Contacts

For Riverstone Credit Opportunities Income Plc:

Jingcai Zhu

+1 212 271 6261

1 Gross realised capital is total gross income realised on invested capital.

(2) Includes fair market value of equity and rights where

applicable as a percentage of par.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFURTMATMTTTBTB

(END) Dow Jones Newswires

July 23, 2021 02:00 ET (06:00 GMT)

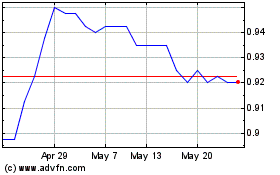

Riverstone Credit Opport... (LSE:RCOI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Riverstone Credit Opport... (LSE:RCOI)

Historical Stock Chart

From Jul 2023 to Jul 2024