TIDMSOM

RNS Number : 5136Y

Somero Enterprises Inc.

07 September 2022

Press Announcement

For immediate release

07 September 2022

Somero(R) Enterprises, Inc.

("Somero" or "the Company" or "the Group")

Interim Results for the six months ended June 30, 2022

Record H1 revenue driven by continued strength in the US

market

Financial Highlights

-- H1 2022 revenues were US$ 68.5m (H1 2021: US$64.4m), a record level for H1

o Led by US revenues which were up 9% on H1 2021, reflecting a

strong, active non-residential construction market and the positive

impact of 2022 price increases

o Three of the Company's five regions reported revenues up over

H1 2021 including the US, with Australia and Latin America

contributing a combined US$ 1.9m to H1 2022 growth

-- Record H1 revenue translated efficiently to strong profits and operating cash flow

o US$ 24.1m in H1 2022 adjusted EBITDA (H1 2021: US$ 24.6m)

o US$ 12.8m in H1 2022 cash flow from operations (H1 2021: US$

16.0m)

-- Based on strong H1 2022 results and a positive H2 2022

outlook, the Board anticipates the business to trade in line with

expectations for 2022 revenues of approximately US$ 138.8m, EBITDA

of approximately US$ 47.7m, and year-end cash of approximately US$

39.9m

H1 2022 H1 2021 % Change

US$ US$

Revenue $68.5m $ 64.4m 6%

Adjusted EBITDA(1,2) $24.1m $ 24.6m -2%

Adjusted EBITDA margin(1,2) 35.3% 38.2% -290bps

Profits before tax $22.4m $ 23.5m -5%

Adjusted net income(1,3) $17.3m $ 18.2m -5%

Diluted adjusted net income

per share(1,3) $0.31 $ 0.32 -3%

Cash flow from operations $12.8m $ 16.0m -20%

Net cash(4) $27.2m $ 32.8m -17%

Interim dividend per share $ 0.10 $ 0.09 11%

Operational Highlights

-- Re-investing for sustainable long-term growth

o The US$ 9.5m expansion project for the Houghton, Michigan,

Operations and Support Offices remains on track for Q3 2022

completion

o The Company added a total of seventeen employees since June

30, 2021 primarily in sales, customer support and operational

roles, with six employees added in Europe and Australia

combined

-- Developing new products to expand the addressable market and contribute to growth

o The SkyScreed(R) 36, S-PS50, SkyStrip (R) and Somero

Broom+Cure(TM) , all launched since 2019 to target new market

segments, combined to contribute US$ 3.2m to H1 2022 revenues (H1

2021: US$ 1.4m)

o The customer-led product development process made substantial

progress in H1 2022 driven by a high volume of job site visits with

customers and innovation council events

Post-Period Highlights

-- The Board has also declared a US$ 0.10 per share interim

dividend, an 11% increase compared to the 2021 interim dividend

Notes:

1. The Company uses non-US GAAP financial measures to provide

supplemental information regarding the Company's operating

performance. See further information regarding non-GAAP measures

below.

2. Adjusted EBITDA as used herein is a calculation of the

Company's net income plus tax provision, interest expense, interest

income, foreign exchange loss, other expense, depreciation,

amortization stock-based compensation and non-cash lease

expense.

3. Adjusted net income as used herein is a calculation of net

income plus amortization of intangibles and excluding the tax

impact of stock option and RSU settlements and other special

items.

4. Net cash is defined as cash and cash equivalents less

borrowings under bank obligations exclusive of deferred financing

costs.

Jack Cooney, CEO of Somero, said:

"The Company delivered record H1 2022 revenues thanks to the

remarkable performance by our talented and dedicated employees who

managed to keep pace with a highly active US market, delivering

equipment to meet our customers' needs and continuing to reinforce

our reputation as reliable partners. Outside of a very strong US

market, we are pleased with the contribution to revenues from our

international regions, and in particular with the activity levels

and interest in our equipment, new and existing, that we continue

to see in Europe and Australia.

Equally impressive was the efficiency of our operations during

this period. The Company delivered a very healthy level of profit

and generated a high-level of cash from operations, providing the

financial strength necessary to fund investment in new employees

and a major expansion of our Houghton facility.

The Company also made good progress on executing its product

development growth strategy. New products contributed materially to

H1 2022 revenues and we took meaningful steps to enhance our

product development pipeline.

Based on the success of the first half and current market

conditions, we confirm our guidance for 2022. We expect to deliver

strong revenues, profits and cash flow for our shareholders and,

most importantly, we remain committed to making sound strategic

investments to deliver healthy profits and cash flows to our

shareholders in the years that follow."

For further information, please contact:

Enquiries:

Somero Enterprises, Inc. www.somero.com

Jack Cooney, CEO +1 239 210 6500

John Yuncza, President

Vincenzo LiCausi, CFO

Howard Hohmann, EVP Sales

finnCap Ltd (NOMAD and Broker)

Matt Goode /Seamus Fricker/Fergus Sullivan(Corporate Finance)

+44 (0)20 7220 0500

Tim Redfern/Richard Chambers (ECM)

Alma PR (Financial PR Advisor) somero@almapr.co.uk

David Ison +44 (0)20 3405 0205

Pippa Crabtree

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

Notes to Editors:

Somero Enterprises provides industry-leading concrete-levelling

equipment, training, education, and support to customers in over 90

countries. The Company's cutting-edge technology allows its

customers to install high-quality horizontal concrete floors

faster, flatter and with fewer people. Somero equipment that

incorporates laser-technology and wide-placement methods is used to

place and screed the concrete slab in all building types and has

been specified for use in a wide range of commercial construction

projects for numerous global blue-chip companies.

Somero pioneered the Laser Screed(R) market in 1986 and has

maintained its market-leading position by continuing to focus on

bringing new products to market and developing patent-protected

proprietary designs. In addition to its products, Somero offers

customers unparalleled global service, technical support, training,

and education, reflecting the Company's emphasis on helping its

customers achieve their business and profitability goals, a key

differentiator to its peers.

For more information, visit www.somero.com

Chairman's and Chief Executive Officer's Statement

Overview

H1 2022 revenue totaled US$ 68.5m, growing 6% compared to H1

2021 to reach record H1 revenues. North America drove the strong

performance, reporting H1 2022 revenues of US$ 55.6m (H1 2021: US$

50.9m) reflecting a robust US non-residential construction market.

Our international regions contributed meaningfully to revenues in

the period, led by Europe and Australia, which contributed US$ 4.8m

(H1 2021: US$ 6.4m) and US$ 4.0m (H1 2021: US$ 2.7m), respectively.

In addition to the strong H1 2022 trading, the Company made

substantial progress on its new product growth strategy, both in

generating revenues and developing the pipeline of new

products.

Leveraging the H1 2022 revenue, the Company delivered strong

profits and cash generation during the period. H1 2022 adjusted

EBITDA was US$ 24.1m (H1 2021: US$ 24.6m) reflecting an adjusted

EBITDA margin of 35.3% (H1 2021: 38.2%). The Company mostly offset

higher expenses compared to H1 2021 from a higher headcount and

cost inflation with 2022 price increases and improved operational

efficiency. H1 2022 profits benefitted from a strong gross margin

of 58.3% (H1 2021: 58.6%) as the aforementioned 2022 price

increases and operational efficiency gains mostly offset higher

materials and logistics costs. Operating cash flow in H1 2022 was

US$ 12.8m (H1 2021: US$ 16.0m), a healthy level that translated to

a sizable June 30, 2022 cash balance of US$ 27.2m, notwithstanding

the payment of a substantial US$ 23.4m dividend in May 2022. The H1

2022 results highlight the scalability of operations to efficiently

meet high demand and the Company's commitment to add key talent to

execute its long-term growth plan.

