TIDMTMT

RNS Number : 8046N

TMT Investments PLC

01 October 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN (THIS

"ANNOUNCEMENT") IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

INTO OR FROM AUSTRALIA, CANADA, JAPAN, NEW ZEALAND, THE REPUBLIC OF

SOUTH AFRICA OR THE UNITED STATES OR ANY OTHER JURISDICTION IN

WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN TMT INVESTMENTS PLC OR ANY OTHER

ENTITY IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

For immediate release

1 October 2021

TMT INVESTMENTS PLC

Placing and Subscription to raise gross proceeds of US$18.5

million

and

Proposed PrimaryBid Offer

TMT Investments Plc (AIM: TMT) ("TMT" or the "Company"), the

venture capital company investing in high-growth, technology

companies across a number of core specialist sectors, is pleased to

announce a conditional capital raising to raise US$18.5 million

before expenses (the "Capital Raising") by way of the issue of an

aggregate of 2,176,471 new ordinary shares of no par value in the

Company ("Ordinary Shares") at an issue price of US$8.50 per share

(the "Issue Price").

The Capital Raising consists of a conditional placing of

1,577,672 new Ordinary Shares (the "Placing Shares") at the Issue

Price with new and existing institutional investors (the "Placing")

and separate conditional direct subscriptions with the Company for

an aggregate of 598,799 new Ordinary Shares (the "Subscription

Shares" and together with the Placing Shares, the "New Ordinary

Shares") by Executive Director Alexander Selegenev and certain

members of the Company's founding management team and their

connected parties (the "Subscription").

The New Ordinary Shares will rank pari passu with the existing

Ordinary Shares in issue and application has been made for the New

Ordinary Shares to be admitted to trading on the AIM Market of the

London Stock Exchange ("Admission"). Admission is expected to

occur, and dealings in the New Ordinary Shares commence, on or

around 8.00 a.m. on 7 October 2021.

Furthermore, in addition to the Capital Raising, the Company is

to provide other investors who may not have taken part in the

Capital Raising with the opportunity to participate in the issue by

the Company of new Ordinary Shares at the Issue Price via

PrimaryBid (the "PrimaryBid Offer"). A separate announcement is

expected to be made by the Company shortly following this

Announcement regarding the PrimaryBid Offer and its terms.

Capital Raising Highlights:

-- Conditional Capital Raising to raise US$18.5 million through

the issue of 2,176,471 New Ordinary Shares at the Issue Price of

US$8.50 per share.

-- Alexander Selegenev, an Executive Director of the Company,

and certain members of the Company's founding management and their

connected persons have conditionally subscribed for, in aggregate,

US$5.1 million pursuant to the Subscription.

-- The net proceeds of the Capital Raising will be deployed by

the Company towards its pipeline of new and potential follow-on

investments in accordance with its stated investment policy.

-- PrimaryBid Offer to provide investors who may not have taken

part in the Capital Raising with the opportunity to participate in

the issue by the Company in new Ordinary Shares at the Issue Price

pursuant to the PrimaryBid Offer, which shall remain open until 12

noon on 4 October 2021. The Capital Raising is not conditional upon

the PrimaryBid Offer.

-- The Issue Price equates to a 7.6 per cent. discount to the

closing middle market price per Ordinary Share of US$9.20 on 30

September 2021 (being the latest practicable date prior to the

publication of this Announcement) and a premium of 13.5 per cent.

to the Company's unaudited net asset value per share of US$7.49 as

at 30 June 2021.

-- Cenkos Securities plc ("Cenkos") acted as Lead Broker and

Bookrunner and Hybridan LLP ("Hybridan" and together with Cenkos,

the "Joint Brokers") acted as Joint Broker, in respect of the

Placing.

-- The New Ordinary Shares will represent 6.9 per cent. of the

Company's issued share capital as enlarged by the Capital Raising

(the "Enlarged Share Capital").

