TIDMVTA

Volta Finance Limited (VTA/VTAS)

Notification of transactions by directors, persons discharging

managerial

responsibilities and persons closely associated with them

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES

*****

Guernsey, 1 November 2023

Pursuant to the announcements made on 5 April 2019 and 26 June

2020 relating to changes to the payment of directors fees, Volta

Finance Limited (the "Company" or "Volta") has purchased 4,549

ordinary shares of no par value in the Company ("Ordinary Shares")

at an average price of EUR5.09 per share.

Each director receives 30% of their Director's fees for any year

in the form of shares, which they are required to retain for a

period of no less than one year from their respective date of

issue.

The shares will be issued to the Directors, who for the purposes

of Regulation (EU) No 596/2014 on Market Abuse ("MAR") are "persons

discharging managerial responsibilities" (a "PDMR").

-- Dagmar Kershaw, Chairman and a PDMR for the purposes of MAR, acquired

1,152 additional Ordinary Shares in the Company. Following the settlement

of this transaction, Ms Kershaw will have an interest in 9,605 Ordinary

Shares, representing 0.03% of the issued shares of the Company;

-- Stephen Le Page, Director and a PDMR for the purposes of MAR, acquired

979 additional Ordinary Shares in the Company. Following the settlement

of this transaction, Mr Le Page will have an interest in 47,970 Ordinary

Shares, representing 0.13% of the issued shares of the Company;

-- Graham Harrison, Director and a PDMR for the purposes of MAR, acquired

806 additional Ordinary Shares in the Company. Following the settlement

of this transaction, Mr Harrison will have an interest in 29,994 Ordinary

Shares, representing 0.08% of the issued shares of the Company;

-- Yedau Ogoundele, Director and a PDMR for the purposes of MAR acquired 806

additional Ordinary Shares in the Company. Following the settlement of

this transaction, Mrs Ogoundele will have an interest in 4,598 Ordinary

Shares, representing 0.01% of the issued shares of the Company; and

-- Joanne Peacegood, Director and a PDMR for the purposes of MAR acquired

806 additional Ordinary Shares in the Company. Following the settlement

of this transaction, Mrs Peacegood will have an interest in 1,085

Ordinary Shares, representing 0.01% of the issued shares of the Company;

The notifications below, made in accordance with the

requirements of MAR, provide further detail in relation to the

above transactions:

1. Details of the person discharging managerial

responsibilities / person closely associated

--------------------------------------------------------------------------------------------------------------------

a) Dagmar Kershaw b) Stephen Le c) Graham Harrison d) Yedau Ogoundele e) Joanne Peacegood

CHAIRMAN & DIRECTOR Page DIRECTOR DIRECTOR DIRECTOR

DIRECTOR

------------------------------- ---------------------- ------------------ ------------------ -------------------

1. Reason for the notification

--------------------------------------------------------------------------------------------------------------------

a. Position/status Director

----------------------------------- -------------------------------------------------------------------------------

b. Initial notification/Amendment Initial notification

----------------------------------- -------------------------------------------------------------------------------

1. Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor

--------------------------------------------------------------------------------------------------------------------

a. Name Volta Finance Limited

----------------------------------- -------------------------------------------------------------------------------

b. LEI 2138004N6QDNAZ2V3W80

----------------------------------- -------------------------------------------------------------------------------

1. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place

where transactions have been conducted

--------------------------------------------------------------------------------------------------------------------

a. Description of financial Ordinary Shares

instrument, type of instrument

----------------------------------- -------------------------------------------------------------------------------

b. Identification code GG00B1GHHH78

----------------------------------- -------------------------------------------------------------------------------

c. Nature of the transaction Purchase and allocation of Ordinary Shares relation

to the part-payment of Directors' fees for the

quarter ended 31 July 2023

----------------------------------- -------------------------------------------------------------------------------

d. Price(s) EUR5.09 per share

----------------------------------- -------------------------------------------------------------------------------

e. Volume(s) Total: 4,549

----------------------------------- -------------------------------------------------------------------------------

f. Date of transaction 1 November 2023

----------------------------------- -------------------------------------------------------------------------------

g. Place of transaction On-market -- London

----------------------------------- -------------------------------------------------------------------------------

