TIDMDAIP

RNS Number : 1847P

Daily Internet PLC

30 September 2013

30 September 2013

Daily Internet plc

("Daily Internet" or "the Group")

Annual Report

Daily Internet, the AIM listed web hosting provider, is pleased

to announce its audited results for the year ended 31 March

2013.

Highlights

-- Revenue increased by 7.3% to GBP1.56 million reflecting good organic growth

-- Gross profit of GBP792,000 (2012: GBP756,000)

-- Number of active domains increased by 10.0% to 169,486

-- Number of active hosting services increased by 1.6% to 20,901

-- GBP242,000 investment in infrastructure

-- GBP278,000 investment in personnel to enable expansion into the next phase of development

-- Two fundraisings completed amounting to GBP1,075,000 after expenses

-- Admission to AIM completed in January 2013

Michael Edelson, Chairman of Daily Internet, commented:

"The Group has made steady progress during the financial year

under review and the Daily brand continues to be well regarded in

the marketplace as demonstrated by continued organic growth against

a backdrop of a flat UK economy. Our customer base has continued to

grow and from this we have built a recurring revenue base that will

provide funding to develop and maintain the current product set for

the foreseeable future."

For further information please contact:

Daily Internet plc +44 (0)115

Abby Hardoon, Managing Director 973 7260

Sanlam Securities UK Limited (Nominated

Adviser and Joint Broker)

Simon Clements/Virginia Bull/Richard +44 (0)20 7628

Goldsmith 2200

Loeb Aron & Company Limited (Joint

Broker) +44 (0)20 7628

Dr Frank Lucas/Peter Freeman 1128

Square1 Consulting Limited +44 (0)20 7929

David Bick/Mark Longson 5599

About Daily Internet

Daily Internet is an award-winning second generation UK web

hosting provider which delivers a wide range of internet solutions

to individuals as well as SME and large business users. The people

behind Daily Internet have in-depth expertise and experience in the

Internet hosting sector and have built some of the UK's best known

web hosting brands.

Chairman's Statement

I am pleased to present the 31 March 2013 financial results for

Daily Internet plc (Daily).

Performance Summary

The Group has made steady progress during the financial year

under review and in-line with one of the goals set out in my

Statement last year it achieved cash flow break even at the

operating unit level (excluding the investment in our Phase II

growth) during the second quarter of 2012.

The Daily brand continues to be well regarded in the marketplace

as demonstrated by continued organic growth against a backdrop of a

flat UK economy. Our continually improving renewal rates

demonstrate our ability to deliver excellent customer service and

value.

The Group has now developed a broad portfolio of hosting

products, email and domain name registration services to provide

both the small business user and consumer with all their hosting

requirements. Our customer base has continued to grow and from this

we have built a recurring revenue base that will provide funding to

develop and maintain the current product set for the foreseeable

future.

The launch and introduction of our dedicated server product in

January 2013 completed Phase II of our strategic development to

provide a one-stop shop for hosting products for SMEs and

individuals.

Outlook

We continue to develop our existing product base and introduce

new products as the market demands. Our new web design product

launched after the year end has been well received and complements

our existing product portfolio.

The management team at Daily will continue to work hard with

enthusiasm and energy seeking out new technologies to further

capture market share, increase revenue and consolidate our

position; and at the same time endeavouring to target and execute

accretive acquisitions to enable us to extend our reach into new

markets with new brands at a much faster rate than organic

growth.

Placing

The Company completed two fundraisings during the year amounting

to GBP1,075,000 after expenses and the funds raised were utilised

in completing phase II of the company's development strategy and

funding the admission to AIM which was successfully completed in

January 2013.

Conclusion

I take this opportunity to thank all our shareholders for their

continued support and the Daily staff for their passion, dedication

and commitment to the company and our customers.

Michael Edelson

Chairman

27 September 2013

Operational and Financial Review

Performance

2013 has been another year of continued revenue growth. Revenue

for the Group reached nearly GBP1.6 million for the year to 31

March 2013, an increase of 7.3% compared to the previous year.

Daily Internet offers hosting services paid for on a variable

subscription basis. Where the subscription is paid for on an annual

basis, sales attributable to future periods are deferred. As such,

revenue reported in the accounts is different from actual cash

received. The Group's cash receipts for the year amounted to

GBP1,550,000 compared to GBP1,503,000 for the previous year; an

increase of 3%. The amount of cash received which has been deferred

to future periods at 31 March 2013 is GBP307,000.