Total Voting Rights

Following Admission, assuming no further shares are issued

pursuant to the PrimaryBid Offer, the Company's Enlarged Share

Capital will comprise 31,362,302 Ordinary Shares, with voting

rights. The Company does not hold any Ordinary Shares in treasury.

Accordingly, on Admission, assuming no further shares are issued

pursuant to the PrimaryBid Offer, the total number of Ordinary

Shares in the Company with voting rights will be 31,362,302

Ordinary Shares and shareholders may use this figure as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or change to their

interest in, the share capital of the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Alexander Selegenev, Executive Director of TMT, commented :

"I am delighted with the continued support we have received from

our existing shareholders and to welcome our new shareholders who

have demonstrated their belief in our investment strategy. With the

proceeds of this fundraising, completed at a premium to the

Company's most recently reported NAV, we look forward to continuing

our investment programme through the pursuit of exciting new

companies and further investment into our strong existing portfolio

as and when funding opportunities arise."

For further information contact :

TMT Investments Plc +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited (Nominated

Adviser)

James Bellman / James Dance +44 (0)20 7409 3494

Cenkos Securities plc (Lead Broker

and Bookrunner)

Ben Jeynes / George Lawson - Corporate

Finance

Michael Johnson - Sales +44 (0)20 7397 8900

Hybridan LLP (Joint Broker)

Claire Louise Noyce

Niall Pearson - Sales +44 (0)20 3764 2341

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 (as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018). Upon the publication of this Announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

The person responsible for arranging the release of this

Announcement on behalf of the Company is Alexander Selegenev, a

director of the Company.

About TMT Investments Plc

TMT Investments Plc invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has a current investment portfolio of over 45 companies

and unaudited net assets of US$218 million as at 30 June 2021. The

Company's objective is to generate an attractive rate of return for

shareholders, predominantly through capital appreciation. The

Company is traded on the AIM market of the London Stock Exchange.

www.tmtinvestments.com .

BACKGROUND TO AND REASONS FOR THE CAPITAL RAISING

As announced by the Company on 18 August 2021, the Company saw

further positive progress across its portfolio during the six

months to 30 June 2021. In addition to a number of existing

portfolio companies raising additional equity capital at higher

valuations during the period, further validating their business

models, TMT made a total of 13 new investments (US$14.1 million) in

new and existing portfolio companies in the first half of the

year.

Since 30 June 2021, the Company has made a further 12

investments (totalling US$13.0 million) in new and existing

companies and the Company had unaudited cash reserves of US$11.2

million as at 16 September 2021.

As a leading AIM-quoted venture capital company investing in

high-growth private companies in the technology sector, the Company

continues to grow a pipeline of attractive potential investment

opportunities and the net proceeds of the Capital Raising of

approximately US$17.8 million, together with any additional

proceeds raised pursuant to the PrimaryBid Offer, will provide the

Company with additional cash resources to continue the Company's

investment programme.

DETAILS OF THE PLACING AGREEMENT

The Capital Raising is conditional, inter alia, upon the placing

agreement (the "Placing Agreement") entered into between the

Company and the Joint Brokers becoming unconditional in all

respects.

Pursuant to the terms of the Placing Agreement, Cenkos and

Hybridan have conditionally agreed to use their respective

reasonable endeavours, as agents for the Company, to place the

Placing Shares at the Issue Price with certain institutional and

other investors. The Placing has not been underwritten. The Placing

Agreement is conditional upon, inter alia Admission becoming

effective by not later than 8.00 a.m. on 7 October 2021 (or such

later date as is agreed between the Company, Cenkos and Hybridan,

being not later than 8.00 a.m. on 31 October 2021).

The Placing Agreement contains warranties from the Company in

favour of the Joint Brokers in relation to, inter alia, the

accuracy of the information in this Announcement and other matters

relating to the Company and its business. In addition, the Company

has agreed to indemnify the Joint Brokers in relation to certain

liabilities they may incur in respect of the Placing. The Joint

Brokers have the right to terminate the Placing Agreement in

certain circumstances prior to Admission, in particular, in the

event of a breach of the warranties given to the Joint Brokers in

the Placing Agreement, the failure of the Company to comply with

its obligations under the Placing Agreement, the occurrence of a

force majeure event or a material adverse change affecting the

condition, or the earnings, management business, affairs, solvency

or prospects of the Company as a whole.