Region and Product Reviews

North America

H1 2022 North American sales grew 9% from H1 2021 to US$ 55.6m

as our US customers continued work on a large volume of projects,

including large footprint manufacturing facilities and warehousing.

During the period, customers were able to manage through supply

challenges, including inconsistent availability of concrete,

long-lead times from equipment providers other than Somero, and the

long-standing and worsening shortage of skilled labor, challenges

that remain in place as we enter H2 2022.

Europe

Europe reported sales of US$ 4.8m in H1 2022, down from US$ 6.4m

in H1 2021. Although trading fell below the prior year, activity

was healthy along with solid interest in our equipment during the

period. The H1 2022 trading result in Europe was impacted by

temporary logistics delays that resulted in shipment of certain

orders getting pushed to H2 2022. We anticipate improved trading in

Europe in H2 2022 as these temporarily delays are resolved and with

the solid activity and interest levels expected to continue.

Europe is one of our target international markets where we see

meaningful opportunity for growth from sales of new and existing

products. In H1 2022, we took steps to execute our European growth

strategy that included starting the process to introduce the

SkyScreed(R) 36 to the UK market, adding three European-based sales

and customer support employees including a direct sales territory

manager in Italy, and at the end of H1 2022 introducing a

competitively priced, entry-level ride-on screed, the EcoScreed,

designed to attract new customers to the Somero family.

Australia

Australia reported H1 2022 sales of US$ 4.0m, a 48% increase

from the US$ 2.7m in H1 2021. The higher sales were attributable to

a direct sales team focused on selling a broader range of our

products, a direct support team strengthening customer

relationships and identifying sales opportunities, and to favorable

exchange rates. We are introducing the SkyScreed(R) 36 to the

Australian market in 2022 and excited by the opportunity to gain

traction with this product in an Australian structural high-rise

market segment that has similar characteristics to those in the

US.

Australia is also a target international market where we see

meaningful opportunity for growth. The transition to a direct sales

and support model at the end of 2020 has provided the foundation

for strong performance in H1 2022 and future growth, and we grew

this team by adding three customer service employees that will

support new product launches, a higher volume of job site

demonstrations, and the introduction of the SkyScreed(R) 36 to the

market.

Latin America

Latin America reported US$ 1.4m in H1 2022 sales, a US$ 0.6m

increase compared to H1 2021 with positive activity in the region's

main market, Mexico. Latin America remains a relatively small

contributor to overall sales, and as such, period to period results

will be subject to a certain level of volatility due to the small

base of revenues.

Rest of World

Our Rest of World region, which includes China, the Middle East,

India, Southeast Asia, and Korea, reported H1 2022 sales of US$

2.7m, representing a US$ 0.9m decrease compared to H1 2021. The

main contributors to H1 2022 revenues, as in past periods, were

China, India, and the Middle East. Excluding China, the Rest of

World region reported H1 2022 revenues of US$ 2.3m, an increase of

US$ 0.4m compared to H1 2021. China reported H1 2022 revenues of

US$ 0.4m (H1 2021: US$ 1.7m), down from the prior year period as

expected due to the previously announced downsizing of our local

China team, severe COVID-19 restrictions put in place by the

Chinese government that drastically limited activity across broad

sections of the country, and to the negative impact of a worsening

environment for multi-national firms investing in China-based

building projects. India reported sales of US$ 1.5m in H1 2022, a

US$ 0.4m increase compared to H1 2021. This was thanks to a strong

contribution from our local sales team despite the lingering

effects of COVID-19 restrictions, while the Middle East reported

sales of US$ 0.5m compared to US$ 0.2m in H1 2021, an encouraging

improvement albeit off a small base.

Products

Revenue from sales of Boomed screeds, Ride-on screeds, 3D

Profiler Systems, and Other revenues all increased compared to H1

2021, reflecting a healthy and balanced range of construction

projects in the market. There continues to be healthy demand for

our large Boomed screed equipment suitable for large footprint

projects such as warehousing and manufacturing facilities. There

also continues to be healthy demand for our Ride-on screeds

suitable for smaller footprint projects and smaller concrete slab

pours necessitated by an inconsistent supply of concrete. Sales of

the 3D Profiler System contributed US$ 5.3m to H1 2022 revenue, an

increase of 15% over H1 2021, driven by continued growth in

concrete parking and loading areas around the perimeter of

buildings. Other revenues, primarily parts and accessories, grew 8%

from H1 2021 to US$ 14.3m due to a larger installed base of

equipment and a high-level of equipment utilization in the market.

The period over period comparisons for other product lines were

subject to typical fluctuation driven by customer project

types.

New products are a key driver of long-term growth. Products

released since 2019, the SkyScreed(R) 36, S-PS50, SkyStrip(R) and

the Somero Broom+Cure(TM) , that target entirely new market

segments, combined to contribute US$ 3.2m in H1 2022 revenues US$

1.8m ahead of H1 2021, as we continue to build market acceptance

for these disruptive products. Our customer-led product development

process remained highly active in H1 2022 with extensive job-site

visits and innovation council events to advance new product ideas

through our multi-stage development process.

Our People

On behalf of the Board, we would like to thank all our global

employees for their remarkable performance in H1 2022. The effort

of the entire Somero team to overcome formidable challenges and

deliver these outstanding results sets us apart from other

providers of equipment in our industry. In addition to retaining

our talented employees, we are pleased to have added a range of new

talent to the organization that will support our long-term growth

strategy. Since June 30, 2021, we have added seventeen employees to

fill important positions across our global operations. The Board

and management team remain as committed as ever to providing all

our employees with a rewarding and challenging working environment

that is full of opportunity.

Facility Expansion

We made substantial progress on the project to expand our

Houghton, Michigan, Operations and Support Offices during H1 2022.

The 50,000 square foot expansion provides a 35% increase in

operational capacity that will increase operational efficiency,

support future growth of our product portfolio, and provide our

engineering team with an expanded development and testing area. The

project remains in line with the US$ 9.5m budgeted cost and we

anticipate project completion in Q3 2022 with the new space fully

operational in Q4 2022.

Environmental, Social and Governance

The Board closely monitors material environmental, social and

governance topics that impact our stakeholders. These topics are

routinely discussed at the Board level to ensure Somero strikes the

right balance between shareholder expectations and the needs and

concerns of our employees, customers, communities, our impact on

the environment, and that Somero is actively engaging with

stakeholders on these material topics. One material topic is the

environmental impact of the use of our equipment in the

construction process. In 2021, we commissioned an initial study

with a university to issue a white paper that outlines this impact.

The study concluded that the use of our laser screed machines in

non-residential construction projects provides a number of

environment benefits including a reduction in concrete required to

install the concrete slab. In H2 2022, we will begin part two of

the study that will comprehensively assess the environmental impact

from the use of our equipment in the construction process. We

anticipate the study will be completed in H1 2023.

