TIDMRTN TIDMTTM

RNS Number : 5044X

Restaurant Group PLC (The)

20 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

20 December 2023

RECOMMED CASH ACQUISITION

OF

THE RESTAURANT GROUP PLC ("TRG")

BY

ROCK BIDCO LIMITED ("BIDCO")

(a special purpose vehicle indirectly owned by the Apollo Funds,

managed by affiliates of Apollo Global Management, Inc.)

Court sanction of Scheme of Arrangement

On 12 October 2023, the boards of TRG and Bidco announced that

they had reached agreement on the terms and conditions of a

recommended cash acquisition by Bidco of the entire issued, and to

be issued, ordinary share capital of TRG ("Acquisition") , to be

effected by way of a Court-sanctioned scheme of arrangement under

Part 26 of the Companies Act (the "Scheme").

The circular in relation to the Scheme, including full details

of the Acquisition was published on 2 November 2023 (the "Scheme

Document"). Capitalised terms used in this announcement shall,

unless otherwise defined, have the same meanings as set out in the

Scheme Document.

On 27 November 2023, the requisite majority of Scheme

Shareholders voted to approve the Scheme at the Court Meeting and

the requisite majority of TRG Shareholders voted to pass the

Special Resolution to implement the Scheme, including the amendment

of TRG's articles of association, at the General Meeting.

TRG is pleased to announce that the Court of Session in

Edinburgh has today sanctioned the Scheme.

The expected timetable of principal events for the

implementation of the Scheme remains as set out on and in the

announcement made by TRG in relation to the Acquisition on 27

November 2023.

It is currently expected that the Effective Date of the Scheme

will be 21 December 2023, which is when a copy of the Court Order

is expected to be delivered to the Registrar of Companies.

TRG will give adequate notice of any change or revision of the

currently expected dates and/or times by issuing an announcement of

the revised dates and/or times through a Regulatory Information

Service, with such announcement being made available on TRG's

website at https://www.trgplc.com/investors/.

A further announcement will be made when the Scheme has become

Effective.

Enquiries:

TRG

Ken Hanna, Chair +44 20 3117

Umer Usman, Investor Relations 5001

Lazard & Co., Limited

(Lead Financial Adviser and Rule 3 Adviser

to TRG)

Louise Campbell +44 20 7187

Adam Blin 2000

Centerview Partners UK LLP

(Financial Adviser to TRG)

Nick Reid

Hadleigh Beals +44 20 7409

James Tookman 9700

Citigroup Global Markets Limited

(Financial Adviser and Joint Corporate Broker

to TRG)

Christopher Wren

James Ibbotson +44 20 7986

Peter Catterall 4000

Investec Bank plc

(Joint Corporate Broker to TRG)

David Flin +44 20 7 597

Ben Farrow 4000

+ 44 20 3128

MHP Group 8789

(PR Adviser to TRG)

Oliver Hughes +44 7885 224532

James McFarlane +44 7584 142665

Kirkland & Ellis International LLP is acting as legal

adviser to Apollo and Bidco.

Slaughter and May is acting as legal adviser to TRG.

Important notices

Lazard & Co., Limited, which is authorised and regulated in

the United Kingdom by the Financial Conduct Authority ("FCA"), is

acting exclusively as lead financial adviser and Rule 3 adviser to

TRG and no one else in connection with the matters described in

this announcement and will not be responsible to anyone other than

TRG for providing the protections afforded to clients of Lazard nor

for providing advice in relation to the contents of this

announcement or any other matter or arrangement referred to herein.

Neither Lazard nor any of its affiliates (nor their respective

directors, officers, employees or agents) owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Lazard in connection with this

announcement, any matter, arrangement or statement contained or

referred to herein or otherwise.

Centerview Partners UK LLP, which is authorised and regulated in

the United Kingdom by the FCA, is acting exclusively as financial

adviser to TRG and no one else in connection with the matters set

out in this announcement and will not be responsible to anyone

other than TRG for providing the protections afforded to its

clients or for providing advice in relation to the matters set out

in this announcement, the contents of this announcement or any

other matters referred to in this announcement. Neither Centerview

nor any of its affiliates, nor any of Centerview's and such

affiliates' respective members, directors, officers, controlling

persons or employees owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect,

consequential, whether in contract, in tort, in delict, under

statute or otherwise) to any person who is not a client of

Centerview in connection with this announcement, any statement

contained herein or otherwise.

