TIDMUKR

RNS Number : 5049A

Ukrproduct Group Ltd

30 September 2020

30 September 2020

UKRPRODUCT GROUP LIMITED

("Ukrproduct", the "Company" or, together with its subsidiaries,

the "Group")

U N A U DIT E D I N TERIM F I NANC I AL RE S UL T S F OR THE S

IX M ONTHS EN D ED 30 J U NE 20 20

Ukrproduct Group Limited (AIM:UKR), one of the leading Ukrainian

producers and distributors of branded dairy foods and beverages

(kvass), today announces its unaudited interim financial results

for the six months ended 30 June 2020.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

For further information contact:

Ukrproduct Group Ltd

Jack Rowell, Non-Executive Chairman Tel: +380 44 232 9602

Alexander Slipchuk, Chief Executive www.ukrproduct.com

Officer

Strand Hanson Limited

Nominated Adviser and Broker Tel: + 44 20 7409 3494

Rory Murphy, James Dance, Jack Botros www.strandhanson.co.uk

Chairman and Chief Executive Statement

Ukrproduct, one of the leading Ukrainian producers and

distributors of branded dairy foods and beverages (kvass), is

pleased to announce its interim results for the half year ended 30

June 2020 ("1H 2020") and outlook for 2020.

1H 2020 financial highlights

-- Revenue increased by 24% to GBP27.5 million (1H 2019: GBP22.2 million)

-- Gross profit increased by 1 5 % to GBP2. 2 million (1H 2019: GBP1.9 million)

-- Operating profit increased by 2 3 % to GBP0.49 million (1H 2019: 0. 4 million)

-- EBITDA margin decreased to 2. 8 % (1H 2019: 3%)

-- Net foreign exchange loss of GBP0.67 million (1H2019: gain GBP0.59 million)

-- Loss after tax of GBP0.4 2 million (1H 2019: Profit GBP0.74 million)

1H 2020 Trading Update

Overall, the Ukrainian economy, in the first half of 2020, faced

decline caused by COVID-19 related quarantine measures. The

restrictions had an impact on services in general, resulted in a

significant fall in investment, deepened the decline in consumer

spending. This was primarily due to the difficult fiscal situation

and weaker growth in private consumption and exports amid weakening

external demand. According to National Bank of Ukraine, the economy

will contract by 6% in 2020. Despite the coronavirus crisis,

consumer spending has continued to rise, including on essential

goods. However, consumer behavior has changed on the back of the

prevailing economic uncertainty, which has caused an increase in

the consumption of cheaper products rather than premium ones.

Nevertheless, in this challenging operating environment, for 1H

2020, the Group is pleased to report improved revenue of

approximately GBP27.5 million, which is an increase of 24% compared

with the 6 months to 30 June 2019 ("1H 2019"). Overall for 2020,

the Group plans to report improved revenue when compared to

2019.

Operating profit increased by 2 3% to approximately GBP0.49

million. The Group`s ongoing pursuit to deliver cost efficiencies

helped to improve 1H 2020 gross profit by 1 5 % against 1H 2019,

however these results are below the Company's pre-COVID quarantine

expectations at the beginning of the year.

Financial position

Ukrproduct report ed net assets of GBP2.6 million as at 30 June

2020, including cash balances of GBP0.3 9 million.

During 2020, the Group continued to breach certain loan

covenants in relation to the EBRD debt. However, the Company

continued to settle certain amounts to EBRD according to an agreed

schedule. The Directors are confident that EBRD will not demand

accelerated repayment of the loan due to breach of covenants.

Outlook for 2020

Overall, the business environment in Ukraine in general and in

the food industry in particular has been recovering since

quarantine restrictions were eased. The Group's management is

seeking further improvements and efficiencies in order to improve

the Group results in 2H 2020. The financial result is negatively

affected by the decline of protein prices in the world market,

however, the Group compensates these losses by increasing sales and

market share for processed cheese, butter, spreads and implementing

cost cutting projects. Though the Group expects to report improved

operating results and profit from operations for 2020, the net

profitability performance is still difficult to predict due to the

volatile local currency (UAH) exchange rate.

Statement of Management's Responsibilities

for preparation and approval of condensed consolidated interim

financial statements for the six months ended 30 June 20 20

The directors are responsible for the preparation of the

condensed consolidated interim financial statements in accordance

with applicable Jersey law and other regulations and enactments in

force at the time. The Companies (Jersey) Law 1991 as amended

requires the directors to prepare financial statements for each

year in accordance with Generally Accepted Accounting

Principles.