Dividend and share buyback program

Based on record results in H1 2022, our strong financial

position and confidence in the outlook for the remainder of 2022,

we are pleased to report that the Board has decided to declare an

interim 2022 dividend of US$ 0.10 per share, representing a 11%

increase from the interim 2021 dividend as a step toward more

balanced payments of ordinary interim and final dividends. The

dividend, representing a total payment of approximately US$ 5.6m,

will be payable on October 21, 2022 to shareholders on the register

as of September 23, 2022.

In H1 2022, the Company repurchased a total of 138,130 shares of

common stock under the Company's share buyback program put in place

to offset dilution from on-going equity award programs. Of the

total common shares repurchased in H1 2022, 5,901 common shares

were to complete the 2021 US$ 1.0m share buyback authorization

approved by the Board in February 2021, and 132,229 common shares

were repurchased pursuant to the US$ 2.0m share buyback

authorization approved by the Board in February 2022. The Company

is on pace to complete the majority of the US$ 2.0m share buyback

by the end of 2022. Under the buyback program, the maximum price

paid per Ordinary Share is to be no more than the higher of 105% of

the average middle market closing price of an ordinary share for

the five business days preceding the date of any share buyback, the

price of the last independent trade and the highest current

independent purchase bid. It is intended that any shares

repurchased will be immediately cancelled and the Company will make

further announcements to the market as and when share purchases are

made.

Current Trading and Outlook

H1 2022 was an outstanding start to the year and established a

record level of H1 revenue. Strong trading in North America,

meaningful contributions from international markets and new

products, and the positive impact of 2022 price increases

translated to strong profits and operating cash flow that funded

re-investment in the business to expand our operational footprint

and add key new talent to the organization.

Favorable H1 2022 activity is carrying over into H2 2022, and

our positive outlook for H2 2022 is supported by a US

non-residential construction market that remains healthy with

extended customer project backlogs and by opportunities for growth

in our international markets and from new products. In Europe, we

were pleased by the interest in our equipment during H1 2022 and

the level of non-residential construction taking place across the

region. In Australia, the positive momentum from strong H1 2022

trading is carrying over to H2 2022, and we continue to see strong

opportunities for growth from new products, including the

introduction of the SkyScreed(R) 36. In our Rest of World regions,

we expect to see opportunities for growth, with the exception of

China, where we expect revenues will decline from the prior year

period due to the downsizing of our operations there and limited

near-term growth opportunities in our targeted quality market

segment.

We maintain a positive outlook for the remainder of 2022 and

anticipate delivering strong revenues, profits, and cash flows to

shareholders for the year. We recognize risks associated with

supply chain shortages that could slow our ability to fulfill

customer orders and the pace of customers' work on their healthy

backlog of projects. While these shortages can carry over and

negatively impact 2023 trading if continuing unimproved, based on

the strong H1 2022 results, confidence in the health of the

non-residential construction market, and with the benefit of

unfilled orders carried over from H1 2022, the Board is pleased to

confirm 2022 results are anticipated to fall in line with market

expectations for revenues of approximately US$ 138.8m, EBITDA of

approximately US$ 47.7m, and year-end cash of approximately US$

39.9m.

Larry Horsch

Non-Executive Chairman

Jack Cooney

Chief Executive Officer

September 7, 2022

FINANCIAL REVIEW

For the six months ended

Summary of financial results June 30

* unaudited 2022 2021

US$ 000 US$ 000

Except per Except per

share data share data

------------- -------------

Revenue 68,473 64,384

Cost of sales 28,535 26,636

------------- -------------

Gross profit 39,938 37,748

Operating expenses

Selling, marketing and customer support 7,391 6,053

Engineering and product development 1,203 1,066

General and administrative 8,747 7,426

Total operating expenses 17,341 14,545

------------------------------------------------- ------------- -------------

Operating income 22,597 23,203

Other income (expense)

Interest expense (9) (24)

Interest income 38 97

Foreign exchange impact (242) 105

Other (3) 118

Income before income taxes 22,381 23,499

------------------------------------------------- ------------- -------------

Provision for income taxes 4,891 5,200

Net income 17,490 18,299

=================== ============================ ============= =============

Per Share Per Share

US$ US$

Basic earnings per share 0.31 0.33

Diluted earnings per share 0.31 0.32

Basic adjusted net income per share (1),

(2), (4) 0.31 0.32

Diluted adjusted net income per share

(1), (2), (4) 0.31 0.32

------------------------------------------------- ------------- -------------

Other

data

Adjusted EBITDA (1), (2), (4) 24,141 24,564

Adjusted net income (1), (3), (4) 17,323 18,239

Depreciation expense 656 549

Amortization of intangibles 67 77

Capital expenditures 2,251 645

Notes:

1. Adjusted EBITDA and Adjusted net income are not measurements

of the Company's financial performance under US GAAP and should not

be considered as an alternative to net income, operating income or

any other performance measures derived in accordance with US GAAP

or as an alternative to US GAAP cash flow from operating activities

as a measure of profitability or liquidity. Adjusted EBITDA and

Adjusted net income are presented herein because management

believes they are useful analytical tools for measuring the

profitability and cash generation of the business. Adjusted EBITDA

is also used to determine pricing and covenant compliance under the

Company's credit facility and as a measurement for calculation of

management incentive compensation. The Company understands that

although Adjusted EBITDA is frequently used by securities analysts,

lenders, and others in their evaluation of companies, its

calculation of Adjusted EBITDA may not be comparable to other

similarly titled measures reported by other companies.

2. Adjusted EBITDA as used herein is a calculation of net income

plus tax provision, interest expense, interest income, foreign

exchange gain (loss), other expense, depreciation, amortization,

stock-based compensation, and non-cash lease expense.

3. Adjusted net income as used herein is a calculation of net

income plus amortization of intangibles and excluding the tax

impact of stock option and RSU settlements and other special

items.

4. The Company uses non-US GAAP financial measures to provide

supplemental information regarding the Company's operating

performance. The non-US GAAP financial measures presented herein

should not be considered in isolation from, or as a substitute to,

financial measures calculated in accordance with US GAAP. Investors

are cautioned that there are inherent limitations associated with

the use of each non-US GAAP financial measure. In particular,

non-US GAAP financial measures are not based on a comprehensive set

of accounting rules or principles, and many of the adjustments to

the US GAAP financial measures reflect the exclusion of items that

may have a material effect on the Company's financial results

calculated in accordance with US GAAP.

Net income to adjusted EBITDA reconciliation and

Adjusted net income reconciliation

* unaudited Six months ended June

30

2022 2021

US$ 000 US$ 000

------------ -----------

Adjusted EBITDA reconciliation

Net income 17,490 18,299

Tax provision 4,891 5,200

Interest expense 9 24

Interest income (38) (97)

Foreign exchange impact 242 (105)

Other 3 (118)

Depreciation 656 549

Amortization 67 77

Non-cash lease expense 148 135

Stock-based compensation 673 600

----------------------------------------------- ------------ -----------

Adjusted EBITDA 24,141 24,564

----------------------------------------------- ------------ -----------

Adjusted net income reconciliation

Net income 17,490 18,299

Amortization 67 77

Tax impact of stock option & RSU settlements (234) (137)

----------------------------------------------- ------------ -----------

Adjusted net income reconciliation 17,323 18,239

----------------------------------------------- ------------ -----------

Notes:

1. Adjusted EBITDA and Adjusted net income are not measurements

of the Company's financial performance under US GAAP and should not

be considered as an alternative to net income, operating income or

any other performance measures derived in accordance with US GAAP

or as an alternative to US GAAP cash flow from operating activities

as a measure of profitability or liquidity. Adjusted EBITDA and

Adjusted net income are presented herein because management

believes they are useful analytical tools for measuring the

profitability and cash generation of the business. Adjusted EBITDA

is also used to determine pricing and covenant compliance under the

Company's credit facility and as a measurement for calculation of

management incentive compensation. The Company understands that

although Adjusted EBITDA is frequently used by securities analysts,

lenders, and others in their evaluation of companies, its

calculation of Adjusted EBITDA may not be comparable to other

similarly titled measures reported by other companies.

