Vector Capital PLC Trading Update (3510X)

December 20 2023 - 1:00AM

UK Regulatory

TIDMVCAP

RNS Number : 3510X

Vector Capital PLC

20 December 2023

20 December 2023

Vector Capital plc

("Vector", the "Company" or the "Group")

Trading Update

"Trading in line with market expectations and interest rate on

Inter Company Loan"

Vector Capital plc (AIM: VCAP), the commercial lending group

that offers secured loans primarily to businesses located in the

United Kingdom, is pleased to provide the following update on

trading for the year ending 31 December 2023.The Company also

provides confirmation of the interest rate payable on an

inter-company loan.

Current Trading

The Group has continued to trade positively during the second

half of the year, continuing the trend in its interim results, and

the Board expects revenue, profit before tax for the full year and

the aggregate loan book at the year-end to be in line with market

expectations. Despite continued challenging conditions for many of

our customers, and the relentless increase in interest rates

earlier in the year, the Company has been able to generate new

lending opportunities from our introducer base, and work with our

existing clients to maintain profitable trading margins. The Board

will continue to make prudent provision for doubtful debts within

the full year financial statements. Demand for new loans remains

strong and the Company expects to announce its full year results

and recommend a final dividend for the year ended 31 December 2023

in early April 2024.

Intercompany Loan Interest Rate

At a Company Board meeting on 19 December 2023, in accordance

with the terms agreed on 28 December 2022, it was decided that the

interest rate on the Vector Holdings Limited inter-company loan,

currently standing at GBP4 million, will remain unchanged at 6.25

percent for the remaining term of the loan to 31 December 2024. The

interest accrues daily and is payable quarterly on the last

business day of March, June, September, and December

The loan continues to provide the Company with medium term

competitively priced finance that can continue to be employed to

grow the loan book.

Related Party Transaction

Vector Holdings Limited is the parent company of the Group and

holds a 75.1 per cent. interest in the Company. Mr. Agam Jain, a

director of Vector, is a controlling shareholder of Vector Holdings

Limited along with his immediate family. Accordingly, the

renegotiation of the inter-company loan is deemed to be a related

party transaction pursuant to AIM Rule 13 of the AIM Rule for

Companies.

The Company's Directors (excluding Mr. Agam Jain, who is

directly related to this transaction), having consulted with Vector

Capital's Nominated Adviser, WH Ireland Limited, consider the

renegotiated terms of the loan to be fair and reasonable in so far

as the Company's shareholders are concerned.

Agam Jain, CEO of Vector Capital Plc commented : "Our business

model and loan management systems have demonstrated resilience

throughout the challenging conditions of the last two years which

has allowed us to continue to lend with confidence from our strong

asset base. With demand for our loans remaining strong we look

forward to 2024 with cautious optimism."

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Enquiries

Vector Capital plc

Robin Stevens (Chairman) Via IFC below

Agam Jain (CEO)

WH Ireland Limited 020 7220 1666

Hugh Morgan Chris Hardie, Darshan Patel

IFC Advisory Limited 020 3934 6630

Graham Herring, Florence Chandler, Zach Cohen

Notes to Editors

Vector Capital Plc provides secured, business-to-business loans

to SMEs based principally in England and Wales. Loans are typically

secured by a first legal charge against real estate. The Group's

customers typically borrow for general working capital purposes,

bridging ahead of refinancing, land development and property

acquisition. The loans provided by the Group are typically for

renewable 12-month terms with fixed interest rates.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKCBQQBDDCBD

(END) Dow Jones Newswires

December 20, 2023 02:00 ET (07:00 GMT)

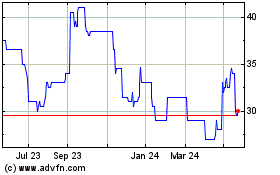

Vector Capital (LSE:VCAP)

Historical Stock Chart

From Feb 2025 to Mar 2025

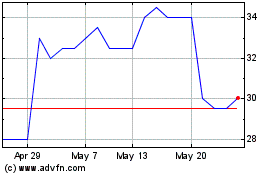

Vector Capital (LSE:VCAP)

Historical Stock Chart

From Mar 2024 to Mar 2025