DETAILS OF THE SUBSCRIPTION AND CONCERT PARTY HOLDINGS

The Subscription

The following shareholders have conditionally agreed to

subscribe for Subscription Shares at the Issue Price pursuant to

the Subscription in the following amounts:

Shareholder Number of Subscription Shares subscribed for

Macmillan Trading Company Limited (1) 158,373

---------------------------------------------

Alexander Selegenev (2) 23,612

---------------------------------------------

Artemii Iniutin 138,938

---------------------------------------------

German Kaplun 138,938

---------------------------------------------

Alexander Morgulchik 138,938

---------------------------------------------

Notes:

1. Macmillan Trading Company Limited is an entity in which

Alexander Morgulchik (45.05%), German Kaplun (29.98%) and Artemii

Iniutin (17.78%) each have beneficial interests. Details of the

resultant beneficial interests of Messrs Morgulchik, Kaplun and

Iniutin are set out below.

2. Alexander Selegnev's resultant holding following the issue of

the Subscription Shares will be 62,812 Ordinary Shares,

representing 0.2 per cent. of the Enlarged Share Capital.

Related Party Transactions

Alexander Selegenev is a Director of the Company, and Macmillan

Trading Company Limited ("Macmillan"), Artemii Iniutin, German

Kaplun and Alexander Morgulchik are substantial shareholders in the

Company with beneficial interests of more than 10 per cent. in the

share capital of the Company. Accordingly, Macmillan and Messrs

Selegenev, Iniutin, Kaplun and Morgulchik are deemed to be related

parties of the Company pursuant to the AIM Rules for Companies and

their respective participations in the Subscription constitute a

related party transaction for the purposes of Rule 13 of the AIM

Rules for Companies.

The independent directors of the Company for the purposes of the

Subscription, being Yuri Mostovoy, James Mullins and Petr Lanin,

consider, having consulted with Strand Hanson Limited, the

Company's nominated adviser, that the terms of the Subscription are

fair and reasonable insofar as the Company's shareholders are

concerned.

Concert Party Holdings

On Admission, assuming no further Ordinary Shares are issued

pursuant to the PrimaryBid Offer , the shareholdings in the Company

of the members of the concert party which currently exists in the

Company (the "Concert Party"), as defined in the City Code on

Takeovers and Mergers (the "Code"), will be as follows (based on

the latest information available to the Company and assuming no

other changes in the shareholdings of the members of the Concert

Party):

Shareholder (legal holder) Beneficial holder No. of Ordinary Shares % of issued share capital

(if different to legal holder)

Alexander Morgulchik 45.05%,

German Kaplun 29.28%, Artemii

Iniutin 17.78%, Nelli

Macmillan Trading Company Morgulchik

Limited 7.88% 6,975,436 22.24%

------------------------------- ----------------------- --------------------------

Wissey Trade & Invest Ltd Andrey Kareev 5,000,000 15.94%

------------------------------- ----------------------- --------------------------

Ramify Consulting Corp. German Kaplun 4,728,576 15.08%

------------------------------- ----------------------- --------------------------

Merit Systems Inc. Artemii Iniutin 2,054,865 6.55%

------------------------------- ----------------------- --------------------------

Eclectic Capital Limited Nika Kirpichenko 1,800,000 5.74%

------------------------------- ----------------------- --------------------------

Menostar Holdings Limited Dmitry Kirpichenko 1,790,000 5.71%

------------------------------- ----------------------- --------------------------

Natalia Inyutina (Adult

daughter of Artemii Iniutin) - 727,156 2.32%

------------------------------- ----------------------- --------------------------