Marketing and staff costs represent the majority of our

operating expenses. During 2013 we have continued to improve

marketing efficiencies by using social media channels, improving

our brand recognition and increasing our market reputation.

Customer and other referrals are now a key driver for gaining new

sales and customers; as such marketing spend for the year reduced

by 16% to GBP187,000 and customer signups increased by 10% to a

total of 67,000 by 31 March 2013.

During the year the Group invested GBP278,000 in its Phase II

project pre-launch, adding personnel within the Sales and Marketing

and Customer Service departments, and in January 2013 launched a

new Dedicated Server product range.

Gross profit for the year was GBP792,000 (2012: GBP756,000)

representing a gross margin of 50.9% (2012: 52.1%). EBITDA* loss

for the year to 31 March 2013 is reported in the financial

statements at GBP705,000 (2012: GBP139.000). Included within this

figure are additional costs of GBP278,000 (2012: GBP51,000) for

Phase II development and GBP234,000 of AIM admission costs and

share based payment costs of GBP24,000. The underlying EBITDA loss

being GBP169,000 (2012: GBP88,000).

Focus on excellent customer service and continued systems

improvements within the Group's established product set have driven

increased revenue per operational head. In the coming year we aim

to continue to drive additional new sales and maintain our renewal

base without incurring additional staff costs.

Balance Sheet and Treasury

The Group has continued to invest in its infrastructure during

the year to 31 March 2013, having spent GBP242,000 during the year

on the maintenance and expansion of its core products (2012:

GBP124,000). The total investment at 31 March 2013 in the Group's

tangible and intangible assets amounts to GBP1,053,000 (2012:

GBP811,000), these are written down over time in accordance with

the Company's depreciation policy and the net book value of these

assets is reported at GBP330,000 (2012: GBP192,000).

Net cash outflow from operating activities during the year

amounted to GBP680,000 (2012: GBP9,000). Of this amount GBP234,000

related to AIM listing costs and GBP278,000 related to pre-launch

Phase II costs. Cash at bank at 31 March 2013 was ahead of plan at

GBP373,000 (2012: GBP108,000). A facility of GBP580,000, which is

available until 31 March 2015, has been arranged for working

capital requirements, of which GBP405,000 has been utilised as at

31 March 2013. The Directors are confident that this amount is

sufficient to allow the Group to continue its organic growth and to

achieve an overall cashflow breakeven position in the current

financial year. However, fundraising would be required should an

acquisition target become available.

Payables falling due within one year are reported at GBP806,000

(2012: GBP709,000). This figure includes an amount of GBP307,000

(2012: GBP283,000) for deferred revenue which will be released to

profit in future years.

Payables falling due after one year are reported at GBP792,000

(2012: GBP708,000). This includes an amount of GBP260,000 (2012:

GBP269,000) representing the carrying value on convertible loan

notes which were renewed on 9 January 2012 and the GBP405,000 loan

facility referred to above.

Julie Joyce

Finance Director

27 September 2013

Consolidated Statement of Comprehensive Income for the Year

Ended 31 March 2013

2013 2012

Group Group

Notes GBP,000 GBP,000

Revenue 1,557 1,451

Cost of sales (765) (695)

Gross profit 792 756

Administration expenses before amortisation,

depreciation, Phase II costs and

share based payments 961 844

Depreciation and other amortisation 104 68

Phase II costs 278 51

AIM admission costs 234 -

Share based payments 24 -

---------------------------------------------- ------- --------- ---------

Administrative expenses (1,601) (963)

--------- ---------

Loss from operations (809) (207)

--------- ---------

Finance costs (91) (63)

--------- ---------

Loss before taxation (900) (270)

Taxation 3 - -

--------- ---------

Total comprehensive loss attributable

to the equity holders of the company (900) (270)

Basic and fully diluted loss per 2 GBP0.011 GBP0.004

share

--------- ---------

The Group's results are derived from continuing

operations.

The accompanying notes form an integral part of

this consolidated statement of comprehensive income.