The directors of the Group are responsible for preparing the

condensed consolidated interim financial statements which reflect

in all material aspects the financial position of the Group as at

30 June 2020, as well as the results of its activities, cash flows

and changes in equity for the six months then ended in accordance

with International Financial Reporting Standards (IFRS) as adopted

by the European Union.

In preparing condensed consolidated interim financial statements

the Group's Management is responsible for:

- selecting appropriate accounting policies and their consistent application ;

- making reasonable measurement and calculation ;

- following principles of IFRS as adopted by the European Union

or disclosing all considerable deviations from IFRS in the notes to

condensed consolidated interim financial statements;

- preparing condensed consolidated interim financial statements

of the Group on the going concern basis, except for the cases when

such assumption is not appropriate .

The board of directors confirms that the Group has complied with

the abovementioned requirements in preparing its condensed

consolidated interim financial statements.

The directors are also responsible for:

- implementing and maintaining an efficient and reliable system

of internal controls in the Group ;

- keeping accounting records in compliance with the legislation

and accounting standards of the respective country of the Group's

registration;

- taking reasonable steps within its cognizance to safeguard the

assets of the Group ;

- detecting and preventing from fraud and other

irregularities.

These condensed consolidated interim financial statements as at

3 0 June 2020 prepared in compliance with IFRS as approved by the

European Union are approved on behalf of the Group's Directors on 2

9 September 2020.

Management Statements

This statement is provided to confirm that, to the best of our

knowledge, the condensed consolidated interim financial statements

for the six months ended 30 June 2020, and the comparable

information, have been prepared in compliance with International

Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board and as adopted by the European Union and

give a true, fair and clear view of Group's assets, financial

standing and net results.

Single Management Report

1. Operational and Financial Results

The following table sets forth the Group's results of operations

derived from the condensed consolidated interim financial

statements:

Six months Six months Changes

ended ended in

--------

3 0 June 20 30 June 201

20 9

------------ ------------ --------

GBP '000 GBP '000 %

------------ ------------ --------

Revenue 27 523 22 236 24%

Cost of sales (25 308) ( 20 310 ) 25%

------------ ------------ --------

GROSS PROFIT 2 215 1 926 15%

Administrative expenses (576) ( 534 ) 8%

Selling and distribution expenses (1 158) ( 943 ) 23%

Other operating incomes /(

expenses ) 5 ( 53 ) -109%

------------ ------------ --------

PROFIT FROM OPERATIONS 486 396 23%

Net finance expenses (253) ( 265 ) -4%

Net foreign exchange ( loss

) gain (673) 592 -214%

------------ ------------ --------

PROFIT BEFORE TAXATION (440) 723 -1 61 %

Income tax ( expense ) / credit 19 1 7 12%

------------ ------------ --------

( LOSS ) / PROFIT FOR THE

SIX MONTHS (421) 740 -157%

============ ============ ========

Attributable to:

Owners of the Parent (421) 740 -157%

Non-controlling interests - -

Earnings per share:

Basic (pence) (1,06) 1 ,8 6

Diluted (pence) (1,06) 1 , 86

OTHER COMPREHENSIVE INCOME:

Items that may be subsequently

reclassified to profit or

loss

Currency translation differences (167) ( 332 ) -50%

Items that will not be reclassified

to profit or loss

OTHER COMPREHENSIVE INCOME,

NET OF TAX (167) (3 32 ) -50%

------------ ------------ --------

TOTAL COMPREHENSIVE INCOME

FOR THE SIX MONTHS (588) 408 -244%

============ ============ ========

Attributable to:

Owners of the Parent (588) 408 -244%

Non-controlling interests - -

Non-IFRS financial information

The Group's results are reported under International Financial

Reporting Standards (IFRS). However, the Group uses Non-IFRS

measures including earnings before interest and taxes (EBIT) and

earnings before interest, taxes, depreciation and amortisation

(EBITDA) which are used to measure segment performance. Non-IFRS

measures have not been subject to audit or review.

The Group uses EBIT and EBITDA as key measures of its

performance.

EBIT is an indicator of a Group`s profitability, calculated as

revenue less expenses, the latter excluding tax and interest. To

external users, EBIT provides information on the Group's ability to

generate earnings directly from its operations, disregarding its

cost of capital and the tax burden and thus making the Group's

results comparable to similar companies across the industry where

those companies may have varying capital structures or tax

environments. To the management, EBIT provides a performance

measure additionally adjusted for expenses that may be deemed fixed

(i.e. stemming from the given capital structure) or externally

imposed by the environment (i.e. the tax burden).

