TIDMUKR

RNS Number : 9747M

Ukrproduct Group Ltd

27 September 2021

27 September 2021

UKRPRODUCT GROUP LTD

("Ukrproduct", the "Company" or, together with its subsidiaries,

the "Group")

UNAUDITED INTERIM FINANCIAL RESULTS FOR THE SIX MONTHSED 30 JUNE

2021

Ukrproduct Group Ltd (AIM: UKR), one of the leading Ukrainian

producers and distributors of branded dairy foods and beverages

(kvass), today announces its unaudited interim financial results

for the six months ended 30 June 2021.

The full unaudited interim financial results for the six months

ended 30 June 2021 are available on the Company's website at

www.ukrproduct.com .

For further information contact:

Ukrproduct Group Ltd

Jack Rowell, Non-Executive Chairman Tel: +44 1534 814814

Alexander Slipchuk, Chief Executive www.ukrproduct.com

Officer

Strand Hanson Limited

Nominated Adviser and Broker Tel: +44 20 7409 3494

Rory Murphy, Rob Patrick www.strandhanson.co.uk

This announcement contains inside information for the purposes

of Article 7 of EU Regulation No. 596/2014, which forms part of

United Kingdom domestic law by virtue of the European (Withdrawal)

Act 2018.

Ukrproduct Group Ltd is one of the leading Ukrainian producers

and distributors of branded dairy products and kvass, a traditional

fermented beverage. The Group's current product portfolio includes

processed and hard cheese, packaged butter, skimmed milk powder

(SMP) and kvass. Ukrproduct has built a range of recognisable

product brands ("Our Dairyman", "People's Product", "Creamy

Valley", "Molendam", "Farmer's") that are well known and highly

regarded by consumers. Ukrproduct's securities are traded under the

symbol "UKR" on AIM, a market operated by the London Stock

Exchange.

Chairman and Chief Executive Statement

Ukrproduct, one of the leading Ukrainian producers and

distributors of branded dairy foods and beverages (kvass), is

pleased to announce its interim results for the half year ended 30

June 2021 ("1H 2021") and outlook for 2021.

2021 Half-Year Highlights:

-- Consolidated revenue of the Group in local currency increased

by 7.3%, however owing to devaluation of UAH to GBP it decreased by

7.2% to GBP25.5 million on a like-for-like basis (1H 2020: GBP27.5

million). Growth in volume stood at 8.1%.

-- The Group significantly changed the product portfolio and

sales structure compared to the prior half a year in order to

support the product margins: a significant rise in revenue of 71.1%

was provided by processed cheese and associated product (with its

market share increasing from 22% to 41%), while the revenue from

butter decreased by 42.6% as the Group reoriented from the mass

towards the premium market (with its market share decreasing from

33% to 21%).

-- Despite the increase in sales, pressure on the input costs

owing to higher prices for raw milk on a comparable basis and

energy related expenses triggered the decline of the gross profit

by 9.8% to GBP2.0 million (1H 2020: GBP2.2 million).

-- Higher material costs had a negative impact on the operating

result, as EBITDA amounted to GBP0.49 million (1H 2020: GBP0.78

million) corresponding to EBITDA margin of 1.9% (1H 2020:

2.8%).

-- Net profit for the period amounted to GBP0.15 million

compared to the loss in the prior period (1H 2020: GBP0.42 million)

owing to the positive exchange difference of GBP0.36 million.

2021 Half-Year Trading Update

According to the State Statistics Service of Ukraine, in the

first half of 2021 the total milk production in Ukraine declined by

5.6%, or 255 thousand tons compared to the same period last year,

to 4.3 million tons. T hough t his decrease was offset by imports,

primarily from the European Union, it resulted in local raw milk

prices increasing. It is noteworthy to highlight that in the first

half of 2021, there was no seasonal decline in raw milk prices. In

May-June 2021, prices excluding VAT were generally in line with the

prices in January-February and sometimes even exceeded them. The

average purchase prices of milk (of all categories) by agricultural

enterprises increased in the first half of 2021 by more than 24%

against the corresponding level in 2020 owing to the general rally

of food commodities worldwide. While the average extra grade raw

milk (produced by the farmers) price increased by around 20%, the

average first grade raw milk (supplied by the villagers) price rose

by almost 30%. Additionally, the prices of another important raw

material - palm oil - skyrocketed by circa 30% during the first

half of 2021.

