TIDMSUN

RNS Number : 0622A

Surgical Innovations Group PLC

21 September 2022

Surgical Innovations Group plc

("SI", the "Group" or "the Company")

Half-year Report

Interim results for the six-months ended 30 June 2022

Surgical Innovations Group plc (AIM: SUN), the designer,

manufacturer and distributor of innovative medical technology for

minimally invasive surgery, reports its unaudited financial results

for the six-month period ended 30 June 2022 ("2022 H1") and

provides an update on current trading and the outlook for the

Group's business.

Commercial and operational highlights:

-- Geographical expansion and sustainability programmes

providing further opportunities for growth

-- Investment in Sales & Marketing, with a focus of driving

forward new initiatives in key markets

-- Strategies to address the challenges of retaining and

attracting key personnel are having a positive impact

-- Further investment in key processes and people to ensure that

the Company remains on track for Medical Device Regulations

(MDR)

-- Capex on equipment to build and enhance manufacturing capabilities and efficiencies

-- Maintaining higher than normal levels of inventory and dual

sourcing of materials and parts to mitigate supply chain

disruptions

Financial highlights (1) :

-- Revenues increased 28% on prior year to GBP5.41m and amounted

to 106% of the comparable pre-pandemic period in 2019 (H1 2021:

GBP4.22m, 2019 H1: GBP5.10m(1) )

-- Strong sales in the UK & APAC (excluding OEM) region,

particularly Japan, providing significant growth in H1, up 39% on

prior year (2022 H1: GBP3.17 m, 2021 H1: GBP2.28m, 2019 H1:

GBP2.42m) and providing a good foundation for growth

-- Commercial gross margins improving at 45.3% compared to 2021

H1 despite inflationary pressures (2021 H1: 42.36%; 2019 H1:

44.5%(1) )

-- Adjusted EBITDA(2) profit of GBP0.29m (2021 H1: GBP0.21m; 2019 H1: GBP0.65m(1) )

-- Small adjusted operating loss(2) of GBP0.01m (2021 H1:

GBP0.15m loss; 2019 H1: GBP0.22m profit(1) )

-- Adjusted EPS amounted to a loss(2) of 0.004p per share (2021

H1: loss of 0.004p; 2019 H1: earnings of 0.023p per share(1) )

-- Cash generated from operations at GBP0.22m (full year 2021: GBP0.53m cash used)

-- Net cash(3) at end of period of GBP1.53m (as at 31 Dec 2021: GBP1.76m)

1 Comparative information is shown for the six months ended 30

June 2021, except where otherwise stated. Further comparative

information for the six months ended 30 June 2019 has been included

to provide a comparison with pre-pandemic trading.

2 Adjusted EBITDA, adjusted operating (loss)/ profit and

adjusted EPS are stated before deducting non-recurring exceptional

costs of GBP0.03m (2021 H1: nil, 2019 H1: GBP0.1m), amortisation

and impairment of intangible acquisition costs of GBPnil (2021 H1:

nil, 2019 H1: GBP0.18m) and share based payment costs of GBP0.02m

(2021 H1 GBP0.01m, 2019 H1: GBP0.10m).

3 Net cash equals cash less bank debt and HP leases only.

Current Trading and Outlook

-- Revenues have exceeded management expectations in the UK and

are largely recovering towards pre-pandemic levels in most

markets

-- Group revenues for the first two months of the second half

are approximately 113% above the level seen in the comparable

period last year, and 116% ahead of that seen for the same period

in 2019 (pre-pandemic), with an increased level of backorders at

GBP0.7m

-- The Group continues to trade profitably at the level of

adjusted EBITDA, notwithstanding an increasing overhead base

-- Further opportunity in UK hospitals is expected as the

well-documented increasing backlogs begin to be addressed - sales

backlog, forward order book and new conversions are expected to

provide growth and further underpin sustainability strategy

-- Growth in new markets, along with new collaborative

partnerships, are anticipated for the remainder of 2022 and

beyond

-- Strong sales in the UK and Japan provide a good foundation for growth

-- Planned investment in new product development, facilitating

key product launches in the second half of the current financial

year

Chairman of SI, Nigel Rogers, said:

" Revenues in the period to 31 August 2022 have continued to

grow and strengthen, significantly increasing by approximately 113%

above the level achieved in the prior year, and around 116% ahead

of the corresponding pre-pandemic period of 2019, despite being

suppressed by a large sales backorder of GBP0.7m which is to be

shipped in the second half of the year . Production activity has

been challenging with extended supply chain lead times and a

reduction of skilled labour, but investment in capital expenditure

and people should increase the capacity and improve efficiency in

the second half of the year. The increasing overhead base has put

pressure on the business, but the Group remains profitable at

adjusted EBITDA, and this will continue to improve with further

growth opportunities.