Six months ended Six months ended

30 June 20 20 30 June 201 9

----------------- -----------------

GBP '000 GBP '000

----------------- -----------------

CONTINUING OPERATIONS

Revenue for the period 27 523 22 236

Cost of sales ( 25 308 ) ( 20 310 )

Operating expenses ( 1729 ) (1530)

----------------- -----------------

EBIT 486 396

================= =================

EBITDA is calculated as revenue less expenses, the latter

excluding tax, interest, depreciation and amortisation. Being a

proxy to the operating cash flow before working capital changes,

EBITDA is widely used as an indicator of a company's ability to

generate cash flows, as well as its ability to service debt.

Consequently, to the management, EBITDA serves as a measure to

estimate financial stability of the Group. Besides, excluding the

effect of depreciation and amortisation, along with cost of capital

and taxation, provides to external users another measure to compare

to similar companies, regardless of varying tax environments,

capital structures or depreciation accounting policies.

Six months ended Six months ended

30 June 20 20 30 June 201 9

----------------- -----------------

GBP '000 GBP '000

----------------- -----------------

CONTINUING OPERATIONS

EBIT 486 39 6

Depreciation and amortization 297 278

----------------- -----------------

EBITDA 783 674

================= =================

Revenue

The Group's revenue from sales of finished products increased by

37% in 1H 2020 in comparison with previous period.

The most significant portion of the Group's revenue comes from

selling packaged butter and supplementary products, which

represented 51.9% in the first half of 2020 and 57.2% in first half

of 2019 of total revenue for the relevant periods.

Cost of sales

The Group's cost of sales increased to GBP 2 5 .3 million in the

current period from GBP 20.3 million in previous period. The

following table sets forth the principal components of the Group's

cost of sales for the periods indicated:

Six months Six months Changes

ended ended in

--------

30 June 20 30 June 201

20 9

----------- ------------ --------

GBP '000 GBP '000 %

----------- ------------ --------

Raw materials 15 293 11 787 30%

Supplementary products 5 590 5 951 -6%

Manufacturing overhead 2 117 1 016 108%

Wages and salaries 1 173 552 113%

Transport 670 532 26%

Fuel and energy supply 537 620 -13%

Depreciation and amortization 239 135 77%

Other expenses 29 84 -65%

Adjustments ( 340 ) (367) -7%

----------- ------------ --------

25 3 08 20 310 25%

=========== ============ ========

Gross profit/(loss)

The Group's gross profit increased to GBP 2.2 million in 1H 2020

from GBP 1.9 million of gross profit in 1H 2019.

Selling and distribution expenses

Selling and distribution expenses increased year-on-year to GBP

1.2 million in the current period from GBP 0.9 million in 1H 2019,

reflecting an increase in sales volume and delivery costs in

2020.

Net foreign exchange loss

In 1H 2020, the Group reports a net foreign exchange loss of GBP

0.7 million versus a net gain of GBP 0.6 million in the 1H

2019.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

FOR THE SIX MONTHSED 30 JUNE 2020

(in thousand GBP, unless otherwise stated)

Note Six months Six months

ended ended

3 0 June 2020 30 June 2019

-------------- -------------

GBP '000 GBP '000

-------------- -------------

Revenue 8 27 523 22 236

Cost of sales (25 308) ( 20 310 )

-------------- -------------

GROSS PROFIT 2 215 1 926

Administrative expenses (576) ( 534 )

Selling and distribution expenses (1 158) ( 943 )

Other operating expenses 5 ( 53 )

-------------- -------------

PROFIT FROM OPERATIONS 486 396

Net finance expenses (253) ( 2 65)

Net foreign exchange (loss)/gain (673) 592

-------------- -------------

(LOSS)/ PROFIT BEFORE TAXATION (440) 7 23

Income tax credit 19 1 7

-------------- -------------

(LOSS)/ PROFIT FOR THE SIX MONTHS (421) 740

============== =============

Attributable to:

Owners of the Parent (421) 7 40

Non-controlling interests - -

Earnings per share:

Basic (in pence) 9 (1,06) 1 ,8 7

Diluted (in pence) 9 (1,06) 1 , 8 7

OTHER COMPREHENSIVE INCOME:

Items that may be subsequently

reclassified to profit or loss

Currency translation differences (167) ( 3 32)