Consolidated Statement of Financial Position as at 31 March

2013

2013 2012

Group Group

Notes GBP,000 GBP,000

-------- --------

Assets

Non-current assets

Goodwill 392 392

Intangible assets - 9

Property, plant and equipment 330 183

-------- --------

722 584

Current assets

Trade and other receivables 5 49 47

Cash and cash equivalents 373 108

-------- --------

422 155

-------- --------

Total Assets 1,144 739

-------- --------

Equity and Liabilities

Equity attributable to the equity

shareholders of the parent

Called up share capital 8 595 313

Share premium reserve 3,438 2,629

Other reserve 173 242

Retained losses (4,660) (3,862)

-------- --------

(454) (678)

-------- --------

Non-current liabilities

Obligations under finance leases 127 34

Convertible loan notes 7 260 269

Other loans 7 405 405

-------- --------

792 708

-------- --------

Current liabilities

Trade and other payables 6 730 687

Obligations under finance leases 76 22

-------- --------

806 709

-------- --------

Total Equity and Liabilities 1,144 739

-------- --------

Consolidated Statement of Changes in Equity for the Year Ended

31 March 2013

Attributable to equity holders

of the parent

Share

Share premium Other Retained

capital reserve reserve losses Total

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2011 305 2,600 242 (3,592) (445)

Loss and total

comprehensive income

for the year - - - (270) (270)

Issue of share

capital 8 29 - - 37

--------- --------- --------- --------- -------

At 1 April 2012 313 2,629 242 (3,862) (678)

Loss and total

comprehensive income

for the period - - - (900) (900)

Issue of share

capital 282 866 - - 1,148

Expenses of share

issue - (57) - - (57)

Movement in share

option reserve - - (78) 102 24

Equity element

of convertible

loan note - - 9 - 9

--------- --------- --------- --------- -------

At 31 March 2013 595 3,438 173 (4,660) (454)

--------- --------- --------- --------- -------

The following describes the nature and purpose

of each reserve within equity:

Reserve Description and purpose

Share Premium Reserve Amount subscribed for share capital

in excess of nominal values.

Other Reserve Amount reserved for share based

payments to be released over

the life of the instruments and

the equity element of convertible

loan notes.

Retained losses All other net gains and losses

and transactions with owners

(e.g. dividends) not recognised

elsewhere.

Consolidated Statement of Cash Flows for the Year Ended 31 March

2013

2013 2012

Group Group

GBP000 GBP000

Cash flows used in operating

activities

Loss generated from operations (809) (207)

Adjustments for:

Depreciation and other amortisation 104 68

Share based payments 24 -

Operating cash flows before movement

in working capital (681) (139)

------- -------

(Increase) in trade and other

receivables (2) (20)

Increase in trade and other payables 3 150

Net cash used in operating activities (680) (9)

------- -------

Cash flows from investing activities

Payments to acquire property,

plant & equipment (242) (124)

Net cash used in investing activities (242) (124)

------- -------

Cash flows from financing activities

Issue of ordinary share capital 1,091 37

Drawdown of loan facility - 130

Interest paid (5) (36)

Loan note interest paid (26) (24)

Interest element of finance lease

payments (20) (3)

Capital repayment of finance

leases (54) (13)

New lease finance secured on

assets 201 51

Net cash from financing activities 1,187 142

------- -------

Net increase in cash and cash

equivalents 265 9

Cash and cash equivalents at

the beginning of the year 108 99

------- -------

Cash and cash equivalents at

the end of the year 373 108

------- -------

Notes to the Consolidated Financial Statements

1 Accounting policies

Basis of preparation

The financial information set out in this announcement does not

constitute statutory financial statements for the years ended 31

March 2013 or 31 March 2012. Statutory accounts for the years ended

31 March 2013 and 31 March 2012 have been reported on by the

Independent Auditors.

The Independent Auditors' Reports on the Annual Report and

Financial Statements for 2013 and 2012 were unqualified, did not

draw attention to any matters by way of emphasis, and did not

contain a statement under s.498(2) or s.498(3) of the Companies Act

2006.

Statutory accounts for the year ended 31 March 2012 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 31 March 2013 will be delivered to the Registrar in

due course.

Going concern

The Directors have prepared the Financial Statements on a going

concern basis which assumes that the group and the company will

continue to meet liabilities as they fall due.