2. Adjusted EBITDA as used herein is a calculation of the

Company's net income plus tax provision, interest expense, interest

income, foreign exchange gain (loss), other expense, depreciation,

amortization, stock-based compensation, and non-cash lease

expense.

3. Adjusted net income as used herein is a calculation of net

income plus amortization of intangibles and excluding the tax

impact of stock option and RSU settlements and other special

items.

4. The Company uses non-US GAAP financial measures in order to

provide supplemental information regarding the Company's operating

performance. The non-US GAAP financial measures presented herein

should not be considered in isolation from, or as a substitute to,

financial measures calculated in accordance with US GAAP. Investors

are cautioned that there are inherent limitations associated with

the use of each non-US GAAP financial measure. In particular,

non-US GAAP financial measures are not based on a comprehensive set

of accounting rules or principles, and many of the adjustments to

the US GAAP financial measures reflect the exclusion of items that

may have a material effect on the Company's financial results

calculated in accordance with US GAAP.

Revenues

The Company's consolidated revenues increased by 6% to US$ 68.5

(H1 2021: US$ 64.4--m). The Company's revenues consist primarily of

sales from Boomed Screed products, which include the S-28EZ,

S22-EZ, S-15R, S-10A and SRS-4 Laser Screed machines, sales from

Ride-on Screed products, which are drive through the concrete

machines that include the S-485, S-940 and S-158C Laser Screed

machines, remanufactured machines sales, 3-D Profiler Systems,

Somero Line Dragon(R), SkyScreed(R), Broom+Cure(TM) , S-PS50 and

Other revenues which consist of revenue from sales of parts and

accessories, sales of other equipment, service, training and

shipping charges. The overall increase for the period was primarily

driven by higher pricing across most of our product portfolio,

including the newly launched S-28EZ versus its predecessor,

elevated volume in Ride-on Screed products, remanufactured machines

and 3-D Profiler systems, along with an increased take rate in our

new product offerings.

Boomed Screed sales increased to US$ 32.9 (H1 2021: US$ 32.1--m)

as price increases offset unit volume decrease to 93 units (H1

2021: 105 units), Ride-on screed sales increased to US$ 10.5m (H1

2021: US$ 9.9m) partly due to price increases and an increase in

volume to 90 units (H1 2021: 87), remanufactured machine sales

increased to US$ 3.2m (H1 2021: US$ 2.0m) as unit volume increased

to 14 units (H1 2021: 12), 3-D Profiler System sales increased to

US$ 5.3m (H1 2021: US$ 4.6m) as unit volume increased to 43 units

(H1 2021: 39), Somero Line Dragon(R) sales decreased to US$ 1.2m

(H1 2021: US$ 2.3m) as unit volume decreased to 29 units (H1 2021:

62), SkyScreed(R) sales increased to US$ 1.1m (H1 2021: USD$ 0.2m),

as unit volume increased to 3 units (H1 2021: 1) and Other revenues

increased to US$ 14.3 (H1 2021: US$ 13.3m) mostly due to the

introduction of the S-PS50 in 2022, which contributed revenue of

US$ 0.8m. The following table shows the breakdown during the six

months ended June 30, 2022 and 2021:

Revenue breakdown by

geography

North America EMEA (1) ROW (2) Total

US$ in US$ in millions US$ in US$ in millions

millions millions

2022 2021

%

% of of

Net Net Net Net

2022 2021 2022 2021 2022 2021 sales sales sales sales

Boomed screeds

(3) 26.9 24.2 2.8 4.6 3.2 3.3 32.9 48.0% 32.1 49.9%

Ride-on screeds

(4) 7.5 7.8 0.8 0.8 2.2 1.3 10.5 15.3% 9.9 15.4%

Remanufactured

machines 2.9 2.0 0.3 - - - 3.2 4.7% 2.0 3.1%

3D Profiler

System 5.0 4.2 - 0.1 0.3 0.3 5.3 7.7% 4.6 7.1%

Somero Line

Dragon (R) 1.1 2.3 0.1 - - - 1.2 1.8% 2.3 3.5%

SkyScreed

(R) 1.1 0.2 - - - - 1.1 1.6% 0.2 0.3%

Other (5) 11.1 10.2 1.4 1.2 1.8 1.9 14.3 20.9% 13.3 20.7%

Total 55.6 50.9 5.4 6.7 7.5 6.8 68.5 100% 64.4 100.0%

------ -------- ------ ------ ------------ -------

Notes:

1. EMEA includes the Europe, Middle East, and Scandinavia.

2. ROW includes Australia, Latin America, India, China, Korea,

and Southeast Asia

3. Boomed Screeds include the S-22EZ, S-28EZ, S-15R, S-10A and

SRS-4.

4. Ride-on Screeds include the S-940, S-485, and S-158C.

5. Other includes parts, accessories, services, and freight, as

well as other equipment such as the Somero Broom+Cure (TM) ,

STS-11M Topping Spreader, Copperhead, Mini Screed C and S-PS50.

Units by product

line H1 2022 H1 2021

--------------------------- --------- ---------

Boomed screeds 93 105

Ride-on screeds 90 87

Remanufactured machines 14 12

3-D Profiler System 43 39

Somero Line

Dragon (R) 29 62

SkyScreed (R) 3 1

Other (1) 28 25

-------------------------------- --------- ---------

Total 300 331

-------------------------------- --------- ---------

Notes:

1. Other includes equipment such as the Somero Broom+Cure (TM) ,

STS-11M Topping Spreader, Copperhead, Mini Screed C and S-PS50.

Sales to customers located in North America contributed 81% of

total revenue (H1 2021: 79%), sales to customers in EMEA (Europe,

Middle East, and Scandinavia) contributed 8% (H1 2021: 10%) and

sales to customers in ROW (Southeast Asia, Australia, Latin

America, India and China) contributed 11% (H1 2021: 11%).

Sales in North America totaled US$ 55.6m (H1 2021: US$ 50.9m) up

9%, primarily driven by an increase in pricing across most of the

product portfolio, including the newly launched S-28EZ versus its

predecessor, higher volumes of the SRS-4, 3-D Profiler systems, the

Somero Broom+Cure(TM) , and Mini C, and strong contribution from

new products including the S-PS50, and the SkyScreed, as well as

parts and accessories. Sales to customers in EMEA were US$ 5.4m (H1

2021: US$ 6.7m) which decreased 19% driven by supply chain and

logistical challenges in building up inventory levels in H1. Sales

to customers in ROW were US$ 7.5m (H1 2021: US$ 6.8m) increasing by

10% driven by an increase in sales of Ride-on Screeds.

US$ in millions

--------------------

Regional sales H1 2022 H1 2021

-------------------- --------- ---------

North America 55.6 50.9

Europe 4.8 6.4

Australia 4.0 2.7

Latin America 1.4 0.8

Rest of World(1) 2.7 3.6

Total 68.5 64.4

------------------------- --------- ---------

Notes:

(1) Includes India, Middle East, China, Southeast Asia, and

Korea.