OTHER COMPREHENSIVE INCOME, NET

OF TAX (167) (332)

-------------- -------------

TOTAL COMPREHENSIVE INCOME FOR

THE SIX MONTHS (588) 408

============== =============

Attributable to:

Owners of the Parent (588) 408

Non-controlling interests - -

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL

POSITION

AS AT 30 JUNE 2020

(in thousand GBP, unless otherwise stated)

Note As at As at As at

-----

30 June 31 December 30 June

2020 2019 2019

----- --------- ------------ ---------

GBP '000 GBP '000 GBP '000

--------- ------------ ---------

ASSETS

Non-current assets

Property, plant and equipment 6 538 6 994 6 663

Intangible assets 546 493 504

Deferred tax assets - - -

7 084 7 487 7 167

Current assets

Inventories 6 6 386 5 071 4 713

Trade and other receivables 7 292 7 257 5 555

Current taxes 427 310 484

Other financial assets 32 31 26

Cash and cash equivalents 389 231 227

--------- ------------ ---------

14 526 12 900 11 005

--------- ------------ ---------

TOTAL ASSETS 21 610 20 387 18 172

========= ============ =========

EQUITY AND LIABILITIES

Equity attributable to owners

of the parent

Share capital 3 967 3 967 3 967

Share premium 4 56 2 4 56 2 4 562

(15 2 3

Translation reserve (14 904) (14 737) 4)

Revaluation reserve 3 348 3 437 3 538

Retained earnings 5 59 9 5 93 2 4 5 40

--------- ------------ ---------

2 572 3 160 1 372

Non-controlling interests - - -

--------- ------------ ---------

TOTAL EQUITY 2 572 3 160 1 372

Non-current Liabilities

Bank loans - - 5 170

Long-term payables - - 463

Liabilities of rent assets(LT) 50 69 -

Liabilities of rent assets(ST) - (1) -

Deferred tax liabilities 215 242 244

--------- ------------ ---------

265 310 5 877

Current liabilities

Bank loans 7 834 7 213 2 222

Short-term payables 441 -

Trade and other payables 10 907 9 245 8 673

Current income tax liabilities - - -

Other taxes payable 32 18 28

--------- ------------ ---------

18 773 16 917 10 923

--------- ------------ ---------

TOTAL LIABILITIES 19 038 17 227 16 800

--------- ------------ ---------

TOTAL EQUITY AND LIABILITIES 21 610 20 387 18 172

CONDENSED CONSOLIDATED INTERIM STATEMENT OF C HANGES IN

EQUITY

FOR THE SIX MONTHSED 30 JUNE 2020

(in thousand GBP, unless otherwise stated)

Attributable to owners of the parent Total Non-con-trolling Total

interests Equity

------ ----------------- --------

Share Share Revaluation Retained Translation

capital premium reserve earnings reserve

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

GBP GBP '000 GBP '000 GBP '000 GBP '000 GBP GBP '000 GBP

'000 '000 '000

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As At 1 January

201 9 3 967 4 562 3 619 3 718 (14 902) 964 - 964

Profit for

the six months - - - 740 - 740 - 740

Currency (3

translation (3 32 32 (3

differences - - - - ) ) - 32 )

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

Total

comprehensive (3 32

income - - - 740 ) 408 - 408

Depreciation

on revaluation

of property,

plant and

equipment - - (81) 81 - - - -

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As At 30 June 4 5 (15 2

201 9 3 967 4 562 3 538 3 9 34 ) 1 372 - 1 372

========= ========= ============ ========== ============ ====== ================= ========

Profit for

the six months - - - 1 291 - 1 291 - 1 291

Currency

translation

differences - - - - 497 497 - 497

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

Total

comprehensive

loss - - - 1 291 497 1 788 - 1 788

Depreciation

on revaluation

of property,

plant and

equipment - - (101) 101 - - - -

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As At 31 December

20 19 3 967 4 562 3 437 5 931 (14 737) 3 160 - 3 160

========= ========= ============ ========== ============ ====== ================= ========

Loss for the

six months - - - (421) - (421) - (421)

Currency

translation

differences - - - (167) (167) - (167)

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

Total

comprehensive

income - - - (421) (167) (588) - (588)

Depreciation

on revaluation

of property,

plant and

equipment - - (89) 89 - - - -

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As At 30 June 4 56 5 59

20 20 3 967 2 3 348 9 (14 904) 2 572 - 2 572

========= ========= ============ ========== ============ ====== ================= ========