Artemii Iniutin - 380,877 1.21%

------------------------------- ----------------------- --------------------------

Vlada Kaplun (Adult Daughter of

German Kaplun) - 363,578 1.16%

------------------------------- ----------------------- --------------------------

Marina Kedrova (Adult Daughter

of German Kaplun) - 363,578 1.16%

------------------------------- ----------------------- --------------------------

German Kaplun - 138,938 0.44%

------------------------------- ----------------------- --------------------------

Alexander Morqulchik - 138,938 0.44%

------------------------------- ----------------------- --------------------------

Total - 24,461,942 78.00%

------------------------------- ----------------------- --------------------------

On Admission, assuming no further Ordinary Shares are issued

pursuant to the PrimaryBid Offer , the total direct and indirect

interest in TMT by the beneficial holders within the Concert Party

will be as follows (assuming that no other changes in shareholdings

of the members of the Concert Party take place prior to

Admission):

Beneficial holder No. of Ordinary Shares % of issued share capital

German Kaplun 6,910,172 22.03%

----------------------- --------------------------

Andrey Gareev 5,000,000 15.94%

----------------------- --------------------------

Alexander Morgulchik 3,281,381 10.46%

----------------------- --------------------------

Artemii Iniutin 3,676,194 11.72%

----------------------- --------------------------

Nika Kirpichenko 1,800,000 5.74%

----------------------- --------------------------

Dmitry Kirpichenko 1,790,000 5.71%

----------------------- --------------------------

Natalia Inyutina 727,156 2.32%

----------------------- --------------------------

Nelli Morgulchik 549,883 1.75%

----------------------- --------------------------

Vlada Kaplun 363,578 1.16%

----------------------- --------------------------

Marina Kedrova 363,578 1.16%

----------------------- --------------------------

Total 24,461,942 78.00%

----------------------- --------------------------

DETAILS OF THE PRIMARYBID OFFER

The PrimaryBid Offer will allow investors to participate in the

issue by the Company in new Ordinary Shares at the Issue Price by

subscribing via PrimaryBid.com.

The PrimaryBid Offer will be conditional on the Capital Raising

becoming unconditional in all respects.

Any new Ordinary Shares to be issued pursuant to the PrimaryBid

Offer (the "PrimaryBid Offer Shares") will be free of all liens,

charges and encumbrances and will, when issued and fully paid, rank

pari passu, in all respects with the Company's existing issued

Ordinary Shares, including the right to receive dividends and other

distributions declared following Admission.

A maximum of approximately US$1.5 million will be raised

pursuant to the PrimaryBid Offer through the issue of a maximum of

176,470 PrimaryBid Offer Shares.

The PrimaryBid Offer will not be underwritten and will be closed

at 12 noon on 4 October 2021 (or earlier, subject to the terms of

the PrimaryBid Offer).

The PrimaryBid Offer will be offered under the exemptions

against the need for a prospectus allowed under the Prospectus

Regulation Rules of the Financial Conduct Authority (the

"Prospectus Regulation Rules"). As such, the Company is not

required to publish a prospectus pursuant to the Prospectus

Regulation Rules.

A further announcement will be made shortly by the Company

regarding further details of the PrimaryBid Offer and how investors

may participate.

Investors should make their own investigations into the merits

of an investment in the Company.

It should be noted that a subscription for PrimaryBid Offer

Shares and investment in the Company carries a number of risks.

Investors should consider the risk factors set out on

PrimaryBid.com before making a decision to subscribe for PrimaryBid

Offer Shares. Investors should take independent advice from a

person experienced in advising on investment in securities such as

the PrimaryBid Offer Shares if they are in any doubt.

Important notices

The distribution of this Announcement and any other

documentation associated with the Capital Raising into

jurisdictions other than the United Kingdom may be restricted by

law. Persons into whose possession these documents come should

inform themselves about and observe any such restrictions. Any

failure to comply with these restrictions may constitute a

violation of the securities laws or regulations of any such

jurisdiction. In particular, such documents should not be

distributed, forwarded to or transmitted, directly or indirectly,

in whole or in part, in, into or from the United States, Australia,

Canada, Japan or the Republic of South Africa or any other

jurisdiction where to do so may constitute a violation of the

securities laws or regulations of any such jurisdiction (each a

"Restricted Jurisdiction" ).