Gross profit

Gross profit increased to US$ 39.9m (2021: US$ 37.7), with gross

margins decreasing slightly to 58.3% compared to 58.6% in H1 2021,

reflecting price increases partly offset by higher input costs.

Operating expenses

Operating expenses excluding depreciation, amortization and

stock-based compensation for H1 2022 were US$ 16.2m (H1 2021: US$

13.3m), which is reflective of increased staffing that includes

investment in sales and support staff in the US and abroad, as well

as higher compensation, employee related expenses and increased

travel.

Debt

As of June 30, 2022, the Company had no outstanding debt and

there were no changes to the Company's US$ 10.0m secured revolving

line of credit which will mature in September 2024.

Provision for income taxes

The provision for income taxes decreased to US$ 4.9m, at an

overall effective tax rate of 22%, compared to a provision of US$

5.2m in H1 2021, at an overall effective tax rate of 22%.

Earnings per share

Basic earnings per share represents income available to common

stockholders divided by the weighted average number of shares

outstanding during the period. Diluted earnings per share reflect

additional common shares that would have been outstanding if

dilutive potential common shares had been issued, as well as any

adjustments to income that would result from the assumed issuance.

Potential common shares that may be issued by the Company relate to

outstanding stock options and restricted stock units.

Earnings per common share has been computed based on the

following:

Six months ended June

30

2022 2021

US$ 000 US$ 000

------------- -------------

Income available to stockholders 17,490 18,299

Basic weighted shares outstanding 56,038,690 56,159,229

Net dilutive effect of stock options

and restricted stock units 661,282 694,625

Diluted weighted average shares outstanding 56,699,972 56,853,854

============================================== ============= =============

Per Share Per Share

US$ US$

Basic earnings per share 0.31 0.33

Diluted earnings per share 0.31 0.32

Basic adjusted net income per share 0.31 0.32

Diluted adjusted net income per share 0.31 0.32

Consolidated Balance Sheets

As of June 30, 2022 and December 31, 2021

As of

June 30, As of

2022 December 31,

* unaudited 2021

US$ 000 US$ 000

------------------- --------------------

Assets

Current assets:

Cash and cash equivalents 27,176 42,146

Accounts receivable - net 6,576 7,691

Inventories - net 19,984 14,293

Prepaid expenses and other assets 2,458 1,590

Income tax receivable 2,720 2,376

---------------------------------------------------------- ------------------- --------------------

Total current assets 58,914 68,096

---------------------------------------------------------- ------------------- --------------------

Accounts receivable, non-current - net 305 461

Property, plant, and equipment - net 23,190 21,589

Financing lease right-of-use assets -

net 315 383

Operating lease right-of-use assets -

net 1,277 1,578

Intangible assets - net 1,325 1,392

Goodwill 3,294 3,294

Deferred tax asset 1,147 172

Other assets 238 394

---------------------------------------------------------- ------------------- --------------------

Total assets 90,005 97,359

========================================================== =================== ====================

Liabilities and stockholders' equity

Current liabilities:

Accounts payable 7,410 7,111

Accrued expenses 10,376 10,291

Financing lease liability - current 163 183

Operating lease liability - current 320 360

Total current liabilities 18,269 17,945

---------------------------------------------------------- ------------------- --------------------

Financing lease liability - long-term 98 127

Operating lease liability - long-term 993 1,255

Other liabilities 2,307 2,367

Total liabilities 21,667 21,694

---------------------------------------------------------- ------------------- --------------------

Stockholders' equity

Preferred stock, US$.001 par value, 50,000,000 - -

shares authorized, no shares issued and

outstanding

Common stock, US$.001 par value, 80,000,000

shares authorized, 56,013,493 and 56,246,964

shares issued on June 30, 2022 and December

31, 2021, respectively, and 55,957,147

and 56,039,924 shares outstanding on

June 30, 2022 and December 31, 2021,

respectively 26 26

Less: treasury stock, 56,346 shares as

of June 30, 2022 and 207,040 shares as

of December 31, 2021 at cost (282) (848)

Additional paid in capital 15,083 16,769

Retained earnings 56,280 62,187

Other comprehensive loss (2,769) (2,469)

Total stockholders' equity 68,338 75,665

---------------------------------------------------------- ------------------- --------------------

Total liabilities and stockholders'

equity 90,005 97,359

========================================================== =================== ====================

See Notes to unaudited consolidated

financial statements.

Consolidated Statements of Comprehensive Income

For the six months ended June 30, 2022 and 2021

* unaudited Six months ended

June 30

2022 2021

US$ 000 US$ 000

Except Except

per share per share

data data

--------------- ---------------

Revenue 68,473 64,384

Cost of sales 28,535 26,636

----------------------------------------------------------------------- --------------- ---------------

Gross profit 39,938 37,748

----------------------------------------------------------------------- --------------- ---------------

Operating expenses

Sales, marketing, and customer support 7,391 6,053

Engineering and product development 1,203 1,066

General and administrative 8,747 7,426

Total operating expenses 17,341 14,545

----------------------------------------------------------------------- --------------- ---------------

Operating income 22,597 23,203

Other income (expense)

Interest expense (9) (24)

Interest income 38 97

Foreign exchange impact (242) 105

Other (3) 118

Income before income taxes 22,381 23,499

----------------------------------------------------------------------- --------------- ---------------

Provision for income taxes 4,891 5,200

Net income 17,490 18,299

----------------------------------------------------------------------- --------------- ---------------

Other comprehensive income

Cumulative translation adjustment (300) 169

Comprehensive income 17,190 18,468

----------------------------------------------------------------------- --------------- ---------------

Earnings per common share

Earnings per share - basic 0.31 0.33

Earnings per share - diluted 0.31 0.32

Weighted average number of common

shares outstanding

Basic 56,038,690 56,159,229

Diluted 56,699,972 56,853,854

See Notes to unaudited consolidated financial statements.

Consolidated Statements of Changes in Stockholders' Equity

For the six months ended June 30, 2022

* unaudited

Common stock Treasury stock

Additional

paid-in Retained Other Total

Amount capital Amount earnings Comprehensive Stockholders'

US$ US$ US$ US$ loss equity

Shares 000 000 Shares 000 000 US$ 000 US$ 000

-------- ------------ -------- ---------- --------------- ---------------

Balance -

December 31,

2021 56,246,964 26 16,769 207,040 (848) 62,187 (2,469) 75,665

--------------- ------------ -------- ------------ ----------- -------- ---------- --------------- ---------------

Cumulative

translation

adjustment - - - - - - (300) (300)

Net income - - - - - 17,490 - 17,490

Stock-based

compensation - - 673 - - - - 673

Dividend - - - - - (23,397) - (23,397)

Treasury

stock (288,824) - (1,287) (288,824) 1,287 - - -

RSUs settled

for cash - - (1,072) - - - - (1,072)

Share buyback - - 138,130 (721) - - (721)

New shares 55,353 - - - - - - -

issued

Balance -

June 30,

2022 56,013,493 26 15,083 56,346 (282) 56,280 (2,769) 68,338

--------------- ------------ -------- ------------ ----------- -------- ---------- --------------- ---------------

See Notes to unaudited consolidated financial statements.

