Acquisition will strengthen customer solutions in North America,

with increased local-for-local production and RHIM’s global leading

innovation and expertise

RHI Magnesita, the leading global supplier of high-grade

refractory products, systems and solutions, is pleased to announce

the completion of the acquisition of the US-based Resco Group, from

an affiliate of Balmoral Funds LLC, a Los Angeles-based private

equity firm, and management. The acquisition, for an enterprise

value of $410 million (c.€390 million), is the most significant

investment by the Group since the merger of RHI and Magnesita in

2017.

A milestone acquisition in North America

The deal marks a major milestone for RHI Magnesita as it focuses

on delivering an exceptional customer experience in the important

North American region. RHIM’s refractory products are essential to

the production processes for cement, steel, aluminium, and many

other industrial producers in the region. The addition of Resco

Group to the Company’s North American operations will significantly

increase local-for-local production, improving supply chain

security for critical industries that underpin the economy of the

continent.

Elevating customer experience through an enlarged

offering

The acquisition will deliver a broad range of benefits to

customers, including:

- A significantly enhanced product portfolio: offering a

wider range of basic and non-basic products, with applications

across multiple industries. The addition of Resco Group will

support RHI Magnesita’s strategic growth trajectory in

alumina-based refractories.

- Supply security: an increased focus on local-for-local

production will result in a reduced reliance on international

imports for US customers.

- Improved responsiveness: the combination of RHI

Magnesita’s global manufacturing capabilities and an improved

local-for-local production footprint will drive logistical

efficiencies and enhanced supply chain agility for shorter lead

times.

- Sustainability advancements: Resco customers will

benefit from RHI Magnesita’s industry leadership in innovation and

sustainability as well as circular economy solutions, to support

broader industrial decarbonization efforts. RHI Magnesita’s

advanced recycling initiatives in particular will play a key role

in reducing waste by converting used refractory materials into

reusable raw materials.

- Industry expertise: supported by RHI Magnesita’s global

leading expertise, Resco Group and RHIM will continue to pioneer

new industry standards for the North American region.

Over the coming weeks and months, RHI Magnesita will focus on

integrating teams, processes, technology, and resources to ensure a

seamless transition and maintain business continuity for the

combined entity’s suppliers, customers and other stakeholders. As

part of the integration of the networks, RHI Magnesita will also

invest into Resco’s plants to further upgrade them, increase

capacities, introduce new product lines and improve overall

productivity.

Stefan Borgas, CEO of RHI Magnesita, commented:

“The acquisition of Resco marks a significant milestone for RHI

Magnesita as we continue to expand our offering in North America,

responding to our customers’ evolving priorities while setting the

highest industry standards. This deal will deliver a step change

for our North American business as we continue to enhance

local-for-local production and expand our product offering. Resco

is a profitable and cash flow generative business with a strong

customer base in the North American petrochemical, cement, and

aluminium industries that will immediately add value to RHI

Magnesita.

“I would like to extend a warm welcome to our new colleagues

from Resco. A business is nothing without its people, and the

excellent reputation of Resco and its strong performance to date

are testament to the hard work of these expert and dedicated

professionals. They will join a collaborative international team,

working alongside colleagues across the globe to benefit from a

diversity of skills, experience, and exceptional career development

opportunities at RHI Magnesita. Together, I am confident that we

will continue to set new industry standards.”

Mark Essig, CEO of Resco from 2022 until the sale,

commented:

"This transaction marks an exciting new chapter for Resco and

our employees. Over our 78-year history, we have built a strong

reputation for delivering high-quality refractory products and

technical solutions to our customers. Joining RHI Magnesita will

allow us to further enhance our capabilities and expand our reach

while maintaining our commitment to excellence in customer service.

We are grateful for Balmoral Funds' support during their ownership,

which helped strengthen our market position, and we look forward to

continuing our growth trajectory as part of RHI Magnesita's global

platform."

About RHI Magnesita

RHI Magnesita is the leading global supplier of high-grade

refractory products, systems and solutions which are critical for

high-temperature processes exceeding 1,200°C in a wide range of

industries, including steel, cement, non-ferrous metals and glass.

With a vertically integrated value chain, from raw materials to

refractory products and full performance-based solutions, RHI

Magnesita serves customers around the world, with over 20,000

employees in 67 main production sites (including raw material

sites), 12 recycling facilities and more than 70 sales offices. RHI

Magnesita intends to leverage its leadership in terms of revenue,

scale, product portfolio and diversified geographic presence to

target strategically those countries and regions benefiting from

more dynamic economic growth prospects.

The Group is listed within the Equity Shares (Commercial

Companies) category (“ESCC”) of the Official List of the London

Stock Exchange (symbol: RHIM) and is a constituent of the FTSE 250

index, with a secondary listing on the Vienna Stock Exchange

(Wiener B�rse). For more information please visit:

www.rhimagnesita.com

About Resco

Resco is a producer of shaped and unshaped refractories,

including products for use in the petrochemical, cement, aluminium,

and steel-making industries. Resco operates seven plants and two

raw material sites in the US and two plants in the UK and Canada.

Resco’s Rescobond and Rescocast brands are widely used in refining

and petrochemical applications by global customers.

Resco recorded unaudited revenues of $252 million in the year to

31 December 2023, with Profit before Tax of $20 million and had

Gross Assets of $191 million at 31 December 2023.

About Balmoral Funds

Balmoral is a Los Angeles, CA based private equity fund that was

founded in 2005. Balmoral’s objective is to be the financial

partner of choice for entrepreneurial and successful C-suite

executives and operating advisors creating transformative outcomes

in the businesses they co-invest in together. Balmoral has

approximately $1.3 billion of assets under management. Balmoral

typically invests in companies that have revenues between $30 to

$500 million and require equity investments of $10 to $120 million,

with the capability of doing more in particularly compelling

opportunities.

About Advisors

Vedder Price P.C. acted as legal counsel to Balmoral Funds and

Resco Group, Jefferies acted as financial advisor to Balmoral Funds

on the sales transaction and A&O Shearman acted as legal

counsel to RHI Magnesita.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128771961/en/

Media:

Abhijit Borah, Head of Corporate Communications & Public

Affairs Tel +43 699 1870 6728 E-mail:

Abhijit.Borah@RHIMagnesita.com

Hudson Sandler Tel +44 020 7796 4133 E-mail:

rhimagnesita@hudsonsandler.com

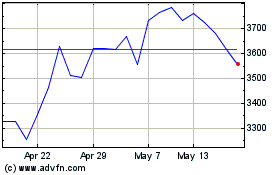

Rhi Magnesita N.v (LSE:RHIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

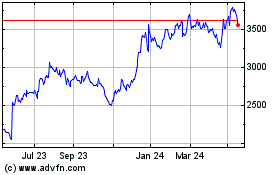

Rhi Magnesita N.v (LSE:RHIM)

Historical Stock Chart

From Feb 2024 to Feb 2025