" The momentum in UK and Japan is indicative of the successful

investment in Sales and Marketing which has been driving our

sustainability initiatives. With further growth opportunities in

the second half of the year as major markets continue to recover,

and the launch of new products into new and existing key markets,

the prospects are certainly encouraging. "

For further information please contact:

Surgical Innovations Group Plc www.sigroupplc.com

David Marsh, CEO Tel: +44 (0)113 230 7597

Charmaine Day, CFO

Walbrook PR Tel: +44 (0)20 7933 8780 or si@walbrookpr.com

(Financial PR & Investor Relations)

Paul McManus / Lianne Applegarth Mob: +44 (0)7980 541 893 / +44 (0)7584

391 303

Singer Capital Markets

(Nominated adviser &Broker) +44 (0)20 7496 3000

Aubrey Powell / Rachel Hayes

About Surgical Innovations Group plc

Strategy

The Group specialises in the design, manufacture, sale and

distribution of innovative, high quality medical products,

primarily for use in minimally invasive surgery. Our product and

business development is guided and supported by a key group of

nationally and internationally renowned surgeons across the

spectrum of minimally invasive surgical activity.

We design and manufacture and source our branded port access

systems, surgical instruments and retraction devices which are sold

directly in the UK home market through our subsidiary, Elemental

Healthcare, and exported widely through a global network of trusted

distribution partners. Many of our products in this field are based

on a "resposable" concept, in which the products are part reusable,

part disposable, offering a high quality and environmentally

responsible solution at a cost that is competitive against fully

disposable alternatives.

Elemental also has exclusive UK distribution for a select group

of specialist products employed in laparoscopy, bariatric and

metabolic surgery, hernia repair and breast reconstruction. In

addition, we design and develop medical devices for carefully

selected OEM partners. We have a number of long-term relationships

with key partner including the design, development and manufacture

of the FIX8 device for AMS and more recently for a new

collaboration with a Robotic company, CMR Surgical ('CMR') to

design and develop and access device for their unique

instrumentation. We have in the past worked with and continue to

maintain a relationship with a major industrial partner to provide

precision engineering solutions to complex problems outside the

medical arena.

We aim for our brands to be recognised and respected by

healthcare professionals in all major geographical markets in which

we operate and provide by development, partnership or acquisition a

broad portfolio of cost effective, procedure specific surgical

instruments and implantable devices that offer reliable solutions

to genuine clinical needs in the operating theatre environment.

Operations

The Group currently employs approximately 100 people across one

site in the UK. Elemental Healthcare was acquired by the Group on 1

August 2017 and provides direct sales representation in the UK home

market and a range of third-party products for UK distribution.

Elemental was originally based in Berkshire and was successfully

relocated in 2021, so all operations are now located at the Leeds

site.

Further information

Further details of the Group's businesses are available on

websites:

www.sigroupplc.com

www.surginno.com , and

www.elementalhealthcare.co.uk

Investors and others can register to receive regular updates by

email at si@walbrookpr.com

Surgical Innovations Group plc

Chairman 's Statement

For the six-month period ended 30 June 2022

Financial Overview

Trading in the first half of the year increased 28% to GBP5.41m

on the comparable period last year (2021 H1: GBP4.22m) and more

encouragingly, revenue growth exceeded pre-pandemic levels, with

Group revenues at 106% of the comparable pre-Covid period (2019 H1:

GBP5.10m).

Demand in the UK market continues to be strong: SI branded

products were GBP0.68m (2021 H1: GBP0.58m, 2019 H1: GBP0.75m), and

UK distribution sales were GBP2.01m (2021 H1: GBP1.30m, 2019 H1:

GBP1.49m), up a combined 43% on the prior corresponding period and

achieving robust growth of 120% against the pre-Covid comparable in

2019. The impetus on the sustainability advantages of our

Resposable(TM) product ranges is driving business wins. This range

is well-placed for further growth as the NHS focus on the

implementation of its 'Net Zero' commitment on sustainability and

implement measures to address the increasing backlog of patients on

waiting lists.

First half revenues in Europe were 2% above the level achieved

last year at GBP0.59m (2021 H1: GBP0.57m) and around 91% of

pre-Covid levels (2019 H1: GBP0.65m). While some countries have

been slower to recover, with focus and investment in Sales and

Marketing and an emphasis on the SI product range, we are seeing

underlying sales growth rates in other countries which are

exceeding internal expectations. New product launches during Q4 in

key countries will provide opportunity for further growth.

Revenues from the US for SI branded products in the first half

decreased to GBP0.59m (2021 H1: GBP0.75m, 2019 H1: GBP0.77m), this

in part due to substantial stocking orders in the first quarter of

2021. Restricted hospital access affected evaluations at the

beginning of the year, increasing activity is being seen in H2 and

expected to continue at a level in line with expectations for the

year. Further investment into the appointment of the international

heads has provided emphasis on supporting the dealer network, and

in conjunction with new product launches, further sales training

and marketing material will be rolled out across the network in the

second half of this year.