Consolidated Statements of Cash Flows

For the six months ended June 30, 2022 and 2021

*unaudited Six months ended June

30

2022 2021

US$ 000 US$ 000

------------ -----------

Cash flows from operating activities:

Net income 17,490 18,299

Adjustments to reconcile net income

to net cash provided by operating activities:

Deferred taxes (976) (1,061)

Depreciation and amortization 723 626

Non-cash lease expense 148 135

Bad debt 113 99

Stock-based compensation 673 600

Gain on disposal of property and equipment (46) (31)

Working capital changes:

Accounts receivable 1,159 (2,758)

Inventories (5,691) (3,130)

Prepaid expenses and other assets (868) (480)

Income taxes receivable (344) (1,316)

Other assets 156 (32)

Accounts payable, accrued expenses

and other liabilities 297 5,080

Net cash provided by operating activities 12,834 16,031

-------------------------------------------------- ------------ -----------

Cash flows from investing activities:

Property and equipment purchases (2,251) (645)

Proceeds from sale of equipment 40 -

Net cash used in investing activities (2,211) (645)

-------------------------------------------------- ------------ -----------

Cash flows from financing activities:

Payment of dividend (23,397) (17,366)

RSUs settled for cash (1,072) (620)

Payments under financing capital leases (103) (99)

Share buy back (721) (41)

Net cash used in financing activities (25,293) (18,126)

-------------------------------------------------- ------------ -----------

Effect of exchange rates on cash and

cash equivalents (300) 169

Net decrease in cash and cash equivalents (14,970) (2,571)

-------------------------------------------------- ------------ -----------

Cash and cash equivalents:

Beginning of period 42,146 35,388

-------------------------------------------------- ------------ -----------

End of period 27,176 32,817

-------------------------------------------------- ------------ -----------

See Notes to unaudited consolidated

financial statements.

Notes to the Consolidated Financial Statements

As of June 30, 2022 and December 31, 2021

1. Organization and description of business

Nature of business

Somero Enterprises, Inc. (the "Company" or "Somero") designs,

assembles, remanufactures, sells, and distributes concrete

levelling, contouring, and placing equipment, related parts and

accessories, and training services worldwide. Somero's Operations

and Support Offices are located in Michigan, USA with Global

Headquarters and Training Facilities in Florida, USA. Sales and

service offices are in Chesterfield, England; Shanghai, China; New

Delhi, India; and Melbourne, Australia.

2. Summary of significant accounting policies

Basis of presentation

The consolidated financial statements of the Company have been

prepared in accordance with accounting principles generally

accepted in the United States of America.

Principles of consolidation

The consolidated financial statements include the accounts of

Somero Enterprises, Inc., and its subsidiaries. All significant

intercompany transactions and accounts have been eliminated in

consolidation.

Cash and cash equivalents

Cash includes cash on hand, cash in banks, and temporary

investments with a maturity of three months or less when purchased.

The Company maintains deposits primarily in one financial

institution, which may at times exceed amounts covered by insurance

provided by the U.S. Federal Deposit Insurance Corporation

("FDIC"). The Company has not experienced any losses related to

amounts in excess of FDIC limits.

Accounts receivable and allowances for doubtful accounts

Financial instruments which potentially subject the Company to

concentrations of credit risk consist primarily of accounts

receivable. The Company's accounts receivable are derived from

revenue earned from a diverse group of customers. The Company

performs credit evaluations of its commercial customers and

maintains an allowance for doubtful accounts receivable based upon

the expected ability to collect accounts receivable. Allowances, if

necessary, are established for amounts determined to be

uncollectible based on specific identification and historical

experience. As of June 30, 2022 and December 31, 2021, the

allowance for doubtful accounts was approximately US$ 1,690,000 and

US$ 1,637,000, respectively. Bad debt expense for the six months

ended June 30, 2022 and 2021, was US$ 113,000 and US$ 99,000,

respectively.

Inventories

Inventories are stated using the first in, first out ("FIFO")

method, at the lower of cost or net realizable value ("NRV").

Provision for potentially obsolete or slow-moving inventory is made

based on management's analysis of inventory levels and future sales

forecasts. As of June 30, 2022 and December 31, 2021, the provision

for obsolete and slow-moving inventory was US$ 864,000 and US$

1,212,000, respectively.

Intangible assets and goodwill

Intangible assets consist primarily of customer relationships,

trademarks, and patents, and are carried at their fair value when

acquired, less accumulated amortization. Intangible assets are

amortized using the straight-line method over a period of three to

seventeen years, which is their estimated period of economic

benefit.

Goodwill is not amortized but is subject to impairment tests on

an annual basis, and the Company has chosen December 31 as its

periodic assessment date. Goodwill represents the excess cost of

the business combination over the Company's interest in the fair

value of the identifiable assets and liabilities. Goodwill arose

from the Company's prior sale from Dover Corporation to The Gores

Group in 2005 and the purchase of the Line Dragon, LLC business

assets in January 2019. The Company did not incur a goodwill

impairment loss for the periods ended June 30, 2022 nor December

31, 2021.

Revenue recognition

The Company generates revenue by selling equipment, parts,

accessories, service agreements and training. The Company

recognizes revenue for equipment, parts, and accessories when it

satisfies the performance obligation of transferring the control to

the customer. For product sales where shipping terms are FOB

shipping point, revenue is recognized upon shipment. For

arrangements which include FOB destination shipping terms, revenue

is recognized upon delivery to the customer. The Company recognizes

the revenue for service agreements and training once the service or

training has occurred.

As of June 30, 2022 and December 31, 2021, there were US$

571,000 and US$ 507,000, respectively, of extended service

agreement liabilities. During the six months ended June 30, 2022

and 2021, US$ 308,000 and US$ 234,000, respectively, of revenue was

recognized related to the amounts recorded as liabilities on the

balance sheets in the prior year (deferred contract revenue).

As of June 30, 2022 and December 31, 2021, there were US$

3,392,000 and US$ 4,009,000, respectively, in customer deposit

liabilities for advance payments received during the period for

contracts expected to ship following the end of the period. As of

June 30, 2022 and December 31, 2021, there are no significant

contract costs such as sales commissions or costs deferred.

Interest income on financing arrangements is recognized as interest

accrues, using the effective interest method.

Warranty liability

The Company provides warranties on all equipment sales ranging

from 60 days to three years, depending on the product. Warranty

liabilities are estimated net of the warranty passed through to the

Company from vendors, based on specific identification of issues

and historical experience.

US$ 000

---------

Balance, January 1, 2021 (1,174)

Warranty charges 362

Accruals (1,174)

----------------------------- ---------

Balance, December 31, 2021 (1,986)

Balance, January 1, 2022 (1,986)

Warranty charges 293

Accruals (371)

----------------------------- ---------

Balance, June 30, 2022 (2,064)

============================= =========

Property, plant, and equipment

Property, plant, and equipment is stated at cost, net of

accumulated depreciation and amortization. Land is not depreciated.

Depreciation is computed using the straight-line method over the

estimated useful lives of the assets, which is 31.5 to 40 years for

buildings (depending on the nature of the building), 15 years for

improvements, and 3 to 10 years for machinery and equipment.

Income taxes

The Company determines income taxes using the asset and

liability approach. Tax laws require items to be included in tax

filings at different times than the items are reflected in the

financial statements. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to

temporary differences between the financial statement carrying

amounts of existing assets and liabilities and their respective tax

basis and operating loss and tax credit carry forwards. Deferred

tax assets and liabilities are measured using enacted tax rates

expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax

rates is recognized in income in the period that includes the

enactment date. Deferred tax assets are reduced by a valuation

allowance, if necessary, to the extent that it appears more likely

than not that such assets will be unrecoverable.