Consequently, the Group experienced the material financial

impact of raw materials inflation, while the products' profit

margins were limited following challenging negotiations with the

local retailers. However, Ukrproduct partially offset such

financial impacts through improved productivity and its optimised

product portfolio, as well as by a number of further measures

focused on margin improvement, including but not limited to the

regular cost-efficiency exercises and ongoing optimisation of the

raw milk supply.

Financial position

As of 30 June 2021, Ukrproduct had net assets of GBP5.7 million

compared to GBP2.6 million as of 30 June 2020.

In the first half of 2021, the Group was in breach of several

provisions of the loan agreement with the European Bank for

Reconstruction and Development ("EBRD") and the bank has not issued

a waiver for the breaches. On 1 June 2021, the Group had settled

the interest amount due on 1 June 2021, however it did not repay

the quarterly loan tranche due on that date. On 3 September 2021,

with reference to the loan agreement, the Group settled the payment

of overdue principal in the amount of EUR 106,200.

In June 2021, Ukrproduct entered discussions with the EBRD to

potentially restructure the loan repayment schedule as a result of

pressure on the working capital requirements of the business owing

to increased raw materials costs and growing working capital

requirements as the Group significantly increased its sales via

retailers as a result of the COVID-19 related restrictions imposed

on the other distribution channels during a number of consequential

lockdowns.

Outlook for 2021

The development of the business in the second half of 2021

remains highly uncertain due to ongoing COVID-19 pandemic and

further inflation in prices of agriculture commodities worldwide in

the second half of the year. Though Ukrproduct's team continues

implementing further efficiencies in procurement, processing,

distribution and sales of its products with a major focus on

pricing on shelves reflecting raw materials costs increase, the

Group expects its margins to experience further pressure until the

end of this year.

Jack Rowell Alexander Slipchuk

Non-Executive Chairman Chief Executive Officer

Ukrproduct Group

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

FOR THE SIX MONTHSED 30 JUNE 2021

(in thousand GBP, unless otherwise stated)

Six months Six months

ended ended

3 0 June 2021 30 June 2020

-------------- -------------

GBP '000 GBP '000

-------------- -------------

Revenue 25 532 27 523

Cost of sales (23 534) (25 308)

-------------- -------------

GROSS PROFIT 1 998 2 215

Administrative expenses (631) (576)

Selling and distribution expenses (1 250) (1 158)

Other operating (expenses)/income (170) 5

-------------- -------------

PROFIT/(LOSS) FROM OPERATIONS (53) 486

Net finance expenses (232) (253)

Net foreign exchange gain/(loss) 366 (673)

-------------- -------------

PROFIT/(LOSS) BEFORE TAXATION 81 (440)

Income tax credit 70 19

-------------- -------------

PROFIT/ (LOSS) FOR THE SIX MONTHS 15 1 (421)

============== =============

Attributable to:

Owners of the Parent 15 1 (421)

Earnings per share:

Basic (in pence) 0 . 38 (1 . 06)

Diluted (in pence) 0 . 38 (1 . 06)

OTHER COMPREHENSIVE INCOME:

Items that may be subsequently

reclassified to profit or loss

Currency translation differences 269 (167)

OTHER COMPREHENSIVE INCOME, NET

OF TAX 269 (167)

-------------- -------------

TOTAL COMPREHENSIVE INCOME FOR

THE SIX MONTHS 42 0 (588)

============== =============

Attributable to:

Owners of the Parent 42 0 (588)

Non-controlling interests - -

Ukrproduct Group

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL

POSITION

AS AT 30 JUNE 2021

(in thousand GBP, unless otherwise stated)