The directors have reviewed forecasts prepared 12 months ending

30 September 2014 and considered the projected trading forecasts

and resultant cash flows together with confirmed loan facilities

and other sources of finance.

The group's forecasts and projections, taking account of

reasonably possible changes in trading performance, show that the

group can continue to operate within the current facilities

available to it.

The Directors therefore have a reasonable expectation that the

group has adequate resources to continue in operational existence

for the foreseeable future and thus they continue to adopt the

going concern basis of accounting in preparing the financial

statements.

2 Loss per share

2013 2012

Loss for the financial GBP900,000 GBP270,000

year attributable to shareholders

Weighted number of equity

shares in issue 84,800,825 61,403,002

Basic/diluted loss per

share GBP0.011 GBP0.004

Since the conversion of potential ordinary shares to ordinary

shares would decrease the net loss per share, they are not

dilutive. Accordingly diluted loss per share is the same as basic

loss per share.

3 Taxation

2013 2012

GBP,000 GBP,000

Current tax charge - -

-------- --------

Deferred tax

Timing differences - -

-------- --------

Total tax charge - -

-------- --------

Factors affecting the tax charge

for the year

Loss on ordinary activities before

taxation (900) (270)

-------- --------

Loss on ordinary activities before

taxation multiplied by the Standard

rate of UK corporation tax of 24%

(2012:26%) (216) (70)

Effects of:

Tax losses 216 70

-------- --------

Total tax charge - -

-------- --------

There is no tax charge for any periods reported due to losses

arising. The Directors have not provided for the potential deferred

tax asset due to the uncertainty of future taxable profits. The tax

losses available were approximately GBP3,760,000 at 31 March 2013

(2012: GBP3,334,000). The deferred tax asset on these tax losses at

24% (2012: 26%) of GBP902,000 (2012: GBP867,000) has not been

recognised due to the uncertainty of the recovery.

4 Investments

Company Company

2013 2012

GBP,000 GBP,000

Investment in Subsidiaries

At 1 April 2012 1,722 1722

Additions - -

Impairment (458) -

---------- ---------

Cost 31 March 2013 1,264 1,722

---------- ---------

The Company's subsidiary undertakings all

of which are wholly owned and included in

the consolidated accounts are:

Undertakings Registration Principal activity

Web hosting

Daily Internet Services and domain

Limited England name registration

Investment

Lambolle Partners plc England Company

The recoverable amounts have been determined from discounted

cash flow calculations based on cash flow projections from approved

budgets covering a two year period to 31 March 2015. The major

assumptions can be seen in note 11. This consequently resulted in

an impairment of GBP458,000 in the year.

Lambolle Partners PLC is a dormant Company and therefore exempt

from audit.

5 Trade and other receivables

Group Company Group Company

2013 2013 2012 2012

GBP,000 GBP,000 GBP,000 GBP,000

Amounts due within

one year:-

Trade debtors 2 - - -

Other receivables - 4 - 1

Prepayments and accrued

income 47 8 47 22

-------- -------- -------- --------

49 12 47 23

-------- -------- -------- --------

Amounts due after more

than one year:-

Amounts owed by subsidiary

undertakings - 134 - 2,324

-------- -------- -------- --------

- 134 - 2,324

-------- -------- -------- --------

Total Receivables 49 146 47 2,347

-------- -------- -------- --------

6 Trade and other payables

Group Company Group Company

2013 2013 2012 2012

Amounts falling due

within one year GBP,000 GBP,000 GBP,000 GBP,000

Trade payables 177 19 203 9

Corporation tax - - - -

Other taxes and social

security costs 63 1 31 1

Other payables 73 - 109 -

Accruals and deferred

income 417 93 344 6

-------- -------- -------- --------

730 113 687 16

-------- -------- -------- --------

Group Company Group Company

2013 2013 2012 2012

Amounts falling due

after one year GBP,000 GBP,000 GBP,000 GBP,000

Other loans 405 405 405 405

Amounts due to subsidiary

undertakings - 860 - 860

Convertible loan note

(see note 16) 260 260 269 269

-------- -------- -------- --------

665 1,525 674 1,534

-------- -------- -------- --------

The maturity of other debt is as follows:

Within one to three

years 665 665 674 674

Over five years - 860 - 860

-------- -------- -------- --------

665 1,525 674 1,534

-------- -------- -------- --------

7 Loans and borrowings

The book value and fair value of loans and borrowings are as

follows:

Group Company Group Company

2013 2013 2012 2012

Non-Current GBP'000 GBP'000 GBP'000 GBP'000

Convertible Loan 260 260 269 269

Other loan 405 405 405 405

Finance lease creditor

(see note 17) 127 - 34 -

-------- -------- ------------ -----------

792 665 708 674

-------- -------- ------------ -----------

2013 2013 2012 2012

Current GBP'000 GBP'000 GBP'000 GBP'000

Finance lease creditor

(see note 17) 76 - 22 -

-------- -------- ------------ -----------

76 0 22 -

-------- -------- ------------ -----------

Loan facility

A loan facility of GBP580,000 has been arranged by the Group

between Abby Hardoon, a director and major shareholder, John

Thompson and Hawkstone Capital Limited. Interest is payable at a

minimum rate of 10% and is repayable or convertible at a conversion

price of 3p per share on 31(st) March 2015. The amount drawn down

at 31 March 2013 is GBP405,000 (2012:GBP405,000).

Convertible Loan note

Fifty six GBP5,000 convertible loan notes were issued on 4

January 2012 which expire in 2015. The 2015 Loan Notes offer a rate

of interest of 9 per cent and are convertible at a conversion price

of 3p per share. The Company is able to redeem a minimum of

GBP1,000 nominal value of each New Loan Note as cash flow allows by

repaying the redeemed nominal value plus six months pro rata

interest, subject to the relevant holders being entitled to convert

such loan notes into ordinary shares in the capital of the Company

at their election at 3p per share.

A warrant was also issued entitling the holder to subscribe for

100,000 ordinary shares at a price of 5p per share, exercisable at

any time before 8 January 2022, provided that the Company may

require the exercise of these warrants if its shares are traded at

a price in excess of 8p per share for a period of 60 business days

and an aggregate value of bargains exceeding GBP60,000 occurs over

that period. The value of the convertible loan notes recognised in

the balance sheet is calculated as follows:

2013 2012

GBP,000 GBP,000

Face value 280 280

Costs of issue (11) (11)

-------- --------

Net proceeds 269 269

Equity component (13) -

Unwinding of liability 4 -

-------- --------

Liability component at 31 March

2013 260 269

-------- --------

8 Share Capital

Group Company Group Company

2013 2013 2012 2012

GBP,000 GBP,000 GBP,000 GBP,000

Authorised

150,000,000 Ordinary

shares of 0.5p

each 750 750 750 750

-------- -------- -------- --------

750 750 750 750

-------- -------- -------- --------

Allotted, called

up and fully paid

At start of year

62,623,550 Ordinary

shares of 0.5p

each 313 313 305 305

Issued during the

year 56,361,342

Ordinary shares

of 0.5p 282 282 8 8

-------- -------- -------- --------

At end of year

118,984,892 Ordinary

shares of 0.5p 595 595 313 313

-------- -------- -------- --------

During the year the Company issued 56,361,342 ordinary shares of

0.5p each. The total amount raised of GBP1,091,000 after costs was

used to fund the Company's admission on to AIM, to fund the launch

of the Group's Dedicated Server product range and to provide

further working capital.

Under the terms of the EMI and unapproved share options a

further 4,250,000 ordinary shares could be issued with a nominal

value of GBP21,250.

9 Annual General Meeting and Availability of Annual Report

The Annual General Meeting of the Company will be held at the

Company's registered office at Number 14 Riverview, Vale Road,

Heaton Mersey, Stockport, Cheshire SK4 3GN on 25 October 2013 at

10.00 a.m.

Copies of the annual report will be available from the Company's

office and also from the Company's website www.daily.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UKVOROWAKUAR

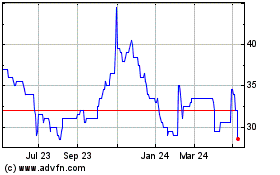

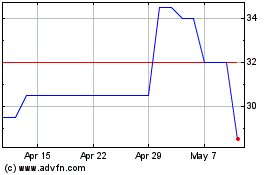

Sysgroup (LSE:SYS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sysgroup (LSE:SYS)

Historical Stock Chart

From Feb 2024 to Feb 2025