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 20 20

(in thousand GBP, unless otherwise stated)

Six months ended Six months ended

3 0 June 2020 30 June 2019

----------------- -----------------

GBP '000 GBP '000

----------------- -----------------

Cash flows from operating activities

Profit before taxation (440) 7 23

Adjustments for:

Exchange difference 67 3 (592)

Depreciation and amortization 297 278

Loss on disposal of non-current assets 5 4

Write off of receivables/payables 1 (1)

Impairment of inventories 82 78

Interest income (1) -

Interest expense on bank loans 254 2 65

----------------- -----------------

Operating cash flow before working capital

changes 871 75 5

Increase in inventories (1 389) (1 05 7 )

Increase in trade and other receivables (143) (2 547)

Increase in trade and other payables 1 682 3 8 73

----------------- -----------------

Changes in working capital 150 269

----------------- -----------------

Cash generated from operations 1 021 1 024

Interest received 1 -

Income tax paid 5 (15)

----------------- -----------------

Net cash generated from operating activities 1 027 1 009

Cash flows from investing activities

Purchases of property, plant and equipment

and intangible assets (334) ( 124 )

Proceeds from sale of property, plant

and equipment 11 5

Repayments of loans issued (3) -

----------------- -----------------

Net cash used in investing activities (326) ( 119 )

Cash flows from financing activities

Interest paid (270) ( 250 )

Decrease in short term borrowing - (163)

Repayments of long term borrowing (42) ( 162 )

----------------- -----------------

Net cash used in from financing activities (312) (575)

Net increase in cash and cash equivalents 389 315

Effect of exchange rate changes on cash

and cash equivalents (231) (269)

----------------- -----------------

Cash and cash equivalents at the beginning

of the six months 231 181

Cash and cash equivalents at the end

of the six months 389 227

================= =================

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 20 20

(in thousand GBP, unless otherwise stated)

BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES

1. REPORTING ENTITY

Ukrproduct Group Limited ("the Company") is a public limited

liability company registered in Jersey with a registered office at

26 New Street, St Helier, Jersey, JE2 3RA, Channel Islands.

The Group's overall management and production facilities are

based in Ukraine, with the HQ in Kyiv. The Group commands leading

positions in the Ukrainian processed cheese and packaged butter

markets and owns a range of widely recognisable trademarks in

Ukraine, including "Nash Molochnik" (translated as Our Dairyman),

"Narodniy Product" (People's Product) "Molendam" and "Vershkova

Dolina" (Creamy Valley).

2. BASIS OF PREPARATION

(a) Statement of compliance

The unaudited condensed consolidated financial statements are

prepared in accordance with International Financial Reporting

Standards (IFRSs) as adopted by the European Union (EU). The

condensed consolidated financial information in this half yearly

report has been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting' (IAS 34), as

adopted by the EU, and the Disclosure Guidance and Transparency

Rules of the Financial Conduct Authority.

The interim financial statements are unaudited but have been

reviewed by the auditors.

The condensed consolidated financial statements have been

prepared on a historical cost basis, except for significant items

of property, plant and equipment which have been measured using

revaluation model. The consolidated financial statements are

presented in British Pounds Sterling (GBP) and all values are

rounded to the nearest thousand (GBP000) except where otherwise

indicated.

The accounting policies used and the methods of computation is

the same as those disclosed in the Group's recent annual

consolidated financial statements except for the adoption of new

and revised accounting standards as disclosed in Note 3.

The preparation of the unaudited condensed consolidated

financial statements requires management to make judgements,

estimates and assumptions that affect the application of policies

and reported amounts of assets and liabilities, income and

expenses. Actual results may differ from those estimates.

The Board has reviewed the Group's ongoing commitments for the

next twelve months and beyond.

The Board's review included the Group's strategic plans and

updated forecasts, capital position, liquidity and credit

facilities. Based on this review no material uncertainties that

would require disclosure have been identified in relation to the

ability of the Group to remain a going concern for at least the

next twelve months, from both the date of the Condensed

Consolidated Statement of Financial Position and the approval of

the Condensed Consolidated Financial Statements.

(a) Going concern

These condensed consolidated interim financial statements have

been prepared on a going concern basis, which envisages the

disposal of assets and the settlement of liabilities in the normal

course of business. The recoverability of Group's assets, as well

as the future operations of the Group, may be significantly

affected by the current and future economic environment.