Citigroup Global Markets Limited, which is authorised by the

Prudential Regulation Authority ("PRA") and regulated in the UK by

the FCA and the PRA is acting exclusively as Financial Adviser and

Joint Corporate Broker to TRG and for no one else in connection

with the matters described in this announcement, and will not be

responsible to anyone other than TRG for providing the protections

afforded to its clients nor for providing advice in relation to the

matters referred to in this announcement. Neither Citi nor any of

its affiliates, directors or employees owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

consequential, whether in contract, tort, in delict, under statute

or otherwise) to any person who is not a client of Citi in

connection with this announcement, any statement contained herein,

or otherwise.

Investec Bank plc, which is authorised by the PRA and regulated

by the FCA and PRA, is acting for TRG and no one else in connection

with the matters described in this announcement and will not be

responsible to anyone other than TRG for providing the protections

afforded to clients of Investec Bank plc nor for giving advice in

relation to the matters described in this announcement. Further,

Investec Bank plc accepts no responsibility whatsoever and makes no

representations or warranty, express or implied, for or in respect

of the contents of this announcement, including its accuracy,

completeness or verification or for any other statement made or

purported to be made by it, or on its behalf, in connection with

the matters described in this announcement, and nothing in this

announcement is, or shall be relied upon as, a promise or

representation in this respect, whether as to the past or future.

Investec Bank plc and its affiliates accordingly disclaim, to the

fullest extent permitted by law, all and any responsibility and

liability whatsoever arising in tort or otherwise as related to

above, which it might otherwise have in respect of this

announcement or any such statement.

Further information

This announcement is for information purposes only and is not

intended to and does not constitute, or form any part of, an offer

to sell or subscribe for or any invitation to purchase or subscribe

for any securities or the solicitation of any vote or approval in

any jurisdiction pursuant to the Acquisition or otherwise. The

Acquisition will be implemented solely through the Scheme Document

(or, if the Acquisition is implemented by way of an Offer, the

offer document).

The statements contained in this announcement are made as at the

date of this announcement, unless some other time is specified in

relation to them, and service of this announcement shall not give

rise to any implication that there has been no change in the facts

set forth in this announcement since such date.

This announcement does not constitute a prospectus, prospectus

equivalent or an exempted document.

This announcement contains inside information in relation to TRG

for the purposes of Article 7 of the Market Abuse Regulation. The

person responsible for arranging the release of this announcement

on behalf of TRG is Andrew Eames (General Counsel & Company

Secretary). TRG's Legal Entity Identifier is

213800V4LJ2FXMQKKA46.

Overseas shareholders

The release, publication or distribution of this announcement in

or into jurisdictions other than the UK may be restricted by law

and therefore any persons who are subject to the law of any

jurisdiction other than the UK should inform themselves of, and

observe, any applicable legal or regulatory requirements. Any

failure to comply with such requirements may constitute a violation

of the securities laws of any such jurisdiction. To the fullest

extent permitted by applicable law, the companies and persons

involved in the Acquisition disclaim any responsibility or

liability for the violation of such restrictions by any person.

This announcement has been prepared in accordance with and for the

purpose of complying with English and Scots law, the Takeover Code,

the Market Abuse Regulation, the Listing Rules and the Disclosure

Guidance and Transparency Rules and information disclosed may not

be the same as that which would have been prepared in accordance

with the laws of jurisdictions outside of the UK.

The availability of the Acquisition to TRG Shareholders who are

not resident in and citizens of the UK may be affected by the laws

of the relevant jurisdictions in which they are located or of which

they are citizens. Persons who are not resident in the UK should

inform themselves of, and observe, any applicable legal or

regulatory requirements of their jurisdictions. Any failure to

comply with the applicable restrictions may constitute a violation

of the securities laws of any such jurisdiction. To the fullest

extent permitted by applicable law, the companies and persons

involved in the Acquisition disclaim any responsibility or

liability for the violation of such restrictions by any person.

Copies of this announcement and any formal documentation

relating to the Acquisition are not being, and must not be,

directly or indirectly, mailed or otherwise forwarded, distributed

or sent in or into or from any Restricted Jurisdiction and persons

receiving such documents (including, without limitation, agents,

custodians, nominees and trustees) must not mail or otherwise

forward, distribute or send it in or into or from any Restricted

Jurisdiction.

