TMT Investments PLC Portfolio Update (3640Y)

May 12 2021 - 4:00AM

UK Regulatory

TIDMTMT

RNS Number : 3640Y

TMT Investments PLC

12 May 2021

12 May 2021

TMT INVESTMENTS PLC

("TMT" or the "Company")

Portfolio Update

TMT Investments Plc (AIM: TMT.L), the venture capital company

investing in high-growth technology companies, is pleased to

announce the following developments in the Company's portfolio

since the publication of the Company's 2020 Annual Report on 25

March 2021.

New investments

The Company has made the following new and further investments

since the publication of its 2020 Annual Report on 25 March

2021:

-- Additional EUR575,000 in Postoplan OÜ, a social network

marketing platform, which helps create, schedule, and promote

content ( www.postoplan.app );

-- GBP200,000 in Balanced Ventures Limited, trading as FemTech

Lab, Europe's first tech accelerator focused on female founders (

www.femtechlab.com );

-- US$300,000 in Agendapro, Inc., a SaaS-based scheduling,

payment and marketing solution for the beauty and wellness industry

in Latin America ( www.agendapro.com );

-- US$2,000,000 in Muncher Inc., a dark kitchen and virtual food

brand operator in Latin America ( www.muncher.com.co );

-- US$1,000,000 in Aurabeat Technology International Limited,

the producer of air purifiers that are FDA-certified to destroy

viruses and bacteria ( www.aurabeat-tech.com ); and

-- Additional GBP1,836,000 (via acquisition of new and existing

shares) in 3S Money Club Limited, a UK-based online banking service

focusing on international trade ( www.3s.money ).

As of 12 May 2021, TMT has approximately US$25.2 million of cash

and cash equivalents on its balance sheet, and the Company

continues to research and identify suitable investment

opportunities.

Alexander Selegenev, Executive Director of TMT, said:

"During the last few months, we have been continuing to actively

invest the proceeds from our US$41 million exit from sales

management software company, Pipedrive, which was completed in

December 2020. We believe the recent investments announced today

represent exciting and fast-growing future prospects, operating

innovative and globally scalable business models. These include a

US$2 million investment into Muncher Inc., a next generation,

fast-growing dark kitchen and virtual food brand operator in Latin

America, whose business model addresses carbon footprint and

sustainability matters by providing food entrepreneurs with kitchen

facilities located in reconverted shipping containers and in closer

proximity to their clients. The other investments made provide

exposure to the wellness and femtech sectors via Agendapro and

FemTech Lab, the Covid-19/hygiene market, via Aurabeat Technology,

the social media/digital marketing sector, via an additional

investment into Postoplan, the cyber-risk management sector, via

Cyberwrite, and the fintech sector via an additional investment

into 3S Money.

"With over 40 companies currently held in its portfolio, TMT

provides a liquid route to invest in a globally diversified

portfolio of hard to access, fast-growing, privately held

technology companies thanks to TMT's publicly traded shares on the

London AIM market. We look forward to keeping shareholders updated

on relevant developments".

For further information contact:

TMT Investments PLC +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited

(Nominated Adviser)

James Bellman / James Dance +44 (0)20 7409 3494

Cenkos Securities plc

(Joint Broker)

Russell Cook / Ben Jeynes +44 (0)20 7397 8900

Hybridan LLP

(Joint Broker)

Claire Louise Noyce +44 (0)20 3764 2341

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

About TMT Investments PLC

TMT Investments PLC invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has invested in over 65 companies to date and has net

assets of US$178 million as of 31 December 2020. The Company's

objective is to generate an attractive rate of return for

shareholders, predominantly through capital appreciation. The

Company is traded on the AIM market of the London Stock Exchange.

www.tmtinvestments.com .

Twitter

LinkedIn

Facebook

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUDKBBQFBKKNPD

(END) Dow Jones Newswires

May 12, 2021 05:00 ET (09:00 GMT)

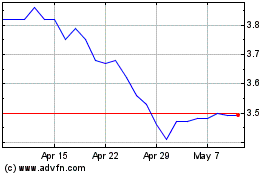

Tmt Investments (LSE:TMT)

Historical Stock Chart

From Jan 2025 to Feb 2025

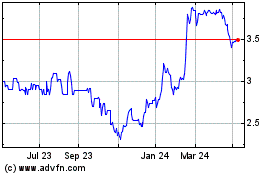

Tmt Investments (LSE:TMT)

Historical Stock Chart

From Feb 2024 to Feb 2025