EBRD covenants

The Board notified EBRD in advance on a breach of one of the

covenants of the loan agreement with EBRD during the first half of

2020. At the same time, EBRD noted that there was significant

progress in compliance with the covenants in general when compared

to the previous period. As such, EBRD has not demanded accelerated

repayment of the loan.

Impact of COVID-19 pandemic

The impact of COVID-2019 on the Group in 1H 2020 was not

material and the Group largely continued to operate as usual. The

management implemented a range of measures for preventing sickness

and spread of infection within the Group premises (including but

not limited to remote working, additional medical screenings,

corporate transportation to and from the workplaces, obligatory use

of protective masks etc.). Additionally the Group reorganised work

in its production facilities in smaller shifts to increase social

distance and to minimise potential spread of infection. So far, the

COVID-19 and respective quarantine impact on the Group's operations

has been limited. Looking ahead, whilst COVID-19 creates

significant economic uncertainty, the Group will continue to apply

acquired experience - most notably remote working - to streamline

and optimise certain administrative and operational processes.

Finally, though the Group faced net foreign exchange loss of GBP

0.67 million, the overall financial results were solid and the

Group generated positive cash flow from operating activities

totaling GBP 1.03 million. Accordingly, the management believes

that th e Group has reliable access to finance capable to support

growing sales and respective increase in working capital

requirements.

(b) Foreign currency translation

Functional and presentation currency

The Ukrainian Hryvnia is the currency of the primary economic

environment in which the majority of

the Group companies operate.

Items included in the financial statements of each of the

Group's companies are measured using the currency of the primary

economic environment in which the company operates ("the functional

currency"). For the companies operating in Cyprus and BVI the

functional currency is United States Dollars ("USD"). For the

Parent company, which is located in Jersey, the functional currency

is Pound Sterling ("GBP"). For the companies operating in Ukraine

the functional currency is Ukrainian Hryvnia ("UAH").

These condensed consolidated interim financial statements are

presented in the thousands of Pound Sterling ("GBP"), unless

otherwise indicated.

Foreign currency transactions and balances

Transactions in foreign currencies are initially recorded by the

Group entities at their respective functional currency rates

prevailing at the date of the transaction.

Monetary assets and liabilities denominated in foreign

currencies are retranslated at the functional currency spot rate of

exchange ruling at the reporting date.

Non-monetary items that are measured in terms of historical cost

in a foreign currency are translated using the exchange rates as at

the dates of the initial transactions. Non-monetary items measured

at fair value in a foreign currency are translated using the

exchange rates at the date when the fair value is determined.

The principal exchange rates used in the preparation of these

condensed consolidated interim financial statements are as

follows:

Currency 30 June Average for 31 December 30 June Average for

2020 the six months 201 9 2019 the six months

ended ended

(spot rate) 30 June (spot rate) (spot rate) 30 June

2020 2019

---------- ------------- ---------------- ------------- ------------- ----------------

UAH/GBP 33,08 33,47 31,02 33,18 34,87

UAH/USD 26,69 26,72 23,69 26,17 26,94

UAH/EUR 29,95 30,05 26,42 29,73 30,45

--------------- ------------- ---------------- ------------- ------------- ----------------

(c) Reclassification

Where applicable, comparatives have been adjusted to present

them on the same basis as current period figures.

(d) Rounding of amounts

Amounts in this financial report have, unless otherwise

indicated, been rounded to the nearest thousand pounds.

3. ADOPTION OF NEW AND REVISED ACCOUNTING STANDARDS

IFRS 16 'Leases'

IFRS 16 replaced the existing standard IAS 17 'Leases' with

effect from 1 January 2019. Its objective

is to ensure that lessees and lessors provide relevant

information in a manner that faithfully represent

lease transactions.

The Group elected to use the following practical expedients on

transition:

- Use of single discount rates to reflecting similar lease terms

and economic environments;

- Recognition exemptions for lease contracts that at the

transition date have a remaining lease term

of 12 months or less;

- Exclusion of initial direct costs from the measurement of the

right of use asset;

- The use of hindsight in determining the lease term for

contracts containing options to extend or terminate the lease;

Recognition and measurement

The lease liability is recognised at the inception of a lease as

the present value of the fixed and certain

variable lease payments, plus any guaranteed residual values,

any termination penalties if the lease term

assumes termination options will be exercised and the purchase

option value if it is reasonably certain

that it will be exercised.

Interest is accrued on the lease liability based on the discount

rate at commencement of the lease and is

accounted for in finance costs and subsequent payments are

deducted from the lease liability.