Additional information for US investors

The Acquisition relates to the shares of a Scottish company and

is being made by means of a scheme of arrangement provided for

under Scots law. A transaction effected by means of a scheme of

arrangement is not subject to the tender offer or proxy

solicitation rules under the U.S. Securities Exchange Act of 1934

(the "U.S. Exchange Act"). Accordingly, the Acquisition is subject

to the disclosure requirements and practices applicable in the UK

to schemes of arrangement which differ from the disclosure

requirements of the U.S. tender offer and proxy solicitation rules.

The financial information included in this announcement has been

prepared in accordance with generally accepted accounting

principles of the United Kingdom and thus may not be comparable to

financial information of U.S. companies or companies whose

financial statements are prepared in accordance with generally

accepted accounting principles in the United States.

It may be difficult for U.S. holders of TRG Shares to enforce

their rights and any claim arising out of the U.S. federal laws,

since Bidco and TRG are located in a non-U.S. jurisdiction, and

some or all of their officers and directors may be residents of a

non-U.S. jurisdiction. U.S. holders of TRG Shares may not be able

to sue a non-U.S. company or its officers or directors in a

non-U.S. court for violations of the U.S. securities laws. Further,

it may be difficult to compel a non-U.S. company and its affiliates

to subject themselves to a U.S. court's judgement.

In accordance with normal UK practice and pursuant to Rule

14e-5(b) of the U.S. Exchange Act, Apollo, its nominees, or their

brokers (acting as agents), may from time to time make certain

purchases of, or arrangements to purchase, TRG Shares outside of

the U.S., other than pursuant to the Acquisition, until the date on

which the Acquisition becomes Effective, lapses or is otherwise

withdrawn. Also, in accordance with Rule 14e-5(b) of the U.S.

Exchange Act, RBC will continue to act as an exempt principal

trader in TRG shares on the London Stock Exchange. These purchases

may occur either in the open market at prevailing prices or in

private transactions at negotiated prices. Any information about

such purchases will be disclosed as required in the United Kingdom,

will be reported to a Regulatory Information Service and will be

available on the London Stock Exchange website,

www.londonstockexchange.com/ .

U.S. TRG Shareholders also should be aware that the transaction

contemplated herein may have tax consequences in the U.S. and, that

such consequences, if any, are not described herein. U.S. TRG

Shareholders are urged to consult with legal, tax and financial

advisers in connection with making a decision regarding this

transaction.

Cautionary Note Regarding Forward-looking statements

This announcement (including information incorporated by

reference in this announcement), oral statements made regarding the

Acquisition, and other information published by Bidco and TRG

contain statements which are, or may be deemed to be,

"forward-looking statements". Forward-looking statements are

prospective in nature and are not based on historical facts, but

rather on current expectations and projections of the management of

Bidco and TRG about future events, and are therefore subject to

risks and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the

forward-looking statements.

The forward-looking statements contained in this announcement

include statements relating to the expected effects of the

Acquisition on Bidco and TRG (including their future prospects,

developments and strategies), the expected timing and scope of the

Acquisition and other statements other than historical facts.

Often, but not always, forward-looking statements can be identified

by the use of forward-looking words such as "prepares", "plans",

"expects" or "does not expect", "is expected", "is subject to",

"budget", "projects", "synergy", "strategy", "scheduled", "goal",

"estimates", "forecasts", "cost-saving", "intends", "anticipates"

or "does not anticipate", or "believes", or variations of such

words and phrases or statements that certain actions, events or

results "may", "could", "should", "would", "might" or "will" be

taken, occur or be achieved. Forward looking statements may include

statements relating to the following: (i) future capital

expenditures, expenses, revenues, earnings, synergies, economic

performance, indebtedness, financial condition, dividend policy,

losses and future prospects; (ii) business and management

strategies and the expansion and growth of Bidco's, TRG's, any

member of the Bidco Group's or any member of the TRG Group's

operations and potential synergies resulting from the Acquisition;

and (iii) the effects of global economic conditions and

governmental regulation on Bidco's, TRG's, any member of the Bidco

Group's or any member of the TRG Group's business.

