TIDMRESI

RNS Number : 0663U

Residential Secure Income PLC

23 March 2023

23 March 2023

Residential Secure Income plc

Share Purchase

Residential Secure Income plc ("ReSI") (LSE: RESI), which

invests in independent retirement living and shared ownership to

deliver secure, inflation-linked returns, announces that Robert

Gray, a Director of ReSI and Antoine Pesenti, a Director of ReSI

Capital Management Limited (ReSI's fund manager), purchased the

following number of ordinary shares in the Company on Tuesday 21

March 2023 and Thursday 23 March 2023, respectively.

PDMR Date Acquired Number of shares acquired

Robert Gray 21 March 2023 86,923

Antoine Pesenti 23 March 2023 309,087

--------------- --------------------------

ReSI's Non-Executive Directors hold 509,088 ordinary shares. The

total number of ordinary shares owned by the directors and former

directors of the Investment Manager is 2,357,380. The Investment

Manager also owns 3,794,306 ordinary shares directly. The

Non-Executive Directors, Investment Manager and its current and

former directors thus hold 6,660,774 ordinary shares, c.3.6% of

shares in issue (excluding shares held in treasury).

Notification and public disclosure of transactions by persons

discharging managerial responsibility and persons closely

associated with them

Details of the person discharging managerial responsibilities/person

1 closely associated

a) Name Robert Gray

----------------------------- ------------------------------------------

Reason for the notification

2

-------------------------------------------------------------------------

a) Position/status Non-Executive Director

----------------------------- ------------------------------------------

b) Initial notification/ Initial notification

Amendment

----------------------------- ------------------------------------------

Details of the issuer, emission allowance market

3 participant, auction platform, auctioneer or auction

monitor

-------------------------------------------------------------------------

a) Name Residential Secure Income plc

----------------------------- ------------------------------------------

b) LEI 213800D24WA531LAR763

----------------------------- ------------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

-------------------------------------------------------------------------

a) Description Ordinary shares of 1 pence each

of the financial

instrument,

type of instrument

ISIN GB00BYSX1508

Identification

code

----------------------------- ------------------------------------------

b) Nature of Purchase of shares

the transaction

----------------------------- ------------------------------------------

c) Price(s) and Price(s) Volume(s)

volume(s)

1. 63.42 pence per 1. 39,418

share

2. 63.15 pence per 2. 47,505

share

----------------------------- ------------------------- ---------------

d) Aggregated

information

- Aggregated 86,923 ordinary shares

volume

- Aggregated Total Price: GBP54,998.30

price

----------------------------- ------------------------------------------

e) Date of the 21 March 2023

transaction

----------------------------- ------------------------------------------

f) Place of the London Stock Exchange

transaction

----------------------------- ------------------------------------------

Details of the person discharging managerial responsibilities/person

1 closely associated

a) Name Antoine Pesenti

-------------------------- ---------------------------------------------

Reason for the notification

2

-------------------------------------------------------------------------

a) Position/status Director of AIFM

-------------------------- ---------------------------------------------

b) Initial notification/ Initial notification

Amendment

-------------------------- ---------------------------------------------

Details of the issuer, emission allowance market

3 participant, auction platform, auctioneer or auction

monitor

-------------------------------------------------------------------------

a) Name Residential Secure Income plc

-------------------------- ---------------------------------------------

b) LEI 213800D24WA531LAR763

-------------------------- ---------------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

-------------------------------------------------------------------------

a) Description Ordinary shares of 1 pence each

of the financial

instrument,

type of instrument

Identification ISIN GB00BYSX1508

code

-------------------------- ---------------------------------------------

b) Nature of Purchase of shares

the transaction

-------------------------- ---------------------------------------------

c) Price(s) and Price(s) Volume(s)

volume(s)

1. 62.7 pence per 1. 309,087

share

-------------------------- ----------------------------- --------------

d) Aggregated

information 309,087 ordinary shares

- Aggregated

volume Total Price: GBP193,797.55

- Aggregated

price

-------------------------- ---------------------------------------------

e) Date of the 23 March 2023

transaction

-------------------------- ---------------------------------------------

f) Place of the London Stock Exchange

transaction

-------------------------- ---------------------------------------------

-S -

For further information, please contact:

ReSI Capital Management Limited / Gresham

House Real Estate

Ben Fry

Brandon Holloway +44 (0) 20 7382 0900

Peel Hunt LLP

Luke Simpson

Huw Jeremy +44 (0) 20 7418 8900

KL Communications gh@kl-communications.com

Charles Gorman +44 (0) 20 3995 6673

Charlotte Francis

Millie Steyn

About ReSI plc

Residential Secure Income plc ("ReSI plc" LSE: RESI) is a real

estate investment trust (REIT) focused on delivering secure,

inflation-linked returns with a focus on two resident sub-sectors

in UK residential - independent retirement rentals and shared

ownership - underpinned by an ageing demographic and untapped and

strong demand for affordable home ownership.

ReSI plc targets a secure, long-dated, inflation-linked dividend

of 5.16 pence per share p.a. [i] (paid quarterly) and a total

return in excess of 8.0% per annum. As at 31 December 2022,

including committed acquisitions, ReSI plc's portfolio comprises

3,303 properties, with an (unaudited) IFRS fair value of GBP364mn

[ii] .

ReSI plc's purpose is to deliver affordable, high-quality, safe

homes with great customer service and long-term stability of tenure

for residents. We achieve this through meeting demand from housing

developers, housing associations, local authorities, and private

developers for long-term investment partners to accelerate the

development of socially and economically beneficial affordable

housing.

ReSI plc's subsidiary, ReSI Housing Limited, is registered as a

for-profit Registered Provider of social housing, and so provides a

unique proposition to its housing developer partners, being a

long-term private sector landlord within the social housing

regulatory environment. As a Registered Provider, ReSI Housing can

acquire affordable housing subject to s106 planning restrictions

and housing funded by government grant.

About Gresham House and Gresham House Real Estate

Gresham House is a London Stock Exchange quoted specialist

alternative asset manager committed to operating responsibly and

sustainably, taking the long view in delivering sustainable

investment solutions.

Gresham House Real Estate has an unparalleled track record in

the affordable housing sector over 20 years, with senior members

having an average of c.30 years' experience.

Gresham House Real Estate offers long term equity investments

into UK housing, through listed and unlisted housing investment

vehicles, each focused on addressing different areas of the

affordable housing problem. Each fund aims to deliver stable and

secure inflation-linked returns whilst providing social and

environmental benefits to its residents, the local community, and

the wider economy.

Further information on ReSI plc is available at

www.resi-reit.com, and further information on Gresham House is

available at www.greshamhouse.com

[i] The dividend target and total return target are targets only

and are not profit forecasts. There can be no assurance that either

target will be met, and they should not be taken as an indication

of the Company's future results.

[ii] Excluding the finance lease gross up and including GBP2mn

of committed acquisitions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHFLFLRVSIVFIV

(END) Dow Jones Newswires

March 23, 2023 12:17 ET (16:17 GMT)

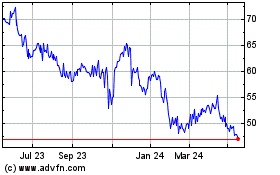

Residential Secure Income (LSE:RESI)

Historical Stock Chart

From Feb 2025 to Mar 2025

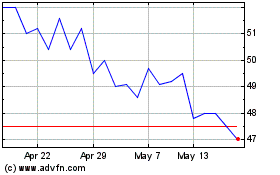

Residential Secure Income (LSE:RESI)

Historical Stock Chart

From Mar 2024 to Mar 2025