The right of use asset is initially measured as the value of the

lease liability, adjusted for any indirect

costs incurred to obtain the lease, restoration provisions and

any lease payments made before the commencement of the lease.

The right of use asset will be depreciated over the life of the

contract on a straight line basis.

Where the Group act as a lessor the lease will be classified as

a finance lease if it transfers substantially

all the risk and rewards incidental to ownership of the

underlying asset, or otherwise as an operating

lease.

An amendment to IFRS 16

The amendments with regard to COVID-19 are effective for annual

reporting periods beginning on or after June 1, 2020.

Nature and effect of amendment to IFRS 16

There are no significant impact on the Group's consolidated

financial statements.

4. ACCOUNTING STANDARDS ISSUED BUT NOT YET EFFECTIVE

IFRS 17 'Insurance Contracts'

The International Accounting Standards Board (IASB) issued IFRS

17 'Insurance Contracts' in May 2017 to replace IFRS 4 'Insurance

Contracts' for annual reporting periods beginning, at the latest,

on or after 1 January 2021. The IASB tentatively decided to defer

the effective date of IFRS 17 'Insurance Contracts' to annual

periods beginning on or after January 1, 2022. In this connection,

the IASB also published "Extension of the Temporary Exemption from

Applying IFRS 9 (Amendments to IFRS 4)' to defer the fixed expiry

date of the amendment also to annual periods beginning on or after

January 1, 2023.

Draft legislation has been laid before Parliament to ensure that

IFRS as endorsed by the EU at the date of the UK leaving the EU

will be adopted for use in the UK as well as providing the

Secretary of State with the power to adopt and endorse IFRS for use

in the UK. It is expected that this power will be delegated to a UK

IFRS Endorsement Board. In the event that IFRS 17 has not been

endorsed by the EU by the time the UK leaves the EU, including any

transitional period or arrangements that may be agreed, then the UK

IFRS Endorsement Board will have responsibility for its

endorsement. This is being monitored closely.

Other pronouncements

There are a number of amendments to IFRS that have been issued

by the IASB that become mandatory during 2020 or in a subsequent

accounting period. The Group has evaluated these changes and none

have had, or are expected to

have, a significant impact on the consolidated financial statements.

5. ESTIMATES AND JUDGEMENTS

The preparation of the interim financial report requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expenses. Actual results

may differ from these estimates.

6. INVENTORY WRITE OFF TO NET REALISABLE VALUE

Inventories are measured at the lower of cost or net realisable

value.

The cost of inventories comprises all costs of purchase, costs

of conversion and other costs incurred in bringing the inventories

to their present location and condition.

The cost of work in progress and finished goods includes costs

of direct materials and labor and other direct productions costs

and related production overheads (based on normal operating

capacity).

The cost of inventories is assigned by using the FIFO

method.

Net realisable value is the estimated selling price in the

ordinary course of business, less estimated costs of completion and

the estimated costs necessary to make the sale.

The Group periodically analyses inventories to determine whether

they are damaged, obsolete or slow-moving or if their net

realisable value has declined, and makes an allowance for such

inventories.

The loss from impairment of inventories amounted to:

Six months ended Six months ended

30 June 20 20 30 June 201 9

----------------- -----------------

GBP '000 GBP '000

----------------- -----------------

Impairment of finished goods (82) (7 8 )

----------------- -----------------

7. RELATED PARTY TRANSACTIONS

A related party is a person or an entity that is related to the

reporting entity:

1. A person or a close member of that person's family is related

to a reporting entity if that person has control, joint control, or

significant influence over the entity or is a member of its key

management personnel.

2. An entity is related to a reporting entity if, among other

circumstances, it is a parent subsidiary, fellow subsidiary,

associate, or joint venture of the reporting entity, or it is

controlled, jointly controlled, or significantly influenced or

managed by a person who is a related party.

The Group enters into transactions with related parties in the

ordinary course of business.

Related parties comprise the Group's shareholders and companies

that are under control of the Group's shareholders.

All sales and purchases were with related parties under common

control of the ultimate beneficiaries of the Company.

Six months ended Six months ended

30 June 20 20 30 June 201 9

----------------- -----------------

GBP '000 GBP '000

----------------- -----------------

Sales - -

Purchases - -

Administrative expenses 9 7

Other operational incomes 38 -

Other operational expenses 113 3

----------------- -----------------

Balances due from/(to) related parties at each period end are

shown below.