Although Bidco and TRG believe that the expectations reflected

in such forward-looking statements are reasonable, Bidco and TRG

can give no assurance that such expectations will prove to be

correct. By their nature, forward-looking statements involve risk

and uncertainty because they relate to events and depend on

circumstances that will occur in the future. There are a number of

factors that could cause actual results and developments to differ

materially from those expressed or implied by such forward-looking

statements.

These factors include, but are not limited to: the ability to

complete the Acquisition; the ability to obtain requisite

regulatory and shareholder approvals and the satisfaction of other

Conditions on the proposed terms and schedule; changes in the

global political, economic, business and competitive environments

and in market and regulatory forces; changes in future exchange and

interest rates; changes in tax rates; future business combinations

or disposals; changes in general economic and business conditions;

changes in the behaviour of other market participants; and changes

in the anticipated benefits from the proposed transaction not being

realised as a result of: changes in general economic and market

conditions in the countries in which Bidco and TRG operate, weak,

volatile or illiquid capital and/or credit markets, changes in tax

rates, interest rate and currency value fluctuations, the degree of

competition in the geographic and business areas in which Bidco and

TRG operate and changes in laws or in supervisory expectations or

requirements. Other unknown or unpredictable factors could cause

actual results to differ materially from those expected, estimated

or projected in the forward-looking statements. If any one or more

of these risks or uncertainties materialises or if any one or more

of the assumptions proves incorrect, actual results may differ

materially from those expected, estimated or projected. Such

forward-looking statements should therefore be construed in the

light of such factors. Neither Bidco nor TRG, nor any of their

respective associates or directors, officers or advisers, provides

any representation, assurance or guarantee that the occurrence of

the events expressed or implied in any forward-looking statements

in this announcement will actually occur. You are cautioned not to

place any reliance on these forward-looking statements.

Specifically, statements of estimated cost savings and synergies

related to future actions and circumstances which, by their nature,

involve risks, uncertainties and contingencies. As a result, the

cost savings and synergies referred to may not be achieved, may be

achieved later or sooner than estimated, or those achieved could be

materially different from those estimated. Due to the scale of the

TRG Group, there may be additional changes to the TRG Group's

operations. As a result, and given the fact that the changes relate

to the future, the resulting cost synergies may be materially

greater or less than those estimated.

Other than in accordance with their legal or regulatory

obligations, neither Bidco nor TRG is under any obligation, and

Bidco and TRG expressly disclaim any intention or obligation, to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

No profit forecasts or estimates

No statement in this announcement is intended as a profit

forecast, profit estimate or quantified benefits statement for any

period and no statement in this announcement should be interpreted

to mean that earnings or earnings per share for TRG for the current

or future financial years would necessarily match or exceed the

historical published earnings or earnings per share for TRG.

Publication of this announcement on website

In accordance with Rule 26.1 of the Takeover Code, a copy of

this announcement and the documents required to be published under

Rule 26 of the Takeover Code will be made available, subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions, on TRG's website at

https://www.trgplc.com/investors/ by no later than 12 noon (London

time) on the Business Day following this announcement. For the

avoidance of doubt, neither the content of these websites nor of

any website accessible from hyperlinks is incorporated by reference

or forms part of this announcement.

Right to receive documents in hard copy form

In accordance with Rule 30.3 of the Takeover Code, TRG

Shareholders, persons with information rights and participants in

TRG Share Plans may request a hard copy of this announcement by:

(i) telephoning Equiniti on +44 (0) 371 384 2426. If calling from

outside of the UK, please ensure the country code is used. Lines

will be open from 8.30 a.m. to 5.30 p.m., Monday to Friday

(excluding public holidays in England and Wales); or (ii)

submitting a request in writing to Equiniti Limited, Aspect House,

Spencer Road, Lancing, West Sussex BN99 6DA, United Kingdom. For

persons who receive a copy of this announcement in electronic form

or via a website notification, a hard copy of this announcement

will not be sent unless so requested. Such persons may also request

that all future documents, announcements and information to be sent

to you in relation to the Acquisition should be in hard copy

form.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OFBEADAEAAADFFA

(END) Dow Jones Newswires

December 20, 2023 08:26 ET (13:26 GMT)

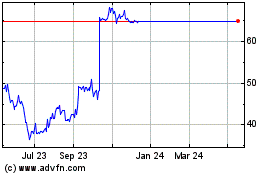

Restaurant (LSE:RTN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Restaurant (LSE:RTN)

Historical Stock Chart

From Dec 2023 to Dec 2024