The Company evaluates tax positions that have been taken or are

expected to be taken in its tax returns and records a liability for

uncertain tax positions. This involves a two-step approach to

recognizing and measuring uncertain tax positions. First, tax

positions are recognized if the weight of available evidence

indicates that it is more likely than not that the position will be

sustained upon examination, including resolution of related appeals

or litigation processes, if any. Second, the tax position is

measured as the largest amount of tax benefit that has a greater

than 50% likelihood of being realized upon settlement.

Use of estimates

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of

America requires management to make estimates and assumptions that

affect the amounts reported in the financial statements and

accompanying notes. Actual results could differ from those

estimates.

Stock-based compensation

The Company recognizes the cost of employee services received in

exchange for an award of equity instruments in the financial

statements over the period the employee is required to perform the

services in exchange for the award (presumptively the vesting

period). The Company measures the cost of employee services in

exchange for an award based on the grant-date fair value of the

award. Compensation expense related to stock-based payments was US$

673,000 and US$ 600,000 for the six months ended June 30, 2022 and

2021, respectively. In addition, the Company settled US$ 1,072,000

and US$ 620,000 in restricted stock units for cash during the six

months ended June 30, 2022 and 2021, respectively.

Transactions in and translation of foreign currency

The functional currency for the Company's subsidiaries outside

the United States is the applicable local currency. The preparation

of the consolidated financial statements requires the translation

of these financial statements to USD. Balance sheet amounts are

translated at period-end exchange rates and the statement of

comprehensive income accounts are translated at average rates. The

resulting gains or losses are charged directly to accumulated other

comprehensive income. The Company is also exposed to market risks

related to fluctuations in foreign exchange rates because some

sales transactions, and some assets and liabilities of its foreign

subsidiaries, are denominated in foreign currencies other than the

designated functional currency. Gains and losses from transactions

are included as foreign exchange gain (loss) in the accompanying

consolidated statements of comprehensive income.

Comprehensive income

Comprehensive income is the combination of reported net income

and other comprehensive income ("OCI"). OCI is changes in equity of

a business enterprise during a period from transactions and other

events and circumstances from non-owner sources not included in net

income.

Earnings per share

Basic earnings per share represents income available to common

stockholders divided by the weighted average number of common

shares outstanding during the year. Diluted earnings per share

reflect additional common shares that would have been outstanding

if dilutive potential common shares had been issued using the

treasury stock method. Potential common shares that may be issued

by the Company relate to outstanding stock options and restricted

stock units.

Earnings per common share have been computed based on the

following:

Six months ended June 30

2022 2021

US$ 000 US$ 000

------------- -------------

Net income 17,490 18,299

Basic weighted shares outstanding 56,038,690 56,159,229

Net dilutive effect of stock options

and restricted stock units 661,282 694,625

---------------------------------------------- ------------- -------------

Diluted weighted average shares outstanding 56,699,972 56,853,854

============================================== ============= =============

Fair value

The carrying values of cash and cash equivalents, accounts

receivable, accounts payable, and other current assets and

liabilities approximate fair value because of the short-term nature

of these instruments. The carrying value of our long-term debt

approximates fair value due to the variable nature of the interest

rates under our Credit Facility.

The FASB has issued accounting guidance on fair value

measurements. This guidance provides a common definition of fair

value and a framework for measuring assets and liabilities at fair

values when a particular standard prescribes it.

This guidance also specifies a fair value hierarchy based upon

the observability of inputs used in valuation techniques. These

valuation techniques may be based upon observable and unobservable

inputs. Observable inputs reflect market data obtained from

independent sources, while unobservable inputs reflect the

Company's market assumptions. These two types of inputs create the

following fair value hierarchy.

-- Level 1 - Quoted prices for identical instruments in active markets.

-- Level 2 - Quoted prices for similar assets and liabilities in

active markets; quoted prices for identical or similar assets and

liabilities in markets that are not active; and model-derived other

inputs that are observable or can be corroborated by observable

market data for substantially the full term of the assets and

liabilities.

-- Level 3 - Unobservable inputs for the asset or liability

which are supported by little or no market activity and reflect the

Company's assumptions that a market participant would use in

pricing the asset or liability.

Quoted prices

in active Significant Significant

markets other other

identical observable unobservable

assets inputs inputs

Level 1 Level 2 Level 3

US$ 000 US$ 000 US$ 000 US$ 000

----------------------- --------- --------------- ------------- ---------------

Year ended December 31,

2021

Asset: Non-recurring

Goodwill 3,294 3,294

Period ended June 30, 2022

Asset: Non-recurring

Goodwill 3,294 3,294

3. Inventories

Inventories consisted of the following:

June December

30, 31,

2022 2021

US$

000 US$ 000

-------- -----------

Raw material 10,931 8,679

Finished goods and work in process 6,995 3,462

Remanufactured 2,058 2,152

------------------------------------- -------- -----------

Total 19,984 14,293

===================================== ======== ===========

4. Goodwill and intangible assets

Goodwill represents the excess of the cost of a business

combination over the fair value of the net assets acquired. The

Company is required to test goodwill for impairment, at the

reporting unit level, annually and when events or circumstances

indicate the fair value of a unit may be below its carrying

value.

The following table reflects other intangible assets:

Weighted December

average June 30, 31,

Amortization 2022 2021

Period US$ 000 US$ 000

---------------- ----------------------- -----------------------

Capitalized cost Patents 12 years 19,247 19,247

Intangible Assets 7,434 7,434

26,681 26,681

------------------- ---------------- ----------------------- -----------------------

Accumulated

amortization Patents 12 years 18,697 18,673

Intangible Assets 6,659 6,616

25,356 25,289

------------------- ---------------- ----------------------- -----------------------

Net carrying

costs Patents 12 years 550 574

Intangible Assets 775 818

1,325 1,392

=================== ================ ======================= =======================

Amortization expense associated with the intangible assets in

each of the six months ended June 30, 2022 and 2021 was

approximately US$ 67,000 and US$ 77,000, respectively. The

amortization expense for each of the next 5 years will be US$

135,000 and the remaining amortization thereafter will be US$

650,000.

5. Property, plant, and equipment

Property, plant, and equipment consist of the following:

June December

30, 31,

2022 2021

US$ 000 US$ 000

----------- -----------

Land 864 864

Building and improvements 22,100 20,191

Machinery and equipment 8,374 8,185

-------------------------------------------------- ----------- -----------

31,338 29,240

-------------------------------------------------- ----------- -----------

Less: accumulated depreciation and amortization (8,148) (7,650)

23,190 21,589

================================================== =========== ===========

Depreciation expense for the six months ended June 30, 2022 and

2021 was approximately US$ 656,000 and US$ 549,000,

respectively.

6. Line of credit and note payable

In November 2020, the Company renewed its amended credit

facility, which consists of a US$ 10.0m secured revolving line of

credit, extending the maturity to September 2024. The interest rate

on the revolving credit line is based on the one-month LIBOR rate

plus 1.25%. The Company's credit facility is secured by

substantially all its business assets. No amounts were drawn under

the secured revolving credit line as of June 30, 2022 and December

31, 2021.