Six months ended Six months ended

30 June 20 20 30 June 201 9

----------------- -----------------

GBP '000 GBP '000

----------------- -----------------

Trade debtors 4 15

Receivables and prepayments - 25

Trade and other payables (7) (11)

Prepayments received - (60)

----------------- -----------------

8. SEGMENT INFORMATION

IFRS 8 requires segment information to be presented on the same

basis as that used by the Board for assessing performance and

allocating resources.

Segment information is presented in respect of the group's key

operating segments. The operating segments are based on the group's

management and internal reporting structure.

At 30 June 2020, the Group was organised internationally into

five main business segments:

1) Branded products - processed cheese, hard cheese, packaged butter and spreads

2) Beverages - kvass, other beverages

3) Non-branded products - skimmed milk powder, other skimmed milk products

4) Distribution services and other - resale of third-party goods and processing services

5) Supplementary products - export trading activities with

non-dairy products. The Group has expanded export sales into

non-dairy products such as corn, protein meal and oil. These

operations make use of third party logistics services and are

financed by deferring payment for purchased products.

Branded Beverages Non-branded Distribution Supplementary Total

products products services products

and other

---------- ---------- ------------ ------------- -------------- -------

GBP '000 GBP '000 GBP '000 GBP '000 GBP '000

---------- ---------- ------------ ------------- -------------- -------

Sales 17 291 772 3 256 1 180 5 024 27 523

Gross profit 2 200 439 (879) 320 135 2 215

---------- ---------- ------------ ------------- -------------- -------

The segment results for the six months ended 30 June 2020 are as

follows:

The segment results for the six months ended 30 June 2019 are as

follows:

Branded Beverages Non-branded Distribution Supplementary Total

products products services products

and other

---------- ---------- ------------ ------------- -------------- -------

GBP '000 GBP '000 GBP '000 GBP '000 GBP '000

---------- ---------- ------------ ------------- -------------- -------

Sales 11 228 927 3 447 816 5 81 8 22 236

Gross profit 1 791 465 (690) 197 163 1 926

---------- ---------- ------------ ------------- -------------- -------

9. EARNINGS PER SHARE

The earnings per ordinary share are calculated by reference to

the profit attributable to the ordinary shareholders and the

weighted average number of shares in issue during the period.

Basic earnings per share are calculated by dividing the profit

attributable to the ordinary shareholders of the Parent Company by

the weighted average number of ordinary shares in issue during the

period, excluding ordinary shares purchased by various employee

share trusts and held as own shares.

Diluted earnings per share are calculated by dividing the profit

attributable to the ordinary shareholders of the Parent Company by

the diluted weighted average number of ordinary shares in issue

during the period, excluding ordinary shares purchased by various

employee share trusts and held as own shares.

Six months ended Six months ended

30 June 20 30 June 201

20 9

GBP '000 GBP '000

----------------- -----------------

Net profit attributable to ordinary

shareholders (421) 740

Weighted number of ordinary shares in

issue 39 673 049 39 673 049

Basic earnings per share, pence (1,06) 1,8 7

Diluted average number of shares 39 673 049 39 673 049

Diluted earnings per share, pence (1,06) 1,8 7

10. SUBSEQUENT EVENTS

As at 3 0 June 20 20 , the Group was in breach of the Debt

Service Coverage ratio covenant in the loan facility in place with

European Bank for Reconstruction and Development ("EBRD"). The

Group remained in breach of this covenant as of date of issue of

the report and EBRD has not issued a waiver in respect of this

breach. There has been no demand for repayment of the loan. The

Company continues to communicate with EBRD and the agreed loan

repayments are being met as they fall due.

11. APPROVAL OF INTERIM STATEMENTS

The unaudited condensed consolidated financial statements were

approved by the board of directors on 29 September 2020.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCBXDDGGC

(END) Dow Jones Newswires

September 30, 2020 02:00 ET (06:00 GMT)

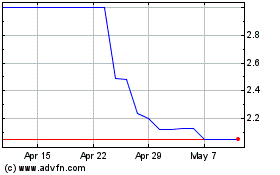

Ukrproduct (LSE:UKR)

Historical Stock Chart

From May 2024 to Jun 2024

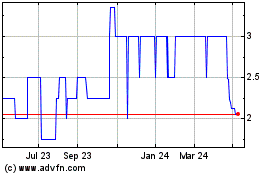

Ukrproduct (LSE:UKR)

Historical Stock Chart

From Jun 2023 to Jun 2024