As at As at As at

30 June 31 December 30 June

202 1 20 20 20 20

--------- ------------ ---------

GBP '000 GBP '000 GBP '000

--------- ------------ ---------

ASSETS

Non-current assets

Property, plant and equipment 9 909 9 934 6 538

Intangible assets 765 598 546

Deferred tax assets - - -

10 674 10 532 7 084

Current assets

Inventories 5 919 7 317 6 386

Trade and other receivables 6 976 6 155 7 292

Current taxes 305 214 427

Other financial assets 41 27 32

Cash and cash equivalents 147 156 389

--------- ------------ ---------

13 388 13 829 14 526

--------- ------------ ---------

TOTAL ASSETS 24 062 24 361 21 610

========= ============ =========

EQUITY AND LIABILITIES

Equity attributable to owners

of the parent

Share capital 3 967 3 967 3 967

Share premium 4 562 4 562 4 56 2

Translation reserve (14 962) (15 231) (14 904)

Revaluation reserve 6 715 7 031 3 348

Retained earnings 5 403 4 935 5 59 9

--------- ------------ ---------

5 685 5 264 2 572

Non-controlling interests - - -

--------- ------------ ---------

TOTAL EQUITY 5 685 5 264 2 572

Non-current Liabilities

Liabilities of rent assets (LT) - 13 50

Liabilities of rent assets (ST) - - -

Deferred tax liabilities 937 1 029 215

--------- ------------ ---------

937 1 042 265

Current liabilities

Bank loans 6 812 6 628 7 834

Short-term payables - 467 -

Trade and other payables 10 610 10 947 10 907

Current income tax liabilities - - -

Other taxes payable 18 13 32

--------- ------------ ---------

17 440 18 055 18 773

--------- ------------ ---------

TOTAL LIABILITIES 18 377 19 097 19 038

--------- ------------ ---------

TOTAL EQUITY AND LIABILITIES 24 062 24 361 21 610

Ukrproduct Group

CONDENSED CONSOLIDATED INTERIM STATEMENT OF C HANGES IN

EQUITY

FOR THE SIX MONTHSED 30 JUNE 2021

(in thousand GBP, unless otherwise stated)

Attributable to owners of the parent Total Non-con-trolling Total

interests Equity

------ ----------------- --------

Share Share Revaluation Retained Translation

capital premium reserve earnings reserve

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

GBP GBP '000 GBP '000 GBP '000 GBP '000 GBP GBP '000 GBP

'000 '000 '000

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As at 31 December

20 19 3 967 4 562 3 437 5 931 (14 737) 3 160 - 3 160

Loss for the

six months - - - (421) - (421) - (421)

Currency

translation

differences - - - (167) (167) - (167)

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

Total

comprehensive

income - - - (421) (167) (588) - (588)

Depreciation

on revaluation

of property,

plant and

equipment - - (89) 89 - - - -

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As at 30 June 4 56 5 59

20 20 3 967 2 3 348 9 (14 904) 2 572 - 2 572

========= ========= ============ ========== ============ ====== ================= ========

Profit for the

six months - - - (739) - (739) - (739)

Currency

translation

differences - - - - (327) (327) - (327)

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

Total

comprehensive (1

loss - - - (739) (327) 066) - (1 066)

Reduction of

revaluation

reserve - - (98) - - (98) - (98)

Gain on

revaluation

of property,

plant and

equipment - - 3 856 - - 3 856 - 3 856

Depreciation

on revaluation

of property,

plant and

equipment - - (75) 75 - - - -

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As at 31 December

20 20 3 967 4 562 7 031 4 935 (15 231) 5 264 - 5 264

========= ========= ============ ========== ============ ====== ================= ========

Profit for the

six months - - - 152 - 152 - 152

Currency

translation

differences - - - - 269 269 - 269

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

Total

comprehensive

income - - - 152 269 421 - 421

Depreciation

on revaluation

of property,

plant and

equipment - - (316) 316 - - - -

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As at 30 June

20 21 3 967 4 562 6 715 5 403 (14 962) 5 685 - 5 685

========= ========= ============ ========== ============ ====== ================= ========

Ukrproduct Group

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 20 21

(in thousand GBP, unless otherwise stated)

Six months ended Six months ended

3 0 June 2021 30 June 2020

----------------- -----------------

GBP '000 GBP '000

----------------- -----------------

Cash flows from operating activities

Profit/(loss) before taxation 8 1 (440)

Adjustments for:

Exchange difference (36 6 ) 67 3

Depreciation and amortization 537 297

Loss on disposal of non-current assets 5 5

Write off of receivables/payables 166 1

Impairment of inventories 9 82

Interest income - (1)