The New Ordinary Shares have not been and will not be registered

under the US Securities Act 1933 (as amended) (the "US Securities

Act" ) or with any securities regulatory authority of any state or

other jurisdiction of the United States and, accordingly, may not

be offered, sold, resold, taken up, transferred, delivered or

distributed, directly or indirectly, within the United States

except in reliance on an exemption from the registration

requirements of the US Securities Act and in compliance with any

applicable securities laws of any state or other jurisdiction of

the United States.

There will be no public offer of the New Ordinary Shares in the

United States. The New Ordinary Shares are being offered and sold

outside the US in reliance on Regulation S under the US Securities

Act. The New Ordinary Shares have not been approved or disapproved

by the US Securities and Exchange Commission, any state securities

commission in the US or any other US regulatory authority, nor have

any of the foregoing authorities passed upon or endorsed the merits

of the offering of the New Ordinary Shares or the accuracy or

adequacy of this Announcement. Any representation to the contrary

is a criminal offence in the US.

The New Ordinary Shares have not been and will not be registered

under the relevant laws of any state, province or territory of any

Restricted Jurisdiction and may not be offered, sold, resold, taken

up, transferred, delivered or distributed, directly or indirectly,

within any Restricted Jurisdiction except pursuant to an applicable

exemption from registration requirements. There will be no public

offer of New Ordinary Shares in Australia, Canada, Japan, or the

Republic of South Africa.

This Announcement is for information purposes only and does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in any jurisdiction and should not be relied upon in

connection with any decision to subscribe for or acquire any of the

New Ordinary Shares. In particular, this Announcement does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in the United States.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No person has been authorised to

give any information or to make any representations other than

those contained in this Announcement and, if given or made, such

information or representations must not be relied on as having been

authorised by the Company or the Joint Brokers. Subject to the AIM

Rules for Companies, the issue of this Announcement shall not, in

any circumstances, create any implication that there has been no

change in the affairs of the Company since the date of this

Announcement or that the information contained in it is correct at

any subsequent date.

Cenkos, which is authorised and regulated in the United Kingdom

by the Financial Conduct Authority, is acting exclusively for the

Company and no one else in connection with the Capital Raising and

will not regard any other person (whether or not a recipient of

this Announcement) as a client in relation to the Capital Raising

and will not be responsible to anyone other than the Company for

providing the protections afforded to its clients or for providing

advice in relation to the Capital Raising or any matters referred

to in this Announcement.

Hybridan, which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority, is acting exclusively

for the Company and no one else in connection with the Capital

Raising and will not regard any other person (whether or not a

recipient of this Announcement) as a client in relation to the

Capital Raising and will not be responsible to anyone other than

the Company for providing the protections afforded to its clients

or for providing advice in relation to the Capital Raising or any

matters referred to in this Announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed on the Joint Brokers by the Financial Services and

Markets Act 2000 or the regulatory regime established thereunder,

neither of the Joint Brokers accepts any responsibility whatsoever

for the contents of this Announcement, and makes no representation

or warranty, express or implied, for the contents of this

Announcement, including its accuracy, completeness or verification,

or for any other statement made or purported to be made by it, or

on its behalf, in connection with the Company or the New Ordinary

Shares or the Capital Raising, and nothing in this Announcement is

or shall be relied upon as, a promise or representation in this

respect whether as to the past or future. The Joint Brokers

accordingly disclaim to the fullest extent permitted by law all and

any liability whether arising in tort, contract or otherwise (save

as referred to above) which it might otherwise have in respect of

this Announcement or any such statement.

No statement in this Announcement is intended to be a profit

forecast or profit estimate for any period and no statement in this

Announcement should be interpreted to mean that earnings or

earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings or earnings per share of the Company.

This Announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this Announcement and include statements

regarding the Directors' current intentions, beliefs or

expectations concerning, among other things, the Company's results

of operations, financial condition, liquidity, prospects, growth,

strategies and the Company's markets. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. Actual results and

developments could differ materially from those expressed or

implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this Announcement are based on

certain factors and assumptions, including the Directors' current

view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. Whilst the Directors

consider these assumptions to be reasonable based upon information

currently available, they may prove to be incorrect. Save as

required by applicable law or by the AIM Rules for Companies, the

Company undertakes no obligation to release publicly the results of

any revisions to any forward-looking statements in this

Announcement that may occur due to any change in the Directors'

expectations or to reflect events or circumstances after the date

of this Announcement.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within of Chapter 3 of the FCA Handbook Production

Intervention and Product Governance Sourcebook (the "UK Product

Governance Requirements"), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the UK Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that such securities are: (i) compatible with an end

target market of investors who meet the criteria of retail

investors and investors who meet the criteria of professional

clients and eligible counterparties, each as defined in paragraph 3

of the FCA Handbook Conduct of Business Sourcebook; and (ii)

eligible for distribution through all distribution channels (the

"Target Market Assessment"). Notwithstanding the Target Market

Assessment, distributors (for the purposes of UK Product Governance

Requirements) should note that: (a) the price of the Placing Shares

may decline and investors could lose all or part of their

investment; (b) the Placing Shares offer no guaranteed income and

no capital protection; and (c) an investment in the Placing Shares

is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction

with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have

sufficient resources to be able to bear any losses that may result

therefrom. The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the Target Market Assessment, the Joint

Brokers will only procure investors who meet the criteria of

professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Chapter 9A or 10A respectively of the FCA

Handbook Conduct of Business Sourcebook; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the Placing

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Neither the content of the Company's website nor any website

accessible by hyperlinks to the Company's website is incorporated

in, or forms part of, this Announcement.

Certain figures contained in this Announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this Announcement may not conform exactly

with the total figure given.

All references to time in this Announcement are to London time,

unless otherwise stated.

PDMR NOTIFICATION FORMS

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name German Kaplun

--------------------------------- ----------------------------------------------------

2 Reason for the notification

---------------------------------------------------------------------------------------

a) Position/status PDMR (Head of Strategy)

--------------------------------- ----------------------------------------------------

b) Initial notification Initial notification

/Amendment

--------------------------------- ----------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------------------

a) Name TMT Investments Plc

--------------------------------- ----------------------------------------------------

b) LEI 213800UGZLGI4R6YW964

--------------------------------- ----------------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---------------------------------------------------------------------------------------

a) Description of the Ordinary shares of no par value each

financial instrument,

type of instrument

Identification code JE00B3RQZ289

b) Nature of the transaction a direct and indirect (via MacMillan Trading

Company Limited ("MacMillan")) participation

in a subscription for new ordinary shares

in the issuer

--------------------------------- ----------------------------------------------------

c) Price(s) and volume(s)

Price(s) Volume(s)

US$ 8.50 138,938

-------------------------------------------------------- ------------------------------

US$ 8.50 158,373 (via

MacMillan, in

which Mr Kaplun

has a 29.28%

interest)

-------------------------------------------------------- ------------------------------

d) Aggregated information

- Aggregated volume 297,311 ordinary shares

- Price US$ 8.50 per share

e) Date of the transaction 1 October 2021

--------------------------------- ----------------------------------------------------

f) Place of the transaction Outside of a trading venue

--------------------------------- ----------------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Artemii Iniutin

-------------------------------- -----------------------------------------------

2 Reason for the notification

---------------------------------------------------------------------------------

a) Position/status PDMR (Head of Investments)