1. Aggregate Purchase Information

--------------------------------------------------------------------------------------------------------------------

a) b) c) d) e)

Dagmar Kershaw Steve Le Page Graham Harrison Yedau Ogoundele Joanne Peacegood

Chairman and Director Director Director Director Director

--------------------------------- -------------------- ------------------ ------------------ -------------------

Aggr. Volume: Aggr. Volume: Aggr. Volume: Aggr. Volume: Aggr. Volume:

1,152 979 806 806 806

Price: Price: Price: Price: Price:

EUR5.09 per share EUR5.09 per share EUR5.09 per share EUR5.09 per share EUR5.09 per share

--------------------------------- -------------------- ------------------ ------------------ -------------------

CONTACTS

For the Investment Manager

AXA Investment Managers Paris

Serge Demay

serge.demay@axa-im.com

https://www.globenewswire.com/Tracker?data=lcZzb2j-xFKVg8SlTJO-gQq28dgfQjwhqz0rkZnLBpq3y-82iLrmfmQwZ5N-GUFmK5GegueonNuL932XH-R5ERLZEgHBycFhII4aJSGJmzE=

+33 (0) 1 44 45 84 47

Company Secretary and Administrator

BNP Paribas S.A, Guernsey Branch

guernsey.bp2s.volta.cosec@bnpparibas.com

https://www.globenewswire.com/Tracker?data=1YoTOjOAzw1szc93FwO_e6SkO2pTUJe8-pZaK69_LiAxDiZz-V4zatKt1rtnyI2DcbI61vZNHT83jAF5ALatKCfgYc90_mWzTfjorfyj-aaWGzxs41vCusEDP12Ohz2VrZWCDHz-5bxVl1lndD0nPnBysYd4vDx8zIxfc6hKWREanl7xgvpDqoqGW2vhdcTYFjfwedZWPBHFcvV-9zkNPJVa1pPNRjtBT2oXZswek_p0Xxls0gMUaTl4Lnj3jdONQ1s95_824uVfq1fqn0c9zqMle24i4obOQ5VTcfVZ3PzHzlV7cuddcXhVcc5wTmHUzb5AntRTXIjlocC3PNG2rEkb7bdLI6fe6EsMxFpnrVWZHfq-ZZSU5y8Y7XtXkm_M

+44 (0) 1481 750 853

Corporate Broker

Cenkos Securities plc

Andrew Worne

Daniel Balabanoff

+44 (0) 20 7397 8900

*****

ABOUT VOLTA FINANCE LIMITED

Volta Finance Limited is incorporated in Guernsey under the

Companies (Guernsey) Law, 2008 (as amended) and listed on Euronext

Amsterdam and the London Stock Exchange's Main Market for listed

securities. Volta's home member state for the purposes of the EU

Transparency Directive is the Netherlands. As such, Volta is

subject to regulation and supervision by the AFM, being the

regulator for financial markets in the Netherlands.

Volta's Investment objectives are to preserve its capital across

the credit cycle and to provide a stable stream of income to its

Shareholders through dividends that it expects to distribute on a

quarterly basis. The Company currently seeks to achieve its

investment objectives by pursuing exposure predominantly to CLO's

and similar asset classes. A more diversified investment strategy

across structured finance assets may be pursued opportunistically.

The Company has appointed AXA Investment Managers Paris an

investment management company with a division specialised in

structured credit, for the investment management of all its

assets.

*****

ABOUT AXA INVESTMENT MANAGERS

AXA Investment Managers (AXA IM) is a multi-expert asset

management company within the AXA Group, a global leader in

financial protection and wealth management. AXA IM is one of the

largest European-based asset managers with 2,600 professionals and

EUR824 billion in assets under management as of the end of December

2022.