The APAC region continues to generate strong revenue growth to

GBP0.48m, a 19% increase on the comparable period (2021 H1:

GBP0.41m) and surpassing levels seen in the first half of 2019

(2019 H1: GBP0.17m). We continue to work closely with our Japanese

distributor as they gain market share. The focus on sustainability

continues to gain traction here also, initial stocking orders have

been placed for launching the Logic reusable instrument range which

are expected to be shipped in the final quarter of 2022.

OEM revenues for the first half more than doubled to GBP0.92m

(2021 H1: GBP0.45m), nearly recovering to pre-Covid levels (2019

H1: GBP1.01m). This reflects the general recovery trend experienced

by our long-standing key OEM partners in the medical sector, but

also the supply chain challenges faced in the first half of the

year which have started to improve in Q3. New collaborations with

CMR Surgical have been successful; the initial stocking order for

YelloPort Elite (TM) was launched in the second quarter of this

year and we expect momentum to continue in the second half with a

strong orderbook from our partners AMS, CMR and Becton Dickinson/

Carefusion.

Commercial or underlying margins remained within target range at

45.3%, with inflationary pressures from material suppliers

mitigated and passed on where possible. However, the reported gross

margin of 34.6% (2021: H1 33.9%, 2019: H1 43.1%), which includes

the net cost of manufacturing, reflects the increased inflationary

challenges on labour costs. In addition, and as a consequence of

the shortage of skilled labour and extended supply chain lead

times, manufacturing productivity reduced and costs were

under-recovered. To mitigate this partially, inventory levels have

been maintained at higher levels; as at 30 June 2022 GBP3.04m (31

Dec 2021: GBP2.97m).

Other operating expenses increased to GBP1.93m (2021 H1:

GBP1.62m), due to investment in Sales and Marketing and Regulatory

functions, combined with increased employee remuneration as a

result of inflationary pressures. Excluding the effects of

exceptional items and share based payments, operating expenses

increased by GBP0.28m to GBP1.88m (2021 H1: 1.60m). Despite these

increases, the Group is trading at an adjusted EBITDA profit for

the period of GBP0.29m (2021 H1: GBP0.21m). The full effect of

these additional costs will impact the second half of the year but

the Group will continue to be profitable at the adjusted EBITDA

level.

Adjusted operating loss before tax for the period (before

exceptional items, acquisition related costs and share based

payment charges) was close to breakeven at GBP0.01m (2021 H1: loss

of GBP0.15m, 2019 H1: profit of GBP0.22m). The reported net loss

before taxation amounted to GBP0.11m against a net loss before

taxation of GBP0.22m in the first half last year.

The Group reported a tax credit in the period of GBP0.09m (2021

H1: credit of GBP0.13m) which related to an enhanced research and

development ("R&D") claim for 2020. We anticipate submitting

the claim for 2021 before the end of this year. In terms of

deferred tax, the Group continues to hold substantial corporation

tax losses on which management takes a cautious view, and

consequently, the Group does not recognise a corresponding deferred

tax asset.

Adjusted net earnings per share amounted to 0.004p (2021 H1:

GBP0.004p, 2019 H1: loss of earnings 0.023p). The net total

comprehensive income for the period amounted to a loss of GBP0.01m

(2021 H1: loss of GBP0.09m, 2019 H1: loss of GBP0.30m).

In March 2022, the Group refinanced its borrowing facilities,

and as a result, the GBP1.5m Coronavirus Business Interruption

scheme (CBILS) loan was extended to be repayable in May 2026. In

addition, to replace the existing loan and RCF facility, an invoice

discounting facility of GBP1.0m was agreed. This facility provides

headroom for the Group and remains undrawn to date.

For the first half of 2022, cash generated from operations was

GBP0.22m (full year 2021: GBP0.53m used, 2021 H1: GBP0.17m used).

After continued investment into R&D of GBP0.17m (full year

2021: GBP0.45m, 2021 H1: GBP0.18m), capital expenditure of GBP0.34m

(full year 2021: GBP0.21m, 2021 H1: GBP0.17m) and the refinancing

of the existing bank loan, the Company had available cash balances

including the unused invoice discounting facility of GBP1.0m

totalling GBP4.04m (31 Dec 2021 GBP4.04m). Financial covenants have

been complied with in full and continue to be tested on a quarterly

basis. The Board is satisfied that the current financial position

and borrowing arrangement provide ample headroom to support the

business.