-------------------------------- -----------------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------------- -----------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------------

a) Name TMT Investments Plc

-------------------------------- -----------------------------------------------

b) LEI 213800UGZLGI4R6YW964

-------------------------------- -----------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---------------------------------------------------------------------------------

a) Description of the Ordinary shares of no par value each

financial instrument,

type of instrument

Identification code JE00B3RQZ289

b) Nature of the transaction a direct and indirect (via MacMillan

Trading Company Limited ("MacMillan"))

participation in a subscription for new

ordinary shares in the issuer

-------------------------------- -----------------------------------------------

c) Price(s) and volume(s)

Price(s) Volume(s)

US$ 8.50 138,938

----------------------------------------------------- ---------------------------

US$ 8.50 158,373 (via

MacMillan, in

which Mr Iniutin

has a 17.78%

interest)

----------------------------------------------------- ---------------------------

d) Aggregated information

- Aggregated volume 297,311 ordinary shares

- Price US$ 8.50 per share

e) Date of the transaction 1 October 2021

-------------------------------- -----------------------------------------------

f) Place of the transaction Outside of a trading venue

-------------------------------- -----------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Alexander Morgulchik

---------------------------------- ----------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------------------

a) Position/status PDMR (Head of Business Development)

---------------------------------- ----------------------------------------------

b) Initial notification Initial notification

/Amendment

---------------------------------- ----------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------------

a) Name TMT Investments Plc

---------------------------------- ----------------------------------------------

b) LEI 213800UGZLGI4R6YW964

---------------------------------- ----------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------------------

a) Description of the Ordinary shares of no par value each

financial instrument,

type of instrument

Identification code JE00B3RQZ289

b) Nature of the transaction a direct and indirect (via MacMillan

Trading Company Limited ("MacMillan"))

participation in a subscription for

new ordinary shares in the issuer

---------------------------------- ----------------------------------------------

c) Price(s) and volume(s)

Price(s) Volume(s)

US$ 8.50 138,938

---------------------------------------------------------- -----------------------

US$ 8.50 158,373 (via

MacMillan,

in which Mr

Morgulchik

has a 45.05%

interest)

---------------------------------------------------------- -----------------------

d) Aggregated information

- Aggregated volume 297,311 ordinary shares ordinary shares

- Price US$ 8.50 per share

e) Date of the transaction 1 October 2021

---------------------------------- ----------------------------------------------

f) Place of the transaction Outside of a trading venue

---------------------------------- ----------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Alexander Selegenev

------------------------------------- -------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------------------

a) Position/status A director of the Company

------------------------------------- -------------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------------- -------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------------

a) Name TMT Investments Plc

------------------------------------- -------------------------------------------

b) LEI 213800UGZLGI4R6YW964

------------------------------------- -------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------------------

a) Description of the Ordinary shares of no par value each

financial instrument,

type of instrument

Identification code JE00B3RQZ289

b) Nature of the transaction Subscription for new ordinary shares

in the issuer

------------------------------------- -------------------------------------------

c) Price(s) and volume(s)

Price(s) Volume(s)

US$ 8.50 23,612

--------------------------------------------------------------- ------------------

d) Aggregated information

- Aggregated volume 23,612 ordinary shares

- Price US$ 8.50 per share

e) Date of the transaction 1 October 2021

------------------------------------- -------------------------------------------

f) Place of the transaction Outside of a trading venue

------------------------------------- -------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFLFLEITLLIIL

(END) Dow Jones Newswires

October 01, 2021 11:29 ET (15:29 GMT)

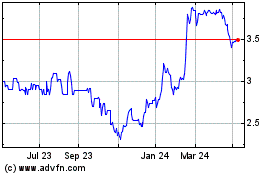

Tmt Investments (LSE:TMT)

Historical Stock Chart

From Jan 2025 to Feb 2025

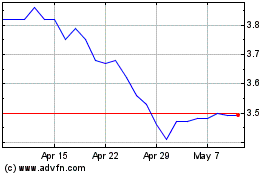

Tmt Investments (LSE:TMT)

Historical Stock Chart

From Feb 2024 to Feb 2025