*****

This press release is published by AXA Investment Managers Paris

("AXA IM"), in its capacity as alternative investment fund manager

(within the meaning of Directive 2011/61/EU, the "AIFM Directive")

of Volta Finance Limited (the "Volta Finance") whose portfolio is

managed by AXA IM.

This press release is for information only and does not

constitute an invitation or inducement to acquire shares in Volta

Finance. Its circulation may be prohibited in certain jurisdictions

and no recipient may circulate copies of this document in breach of

such limitations or restrictions. This document is not an offer for

sale of the securities referred to herein in the United States or

to persons who are "U.S. persons" for purposes of Regulation S

under the U.S. Securities Act of 1933, as amended (the "Securities

Act"), or otherwise in circumstances where such offer would be

restricted by applicable law. Such securities may not be sold in

the United States absent registration or an exemption from

registration from the Securities Act. Volta Finance does not intend

to register any portion of the offer of such securities in the

United States or to conduct a public offering of such securities in

the United States.

*****

This communication is only being distributed to and is only

directed at (i) persons who are outside the United Kingdom or (ii)

investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the "Order") or (iii) high net worth companies, and other

persons to whom it may lawfully be communicated, falling within

Article 49(2)(a) to (d) of the Order (all such persons together

being referred to as "relevant persons"). The securities referred

to herein are only available to, and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire such

securities will be engaged in only with, relevant persons. Any

person who is not a relevant person should not act or rely on this

document or any of its contents. Past performance cannot be relied

on as a guide to future performance.

*****

This press release contains statements that are, or may deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "anticipated",

"expects", "intends", "is/are expected", "may", "will" or "should".

They include the statements regarding the level of the dividend,

the current market context and its impact on the long-term return

of Volta Finance's investments. By their nature, forward-looking

statements involve risks and uncertainties and readers are

cautioned that any such forward-looking statements are not

guarantees of future performance. Volta Finance's actual results,

portfolio composition and performance may differ materially from

the impression created by the forward-looking statements. AXA IM

does not undertake any obligation to publicly update or revise

forward-looking statements.

Any target information is based on certain assumptions as to

future events which may not prove to be realised. Due to the

uncertainty surrounding these future events, the targets are not

intended to be and should not be regarded as profits or earnings or

any other type of forecasts. There can be no assurance that any of

these targets will be achieved. In addition, no assurance can be

given that the investment objective will be achieved.

The figures provided that relate to past months or years and

past performance cannot be relied on as a guide to future

performance or construed as a reliable indicator as to future

performance. Throughout this review, the citation of specific

trades or strategies is intended to illustrate some of the

investment methodologies and philosophies of Volta Finance, as

implemented by AXA IM. The historical success or AXA IM's belief in

the future success, of any of these trades or strategies is not

indicative of, and has no bearing on, future results.

The valuation of financial assets can vary significantly from

the prices that the AXA IM could obtain if it sought to liquidate

the positions on behalf of the Volta Finance due to market

conditions and general economic environment. Such valuations do not

constitute a fairness or similar opinion and should not be regarded

as such.

Editor: AXA INVESTMENT MANAGERS PARIS, a company incorporated

under the laws of France, having its registered office located at

Tour Majunga, 6, Place de la Pyramide - 92800 Puteaux. AXA IMP is

authorized by the Autorité des Marchés Financiers under

registration number GP92008 as an alternative investment fund

manager within the meaning of the AIFM Directive.

*****

(END) Dow Jones Newswires

November 01, 2023 12:10 ET (16:10 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

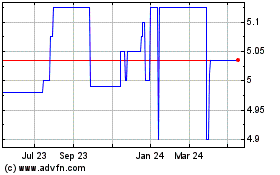

Volta Finance (LSE:VTA)

Historical Stock Chart

From Nov 2024 to Dec 2024

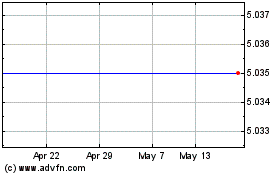

Volta Finance (LSE:VTA)

Historical Stock Chart

From Dec 2023 to Dec 2024