Market overview and new product development opportunities

Strong substantial sales growth is evident in the UK,

underpinned by our sustainability and commercial advantages

relative to single use plastics, which have resulted in multiple

hospital trials and conversions. In one case study for a UK NHS

Trust, we have mapped a four-month break-even point for the Trust,

with an 85% reduction in plastic waste and 6.4 tonnes of carbon

dioxide emissions saved. Despite this, the UK NHS is suffering from

a gap in its workforce which is impacting the substantial and

ever-growing backlog of elective surgery, diagnosis and treatment

across a broad range of procedures. The UK Government and its

agencies are taking steps to streamline processes and provide

additional funding to deal with this issue, including using private

hospitals for capacity as one of the solutions. In addition, record

NHS waiting times appear to be increasing the number of people

paying for private care. As part of the investment into Sales and

Marketing, we have a restructured our resource and now have an

experienced and dedicated sales head to support this area of

activity and take advantage of the pent-up demand.

Globally, markets are still recovering from Covid at different

rates. In the US and EU specifically, restrictions have impacted

hospital activity levels in Q1 and evaluations have been pushed

back as hospital access was limited. However, sales activity

continues, and recovery levels are getting closer to those seen in

the pre pandemic period of 2019. The Group's investment in Sales

and Marketing is driving our sustainability messaging initiatives

and traction continues. Having a dedicated resource to focus more

on training and supporting key distributors is expected to drive

future growth, with training of the US network being rolled out in

H2.

Over the past 18 months, one of our key focuses has been on new

product development, and we are delighted to fully launch in the US

and key EU markets in H2 with the Yell oPort(TM)Elite 5mm ('access

device') and the Optical Trocar. In the US, these products will see

a full launch in Q4 through the Microline sales team. Adding

enhanced sustainable products to the range in H2 2023 will further

bolster the range and growth potential in these markets.

In Germany, where there is a significant installed base of CMR

customers, we have been developing a partnership with a specialist

distribution company and anticipate initial evaluations this

autumn.

In the APAC region, specifically Japan, the market continues to

show strong and significant growth, and this is set to continue as

we extend the sustainable product portfolio and launch the Logic

reusable instrumentation line, along with the Yell oPort(TM)Elite

5mm and Optical Trocar, towards the end of the year.

Underlying revenues in the OEM segment, with which we have long

standing relationships, continue to be somewhat suppressed, not by

demand, but due to supply chain constraints. These issues have

hindered sales in the first half of the year, but have improved in

Q3. New collaborations with CMR Surgical (CMR) continue to

strengthen and grow, with their first significant order placed in

Q2. Further substantial orders have been placed for the second half

of the year which give us opportunities to expand into new markets.

For example we are building a new partnership in India, leveraging

the CMR relationship, and expect to complete product registration

and training in Q4. The momentum with the CMR partnership is set to

continue throughout the remainder of the year and beyond. In

addition, the Group intends to leverage its instrument expertise

and exploit opportunities within robotics so we can extend the

product range offered.

Operational and Regulatory activities

This year has brought challenges in retaining key skilled

manufacturing personnel, with employee turnover at its highest

level for a number of years, combined with the well publicised

challenges of attracting new staff. To address these issues, the

Company has introduced a number of initiates with the

implementation of a four-day working week trial, which started at

the beginning of August, being the most significant. The trial is

supported by the UK pilot programme and has been carefully managed

to ensure five-day continuity of service and support. The scheme is

set to benefit from improved productivity levels from improved

employee wellbeing. Efficiency initiatives are also being rolled

out to ensure that the trial remains operationally effective. In

addition, financial packages were increased to be comparable with

market rates which have been exacerbated by the current

inflationary pressures. Since the trial has started, there have

been successful hires and employee turnover has lowered.

Supply chain disruptions continue; lead times on materials and

parts needed for new machinery have been lengthier than historical

norms. As a consequence, this has impacted manufacturing

efficiencies and delayed sales orders. At the end of August,

backorders remained high, however, the management team is working

hard to mitigate the risks where possible and, in some cases, have

dual sourced suppliers to maintain supply. Inventory holdings will

also remain at higher levels in the short term to alleviate the

pressure. Recently hired skilled labour should improve the capacity

and efficiencies over the coming months, and combined with

investment made into new plant and machinery soon to be fully

operational, will bring some of the manufacturing processes back in

house and provide additional capacity. The improvements made will

certainly provide the capabilities to deal with the pent-up demand

and future growth opportunities of the business.

The regulatory pathway continues to be on track with the EU

Medical Device Regulation (MDR), and additional resource has been

brought in to support the process over the coming months. In

August, the Company successfully completed a quality management

system (QMS) audit. The completion of the MDR QMS audit is si

gnificant achievement towards attaining certification in March

2023. In April, the Company received Medical Device Single Audit

Programme (MDSAP) recertification, maintaining access to the key

strategic markets of Canada, USA, Japan and Australia for a further

three years. As previously reported, there is a significant cost

burden associated with the evolving regulatory requirements which,

whilst challenging, represents an increasing barrier to entry. Some

competitors may not be able to attain the new standards, thus

providing more opportunities to capitalise on our market share.