Interest expense on bank loans 232 254

----------------- -----------------

Operating cash flow before working capital

changes 664 871

Increase in inventories 1 390 (1 389)

Increase in trade and other receivables (1 128) (143)

Increase in trade and other payables (366) 1 682

----------------- -----------------

Changes in working capital (104) 150

----------------- -----------------

Cash generated from operations 560 1 021

Interest received - 1

Income tax paid 9 5

----------------- -----------------

Net cash generated from operating activities 569 1 027

Cash flows from investing activities

Purchases of property, plant and equipment

and intangible assets (519) (334)

Proceeds from sale of property, plant

and equipment - 11

Repayments of loans issued (13) (3)

----------------- -----------------

Net cash used in investing activities (532) (326)

Cash flows from financing activities

Interest paid (188) (270)

Repayments of long term borrowing (57) (42)

----------------- -----------------

Net cash used in from financing activities (245) (312)

Net (decrease)/increase in cash and

cash equivalents (208) 389

Effect of exchange rate changes on cash

and cash equivalents 199 (231)

----------------- -----------------

Cash and cash equivalents at the beginning

of the six months 156 231

Cash and cash equivalents at the end

of the six months 147 389

================= =================

Ukrproduct Group

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 20 21

(in thousand GBP, unless otherwise stated)

EXTRACTS FROM NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

1. Basis of preparation

The unaudited condensed consolidated financial statements are

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European Union (EU). The

condensed consolidated financial information in this half yearly

report has been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting' (IAS 34), as

adopted by the EU, and the Disclosure Guidance and Transparency

Rules of the Financial Conduct Authority.

2. Going concern

These condensed consolidated interim financial statements have

been prepared on a going concern basis, which envisages the

disposal of assets and the settlement of liabilities in the normal

course of business. The recoverability of Group's assets, as well

as the future operations of the Group, may be significantly

affected by the current and future economic environment.

EBRD

In the first half of 2021, the Group continued to be in breach

of several provisions of the loan agreement with the European Bank

for Reconstruction and Development ("EBRD") and the bank has not

issued a waiver for the breaches. On 1 June 2021, Ukrproduct

entered discussions with the EBRD to potentially restructure the

loan repayment schedule as a result of pressure on the working

capital requirements of the business due to increased raw milk

costs and an increase in volumes required to meet demand. The Group

also notified EBRD that although Ukrproduct had settled the

interest amount due on 1 June 2021, it did not repay the quarterly

loan tranche due on that date. In September, with reference to the

loan agreement dated 31 March 2011, as amended on 24 June 2016, the

Company made the repayment of the overdue (by 1 June 2021)

principal in the amount of EUR 106 200 and settled the due interest

amount of EUR 28 582, however, the Group informed EBRD that it

could not undertake the next repayment at the amount of EUR 294 006

that was due on 1 September 2021.

Ukrproduct is seeking to increase its working capital facility

provided locally in Ukraine. The Group's management continues to

have discussions with EBRD and, at present, EBRD has taken no

action to accelerate repayment of the loan. Though the Company is

hopeful that an agreement can be reached in due course that works

for both parties, the management is seeking to secure sufficient

additional funding from the local banks to refinance the existing

loan on more competitive terms. To the best of its knowledge, the

Board has a reasonable expectation that the Group has sufficient

liquidity to continue its operations going forward and to apply the

going concern basis in preparation of the financial statements.

Ukrproduct Group

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2021

(in thousand GBP, unless otherwise stated)

2. Going concern (continued)

Overall, the Group's management has been implementing a number

of steps focused on margin improvement and working capital

replenishment that include, but are not limited to, the actions

described below. Ukrproduct undertakes ongoing optimisation of the

raw milk supply and its settlement scheme that is complemented with

development of the products' portfolio aimed at increasing the

Company's overall margin and turnover. Additionally, the Group's

management is introducing new cost efficiency initiatives in

procurement, processing, distribution, marketing and logistics as

well as carefully reducing overhead.

