TIDMDAIP

RNS Number : 0483W

Daily Internet PLC

20 December 2013

20 December 2013

Daily Internet plc

("Daily Internet" or "the Group")

Interim Results

Daily Internet plc, the hosting and cloud infrastructure

provider, is pleased to announce its unaudited interim results for

the six months ended 30 September 2013.

Highlights

Period under review:

-- Revenue of GBP802,000 (six months ended 30 September 2012: GBP764,000);

-- Gross profit of GBP377,000 (six months ended 30 September 2012: GBP390,000);

-- Number of active domains increased to 173,000; and

-- Number of active hosting services increased to 21,000.

Post period end:

-- Acquisition of Netplan Internet Solutions Limited adding

critical mass and significantly expanding the Group's product

reach;

-- Excluding the acquisition Daily Internet is cash neutral

before PLC costs on a monthly basis;

-- Including the acquisition Daily Internet is cash positive on a monthly basis; and

-- Group trading in-line with expectations with rationalised

costs and business wins in all areas.

For further information please contact:

Daily Internet plc

Abby Hardoon, Managing Director +44 (0)115 973 7260

Sanlam Securities UK Limited (Nominated Adviser

and Joint Broker)

Simon Clements/Virginia Bull/Catherine Miles +44 (0)20 7628 2200

Loeb Aron & Company Limited (Joint Broker)

Dr Frank Lucas/Peter Freeman +44 (0)20 7628 1128

Walbrook PR

Bob Huxford/Guy McDougall/Paul Cornelius +44 (0)20 7933 8780

Chairman's Statement

Daily Internet continued to make steady progress in the period,

showing growth in revenues from new business wins and strong

recurring revenue. Revenue grew 5% against the prior period and as

at 30 September 2013 Daily Internet provided web hosting services

to over 50,000 customers throughout the UK, with 63% of these

customers bringing repeat business.

During the period the Company further diversified its service

range introducing new complementary products in-line with its

strategic aim of becoming a one-stop provider for hosting products

for SMEs and individuals.

Post the period end on 22 October 2013, the Group announced its

intention, subject to shareholder approval, to make its first

acquisition in-line with its stated 'buy and build' strategy, and a

placing to raise GBP3 million to fund the cash consideration

payable in respect of the acquisition. In November 2013, the Group

subsequently acquired 100% of the share capital of Netplan Internet

Solutions Limited ("Netplan"), an established managed hosting and

cloud infrastructure provider based in Coventry. The acquisition of

Netplan and its addition to the Group puts Daily Internet in a

strong position to take advantage of the fast growing cloud

infrastructure market whilst underpinning and accelerating Daily

Internet's continued growth. Netplan not only diversifies the

Group's product range but also moves the Group up the value chain

where revenues per service are significantly higher and stickier in

nature. We were delighted with the support shown by investors for

the acquisition and fundraising, including both new and existing

institutional investors, and look forward to creating shareholder

value throughout continued growth in both businesses.

Following the acquisition, the Company is proceeding with

streamlining the Group's operations with the goal of maximising

synergies and cross selling opportunities with Netplan while

emphasising continued organic growth in both companies. The Group

has also been able to rationalise costs for the combined Group

which will increase gross margins and accelerate the profitability

of the Group.

The Group is currently trading in-line with market expectations

with growth in both the original Daily Internet brand product set

and contracts wins for Netplan since its acquisition. We consider

the acquisition of Netplan to be a pivotal step for the Company,

and the Board is confident that 2014 will see further growth and

progress in creating a one-stop supplier of reliable, scalable,

high performance and resilient infrastructure based hosting

products within the fast-growing UK and European markets with a

multi-brand and multi-location strategy.