Current trading and outlook

Revenues in the two-month period to 31 August 2022 have

continued to grow and strengthen, significantly increasing by

approximately 113% above the level achieved in the comparable

period last year. The recent two months' performance is also around

116% ahead of the corresponding pre-pandemic period of 2019,

despite being suppressed by a large sales backorder of GBP0.7m

which is to be shipped in the second half of the year. Production

activity has continued to be challenging with increased supply

chain lead times and a reduction in the availability of skilled

labour, but investment in capital expenditure and people should

increase capacity and improve efficiency over the course of the

second half. The increasing overhead base has put pressure on the

business, but the Group remains profitable at the adjusted EBITDA

level, and this will continue to improve with growth

opportunities.

The momentum in UK and Japan is indicative of the successful

investment in Sales and Marketing which has been key to driving our

sustainability initiatives. Further growth opportunities persist in

the second half of the year, as major markets continue to recover

and with the launch of new products into new and existing markets,

providing encouraging prospects for the Group.

Nigel Rogers

Chairman

21 September 2022

Unaudited consolidated income statement

for the six months ended 30 June 2022

Unaudited Unaudited Audited

six months six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

Notes GBP'000 GBP'000 GBP'000

--------------------------------- ------ ------------ ------------ -------------

Revenue 3 5,413 4,218 9,126

Cost of sales (3,540) (2,788) (5,995)

--------------------------------- ------ ------------ ------------ -------------

Gross profit 2 1,873 1,430 3,131

Other operating expenses (1,933) (1,615) (3,611)

Other income - 25 25

--------------------------------- ------ ------------ ------------ -------------

Adjusted EBITDA profit * 287 206 500

Amortisation of intangible

assets (129) (117) (257)

Impairment of intangible assets - - (145)

Depreciation of tangible assets (164) (234) (445)

Exceptional items (32) - (78)

Share based payments (22) (15) (30)

--------------------------------- ------ ------------ ------------ -------------

Operating loss (60) (160) (455)

Finance costs 4 (51) (63) (130)

Finance income - - -

--------------------------------- ------ ------------ ------------ -------------

Loss before taxation (111) (223) (585)

Taxation credit/(charge) 5 97 129 129

--------------------------------- ------ ------------ ------------ -------------

Loss and total comprehensive

income (14) (94) (456)

--------------------------------- ------ ------------ ------------ -------------

Earnings per share

Basic 6 (0.002p) (0.010p) (0.049p)

Diluted 6 (0.002p) (0.010p) (0.049p)

--------------------------------- ------ ------------ ------------ -------------

* Adjusted EBITDA is earnings before interest, depreciation,

amortisation (including impairment) and exceptional items.

Unaudited consolidated statement of changes in equity

for the six months ended 30 June 2022

Notes Share Share premium Capital Merger Retained Total

capital reserve reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ------- --------- -------------- --------- --------- ---------- --------

Balance as at 1 January 2022 9,328 6,587 329 1,250 (6,830) 10,664

Employee share-based payment

charge - - - - 22 22

------------------------------------------ --------- -------------- --------- --------- ---------- --------

Total - Transaction with owners 9,328 6,587 329 1,250 (6,808) 10,686

------------------------------------------ --------- -------------- --------- --------- ---------- --------

Loss and total comprehensive

income for the period - - - - (14) (14)

------------------------------------------ --------- -------------- --------- --------- ---------- --------

Unaudited balance as at 30

June 2022 9,328 6,587 329 1,250 (6,822) 10,662

------------------------------------------ --------- -------------- --------- --------- ---------- --------

Unaudited consolidated balance sheet

as at 30 June 2022

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

Notes GBP'000 GBP'000 GBP'000

------------------------------- ---------- ---------- ---------- -------------------------

Assets

Non-current assets

Property, plant and equipment 623 336 366

Right of Use Assets 795 920 832

Intangible assets 6,255 6,234 6,216

7,673 7,490 7,414

------------------------------- ---------- ---------- ---------- -------------------------

Current assets

Inventories 3,040 2,362 2,965

Trade and other receivables 9 2,054 1,529 1,695

Cash at bank and in hand 3,040 4,692 3,644

------------------------------- ---------- ---------- ---------- -------------------------

8,134 8,583 8,304

------------------------------- ---------- ---------- ---------- -------------------------

Total assets 15,807 16,073 15,718

------------------------------- ---------- ---------- ---------- -------------------------

Equity and liabilities

Equity attributable to

equity holders of the parent

company

Share capital 9,328 9,328 9,328

Share premium account 6,587 6,587 6,587

Capital reserve 329 329 329

Merger reserve 1,250 1,250 1,250

Retained earnings (6,822) (6,483) (6,830)