Interest expense for the six months ended June 30, 2022 and 2021

was approximately US$ 9,300 and US$ 23,600, respectively, and

relates primarily to interest costs on leased vehicles.

7. Retirement program

The Company has a savings and retirement plan for its employees,

which is intended to qualify under Section 401(k) of the Internal

Revenue Code ("IRC"). This savings and retirement plan provides for

voluntary contributions by participating employees, not to exceed

maximum limits set forth by the IRC. The Company's matching

contributions vest immediately. The Company contributed

approximately US$ 579,000 and US$ 445,000 to the savings and

retirement plan during the six months ended June 30, 2022 and 2021,

respectively.

8. Leases

The Company leases property, vehicles, and equipment under

leases accounted for as operating and finance leases. The leases

have remaining lease terms of less than 1 year to 11 years, some of

which include options for renewal. The exercise of these renewal

options is at the sole discretion of the Company. The right-of-use

assets and related liabilities presented on the Consolidated

Balance Sheets, reflect management's current expectations regarding

the exercise of renewal options.

The components for lease expense were as follows:

Six Months

Ended

June 30, 2022

US$ 000

----------------------

Operating lease cost 182

Finance lease cost:

Amortization of right-of-use assets 148

Interest on lease liabilities 6

------------------------------------------ ----------------------

Total finance lease cost 154

========================================== ======================

As of June 30, 2022, the weighted average remaining lease term

for finance and operating leases was 1.8 years and 7.2 years,

respectively, and the weighted average discount rate was 4.8% and

3.5%, respectively.

Maturities of lease liabilities represent the remaining six

months for 2022 and the full 12 months of each successive period as

follows:

Operating Finance

Leases Leases

US$ 000 US$ 000

----------------- ------------------------------

2022 182 105

2022 362 118

2023 215 38

2024 96 14

2025 96 -

Thereafter 576 -

----------------- ------------------------------

Total 1,527 275

Less imputed interest (214) (14)

------------------------ ----------------- ------------------------------

Total 1,313 261

9. Supplemental cash flow and non-cash financing disclosures

Six months ended

June 30

2022 2021

US$ 000 US$ 000

---------- ---------------

Cash paid for interest 9 24

Cash paid for taxes 6,274 6,864

Finance lease liabilities arising from obtaining

right-of-use assets (102) (4)

Operating lease liabilities arising from

obtaining right-of-use assets (250) (538)

10. Business and credit concentration

The Company's line of business could be significantly impacted

by, among other things, the state of the general economy, the

Company's ability to continue to protect its intellectual property

rights, and the potential future growth of competitors. Any of the

foregoing may significantly affect management's estimates and the

Company's performance. On June 30, 2022 and December 31, 2021, the

Company had two customers which represented 20% and two customers

that represented 21% of total accounts receivable,

respectively.

11. Commitments and contingencies

The Company has entered into employment agreements with certain

members of senior management. The terms of these are for renewable

one-year periods and include non-compete and non-disclosure

provisions as well as provide for defined severance payments in the

event of termination or change in control.

The Company is also subject to various unresolved legal actions

which arise in the normal course of its business. Although it is

not possible to predict with certainty the outcome of these

unresolved legal actions or the range of possible losses, the

Company believes these unresolved legal actions will not have a

material effect on its consolidated financial statements.

12. Income taxes

The Company's effective tax rate for the six months ended June

30, 2022 was 22% compared to the U.S. federal statutory rate of

21%. The Company is subject to US federal income tax as well as

income tax of multiple state and foreign jurisdictions. The Company

was formed in 2005. The statute of limitations for all federal,

foreign, and state income tax matters for tax years from 2014

forward is still open. The Company has no federal, foreign, or

state income tax returns currently under examination.

On June 30, 2022, the Company had US$ 1,147,000 in non-current

net deferred tax assets recorded on its balance sheet. In assessing

the realizability of deferred tax assets, management considers

whether it is more likely than not that some portion or all the

deferred tax assets will not be realized. The ultimate realization

of the deferred tax assets is dependent upon the generation of

future taxable income during the periods in which those temporary

differences become deductible.

13. Share buyback

In February 2022 and 2021, the Board authorized an on-market

share buyback program for such number of listed shares of common

stock as are equal to US$ 2,000,000 and US$ 1,000,000,

respectively. The maximum price paid per Ordinary Share was no more

than the higher of 105 percent of the average middle market closing

price of an Ordinary Share for the five business days preceding the

date of the share buyback, the price of the last independent trade

and the highest current independent purchase bid. As of June 30,

2022, the Company purchased 132,229 shares of common stock for an

aggregate value of US$ 683,000 pursuant to the share buyback

program authorized in 2022, and 5,901 shares of common stock for an

aggregate value of US$ 38,000, which completed the share buyback

program authorized in 2021. The company estimates the share buyback

program authorized in 2022 will be completed by the end of H2 2022.

In connection with the Company's share buyback programs authorized

in 2022, 2021 and 2020, 288,824 shares held in treasury were

cancelled in H1 2022.

14. Subsequent events

Dividend

The Board declared an interim dividend for the six months ended

June 30, 2022 of 10.0 US cents per share. This dividend will be on

October 21, 2022 to shareholders on the register as of September

23, 2022.

All dividends, including both ordinary and supplemental, have

the option of being paid in two currencies, GBP, and USD. In

addition, there is also the option of being paid by Check or

through Crest for either currency or additionally via BACS for GBP

payments. If no election is made, dividends will be paid in USD and

via Check. If shareholders wish to change their current currency or

payment methods, forms are available through Computershare Investor

Services PLC at

https://www-uk.computershare.com/Investor/#Help/PrintableForms

Distribution amount: $0.10 cents per share

Ex-dividend date: 22 September 2022

-----------------------

Dividend record date: 23 September 2022

-----------------------

Final day for currency election: 7 October 2022

-----------------------

Payment date: 21 October 2022

-----------------------

All dividends have the option of being paid in either GBP or

USD. Payments in USD can be paid by Check or through Crest.

Payments in GBP can be paid via Check, Crest and BACS. The default

option if no election is made will be for a USD payment via check.

Should shareholders wish to change their current currency or

payment methods, forms are available through Computershare Investor

Services PLC at

https://www

uk.computershare.com/Investor/#Help/PrintableForms

If shares are held as Depositary Interests through a broker or

nominee, the holding company must be contacted and advised of the

payment preferences. Such requests are subject to the terms and

conditions of the broker or nominee.

Additional information on currency election and tax withholding

can be found at: https://investors.somero.com/aim-rule-26 .

Shareholders can also contact Computershare Investor Services PLC

by telephone at +44 (0370) 702 0000 or email via

webcorres@computershare.co.uk .

Line of Credit

In August 2022, the Company updated its credit facility to a US$

25.0m secured revolving line of credit, with a maturity date of

August 2027. The interest rate on the revolving credit line is

based on the BSBY Index plus 1.25%. The Company's credit facility

is secured by substantially all its business assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSMFAMEESEIU

(END) Dow Jones Newswires

September 07, 2022 02:00 ET (06:00 GMT)

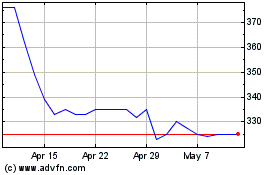

Somero Enterprise (LSE:SOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Somero Enterprise (LSE:SOM)

Historical Stock Chart

From Jul 2023 to Jul 2024