Restaurant Group PLC Completion Of The Acquisition Of Wagamama (4298L)

December 24 2018 - 4:03AM

UK Regulatory

TIDMRTN

RNS Number : 4298L

Restaurant Group PLC

24 December 2018

24 December 2018

THE RESTAURANT GROUP PLC

COMPLETION OF THE ACQUISITION OF WAGAMAMA

The Restaurant Group plc ("TRG" or the "Company") is pleased to

announce the completion of the acquisition of the entire issued

share capital of Mabel Topco Limited ("Wagamama"), the holding

company of a group that owns and operates the Wagamama restaurant

business ("Completion").

Further to the announcement made by the Company on 30 October

2018, Allan Leighton has joined the board of directors of TRG as a

Non-Executive Director with effect from Completion. Allan will be a

member of both the Audit and Nomination Committees of TRG. Allan is

currently Chairman of Co-operative Group Limited and Entertainment

One Limited, among others, and has previously been Chief Executive

Officer of ASDA Group Limited and Pandora A/S and Chairman of Pace

plc and Royal Mail.

Debbie Hewitt MBE, Chairman of the Company said:

"We'd like to thank all shareholders for their engagement in

this process and we look forward to delivering the benefits of the

acquisition. We welcome all Wagamama colleagues and thank them and

all of our colleagues at the Restaurant Group for their continued

focus on our customers during this busy period.

We are delighted to welcome Allan to our Board. He brings

significant knowledge of the sector, and of the Wagamama team and a

wealth of experience in growing consumer businesses."

For further details please contact:

The Restaurant Group plc Tel: +44(0) 203 117 5001

Debbie Hewitt MBE, Chairman

Andy McCue, Chief Executive Officer

Kirk Davis, Chief Financial Officer

MHP Communications (Financial PR Tel: +44(0) 203 128 8742

adviser)

Oliver Hughes / Andrew Jaques

Simon Hockridge / Alistair de Kare-Silver

Notes

No further details remain to be disclosed for Allan Leighton's

appointment as required under Rule 9.6.13 of the Listing Rules.

The Company notes that, on 29 November 2018, in error,

290,430,689 New Ordinary Shares, rather than 290,428,830 New

Ordinary Shares, were admitted to listing on the premium listing

segment of the Official List and to trading on the London Stock

Exchange's main market for listed securities. The figure of

290,428,830 New Ordinary Shares reflects the elimination of

fractions. For the avoidance of doubt, 290,428,830 New Ordinary

Shares have been issued and allotted by the Company in connection

with the Rights Issue, and all announcements made by the Company in

relation to its total share capital and voting rights have been and

continue to be correct. As such, as at today's date, the Company's

issued share capital consists of 491,496,230 ordinary shares with a

nominal value of 28.125 pence each. The Company holds no ordinary

shares in treasury. Capitalised terms used in this paragraph have

the meaning given to them in the combined circular and prospectus

of the Company dated 12 November 2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQFEFFSLFASESE

(END) Dow Jones Newswires

December 24, 2018 05:03 ET (10:03 GMT)

Restaurant (LSE:RTN)

Historical Stock Chart

From Apr 2024 to May 2024

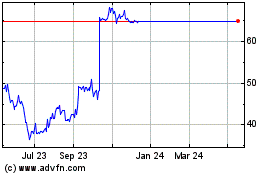

Restaurant (LSE:RTN)

Historical Stock Chart

From May 2023 to May 2024