------------------------------- ---------- ---------- ---------- -------------------------

Total equity 10,662 11,011 10,664

------------------------------- ---------- ---------- ---------- -------------------------

Non-current liabilities

Dilapidation provision 165 165 165

Right of Use lease liability 705 833 750

Borrowings 8 1,117 - -

------------------------------- ---------- ---------- ---------- -------------------------

1,987 998 915

------------------------------- ---------- ---------- ---------- -------------------------

Current liabilities

Trade and other payables 9 1,945 1,456 1,614

Accruals 653 423 488

Right of Use lease liability 167 156 157

Borrowings 8 393 2,029 1,880

------------------------------- ---------- ---------- ---------- -------------------------

3,158 4,064 4,139

------------------------------- ---------- ---------- ---------- -------------------------

Total liabilities 5,145 5,062 5,054

------------------------------- ---------- ---------- ---------- -------------------------

Total equity and liabilities 15,807 16,073 15,718

------------------------------- ---------- ---------- ---------- -------------------------

Unaudited consolidated cash flow statement

for the six months ended 30 June 2022

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

Notes 2022 2021 2021

GBP'000 GBP'000 GBP'000

-------------------------------------- ------ ------------------- ------------------- ----------------

Cash flows from operating activities

Loss after tax for the year (14) (94) (456)

Adjustments for:

Taxation (97) (129) (129)

Finance Income - - (-)

Finance Costs 4 51 63 130

Other Income-CBILS interest

grant - (23) (23)

Depreciation of property, plant

and equipment 80 134 258

Amortisation and impairment

of intangible assets 129 117 402

Depreciation of right of use

assets 84 99 187

Share-based payment charge 22 15 30

Foreign Exchange (loss)/gain (87) 22 12

Increase in inventories (75) (196) (802)

Increase in current receivables (360) (246) (412)

Increase in trade and other

payables 487 64 276

-------------------------------------- ------ ------------------- ------------------- ----------------

Cash generated / (used) from

operations 220 (174) (527)

Taxation received 5 97 129 129

Interest received - - -

Interest paid (32) (10) (35)

-------------------------------------- ------ ------------------- ------------------- ----------------

Net cash generated / (used)

from operating activities 285 (55) (433)

-------------------------------------- ------ ------------------- ------------------- ----------------

Payments to acquire property,

plant and equipment (337) (58) (212)

Acquisition of intangible assets (168) (178) (445)

-------------------------------------- ------ ------------------- ------------------- ----------------

Net cash used in investment

activities (505) (236) (657)

-------------------------------------- ------ ------------------- ------------------- ----------------

Repayment of bank loan 8 (493) (150) (300)

HP leases 8 131 - -

Payments to Right of Use lease

liabilities 7 (109) (123) (232)

-------------------------------------- ------ ------------------- ------------------- ----------------

Net cash (used)/generated in

financing activities (471) (273) (532)

-------------------------------------- ------ ------------------- ------------------- ----------------

Net (decrease)/increase in

cash and cash equivalents (691) (564) (1,622)

Cash and cash equivalents at

beginning of period 3,644 5,278 5,278

Effective exchange rate fluctuations

on cash held 87 (22) (12)

-------------------------------------- ------ ------------------- ------------------- ----------------

Net cash and cash equivalents

at end of period 3,040 4,692 3,644

-------------------------------------- ------ ------------------- ------------------- ----------------

Analysis of net borrowings:

Cash at bank and in hand 3,040 4,692 3,644

Bank loan 8 - (529) (380)

CBILS 8 (1,383) (1,500) (1,500)

Obligations under HP leases (127) - -

Obligations under right of

use lease liabilities (872) (989) (907)

Net Cash/(debt) at end of period 658 1,674 857

-------------------------------------- ------ ------------------- ------------------- ----------------

Notes to the Interim Financial Information

1. Basis of preparation of interim financial information

The interim financial information was approved by the Board of

Directors on 21 September 2022. The financial information set out

in the interim report is unaudited.

The interim financial information has been prepared in

accordance with the AIM Rules for Companies and on a basis

consistent with the accounting policies and methods of computation

as published by the Group in its annual report for the year ended

31 December 2021, which is available on the Group's website.

The Group has chosen not to adopt IAS 34 Interim Financial

Statements in preparing these interim financial statements and

therefore the interim financial information is not in full

compliance with International Financial Reporting Standards as

adopted for use in the European Union.

The financial information set out in this interim report does

not constitute statutory financial statements as defined in section

434 of the Companies Act 2006. The figures for the year ended 31

December 2021 have been extracted from the statutory financial

statements which have been filed with the Registrar of Companies.

The auditor's report on those financial statements was unqualified

and did not contain a statement under sections 498(2) and 498(3) of

the Companies Act 2006.