Michael Edelson

Chairman

20 December 2013

Consolidated Interim Statement of Comprehensive Income

Six months ended 30 September 2013

Restated

Unaudited Unaudited Audited

six months six months year

to to to

30 Sep 2013 30 Sep 2012 31 Mar

2013

Notes GBP,000 GBP,000 GBP,000

Revenue 802 764 1,557

Cost of sales (425) (374) (765)

Gross profit 377 390 792

Operating expenses before

amortisation, depreciation,

Phase II pre-launch costs

and share based payments 666 373 961

Depreciation and other amortisation 52 45 104

Phase II pre-launch costs - 98 278

AIM flotation costs - - 234

Share based payments - - 24

------------ ------------ ---------

Administrative expenses (718) (516) (1,601)

------------ ------------ ---------

Loss from operations (341) (126) (809)

------------ ------------ ---------

Investment income - - -

Finance costs (60) (47) (91)

------------ ------------ ---------

Loss before taxation (401) (173) (900)

Taxation - - -

------------ ------------ ---------

Total comprehensive loss attributable

to the equity holders of the

company (401) (173) (900)

Basic and fully diluted loss 2 GBP0.003 GBP0.003 GBP0.011

per share

============ ============ =========

The Group's results are derived from continuing operations.

Consolidated Interim Statement of Financial Position

As at 30 September 2013

Restated

Unaudited Unaudited Audited

30 Sep 30 Sep 31 Mar

2013 2012 2013

GBP,000 GBP,000 GBP,000

Assets

Non-current assets

Goodwill 392 392 392

Intangible assets - 2 -

Plant, property and equipment 278 192 330

---------- ---------- --------

670 586 722

Current assets

Trade and other receivables 42 38 49

Cash and cash equivalents 263 577 373

---------- ---------- --------

305 615 422

---------- ---------- --------

Total Assets 975 1,201 1,144

========== ========== ========

Equity and Liabilities

Equity attributable to the

equity shareholders of the

parent

Called up share capital 595 459 595

Share premium reserve 3,438 3,055 3,438

Share based payment reserve 173 242 173

Retained losses (5,061) (4,035) (4,660)

---------- ---------- --------

(855) (279) (454)

---------- ---------- --------

Non current liabilities

Obligations under finance

leases 82 48 127

Convertible loan notes 269 269 260

Other loans 605 405 405

---------- ---------- --------

956 722 792

---------- ---------- --------

Current liabilities

Trade and other payables 791 726 730

Obligations under finance

leases 83 32 76

---------- ---------- --------

874 758 806

---------- ---------- --------

Total Equity and Liabilities 975 1,201 1,144

========== ========== ========

Consolidated Interim Statement of Changes in Equity

for the six months to 30 September 2013

Attributable to equity holders of the parent

Share

Share premium Other Accumulated

capital account reserve losses Total

GBP,000 GBP,000 GBP,000 GBP,000 GBP,000

At 1 April 2012 313 2,629 242 (3,862) (678)

Loss and total comprehensive

income for the year - - - (173) (173)

Issue of share capital 146 426 - - 572

---------- ---------- ---------- ------------ --------

At 30 September 2012

(restated) 459 3,055 242 (4,035) (279)

Loss and total comprehensive

income for the period - - - (727) (727)

Issue of share capital 136 440 - - 576

Expenses of share issue - (57) - - (57)

Movement in share option

reserve (78) 102 24

Equity element of convertible

loan note - - 9 - 9

---------- ---------- ---------- ------------ --------

At 31 March 2013 595 3,438 173 (4,660) (454)

Loss and total comprehensive

income for the period - - - (401) (401)

---------- ---------- ---------- ------------ --------

At 30 September 2013 595 3,438 173 (5,061) (855)

---------- ---------- ---------- ------------ --------

The following describes the nature and purpose of each

reserve within equity:

Reserve Description and purpose

Share Premium Amount subscribed for share capital in

excess of nominal values.

Other Reserve Amount reserved for share based payments

to be released over the life of the instruments.

Accumulated losses All other net gains and losses and transactions

with owners (e.g. dividends) not recognised

elsewhere.