The Company has launched new B2B partnerships (as well as

developing existing ones) in dairy processing, logistics and

distribution to capitalise on economies of scale. Moreover,

Ukrproduct continues to introduce new dairy products and beverages

appealing to shifting consumer demand, which is complemented by

focused marketing and promotion efforts, while export trading is

being developed with new packaging to adapt to international

consumer requirements. On a daily basis, the management team is

engaged in proactive negotiation with retailers and other trading

partners in order to reflect input costs volatility in the current

pricing of its end products on shelves, however this process is

challenging and takes time.

Impact of COVID-19 pandemic

As part of the going concern assessment, the Directors performed

an analysis on future cash flows and budgets. The analysis has

shown that the Group will continue to maintain relevant cash

resources and uninterrupted flow of revenues for the foreseeable

future. The Group closely monitors the evolution of the COVID-19

pandemic, including how it may affect the markets, the general

population and the financial impact of these events.

3. Foreign currency translation

Functional and presentation currency

Items included in the financial statements of each of the

Group's companies are measured using the currency of the primary

economic environment in which the company operates ("the functional

currency"). For the companies operating in Cyprus and BVI the

functional currency is United States Dollars ("USD"). For the

Parent company, which is located in Jersey, the functional currency

is Pound Sterling ("GBP"). For the companies operating in Ukraine

the functional currency is Ukrainian Hryvnia ("UAH").

These condensed consolidated interim financial statements are

presented in the thousands of Pound Sterling ("GBP"), unless

otherwise indicated.

Foreign currency transactions and balances

Transactions in foreign currencies are initially recorded by the

Group entities at their respective functional currency rates

prevailing at the date of the transaction.

Monetary assets and liabilities denominated in foreign

currencies are retranslated at the functional currency spot rate of

exchange ruling at the reporting date.

Non-monetary items that are measured in terms of historical cost

in a foreign currency are translated using the exchange rates as at

the dates of the initial transactions. Non-monetary items measured

at fair value in a foreign currency are translated using the

exchange rates at the date when the fair value is determined.

The principal exchange rates used in the preparation of these

condensed consolidated interim financial statements are as

follows:

Currency 30 June Average for 31 December 30 June Average for

2021 the six months 20 20 2020 the six months

ended ended

(spot rate) 30 June (spot rate) (spot rate) 30 June

2021 2020

---------- ------------- ---------------- ------------- ------------- ----------------

UAH/GBP 37 . 58 38 . 55 38 . 44 33 . 08 33 . 47

UAH/USD 27 . 18 27 . 77 28 . 27 26 . 69 26 . 72

UAH/EUR 32 . 30 33 . 46 34 . 74 29 . 95 30 . 05

---------------- ------------- --- ---------------- --- ------------- --- ------------- --- ----------------

4. Subsequent events

Ukrproduct has a significant number of financial obligations to

EBRD. The Group's management has been in negotiations with EBRD to

restructure the current repayment schedule, focusing on, amongst

other things, financial viability assessment and business

projections and financial model covering long-term financial

forecasts. At present, EBRD has taken no action to accelerate

repayment of the loan.

In September 2021, with reference to the loan agreement dated 31

March 2011, as amended on 24 June 2016 the Group made the repayment

of the overdue (by 1 June 2021) principal in the amount of EUR 106

200 and settled the due interest amount of EUR 28 582, however the

Group informed EBRD that it could not undertake the next repayment

at the amount of EUR 294 006 that was due on 1 September 2021.

There were no other material events after the end of the

reporting date, which have a bearing on the understanding of the

financial statement.

5. Approval of interim statements

The unaudited condensed consolidated financial statements were

approved by the board of directors on 23 September 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZLFLFKLZBBV

(END) Dow Jones Newswires

September 27, 2021 02:00 ET (06:00 GMT)

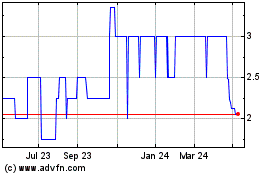

Ukrproduct (LSE:UKR)

Historical Stock Chart

From Nov 2024 to Dec 2024

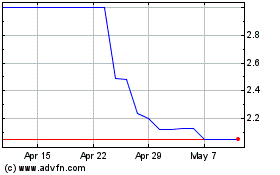

Ukrproduct (LSE:UKR)

Historical Stock Chart

From Dec 2023 to Dec 2024