Going concern and funding

The Directors have considered the available cash resources of

the Group, with the additional secured funding in March 2022 and

the current internal anticipated forecasts the Directors have a

reasonable expectation that the Group have adequate resources. The

Group is expected to continue to generate cash from operations over

the next 12 months as inventory levels reduce and operational

efficiencies improve, therefore providing ample support and

continue in operational existence for the foreseeable future,

considered to be at least 12 months for the date of approval from

the financial statements.

2. Disaggregation of gross margin

The Group has disaggregated margins Six months Six months 12 months

in the following table: ending ending 30 ending

30 June June 2021 31 Dec

2022 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------- --------------- -------------- ----------------

Revenue 5,413 4,218 9,126

Cost of Sales (2,959) (2,431) (5,268)

Underlying Gross Margin 2,454 1,787 3,858

Underlying Gross Margin % 45.34% 42.36% 42.28%

Net Cost of Manufacturing (581) (357) (727)

------------------------------------- --------------- -------------- ----------------

Contribution Margin 1,873 1,430 3,131

------------------------------------- --------------- -------------- ----------------

Contribution Margin % 34.60% 33.90% 34.31%

------------------------------------- --------------- -------------- ----------------

Underlying gross margin (excluding net costs of manufacturing)

is an adjusted KPI measure. Nets costs of Manufacturing are

overheads that have not been effectively absorbed due to reduced

productivity.

Adjusted KPIs are used by the Board to understand underlying

performance and exclude items which distort comparability. The

method of adjustments are consistently applied but are not defined

in International Financial Reporting Standards (IFRS) and,

therefore, are considered to be non-GAAP (Generally Accepted

Accounting Principles) measures. Accordingly, the relevant IFRS

measures are also presented where appropriate.

3. Disaggregation of revenue

The Group has disaggregated revenues in SI Brand Distribution OEM Total

the following table:

Six months ended 30 June 2022 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------- ------------- ------------- -------- --------------

United Kingdom 679 2,006 676 3,361

Europe 587 - - 587

US 596 - 240 836

APAC 484 - - 484

Rest of World 145 - - 145

------------------------------------------- ------------- ------------- -------- --------------

2,491 2,006 916 5,413

------------------------------------------- ------------- ------------- -------- --------------

SI Brand Distribution OEM Total

Six months ended 30 June 2021 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------- ------------- ------------- -------- --------------

United Kingdom 582 1,295 408 2,285

Europe 574 - - 574

US 750 - 37 787

APAC 406 - - 406

Rest of World 166 - - 166

------------------------------------------- ------------- ------------- -------- --------------

2,478 1,295 445 4,218

------------------------------------------- ------------- ------------- -------- --------------

SI Brand Distribution OEM Total

Year ended 31 December 2021 (audited) GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ------------- ------------- -------- --------------

United Kingdom 1,306 3,116 1,008 5,430

Europe 1,075 - - 1,075

US 1,333 - 189 1,522

APAC 743 - - 743

Rest of World 356 - - 356

--------------------------------------- ------------- ------------- -------- --------------

4,813 3,116 1,197 9,126

--------------------------------------- ------------- ------------- -------- --------------

Revenues are allocated geographically on the basis of where

revenues were received from and not from the ultimate final

destination of use.

4. Finance Costs

Finance costs: Six month Six month 12 months

ended ended 30 ended 31

30 June June Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

---------- ---------- ----------

On bank borrowings 24 33 74

---------- ---------- ----------

On right-of-use assets 26 30 56

---------- ---------- ----------

On HP leases 2 - -

---------- ---------- ----------

51 63 130

---------- ---------- ----------

5. Tax

Current taxation

During 2021 the Group submitted an enhanced Research and

development claim in respect of 2020 amounting to GBP0.97m this was

paid in the current year.

Deferred taxation

Overall, the Group continues to hold substantial tax losses on

which it holds a cautious view and consequently the Group has

chosen not to recognise those losses fully.

6. Earnings per share

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

-------------------- ----------- ----------- ------------

Earnings per share

Basic (0.002p) (0.010p) (0.049p)

Diluted (0.002p) (0.010p) (0.049p)

Adjusted 0.004p 0.004p (0.022p)

-------------------- ----------- ----------- ------------

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of shares in issue. Diluted earnings per share is calculated

by dividing the earnings attributable to ordinary shareholders by

the diluted weighted average number of shares in issue. Adjusted

Earnings per share is calculated by dividing the adjusted earnings

attributable to ordinary shareholders (profit before exceptional

and amortisation and impairment costs relating to the acquisition

of Elemental Healthcare and share based payments) by the weighted

average number of shares in issue.

The anti-dilutive effect of unexercised shares options has not

been taken into account and therefore the diluted earnings per

share is equal to the basic earnings per share.