Consolidated Interim Statement of Cash Flows

for the six months to 30 September 2013

Restated

Unaudited Unaudited Audited

six months six months year

to to to

30 Sep 2013 30 Sep 2012 31 Mar 2013

GBP,000 GBP,000 GBP,000

Cash flows used in operating activities

Loss generated from operations (341) (126) (809)

Adjustments for:

Depreciation and other amortisation 52 45 104

Share based payments - - 24

Operating cash flows before movement

in working capital (289) (81) (681)

------------ ------------ ------------

Decrease/(increase) in trade and

other receivables 7 9 (2)

Increase in trade and other payables 42 18 3

Net cash used in operating activities (240) (54) (680)

------------ ------------ ------------

Cash flows from investing activities

Payments to acquire property, plant

& equipment - (4) (242)

Net cash used in investing activities - (4) (242)

------------ ------------ ------------

Cash flows from financing activities

Issue of ordinary share capital - 572 1,091

Drawdown of loan facility 200 - -

Interest paid - (5) (5)

Loan note interest paid (13) (13) (26)

Interest element of finance lease

payments (19) (8) (20)

Capital repayment of finance leases (38) (19) (54)

New lease finance secured on assets - - 201

Net cash from financing activities 130 527 1,187

------------ ------------ ------------

Net (decrease)/increase in cash and

cash equivalents (110) 469 265

Cash and cash equivalents at the beginning

of the

period/year 373 108 108

------------ ------------ ------------

Cash and cash equivalents at the

end of the period/year 263 577 373

------------ ------------ ------------

Notes to the Consolidated Interim Financial Statements

1. Accounting policies

The financial information for the year ended 31 March 2013 set

out in this half yearly report does not constitute statutory

financial statements as defined in section 434 of the Companies Act

2006. The figures for the year ended 31 March 2013 have been

extracted from the Group financial statements for that year. Those

financial statements have been delivered to the Registrar of

Companies and included an independent auditor's report, which was

unqualified and did not contain a statement under section 493 of

the Companies Act 2006.

The half yearly financial information has been prepared using

the same accounting policies and estimation techniques as will be

adopted in the Group financial statements for the year ending 31

March 2014. The Group financial statements for the year ended 31

March 2013 were prepared under International Financial Reporting

Standards as adopted by the European Union. These half yearly

financial statements have been prepared on a consistent basis and

format with the Group financial statements for the year ended 31

March 2013. The comparative half year financial statements to 30

September 2012 previously prepared under UK GAAP have been restated

under IFRS. The provisions of IAS 34 'Interim Financial Reporting'

have not been applied in full.

The half year financial statements to 30 September 2013 have

neither been audited nor reviewed pursuant to guidance issued by

the Auditing Practices Board.

2. Loss per share

Unaudited Unaudited Audited

six months six months year

to to to

30 Sep 2013 30 Sep 2012 31 Mar 2013

GBP,000 GBP,000 GBP,000

------------ ------------ ------------

Loss for the financial year GBP401,000 GBP173,000 GBP900,000

attributable to shareholders

Weighted number of equity shares

in issue 118,984,892 63,260,254 84,800,825

Basic/diluted loss per share GBP0.003 GBP0.003 GBP0.011

------------ ------------ ------------

Since the conversion of potential ordinary shares to ordinary

shares would decrease the net loss per share, they are not

dilutive. Accordingly diluted loss per share is the same as basic

loss per share.

3. Post balance sheet events

On 18 November 2013 Daily Internet PLC raised GBP3 million in a

share placing to fund the initial consideration of the acquisition

of Netplan Internet Solutions Ltd. At this time GBP719,626 of debt

was capitalised. Full details can be found at

http://www.daily.co.uk/investors/company-announcements.html.

4. Availability of Interim Results

Copies of the interim report will be available from the

registered office of the Company at Number 14 Riverview Vale Road,

Heaton Mersey, Stockport, Cheshire SK4 3GN and from the Company's

website www.daily.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FFIEEUFDSEEE

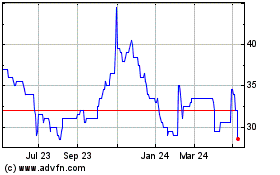

Sysgroup (LSE:SYS)

Historical Stock Chart

From Jan 2025 to Feb 2025

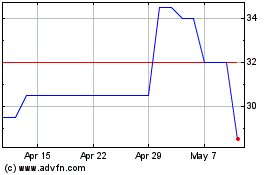

Sysgroup (LSE:SYS)

Historical Stock Chart

From Feb 2024 to Feb 2025