The Group has one category of dilutive potential ordinary shares

being share options issued to Directors and employees. The impact

of dilutive potential ordinary shares on the calculation of

weighted average number of shares is set out below.

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

'000s '000s '000s

-------------------------------------- ----------- ----------- -------------------------

Basic earnings per share 932,816 931,573 936,564

Dilutive effect of unexercised share

options 5,049 1,243 2,220

-------------------------------------- ----------- ----------- -------------------------

Diluted earnings per share 937,865 932,816 938,784

-------------------------------------- ----------- ----------- -------------------------

7. IFRS16

Impa ct on the statement of financial position

30 June 2022 30 June 2021 31 December 2021

Assets Liabilities Assets Liabilities Assets Liabilities

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Right of use assets and

lease liabilities 795 872 920 989 833 907

Of which are:

Current lease liabilities 167 156 157

Non-Current lease liabilities 705 833 750

Impact on Equity (77) (69) (74)

------------------------------- -------- ------------ -------- ------------ -------- ------------

Total impact on statement

of financial position 795 795 920 920 833 833

------------------------------- -------- ------------ -------- ------------ -------- ------------

8. Net borrowings

At amortised cost Six month Six month 12 months

ended ended ended 31

30 June 30 June Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

Cash & cash equivalents 3,040 4,692 3,644

Bank borrowings-Current (352) (2,029) (1,880)

Bank borrowings-Non-current (1,031) - -

Obligations under HP leases-Current (41) - -

Obligations under HP leases-Non-Current (86) - -

Adjusted Net Cash 1,530 2,663 1,764

Right of Use Lease liabilities-Current (167) (156) (157)

Right of Use Lease liabilities Non-current (705) (833) (750)

Net Cash 658 1,674 857

-------------------------------------------- ---------- ---------- ----------

In March 2022, the Group refinanced the existing debt with

Yorkshire bank consisting of the following:

-- Extension to the CBILS of GBP1.5m repayable in May 2026,

Interest rate of 2.94% repayable monthly. Monthly installments are

GBP0.029m.

-- Covenants attached to the CBILS comprise of EBITDA to debt

servicing costs minimum 1.25x. First test 30 June 2022 (last 6

months), then September 22 (9 months), then rolling 12m

afterwards.

-- Additional headroom with an Invoice Discounting facility

GBP1.0m across the Group, to replace loan A and the RCF, 2.5% on

margin with a maximum of nominal administration fee of a maximum of

GBP0.018m if not utilised. As at the date of this announcement this

facility remains undrawn.

9. Financial Instruments

The financial assets of the Group are categorised as

follows:

At amortised cost Six month Six month 12 months

ended ended 30 ended 31

30 June June Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

---------- ---------- ----------

Trade receivables 1,681 1,200 1,395

---------- ---------- ----------

Cash and cash equivalents 3,040 4,692 3,644

---------- ---------- ----------

4,721 5,892 5,039

---------- ---------- ----------

The financial liabilities of the Group are categorised as

follows:

At amortised cost Six month Six month 12 months

ended ended 30 ended 31

30 June June Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

---------- ---------- ----------

Trade payables 1,427 1,000 1,090

---------- ---------- ----------

Other payables 280 321 294

---------- ---------- ----------

Deferred creditors - 20 -

---------- ---------- ----------

Lease liabilities - Current 167 156 157

---------- ---------- ----------

Lease liabilities - Non-current 705 833 750

---------- ---------- ----------

Bank borrowings - Current 352 2,029 1,880

---------- ---------- ----------

Bank borrowings - Non-current 1,032 - -

---------- ---------- ----------

Obligations under finance leases-current 41 - -

---------- ---------- ----------

Obligations under finance leases--Non-current 86 - -

---------- ---------- ----------

4,090 4,359 4,171

---------- ---------- ----------

Trade and other payables Six month Six month 12 months

ended ended 30 ended 31

30 June June Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

---------- ---------- ----------

Trade payables 1,427 1,000 1,090

---------- ---------- ----------

Other tax and social security 238 115 230

---------- ---------- ----------

Corporation tax - - -

---------- ---------- ----------

Other payables 280 321 294

---------- ---------- ----------

Deferred creditors - 20 -

---------- ---------- ----------

1,945 1,456 1,614

---------- ---------- ----------

10. Interim Report

This interim report is available at www.sigroupplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDCUUDDGDG

(END) Dow Jones Newswires

September 21, 2022 02:02 ET (06:02 GMT)

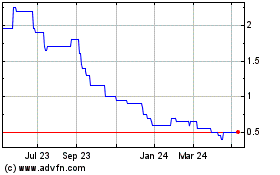

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Feb 2025 to Mar 2025

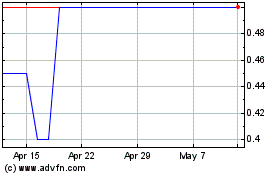

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Mar 2024 to Mar 2025